In light of light inflation measurements, central bankers have no other choice but to step up their rhetoric. Mario Draghi took the mantle earlier this week and has been joined at various points by others. The message they are sending is one that is purposefully muddied. There isn’t left to them any other choice.

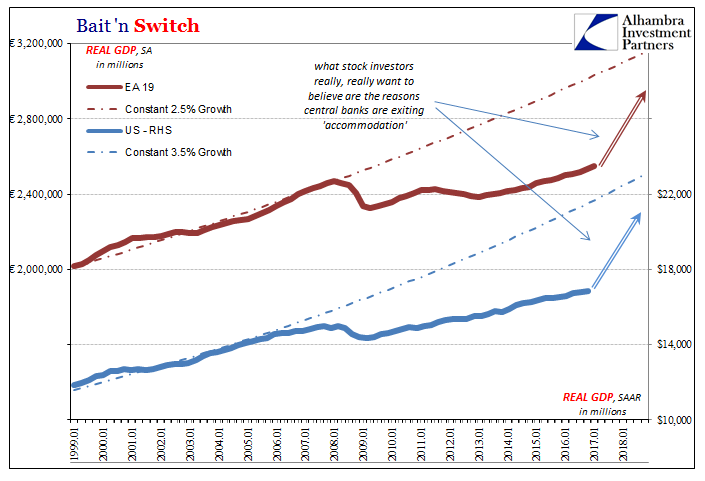

There are only two pillars holding up markets right now, especially, very especially, stocks. Valuations for shares are in the aggregate stretched to dot-com levels based on the idea that growth will accelerate; and if it doesn’t, the Fed, ECB, or whomever else will limit shareholders’ collective risk. Should there not be growth, at least equity participants will have monetary policy “accommodation” to fall back on.

We should clear up immediately that such “accommodation” is a total fiction. Bank reserves are not money which is why central banks are in this mess. But for the stock market in particular, urged on by the media, QE was and low interest rates are believed to be a powerful instrument (no matter how much the idea has been thoroughly refuted even long before 2008).

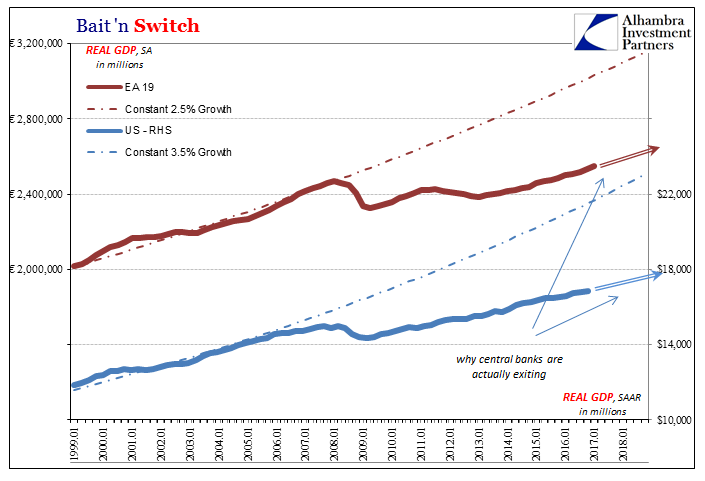

In some ways, stocks are making a substitution that central bankers aren’t really themselves suggesting. Policymakers want out of the “stimulus” business, but given these circumstances arranged the way they are they can’t be fully honest about why. It is an error of omission on the part of shareholders. Mario Draghi and especially Janet Yellen are fine if you as a stock investor believe that growth is the reason for their exit.

It’s the only way to go forward with things as they really are. It’s why just a few days ago FRBSF President (and CEO) John Williams told the Australian Broadcasting Corporation “the stock market is pretty much running on fumes.” Central bankers have to be careful to allow investors to slowly acclimate to a world where there won’t be growth. To do that requires this dissonance, where authorities have to be careful not to be too honest.

If the markets want to believe that they are scaling back QE (ECB), tightening for bubbles (PBOC), or “raising rates” (Federal Reserve) because things are about to get so much better than these various central banks will cringe but not correct. They know better, but given the massive market imbalances they also know better than to say it out loud.

This is why they were perfectly willing to let the collective (media) imagination run wild with 2% CPI’s and HICP’s. The ECB or the Fed wasn’t fooled by the oil price base effect, not for a minute. All their models showed that it was a very temporary “success” and wouldn’t last; but if you or your neighbor wanted to think that was a huge positive, a significant step in the right direction, then so much the better for their shameful task.

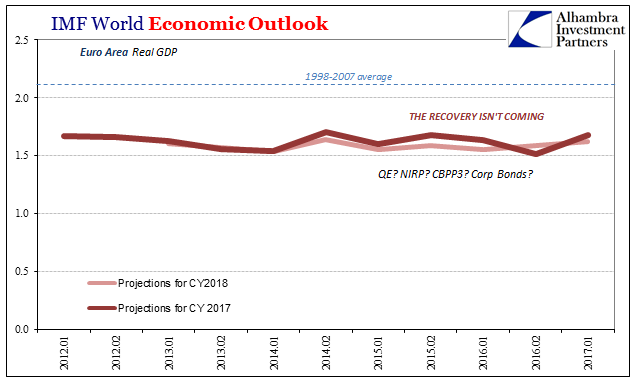

These are the risks that I wrote about last December when it was clear then the ECB, as the others, had actually “surrendered” to a no-recovery world.

The primary danger to it is not that central banks might disappoint in that next round of “stimulus”, but rather that there won’t be a next round at all. There appears to be a pervasive belief that markets, or certain ones or even certain parts of them, are still expecting recovery as it once meant, craving only the right polices that will deliver it from out of the resurrected legends of past myths where geniuses inside central banks can and will think them up. But secular stagnation wasn’t a temporary and wrong academic infatuation, it has become instead a growing means from inside orthodox circles by which to explain how the whole world could have lost a decade despite their genius efforts. That is the salient point not just being discussed but being acted out right now! Even economist authorities are accepting that the decade was lost and in all great likelihood means for us a vastly different future. [emphasis added]

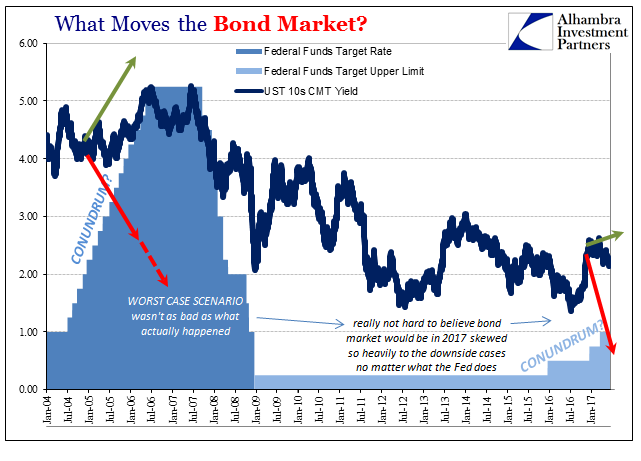

The bond market is about the only place that seems to appreciate these distinctions. For stocks, there just can’t be no recovery, and the longer we go without one so much the better because it must be right there. If central banks are “raising rates” and adjusting other factors in the same way, then this must be it.

Valuations couldn’t ever be supported by recognizing the current global state and the economic paradigm. It is now, with inflation flaming out, the only possible way for a relatively trouble-free monetary policy transition.

And now in a technical trick of semantics and subjective interpretation, they still suggest recovery but one that is defined instead by rising social disorder, political upset, and the ECB tapering QE not because it worked but because they have come to realize in all probability it never will.

That’s what inflation is telling us. You can’t print trillions in several places and find none of it – unless it wasn’t money to begin with. Rather than realize the simple truth, economists have instead come to accept the consequences of it without admitting why.

It is, in the end, the mother of all bait and switch scams. Stock investors, in particular, are paying for full recovery, hard fought and forever sought, but getting instead “recovery”; a supremely salient distinction which even the most optimistic of central bankers (practically all of them) no longer believe can be cured by time. Policymakers are advertising a global economy that is improving, but what they actually mean isn’t at all what we have all along expected, and what far too many still are.

Stay In Touch