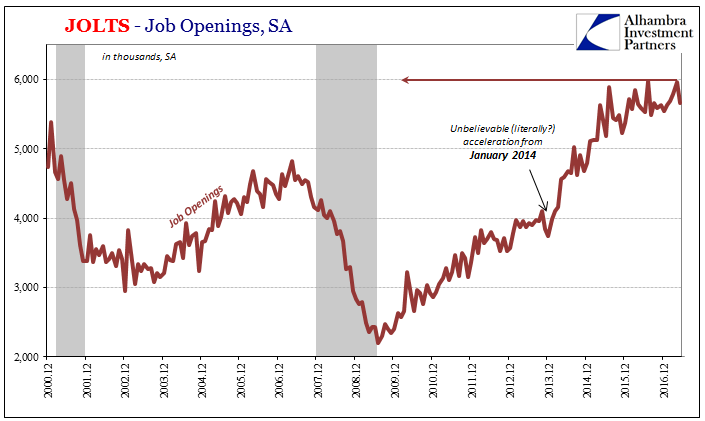

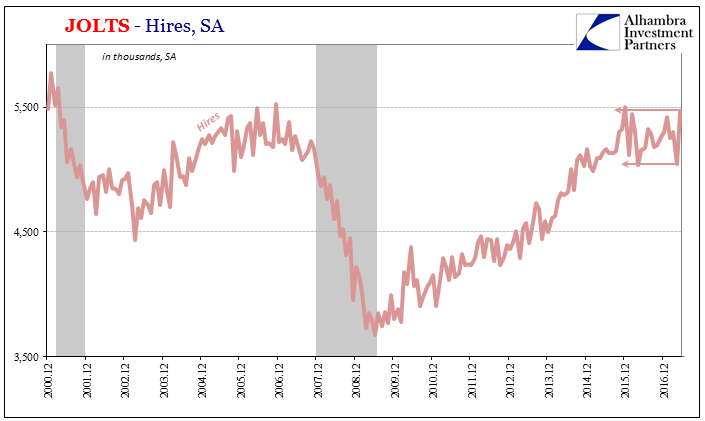

Last month it was Job Openings that soared to a new record high of more than 6 million (for April 2017), while the pace of hiring slammed lower to just more than 5 million. This month (May 2017), the opposite. Hires surged to nearly 5.5 million, while Job Openings fell sharply (and were revised lower for April). The large variations and in opposing directions the past few months underscores what is lingering tension in the JOLTS data.

As with the main payroll reports, whether you are an optimist or pessimist there is data for you. Economists and policymakers have emphasized Job Openings like they have the unemployment rate. Both suggest a blistering pace to the labor market.

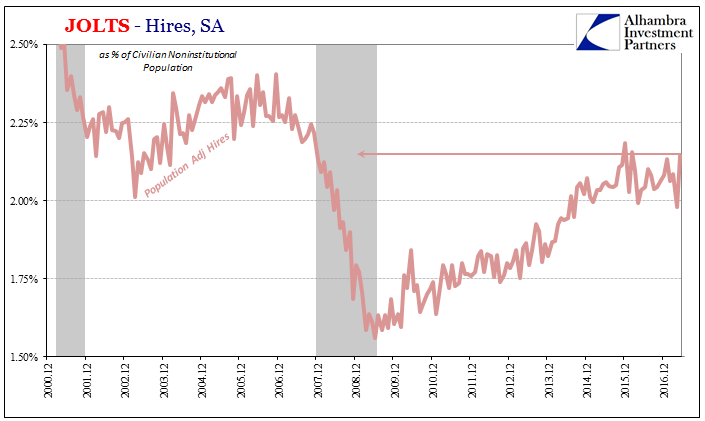

On the other side there is like the headline apathy in the labor force of the payroll reports in JOLTS a tepid recovery in hiring. It is made all the more deficient when properly scaling that activity by the level of population growth.

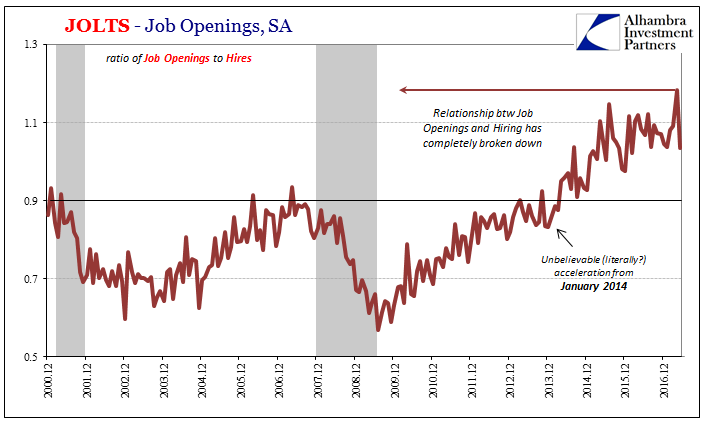

The mere fact of such disharmony, however, argues against the positive viewpoint. A recovery is supposed to be taken literally, whereas that might be the case from the perspective of Job Openings it isn’t even close as estimated by adjusted Hires. The most that might be said of the labor market is that it is advancing, but by how much remains perhaps too open to interpretation.

What is required is corroboration, with the burden of proof shifted to the mainstream view. The unemployment rate, and by association Job Openings, have failed to match economic conditions and therefore have already proved a poor indicator of economic strength/weakness.

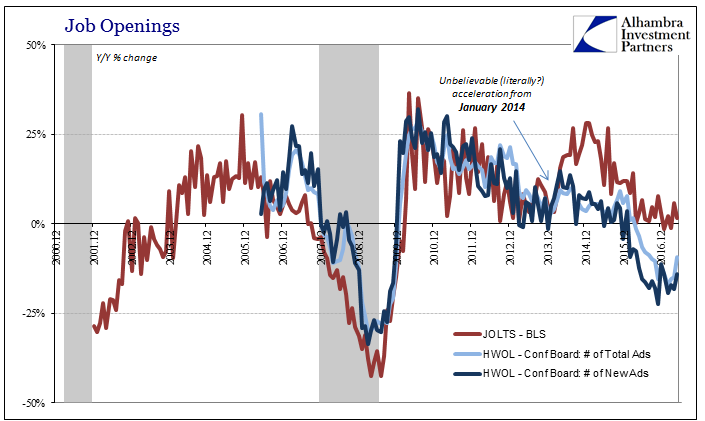

The issue currently centers around the breakout in 2014 – without any similar data supporting that idea. Whether spending, wages, or incomes, the notion that the labor market surged wildly three years ago was never supported even in their own category. In other words, though the JOLTS version of Job Openings jumped, other measures of the same thing did not.

The Conference Board’s HWOL series tallies online posting for jobs, and though there might be some issues with their methodology it wouldn’t have related to the labor market behavior in 2014. The JOLTS series for Job Openings showed an immense burst of demand for labor, while the Conference Board’s competing data figured only a minor, nearly indistinguishable uptick from 2013.

The vast majority of economic accounts behaved in concert with the HWOL data rather than JOLTS JO.

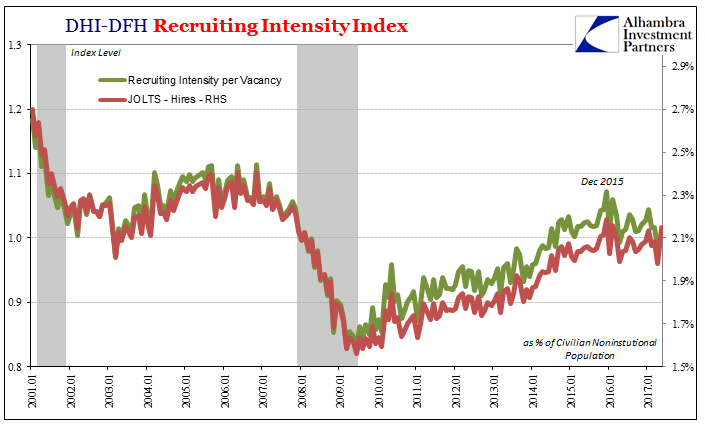

One other relevant data point is provided by DHI Hiring. They track what they call a recruiting intensity index. Placing an online ad for a potential job opening is but one part of the labor demand equation. How intensely a prospective employer goes about filling that vacancy can say a lot more about the dynamics of the labor market from the employer side.

A firm, for example, that is experiencing tremendous revenue growth, or even just anticipates it, will go all out to fill any vacancies, including perks, wage concessions, and being incredibly flexible. A business less assured of revenue prospects might still need a new employee, but could instead go about the procurement in a more rigid and choosy manner.

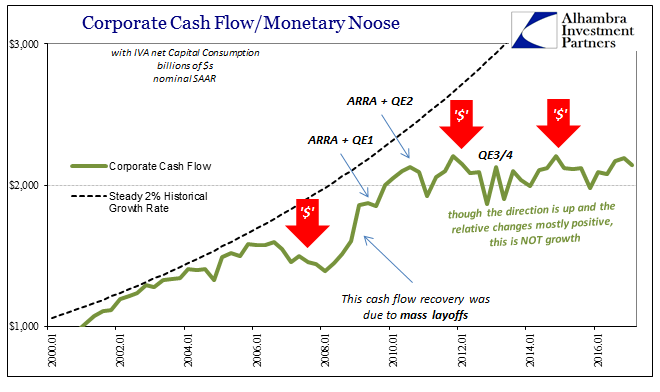

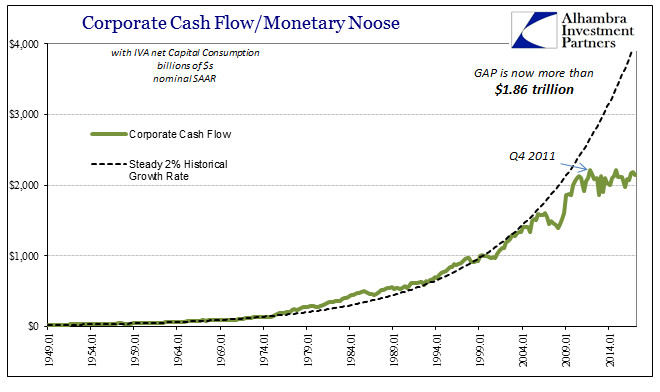

Given the status of aggregate corporate cash flows, as estimated in the GDI series by the BLS, DHI’s index suggests that, again, though the labor market is moving in the right direction it remains highly sluggish or at least far more uncertain than either the unemployment rate or Job Openings would otherwise have it.

In fact, the recruiting intensity data almost perfectly matches the pattern for JOLTS Hires adjusted for population. Both would appear to suggest that though there might be openings and some degree of expansion, businesses aren’t in a rush to fill them. There would appear to be “growth”, but not really growth. That sentence more so fits with the overall characterization of the US and global economy of the past too many years following the Great “Recession.”

They also conform to the idea of a shrunk economy still undergoing non-linear contraction. In this case specifically with regard to labor activity, the economy is advancing in positive numbers but not nearly enough to keep up with even population expansion, let alone the contraction in 2008-09.

Though economists and policymakers will still refer to Job Openings as the unemployment rate from time to time when confronted, we know that increasingly they are being made to instead recognize these other illuminated deficiencies as the correct view of the economy. There was last year the sudden rise in official mentions of drug addicts and Baby Boomers, an outcome that concedes at least the fact that Job Openings can’t be the full story.

This year, that backtracking has been augmented by growing acknowledgements to “populism” as an economic matter. Economists like former Fed Chairman Ben Bernanke are now talking about political reality as a result of this “other” economic reality he spent so much time downplaying, if not dismissing outright (see: Washington Post oped, November 4, 2010).

As I wrote in response to his last speech, which the Mr. Bernanke ironically titled When Growth Is Not Enough, “the last thing anyone associates with Bernanke is growth.” It seems he finally got around to at least admitting to himself there might be something to all the criticism after all.

Bernanke is a very smart guy, but he isn’t as clever as he may think of himself. If you claim to be running an economy and it doesn’t produce in all the traditional ways of output and income, then suddenly saying those aren’t the appropriate standards is as transparent as it gets. It’s not quite convincing given his own public history to in 2017 try to say “it wasn’t all bad.” Methinks the money printer doth protest too much…

If you have to refashion standards to suggest why you maybe could have possibly not performed so badly, then maybe you really did and maybe most people by now know it. And to further think along just those lines, perhaps the election of Trump isn’t so extreme as it might first seem to the delicate orthodox sensibilities of the perpetually slow and ignorant. Maybe it doesn’t leave us in economic dystopia, but that is at least the direction we might have been traveling all this time you called it a recovery.

That’s what the divide in JOLTS is getting at. Those like Bernanke predisposed to see recovery looked at Job Openings, just as the unemployment rate, and said, “there it is!” But they did so with an already closed mind, totally expecting to find that result because for them monetary policy always works(ed). It was the picture of the economy that “should be” at the expense of more dispassionate, objective analysis that actually found far more plentiful and consistent evidence to at the very least warrant caution about jumping to such unsupported optimistic conclusions (again and again and again).

In short, economists and politicians really didn’t want recovery so much as vindication. If they actually did want the former, then long before 2017 they would have recognized all the contrary indications for what they were, realized their grand schemes weren’t working, and maybe tried or at least investigated something else.

These are unique times at least to those living in them. Therefore some disagreement was bound to occur. It’s not nothing, however, to even now in 2017 go back and reassess and more properly clarify and classify what just happened. It wasn’t actually a recovery, and that tells us a great deal about what to expect for tomorrow, next year, and still several years down the road.

Stay In Touch