Why are there so many derivatives? According to the Office of the Comptroller of the Currency, US banks reported for Q1 2017 being party to $178.3 trillion in notional contracts outstanding. The Bank for International Settlements estimates a global total of $482.9 trillion (as of H2 2016). These are for many people simply frightening numbers. They dwarf all sense of economy and therefore the reasons for them are obscured.

The simple answer to the question is really about how banks actually operate. An interest rate swap is akin to a synthetic repo of a hypothetical bond. That’s useful in several capacities that have nothing to do with repo or holding a bond. It allows using market inputs to describe risks, a task that goes largely unappreciated in the mainstream.

My purpose here is not to get too far down the rabbit hole, but hopefully far enough that you get a sense or at least a taste for this stuff and more so why it all exists to the degree it does. From that, the issue of truly modern money can be revealed. It all starts with accounting.

Many people might have a vague memory of accounting standards being changed in early 2009. There were various proposals floated during the panic because of something called OTTI, or other-than-temporary-impairment. It wasn’t until early March 2009, however, that things got serious – not coincidental to the end of the panic.

The issue wasn’t truly “toxic assets” though that was the mainstream frame of reference. On March 6, 2009, the ABA sent a letter to the SEC requesting they nudge the Financial Accounting Standards Board (FASB) to issue clarifying guidance about OTTI. On March 9, it was joined by the Federal Home Loan Banks and 18 separate industry groups essentially demanding that authorities get serious about the increasingly difficult task of fair value accounting. FASB’s Chairman Robert Herz would finally testify before the House Financial Services subcommittee on March 12. He told the Members that the FASB board had voted to approve three new pieces of guidance that the technical staff believed would address concerns over mark-to-market.

The immediate issue was illiquid market inputs. FAS 157 required banks to prioritize observable market-based prices in determining fair value. In the context of September 2006 when the standards first went into effect, that wasn’t so controversial. Amidst panic, banks had a case. They wanted OTTI to mean economic loss rather than market loss.

The test for OTTI is one of the most rudimentary but crucial aspects to bank accounting. It is, essentially, a series of tests to determine what might be done for an asset or liability that is valued below its cost. Obviously, when the market value becomes less than what you paid for it, there is nontrivial risk of loss. If the condition is expected to be temporary, then nothing is done. As the term other-than-temporary explicitly states, it’s what might have to be done when risks change.

An other-than-temporary impairment assessment requires, among other considerations, that the reporting entity assert that it has the intent and ability to hold the security for a period of time sufficient to allow for any anticipated recovery in fair value (SEC Staff Accounting Bulletin [SAB] Topic 5M, Other Than Temporary Impairment of Certain Investments in Debt and Equity Securities, and AICPA Statement on Auditing Standards No. 92, Auditing Derivative Instruments, Hedging Activities, and Investments in Securities). [emphasis added]

There begins what is a huge decision tree from this point forward, encompassing not just the original transaction and its cost but also all manner of hedges designed, really, to avoid ever having to be in this position. As an example given by auditor KPMG:

Company B has a fixed interest liability denominated in US dollars and measured at amortized cost. Company B enters into a pay-LIBOR receive-fixed interest rate swap to hedge 50% of the liability in respect of its benchmark interest exposure. The swap qualifies for hedge accounting. The proportion of the liability that is hedged (50%) will be remeasured with respect to changes in fair value due to changes in the designated benchmark interest rate from the beginning of the hedge relationship. The liability will not be remeasured for any changes in its fair value due to changes in credit spread, liquidity spread, or other factors.

That last part will remain true so long as the interest rate swap hedge is deemed, in accounting terms and according to its tests, effective. Hedges overall remove a good deal of the probability for a bank to face OTTI (as in the above example removing credit risk, liquidity risk, and “other factors” that might force unfavorable fair value calculations).

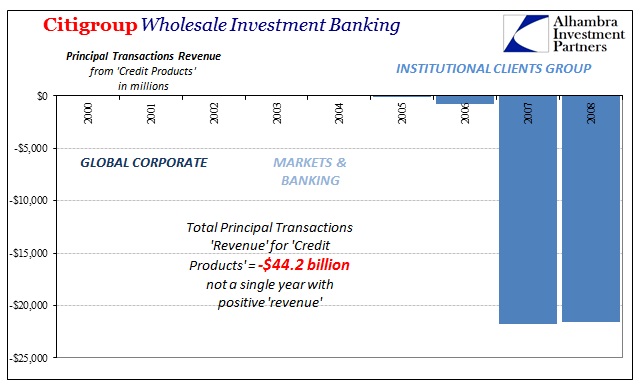

The great crisis problem with OTTI was that once it was determined appropriate, meaning the position wasn’t going to reasonably recover to its cost basis, it required banks to write-down in current-period income the loss based on what banks thought were dubious market values. These were the massive losses that banks like Citigroup took especially in their prop trading positions. The hit to net incomes being so large, it destroyed their capital positions (retained earnings being the primary source) and fed into the (interbank) run.

Even in non-stressed periods banks loathed OTTI. Once the impairment was taken, reducing net income in that period, the position was given a new cost basis but the bank forbidden from using it until the actual sale of the security. In other words, if the position unexpectedly recovered in market value the firm could not reverse the OTTI loss it took earlier on its income statement until the position was actually terminated; even though in that situation the market value would be substantially higher than the revised cost basis.

Being able to predictably avoid OTTI was and is today an essential element in banking. That means hedging and the likewise predictable performance of hedges. Everything from interest rate swaps to forex futures to OTC interest rate caps are used to make the unpredictable world just this quantifiable (in theory). The banking and accounting rules, after all, are themselves quantitatively based.

This becomes paramount under the “portfolio measurement exception” which is applied to groups of securities successfully passing certain tests and standards. If the portfolio meets the criteria, the bank is permitted to measure the fair value of the group rather than the individual securities or loans, including any offsetting risk positions (hedges) on the basis of a calculated net exposure. Everything comes down to net and the math that goes into coming up with it.

It is all of these calculations designed to predictably manage balance sheet positions (and how they might ultimately affect the income statement) where the trillions in notional derivatives are applied. Therefore, I hope, you can see why during periods of “unusual” uncertainty banks turn to very different behavior, almost at times like they were at risk of bank run during times long past.

Even the idea of “unusual” takes on interesting proportions, such as a small but unexpected rise in volatility that in some conditions could theoretically reduce the expected performance of a hedge such that it might be threatened to be judged ineffective and therefore exposing perhaps an entire portfolio of securities to even just the opening consideration for OTTI when calculating net exposure. Nobody likes uncertainty, but this is a whole other dynamic.

The more predictable the net exposure, the more likely to put on more positions (and the lower the cost in VaR, RWA budgets, and even in some cases capital charges). The less predictable, the less the bank is willing to do more financial things, and in some cases turn to actually doing less financial things – just as if it had been reduced of vault cash in the old ways.

Facing such a dreadful possibility, the demand for further hedges can only rise, leaving the more monetary question of whether there is available supply for meeting it and at reasonable terms. This is the essential issue of offered, aggregate balance sheet capacity and why derivatives are and should really be a central focus of systemic monetary considerations. They determine so much more than how much X might have to pay Y above LIBOR (or, in 2020, GC UST repo).

Liquidity in cash is typically the only element ever so considered. Even just about ten years after August 9, 2007, the most that most official capacities have grudgingly accepted is liquidity in repo collateral, still a derivative of but traditional liquidity. There is none for derivative liquidity which drives these very essential elements of total balance sheet construction. In often combination, it is this along with wholesale liquidity that can be the difference between 2006 and 2008; or, 2014 and 2015.

And one feeds the other, for if there is uncertainty in balance sheets and derivatives, there will very likely be the same in wholesale liquidity; and vice versa.

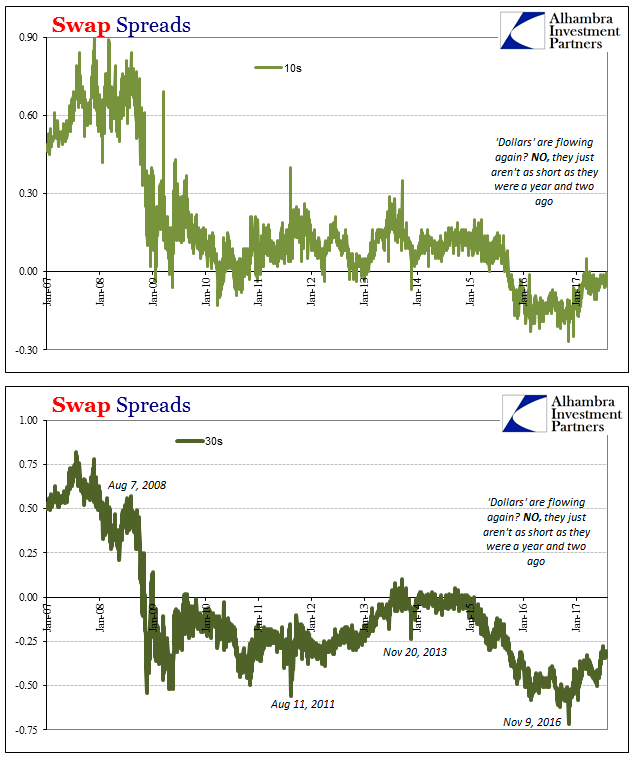

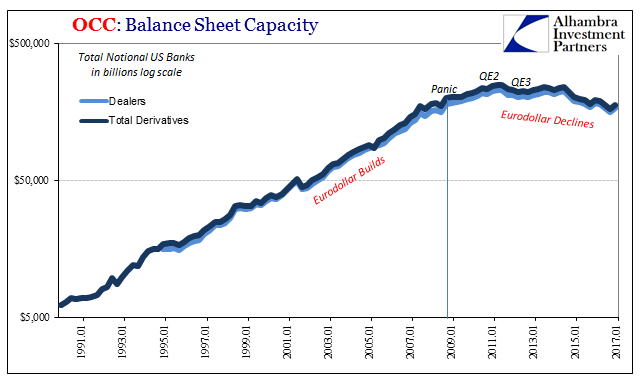

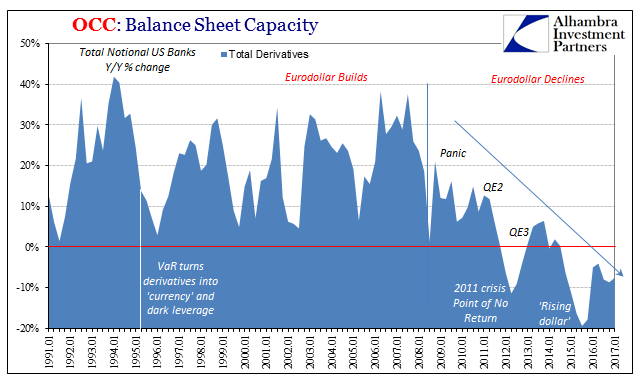

The reduced capacity of dealers since 2008, really 2011, to offer risk absorption activities (money dealing in this dark leverage) has reduced the capacity of largely banks to do these things in the way they were done before (including operations prior to FAS 157; all mark-to-market changed was the priority given to market-based inputs in determining fair value, which is one reason why credit default swap demand exploded in anticipation of the rule). The less balance sheet capacity offered, the less predictable the systemic response to “unexpected” events to absorb them on reasonable terms (which is why a negative swap spread is a useful indication of negative balance sheet factors and what they might mean).

Unfortunately, I have barely scratched the surface and have been forced to generalize and simplify quite a bit above. It can get unbelievably complicated in just the dizzying array of accounting conventions and testing procedures. But these things really matter, because they are the rules that describe how and often why something goes on a balance sheet (or does not) and how it might affect the income statement.

The modern bank reserve is really mathematical, and the determinant of the money multiplier unbelievably so. This version of money is not what is in the bank vault, but what is available to the bank manager to construct the most efficient and favorable quantifiable terms for each desk or division.

Where does the Federal Reserve fit in all this? It does in little more than psychology, meaning that if it can credibly promise (though nothing more than expectations, sort of a self-fulfilling prophecy if it worked) to reduce volatility, or create an economic recovery that would. That’s why 2011 was so fatal; it proved the end to what was credibility already severely strained by 2008. Private liquidity providers, which is all there really is, figured out they were on their own in an increasingly unpredictable paradigm.

Stay In Touch