At the end of his life and career, F. Scott Fitzgerald, the great American novelist, wrote a series of short stories for Esquire Magazine. It’s difficult to tell whether he was forced into the job, far as it might have seemed from the 1920’s salons of Paris carousing with his wife Zelda and other international intellectual luminaries of the time. Writing forty-five shorts was nothing like his crowning achievement, but then again after the royalty checks start to thin out and you perhaps realize that lightning in a bottle isn’t often repeatable, what other end can there be for a man who was a true writer?

One of those stories appearing in December 1939 centered on what might have been a typical scene in any Manhattan office of the late thirties. An important man comes for a visit to one news bureau and the editor responsible unable to take the man to lunch. The task was thus foisted upon the nearest junior copy man, our protagonist Orrison Brown. Unable to make out where he had seen the caller before, he is left knowing by context the importance of him.

In the course of conversing on their way to whatever trendy spot befitted the man’s station, it became clear that something was missing. Brown, though, couldn’t quite place it.

The words were spoken in such a measured way that Orrison concluded this man wouldn’t talk unless he wanted to — and simultaneously wondered if he could have possibly spent the thirties in a prison or an insane asylum.

Everything seemed familiar enough to the guy, but in a hazy sort of way that created palpable empathy despite the clearly uncomfortable nature of their brief association. It was as if time stopped in 1928, the end of the man’s memory or even his whole history.

“Jesus,” he said to himself. “Drunk for ten years.”

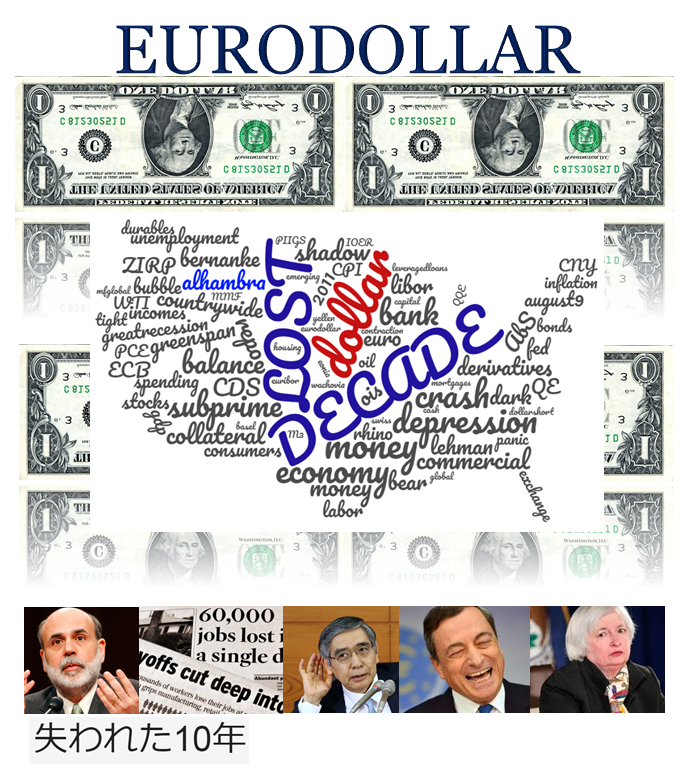

The title of Fitzgerald’s little gem is quite appropriately The Lost Decade. There is a quite a bit packed into what amounts to a few short pages of text. It is in many ways a parable of the Great Depression, people’s memories simply halted by the events of 1929; forcing them to live out the next whole decade in a sort of queer stupor very much like toxic, persistent drunkenness. The world that they knew when sober was gone, and there was both sadness and harsh reality to be mixed in a life wholly unexpected.

We can all, unfortunately, relate.

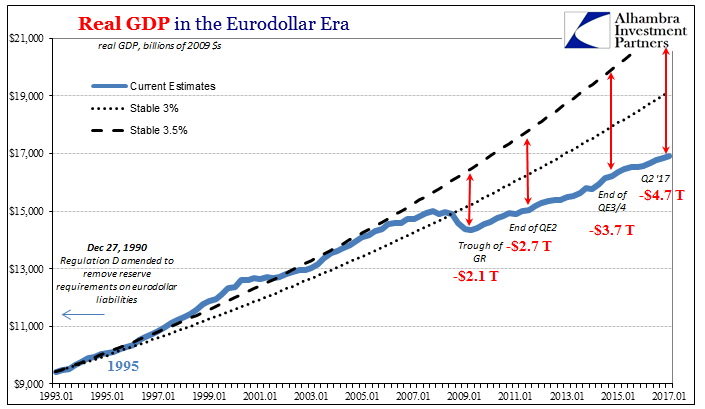

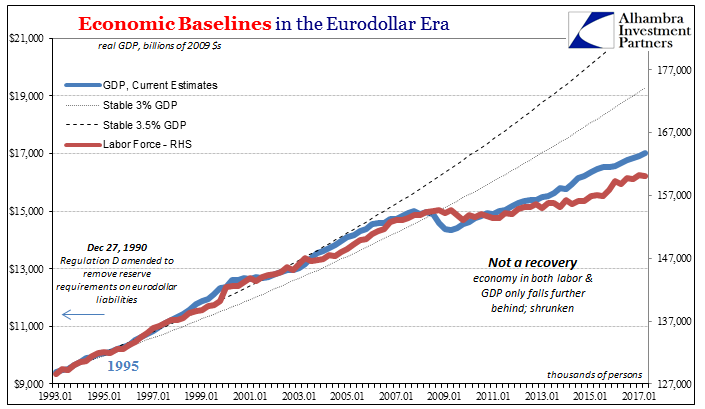

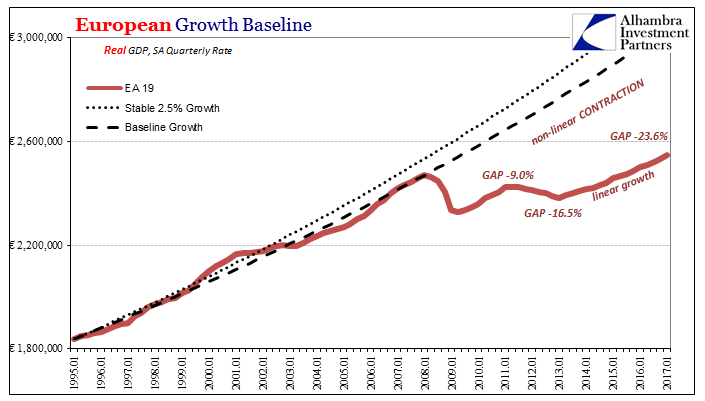

The defining quality for the last decade, if there is but a single one, has to be QE. It was the rushed, emergency response that was supposed to deliver salvation…but didn’t. Many people have often associated the seemingly endless parade of the programs with heroin or cocaine; it is, after all, called “stimulus” in the textbooks.

I’ve always thought this was wrong, not just from a technical standpoint of what is or is not money. QE in my judgment was like anesthesia, effective only at numbing the pain of a world gone so terribly awry. Or alcohol, fomenting an international stupor so as to normalize people to a world so unlike what it used to be; to give, at least, some small hope for the future where more and more hopelessness invaded. The vibrant colors of even the insane housing bubble have been rudely replaced for the utterly drab world of “hey, we actually got 2% growth this quarter!!!”

It’s as if we have become the object of Orrison Brown’s pity, a drunken mug who has been forced to live out a lost decade through no real fault of his own. It’s no wonder ten years has passed out of memory, for the decade wasn’t in any way worthy of remembrance.

The first part of the term “lost decade” has been true since it started, leaving only the terrible passage of time to finally meet the standard for a decade. It all fell apart early in the morning of August 9, 2007. It’s a date that should live in infamy, somewhere along the lines of the assassination of Archduke Ferdinand for its gigantic incongruity.

The murder of the Crown Prince of the Austro-Hungarian Empire spiraled out of control for more than just the carnage of the Great War: the costs of that war led to the almost total abandonment of the gold standard, unleashing a wave of monetary experimentation human civilization had never before seen; leaving it for the Great Depression to sort out, and then, in the cruelest twist of fate, another even more terrible war for it all to finish.

Our experiences in the late 20th century and early 21st mirror in many ways those. The technological changes of the sixties and seventies created conditions for monetary evolution far stranger and more complex than that earlier age. In truth, even today very few people grasp the enormity.

There was also what surely appears as a toggle switch between a world that worked, or appeared to, and the one careening toward destruction. It was not marked by an assassin’s bullet this time, but rather a geographical and functional distinction equally incongruous to what has resulted. Or, as I put on this anniversary occasion three years ago:

Tomorrow is an auspicious anniversary largely unbeknownst to even confident observers of the panic period, with events of that date changing the very character of the financial system irredeemably, as it has turned out. To dryly observe what happened understates the severity, as London trading for “dollars” saw an inordinate discrepancy that cannot be fully comprehended by mere factual recollection. On August 9, 2007, 3-month LIBOR rose from 5.38% to 5.50%; as I said that movement seems more at home in triviality than enduring significance. But in the context of global dollar flow, it was an immense tremor that kicked off the spate of “emergency” monetary measures that ultimately followed.

A 12 bps rise in benchmark LIBOR seems totally out of reference for a permanent cleaving of the entire global economy. This lost decade began as they might often do, with a miscomprehended whimper, a dismissed signal of great significance because authorities who had for a very long time assured the populace of their power to maintain the status quo never bothered to test whether that was true. When challenged, however, they show themselves not just the naked emperor of the fable, but no emperor at all.

It was only supposed to be Japan who could ever lose a decade (or two, perhaps three, but who’s counting?), and it was supposed to be zombie banks and a particular mindset that allowed it to happen. Our experience over the last ten years demonstrates conclusively what makes a lost decade, and it is in general very simple: they really don’t know what they are doing.

My goal here is to chip in some small part to change that, if at least starting from the bottom and working our way up. If officials refuse to see it, and they do, then we will have to make them see it.

What needs to be seen is a monetary system gone so awry, starting on August 9, 2007. In the details of that day, as well as other related conceptual journeys, we can begin to understand how the world got to such an awful, and, make no mistake, dangerous, state. This is my typically long-winded introduction to the Eurodollar University.

It will be unveiled in stages, geared more to explaining the concepts in theory as well as practice. I have gathered here in Stage 1 a small library of reference material for some of them. In addition, I was granted the opportunity by the gracious folks at MacroVoices, including their wonderful host Erik Townsend, to record a multi-part podcast running through in some great detail both evolution and mechanics of the modern eurodollar system up to August 9, 2007 (I’ll let you know when it gets to air).

We have to know how it was built, and how it all used to function, to be able to really know and appreciate how it restrains us now; where those last ten years truly went.

It is, I truly hope, a faithful scientific endeavor where we test hypotheses free from the restraints of ideological fealty. I may seem and often claim to know what’s going on, or has been going on, but I am far more concerned about what it is that I don’t know or can even conceive of that is left to discover. There is simply too much for a small service to cover. It can only succeed if enough people are intelligently engaged.

Description of the events on and surrounding August 9, 2007 from three years ago

Analyzing the mechanics of what went on that day.

Some additional commentary of August 9 from last year.

The 10th anniversary updates:

You’ve Heard Of Bear’s Funds, Why Not BNP’s?

Lombard Street, Not Wall Street

Subprime Is Contained (and other notable statements declaring that They Really Don’t Know What They Are Doing)

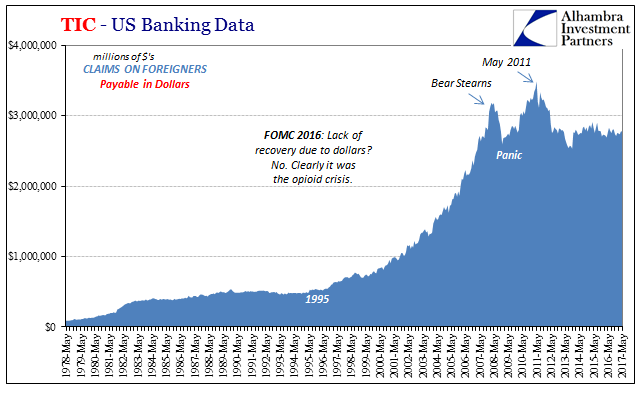

The downside of a “dollar” as a opposed to a dollar is that so much is now unobservable in the form of bank activities that never see the light of day (again, the bank at the center). Since we cannot even define a wholesale “dollar” we cannot think to even attempt its measure as it amounts to chasing a phantom.

A Brief History of Money, Part 1; Part 2; Part 3

We Know How This Ends, Part 1; Part 2

Understanding Eurodollars, Part 1, Part 2, Part 3

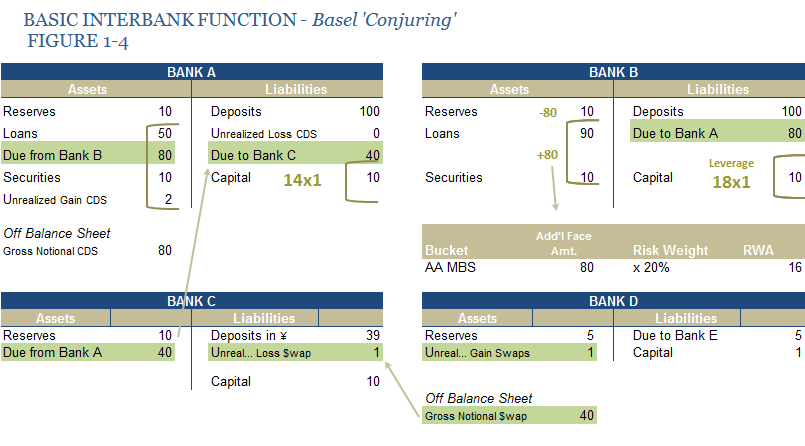

There were two major evolutions in money and banking that seem to fall outside the orthodox narrative. The first was a shift of reserves and bank limitations from the liability side to the asset side. The second was the rise of interbank markets, ledger money, as a source of funding rather than required reserve balancing; replacing the old deposit/loan multiplier model.

Far More Important What Is Not There Than What Is

For the most part, the concept of leverage is straightforward and intuitive. In physics, a lever is something that multiplies force to gain mechanical advantage. That is why the word was transported to finance as it means to multiply the effort of a small capital base. The “mechanical” force applied in the form of financial leverage used to be borrowed money or currency, but in the modern wholesale format the multiplication attains not only different forms but also added dimensions.

Of Modern Money And Multipliers

My purpose here is not to get too far down the rabbit hole, but hopefully far enough that you get a sense or at least a taste for this stuff and more so why it all exists to the degree it does. From that, the issue of truly modern money can be revealed. It all starts with accounting.

It’s the antithesis of the pre-crisis eurodollar system, where then these institutions believed no risk was too great because there would only be reward, but today global banking has been turned totally around to all risk with no reward.

If You Believe There Was Too Much Money During The Monetary Panic, Then Why Not Heroin

As I point out all far too frequently still, September – December 2008 was not the first period in which the federal funds rate had fallen below target in serious fashion for an extended length of time. The very first instance was August 10, 2007, which in many ways was a complete precursor of all these systemic discrepancies.

Currency Elasticity Only Applies Where There Is Currency

And that is the relevant point to our conditions right now. The money markets seem to follow policy decision only under benign conditions. Past some unknowable threshold, money markets become money market(S) with the Fed strictly powerless to enforce any kind of order and restorative measures to bring them all back into singular and seamless function. That makes its primary job of lender of last resort fully indefensible and untenable, which explains a great deal as to why we are where we are.

Forward China

You can appreciate the willingness of Chinese monetary authorities to incorporate this odd arrangement; before the 1990’s, China’s economy was a basket case of authoritarianism as well as unevenness. That uncertainty was the dominant view of the currency, as well. Thus, to peg CNY meant to do so credibly, and what better short cut than to “back” CNY by “dollars?”

I’ll add others as requested or as I think they might fit. Over time, the idea is to expand and organize so that Eurodollar University can be something more of a useful and accessible reference point. I might even go so far as to solicit work and opinions from those of you who have a unique perspective or who can make helpful contributions.

After all, ten years is enough. We’ve been in a stupor for that long already, and we really can’t afford to lose another decade.

Stay In Touch