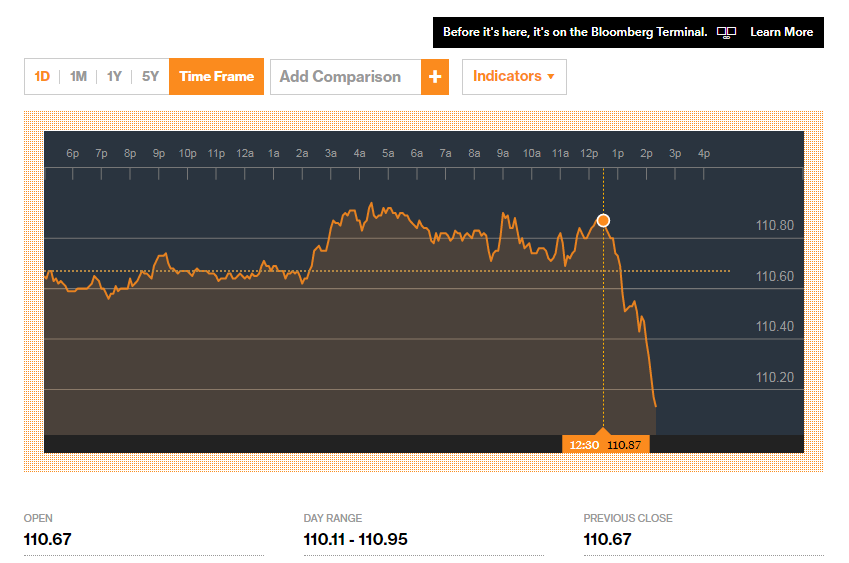

The markets actually turned before the Fed minutes were released, but once in the public (assuming they weren’t leaked again) the anti-“reflation” direction was amplified. Bonds have rallied as have eurodollar futures (near Friday’s recent high), JPY dropped (so you know gold was up, too), and even stocks shifted.

As usual, it is being characterized as a “dovish” statement which is entirely the wrong way to think about it. That’s true of all of them over the past few years, but this one maybe even more than any other.

I have written consistently that markets don’t care whether or not the Fed raises or lowers the federal funds rate (now corridor). What truly matters is why. In the nineties, the Greenspan Fed could get away with predictions, meaning that if they raised rates before inflation was evident the market went with them because it respected what it thought was expertise. It isn’t the nineties anymore.

What is clear even from the bland, sanitized minutes is that the FOMC is voting for “rate hikes” because they are voting for rate hikes and no other reason. They are moving policy and they really don’t know why. They can’t come up with the proper justification for it, yet they move anyway. “Data-dependent” was always a sort of pejorative sneer, and the committee is living right up to its fullest meaning.

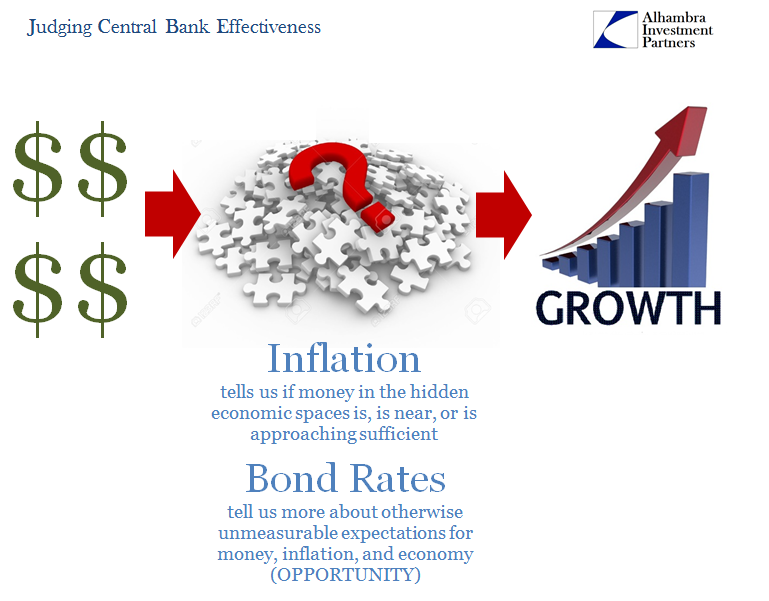

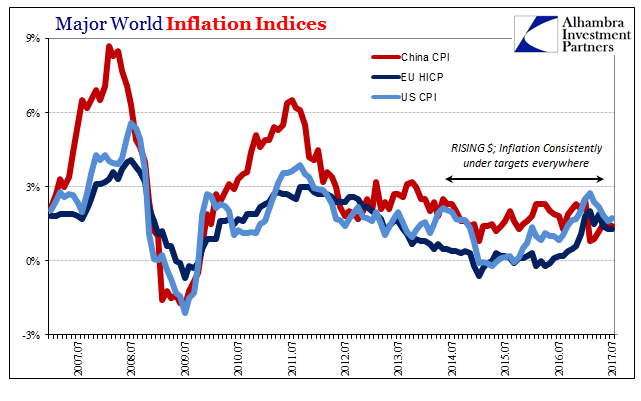

The primary issue is inflation. It’s not about consumer prices except as one window into what is really going on out there in the real economy. The unemployment rate says one thing, the rest of the macro stats another. Economists can claim, as they have, the former applies to the future economy, but they’ve been saying that for years now. Transitory has run out of slack.

To put it quite simply, the Committee is wholly confused and now publicly so. The minutes show what was likely a serious debate about inflation. There is no reason it should still linger well below the 2% target, not at 4.3% unemployment. If you believe in the Phillips Curve, as they do, one has to follow the other else “something” must be very wrong.

Many participants, however, saw some likelihood that inflation might remain below 2 percent for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside…

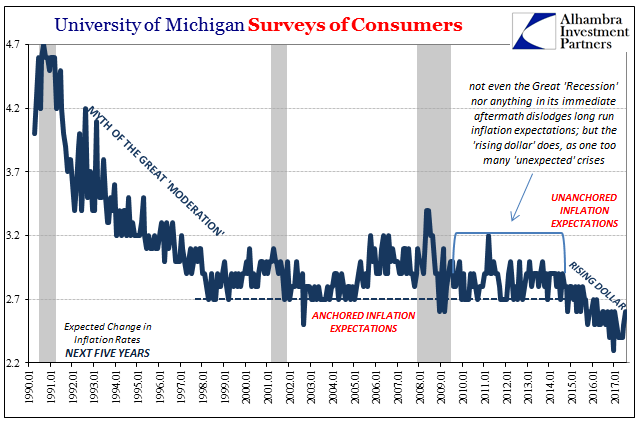

Participants agreed that a fall in longer-term inflation expectations would be undesirable, but they differed in their assessments of whether inflation expectations were well anchored…

Some participants expressed concern about the recent decline in inflation, which had occurred even as resource utilization had tightened, and noted their increased uncertainty about the outlook for inflation.

This is what is driving the conundrum for more than just trading today. It goes back to the previous “rate hike” in March, when at that time policymakers (especially in the form of Yellen’s press conference) couldn’t explain the policy change in plausible economic terms. That is inflation.

There were even hints at this latest meeting the members were rethinking the whole paradigm. This is no trivial deliberation, and gets closer to the heart of what is really going on here (money and how it affects the economy). The July minutes make mention of this “valid framework”, meaning Phillips curve where for orthodox economists inflation comes from wages and the end of labor slack.

A few participants cited evidence suggesting that this framework was not particularly useful in forecasting inflation. However, most participants thought that the framework remained valid, notwithstanding the recent absence of a pickup in inflation in the face of a tightening labor market and real GDP growth in excess of their estimates of its potential rate.

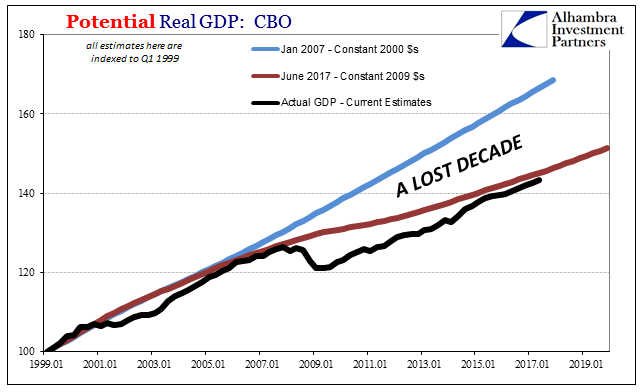

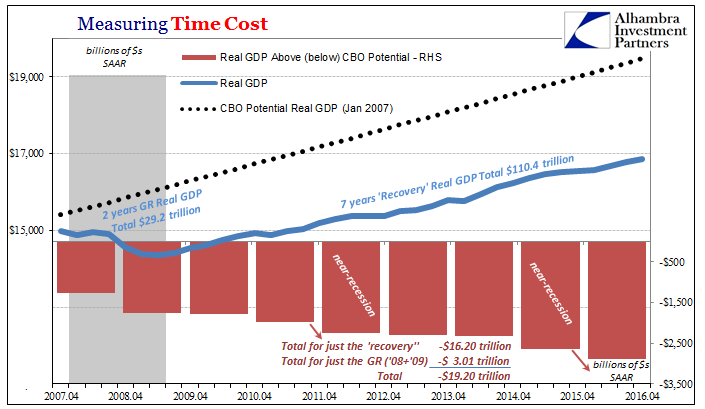

What is potential in this economic case? The FOMC may be satisfied that “growth in excess of their estimates of its potential rate” is occurring, but the inflation misbehavior suggests looking elsewhere. In other words, does it really matter that real GDP growth might be 2% this year compared to 1.8% potential? No, in fact the lack of fulfilling inflation requires re-assessment of how you came by a pitiful 1.8% potential in the first place.

Again, markets have been trading not as all this is “dovish” but that it is concerning in all the same ways as the last ten years of this lost decade. It must be figured in the “reflation” context as well, where after 2016 these markets began to contemplate what the upside might be even within a lost decade. Some hoped it would be actual recovery and real growth, others just better than the “rising dollar” period.

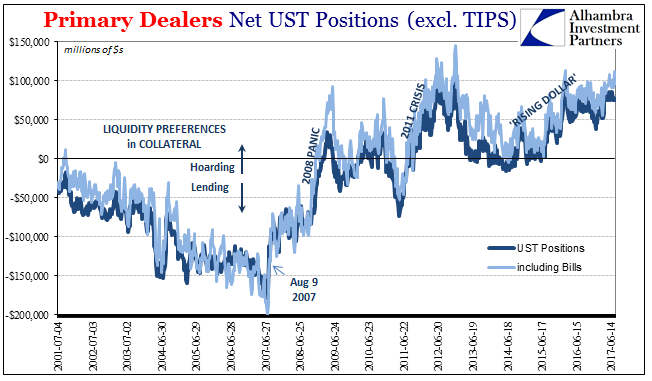

The further we go into 2017, and the more confused policymakers are, the greater the likelihood the upside is really limited if not indistinguishable from the most recent downturn (this is actually what retail sales data suggests). That’s a risk scenario where further hoarding collateral makes perfect sense.

Stay In Touch