You can understand to some small degree economists’ collective confusion about inflation. They believe in wage dynamics, where a recession through mass layoffs creates slack and thus depresses wages. The recovery in a period of robust growth re-employs those unfortunate workers, and after enough time when that slack is reduced or even eliminated wages accelerate again (increased competition for labor). As they do, businesses are forced to raise prices to maintain profits, while workers as consumers buy more stuff and can afford those price increases.

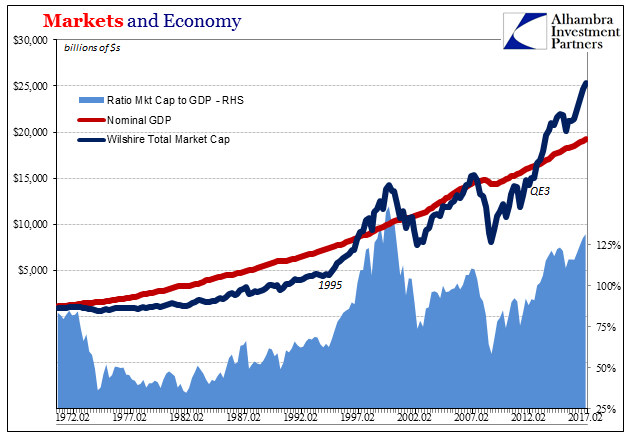

It is the virtuous orthodox circle that they always seek in the aftermath of any business cycle. In modeling this one, though, they believed because of the harshness of the downside as well as the clear sluggishness (by QE3 in 2012) in recovery it would take several years more in order for slack to be sufficiently dissolved.

Since we are not privy to Federal Reserve models, I use instead the CBO’s; not because I believe them any more accurate, or accurate at all, simply because in all likelihood they are very close to the Fed’s.

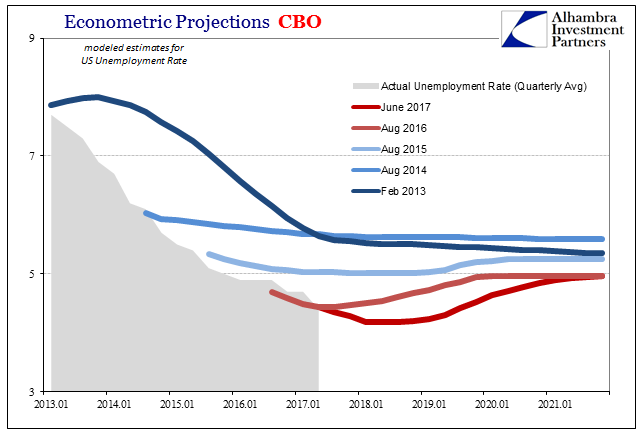

In the CBO’s February 2013 projections, those released just after QE4 began, the unemployment rate wasn’t expected to fall below 6% until this year. That would have matched the slow rate of growth then being observed throughout the US (and global) economy.

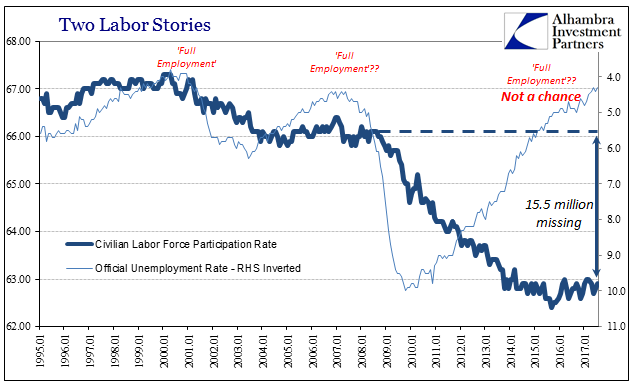

Instead, the unemployment rate practically collapsed. It broke below 6% in late 2014, more than two years early. In 2016, it fell below 5%, which up until that time the CBO expected would have been appreciably less than “full employment.” By this view of the economy, there is every reason to suspect wage acceleration and then broad inflation (according to the orthodox inflation framework noted above).

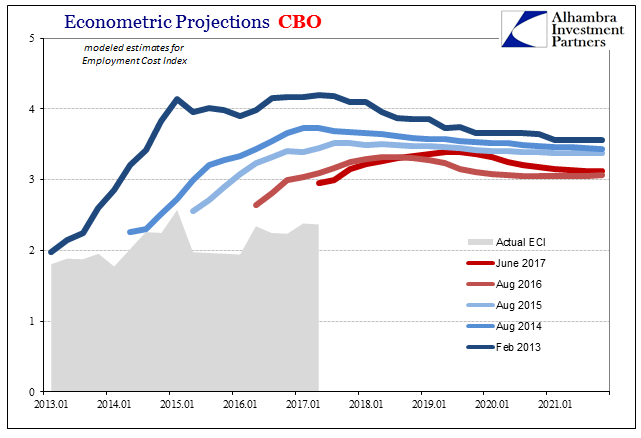

And that is exactly what the CBO forecasts for worker compensation were predicting. But as the actual unemployment rate fell below whatever level of prefigured “full employment” at each point without triggering rapid wage growth, the models have been forced to reconsider what might be “full employment.” In doing so, the impact on expected wages is both a delay and reduction in that point.

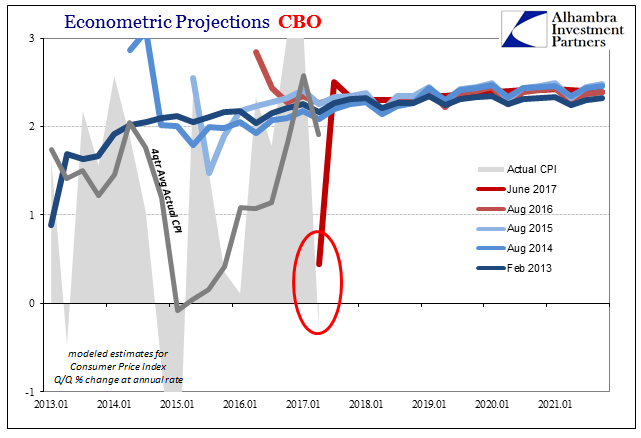

Despite the miss in wages though the extremely low unemployment rate, the CBO models keep forecasting steady and conforming consumer price growth (which for the CPI they show around 2.5%, or 2% for the PCE Deflator; the CBO data for whatever reason displays the inflation rate like GDP as a quarter/quarter change at an annual rate).

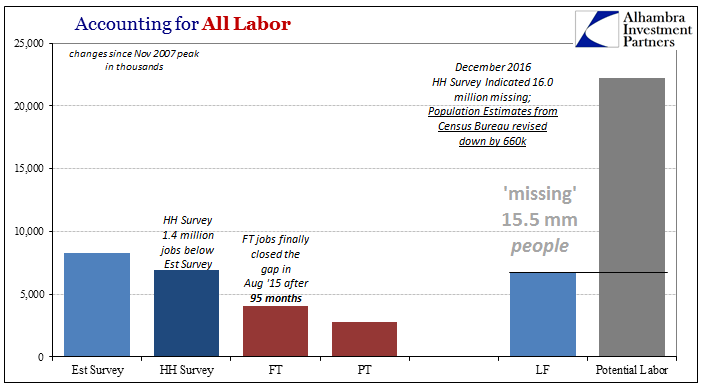

The economy produced a rapidly falling unemployment rate far quicker than the most optimistic of predictions. Yet, that condition has failed quarter after quarter, year after year, to push up wage and compensation growth even by a little. As a result, inflation over this same period hasn’t performed as targeted. Therefore, the point of failure is clearly the unemployment rate, which isn’t a surprise at all.

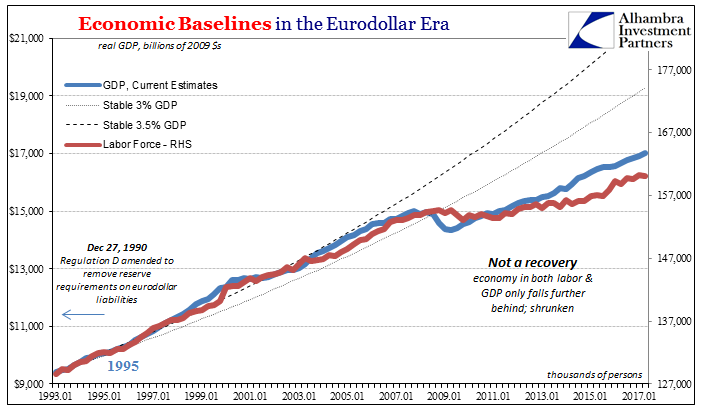

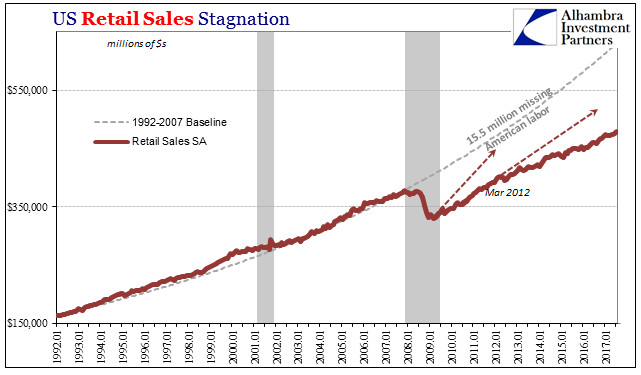

It merely confirms that those 15.5 million people are actually important in calculation and consideration of “slack” at the very least, and to the whole global economy in widespread fashion. And if they are, as nothing more than common sense declares, we have to examine how it could be that the US economy could simply shrink and not recover to such a huge degree. That would mean all the factors that go beyond the merely cyclical, starting with money.

If the FOMC was truly data dependent, the constant evolution of its models would provoke a philosophical change at the very least. It has taken far longer than it should (ideology demands conformity and thus countenances no dissent), but as noted last week there was some minor suggestion this might actually be taking place. The latest FOMC meeting minutes hint at some growing discomfort over the start of affairs as described ably in the CBO estimates (really the constant changes to them).

A few participants cited evidence suggesting that this framework was not particularly useful in forecasting inflation. However, most participants thought that the framework remained valid, notwithstanding the recent absence of a pickup in inflation in the face of a tightening labor market and real GDP growth in excess of their estimates of its potential rate.

Why do we care?

It’s more than just pure entertainment watching the empty suits trying to make sense of what (to them) just doesn’t. From their view QE worked spectacularly well, blowing up the labor market in the “best jobs market in decades.” No wonder they thought 2015 was to be terrific on all counts, if inflicted at the start with “transitory” factors.

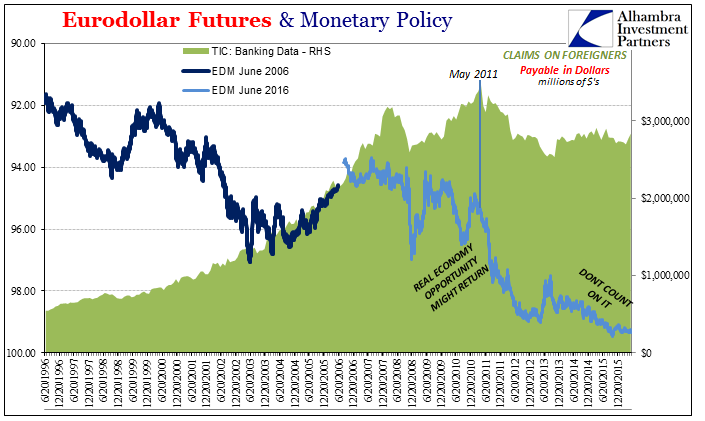

It matters for identifying risks to the economy as well as investing within it. The more confused they become about the unemployment rate, the more we are assured that the wretched economy of this lost decade is continuing. The more confident we are of that, the more we can prove the predictive power of eurodollar futures or treasury yields.

It matters for identifying risks to the economy as well as investing within it. The more confused they become about the unemployment rate, the more we are assured that the wretched economy of this lost decade is continuing. The more confident we are of that, the more we can prove the predictive power of eurodollar futures or treasury yields.

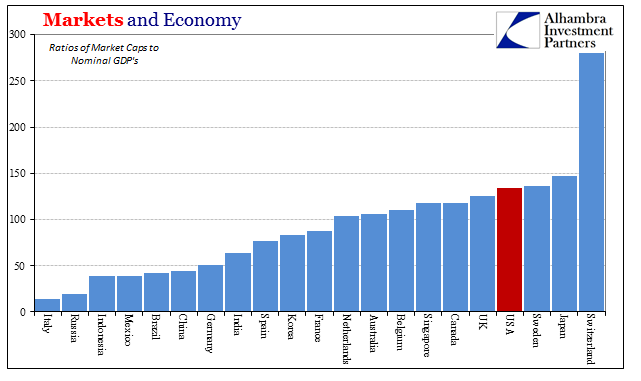

It matters also for stocks but in the limited sense of valuations. So long as prices keep moving in anticipation of “full employment” that just isn’t there, we are pretty confident about the relative risks of share investments. If the economy remains depressed, there isn’t any realistic way for earnings to catch up to prices.

The inflation problem really isn’t about inflation. It is about macro risk and what that means for more than just this or next year.

Stay In Touch