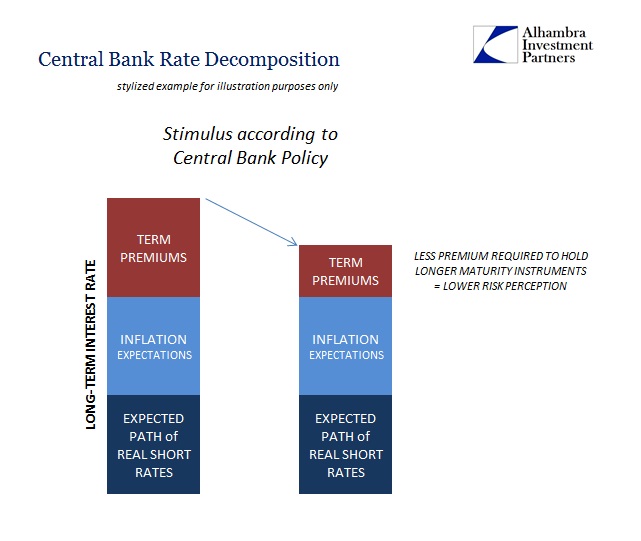

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that much longer (more return to entice an investor to buy a 5-year UST rather than a 4-year, or a 10-year as opposed to a 2-year).

This is, of course, backwards. Lower term premiums would relate to curve dynamics. It is not risk that applies here but opportunity; or, in the parlance of John Maynard Keynes, liquidity preferences. The greater the opportunity in the real economy, the more term premiums demanded for investors to forego that opportunity and hold a liquid substitute. It is why yield curves steepen in recovery.

The compartment or categorizing of these elements doesn’t really matter. If perceptions of reduced future opportunities affect the expected path of real short term interests rates or inflation expectations, does it really matter what we call them? In many ways they are the same thing. They are given different boxes because economists think the central bank is what matters (especially for the future path of money rates).

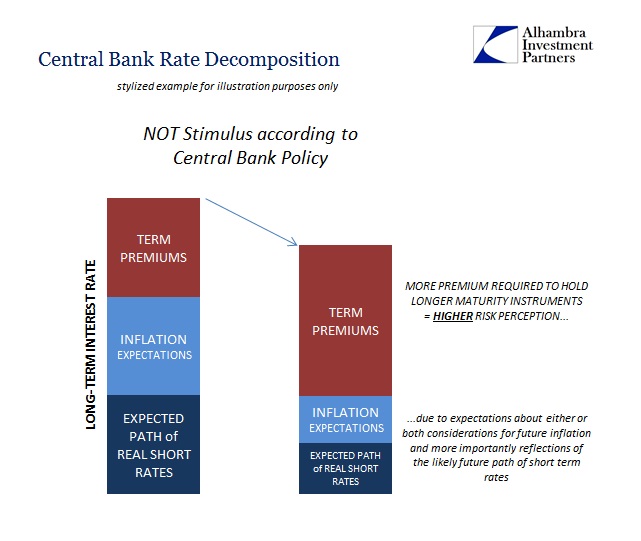

Term premiums are therefore helpful only in the respect that they might force academic economists to realize the bond market is not now and has not been their friend. They can fantasize, as they often did in 2014, that interest rates were falling at the time because term premiums as they saw them were, but that wasn’t ever really the case. In other words, in their own terms and using their own language the bond market was telling them what they refused to hear.

It is doing so again.

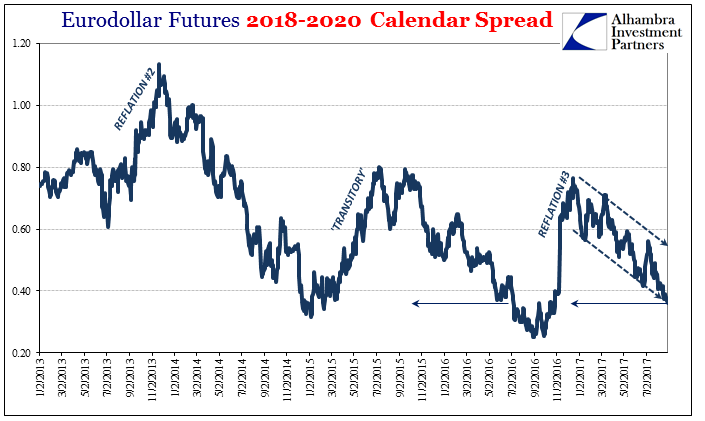

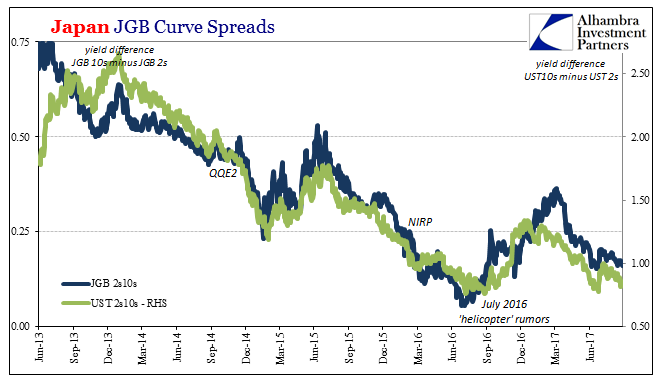

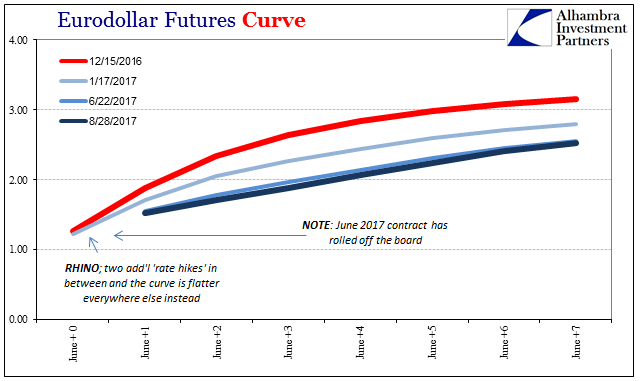

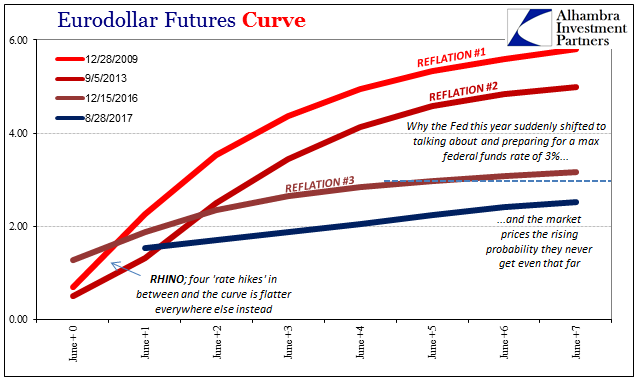

We have proxies for both inflation expectations as well as the expected path of short rates (if not fully in real terms). Inflation expectations never gained much during “reflation” last year, and neither did money rate expectations. Now both are suggesting conditions more like last summer than summer 2013. Using Fisherian decomposition, then, term premiums would have to be rising (if they existed).

Therefore by economists’ own terms the bond market is not suggesting further “stimulus” but further lack of opportunity (rising liquidity preferences as the true substitute for term premiums). It proves for a third time (2011-12, 2014-16, 2017-??) that interest rates aren’t what they are made to be. To claim that they have nowhere to go but up misses the crucial information where curves all agree.

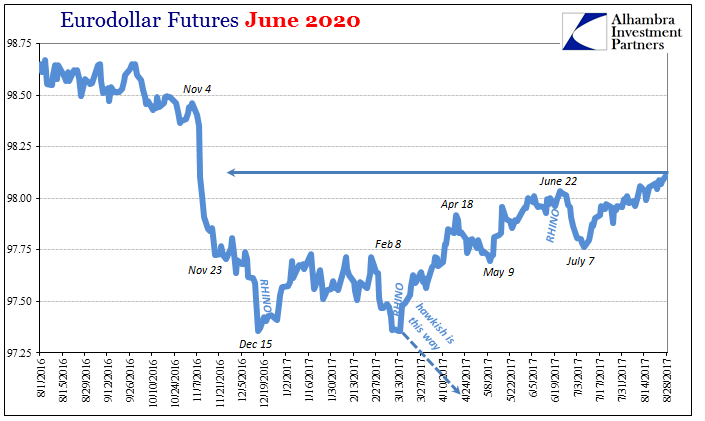

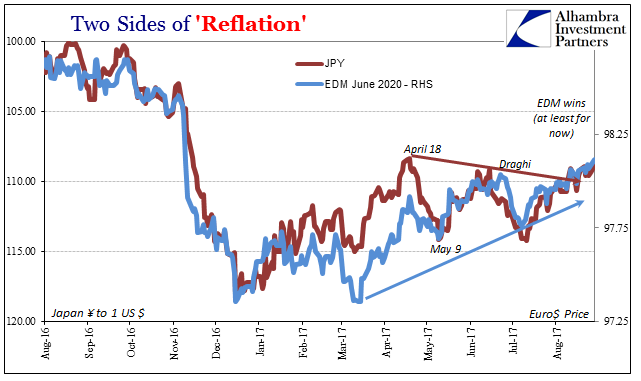

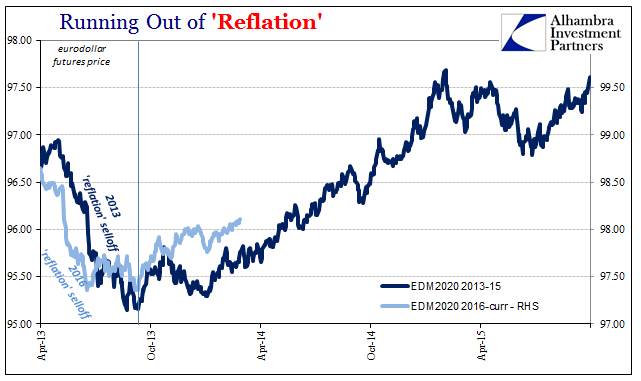

The June 2020 eurodollar futures contract (EDM refers to the June series) closed today at the highest price since the November selloff. That rising price means incrementally lower expectations for future money rates. JPY is as (almost) always not far behind, though as of today remains still less than mid-April.

And it’s not just here in UST’s, it is a global impulse reborn as “reflation” slowly fades in 2017, just as it slowly faded throughout 2014 (German 2s closed at the lowest yield, most negative, since April before the French election). It’s not term premiums but reborn pessimism. With good reason. We’ve seen this movie before.

Stay In Touch