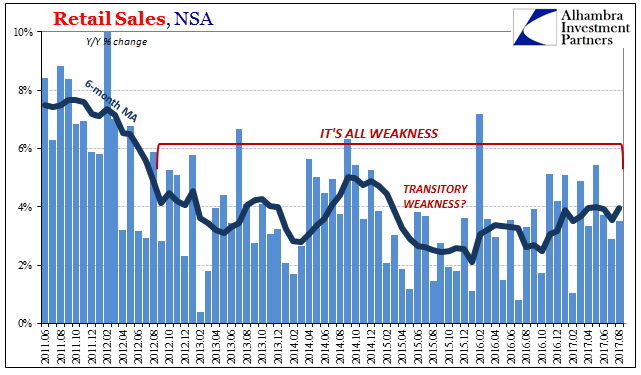

There will be an irresistible urge to the make this about the weather, but more and more data shows it’s not any singular instance. Nor is it transitory. What does prove to be temporary time and again is the upside. The economy gets hit (by “dollar” events), bounces back a little, and then goes right back into the dumps. This, it seems, is the limited extent of cyclicality in these times.

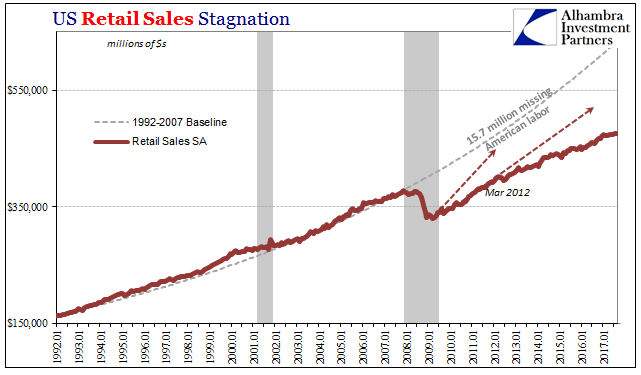

Retail sales were again very concerning in August. The problem is that sales have lagged for much more than just last month. Year-over-year unadjusted total retail sales rose by 3.53%. The 3% level is more recession than recovery, and 6% used to be something of a floor for conditions consistent with regular and healthy economic growth. That low growth rate in August follows a significantly lower revision to July (mostly autos) where the Commerce Department now thinks retail sales expanded by less than 3% (2.90%).

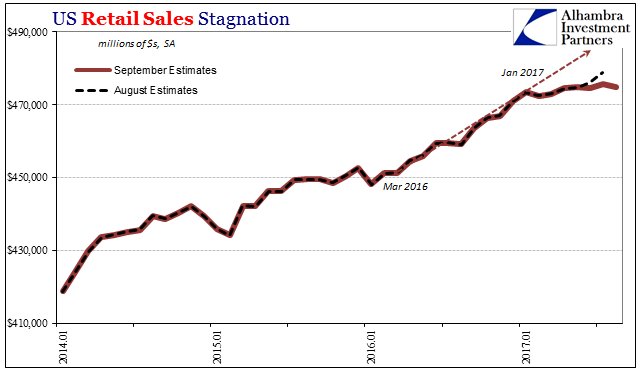

Seasonally-adjusted, retail sales declined in August from July. With the latest revisions for the prior two months, the trend in consumer spending is unmistakably bad. Dating back to January/February, giving us a sufficient chunk of the calendar with which to judge, retail sales have fallen out of “reflation” and back into the same near-recession conditions that almost always otherwise prevail. The upturn out of the near-recession in 2016 was indeed brief and quite limited.

In the seven months July 2016 through January 2017, retail sales (seasonally-adjusted) rose by an almost healthy 3.1%. In the seven months since January, through August, retail sales are basically flat, up 0.3%.

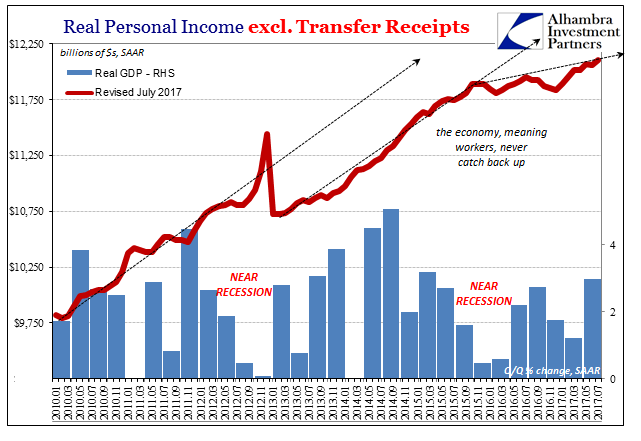

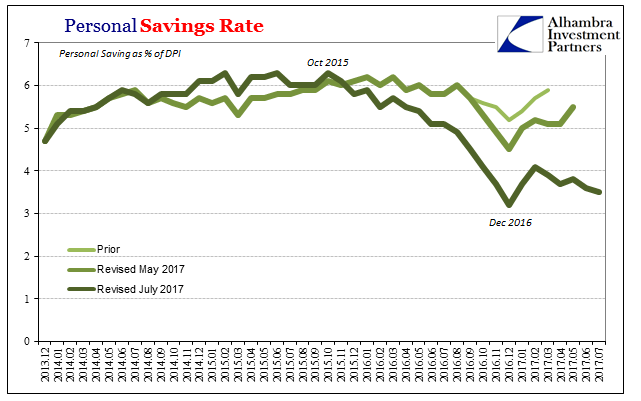

This is all, of course, perfectly consistent with the data from other sources like national income. The slowdown in the labor market and therefore overall aggregate earnings appears to be behind flagging spending (with the initial rebound in oil prices really not helping). As noted before, the drop in the estimated savings rate late last year does appear to have indicated exhaustion and concern that is holding back consumer tendencies.

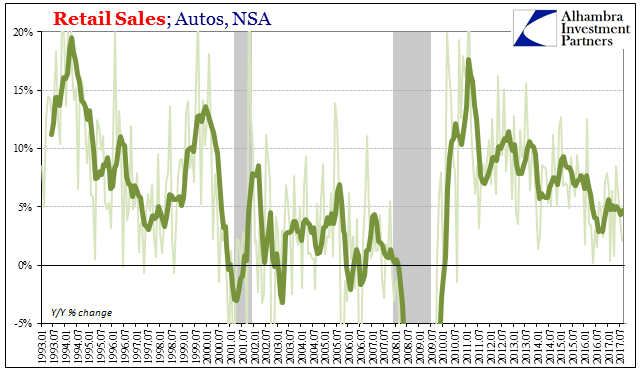

Two segments in particular are establishing this strained position. The first is auto sales. Year-over-year, retail sales in autos were up just 2.1% in August, and are now believed to have been only 3.9% higher in July 2017 than July 2016. The enthusiastic purchases of vehicles no longer contribute to overall sales growth, a product of decelerating income and the related heightened caution for the marginal consumer.

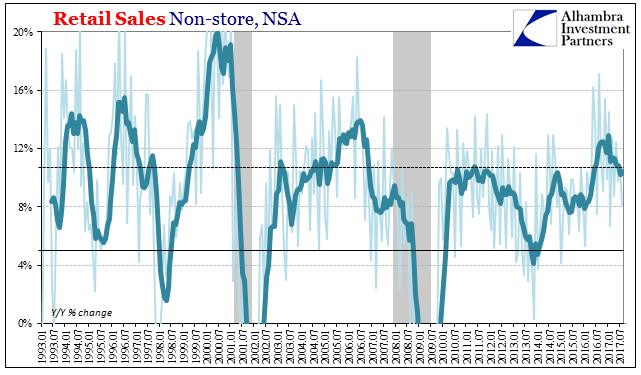

The other is retail sales for non-store outlets. It’s perhaps a bit more difficult to characterize 8% year-over-year growth as in August as something of a drag, but for a good while during the rebound last year non-store sales growth was considerably more. For reasons that aren’t entirely clear right now, perhaps no longer enough of favorable price comparisons, growth online while still solid is not anymore spectacular. That variance matters at the margins of an economy that is seriously struggling.

Consumers are not spending the differences autos and online anywhere else. The estimates for the Personal Savings Rate and the lower track of Personal Income suggest very simply that they can’t. The report for retail sales shows uniformly that all of the economic improvement, such that there was, occurred only in the last half of last year.

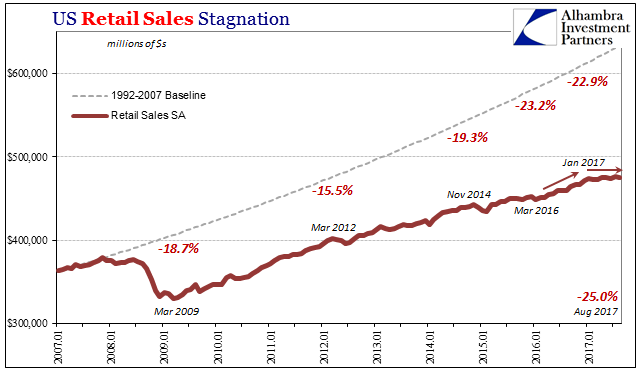

This year, which was supposed to be at least a minimal springboard to better things (what “rate hikes” are believed to be about), has for the consumer part of the economy almost completely fallen out. In market terms, it appears to have been what it had been both times before. The downturn ends and as the uptick appears it is characterized by far too much enthusiasm while at the same time never really appreciated for its limited potential. In other words, the recession/not recession paradigm forces markets and people to see and extrapolate what isn’t there.

“Reflation” is almost certainly gone, and for months now (bond market and eurodollar futures get it right again?), leaving more and more the indications for at least the prerequisite conditions (mainly disappointment, and therefore assessments for downside risk) for the next downturn. It isn’t recession or cycles but variable (global) monetary pressures. The difference is in expectations; in the recession/not recession framework, the end of recession is the end of downward economic forces, the termination of them allowing the economy to get back to its upward potential. That’s what most people believed for this year, just as 2014 or 2011.

In this eurodollar paradigm going back to August 2007, the end of any downturn leaves the economy to bounce back ever so slightly (in diminishing fashion for each time) and then be stuck on a lower growth potential. And while it is there, it is merely awaiting the next “dollar” event and downturn that comes with it. It is the anti-growth baseline, where the global economy only gets weaker. In linear terms it appears to be growing, but it is not growth.

Stay In Touch