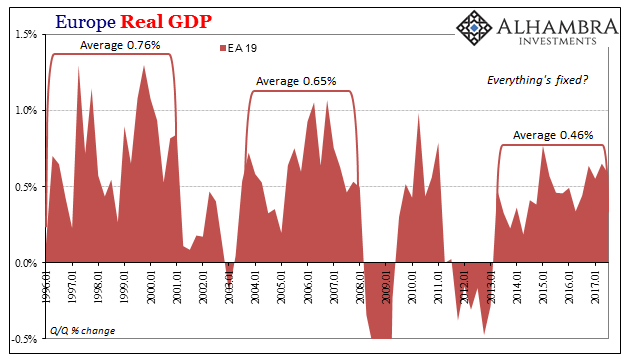

European GDP rose 0.6% quarter-over-quarter in Q3 2017, the eighteenth consecutive increase for the Continental (EA 19) economy. That latter result is being heralded as some sort of achievement, though the 0.6% is also to a lesser degree. The truth is that neither is meaningful, and that Europe’s economy continues toward instead the abyss.

At 0.6%, that doesn’t even equal the average growth rate exhibited from either the late 1990’s or middle 2000’s. Straight away one of the so-called better quarters is already below average by historical comparison. That would suggest Europe’s economy is still struggling.

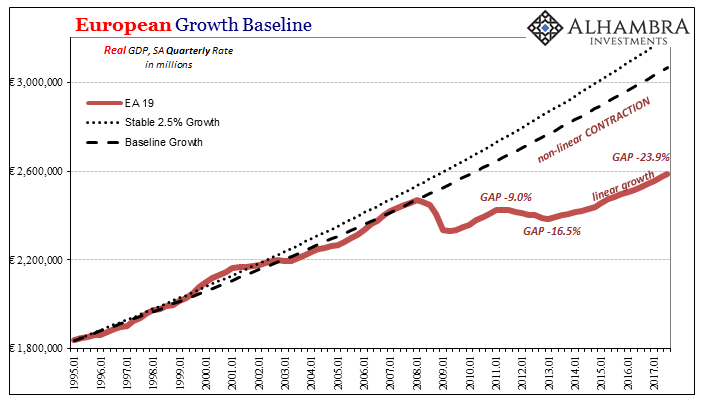

Because even these positive quarters are never all that positive, there can never be enough momentum let alone growth to make up for when there was clear, linear contraction. The economy shrinks and though GDP turns positive afterward, even for eighteen straight quarters, the shrinking isn’t actually concluded.

The gap to Europe’s pre-crisis baseline is actually substantially larger now after four and a half years of steady “growth” than at the bottom of the re-recession trough reached in Q1 2013.

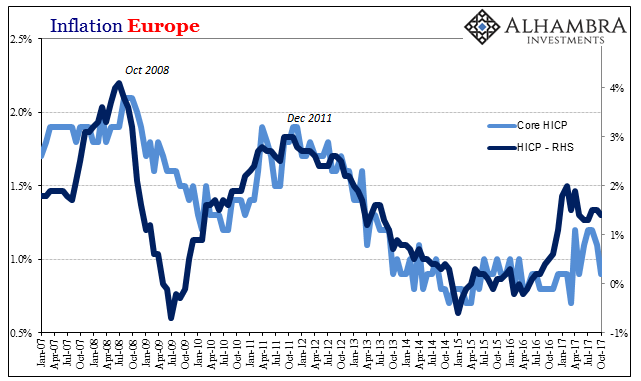

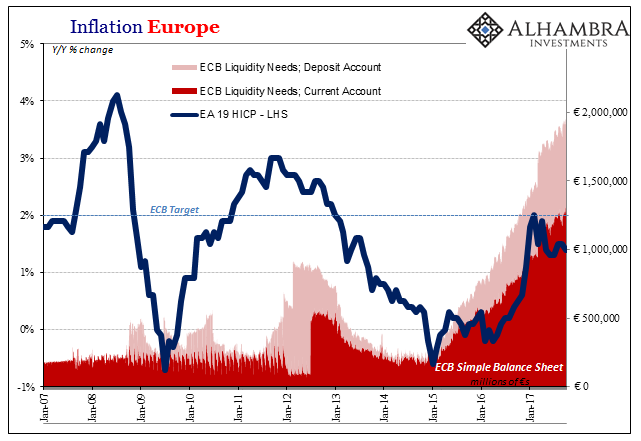

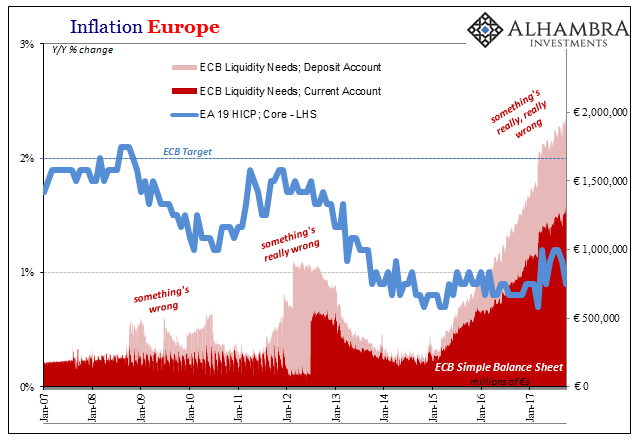

From the perspective of steady growth and successful monetary policy, ECB officials might expect that inflation would start to behave according to the central bank’s target. It hasn’t, and the latest results for October 2017 suggest even more problems along these lines.

The headline HICP decelerated to just 1.4% last month, while more ominously the “core” rate dropped to less than 1% again. The former keeps moving further away from the target when it was expected to do so only for a few months in the middle of this year. Once the oil price base effects were digested around April and May, the ECB’s models predicted gently accelerating inflation reaching (in sustained fashion) their 2% goal by early next year.

The core rate at just 0.9% indicates more so the opposite possibility, continuing the global “conundrum.” Despite ongoing massive ECB intervention supposedly in euro “money”, these operations bear no correlation at all with inflation and therefore effective monetary conditions in the real economy. The lack of inflation continues to advise the non-linear contraction scenario described above with regard to the GDP gap.

The issue is, as always, monetary definitions, which in Europe, as everywhere else, is more than an academic matter. The ECB through its various LSAP’s through the years created bank reserves as a byproduct and nothing more. These are but one form of bank liability and a mostly useless and inert one at that. It is little wonder that the real economy fails to respond to what in the mainstream is wrongly characterized as “money printing”; and therefore why there continues to be expectations consistent with money printing but widespread results contrary to that process.

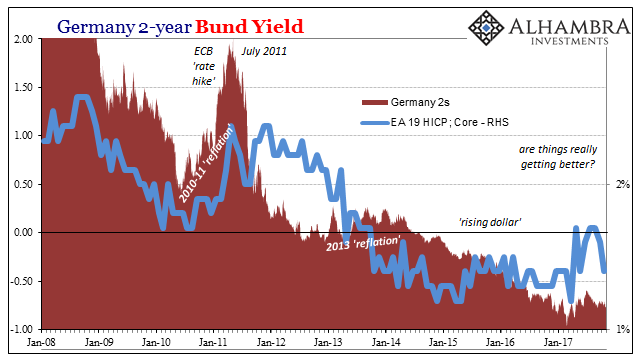

From a more direct monetary view, such as German 2s, there is no inconsistency at all. Even though the ECB will be tapering its bond purchases, and therefore bund purchases, too, German federal yields are trading in the “wrong” direction from what QE tapering is supposed to reflect.

In fact, more negative 2s is instead indicative of higher liquidity preferences, which, for the terms of this discussion, is consistent with a struggling economy unable to generate momentum (and therefore core inflation). That’s why the “yield” moves contrary to fewer ECB purchases because that factor doesn’t matter nearly as much as the other. It’s actually been this way for several months now, going all the way back to the end of June.

You don’t find any of this in mainstream discussion about Europe, only the brief mention of this inflation mystery, and the related confusion over the political situation there, all dismissed easily in the context of the future economy that (always)looks to be so bright (but never is). Because the ECB is tapering QE, that’s all that matters to set the conventional narrative. Europe is booming because Europe has to be booming. Except that it isn’t; not even close.

Stay In Touch