Chicago Fed President Charles Evans is this year a voting FOMC member. Normally, that might not make much difference but in times like this where dissension is building beneath the surface of even the typically stoic central bank, this time it might. Apparently we can count Evans among the list dissatisfied with the current state of monetary policy.

Speaking this week, the policymaker departed from the preferred narrative almost speaking directly to Janet Yellen (perhaps Jerome Powell and his confirmation hearings, too) using her word:

[W]ith each low monthly reading, it gets harder and harder for me to feel comfortable with the idea that the step-down last spring was simply transitory.

…something more persistent is holding down inflation today. Namely, I feel we are facing below-target inflation expectations.

In some (small) ways this is unfair to Yellen who inherited this mess from Bernanke. The previous Fed Chairman at least had the specter of further crisis with which to keep often intense disagreement in private. Not that Yellen really distinguished herself all that much then or now, but this is not a huge question mark blotting just her record.

Nor is Evans adding much to the debate, either. He’s basically citing the obvious, which only goes to show just how much and by how far the central bank has been reduced. When stating what is perfectly evident becomes progress the whole enterprise can only be corrupted down to its very foundation.

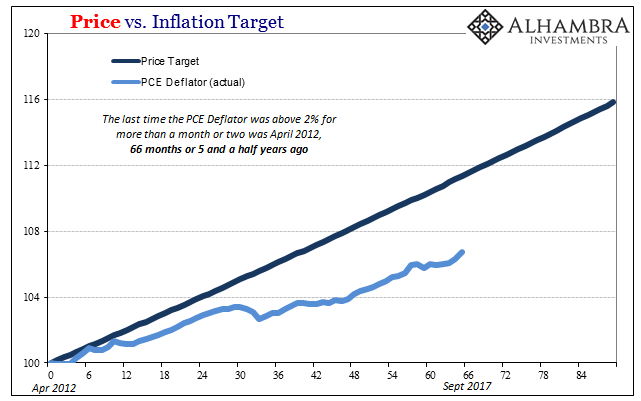

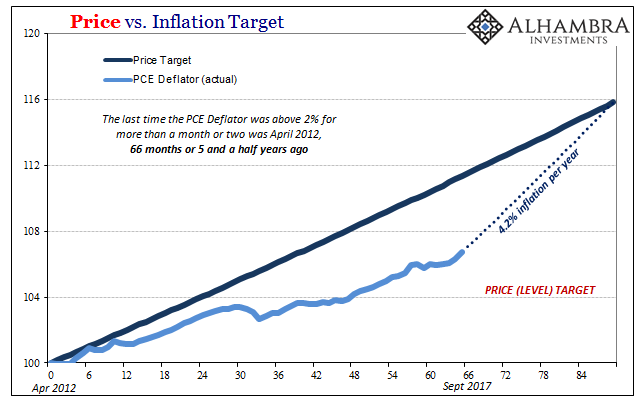

It’s been five and a half years, let me repeat that, five and a half years, since the Fed last met its definition of price stability. In any other profession, including politics, such a track record would have been met with a thorough housecleaning. Yet, the Fed persists. Some officials, I believe, can sense that its real institutional abilities, PR mainly, can only keep the hounds of reckoning at bay for so much longer before this central bank, already quite unpopular to more than just the populists, is caught up in righteous demands for real answers.

Obfuscations, a Bernanke specialty, learned directly from the maestro Fedspeak master Greenspan, have passed their expiration.

In trying to make sense of why they might have to forthrightly respond to legitimate grievances, the Fed is being made to face some ugly reality right in its own backyard. Inflation is their purview, the exclusive domain of money which is the exclusive territory of the central bank – or so everyone believes(d). Missing a target for a few months doesn’t raise objections; five and a half years is kind of hard to defend, though most of them are still trying.

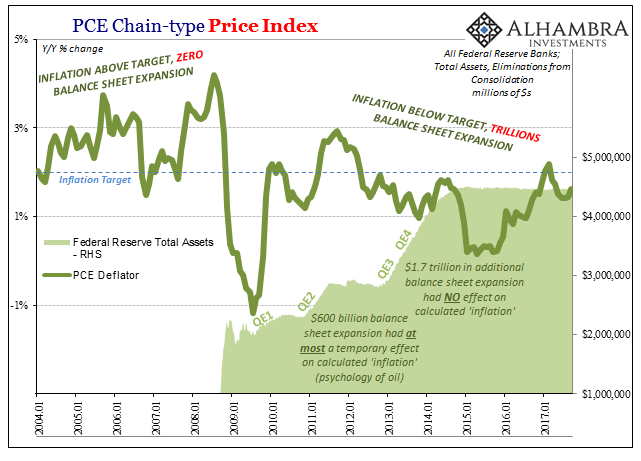

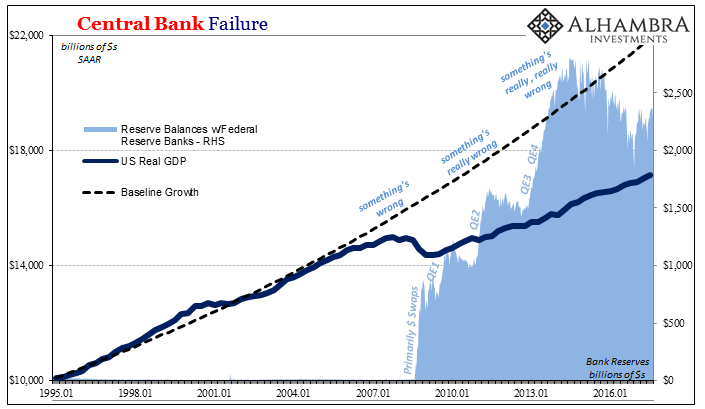

That’s especially true when you do four QE’s totaling about $3.5 trillion in Fed balance sheet expansion. You did it and it sounded great, scientific even (quantitative easing), but where is it? Nearly three years claiming it will show up once transitory factors disappear only raises that many more questions of an even more cutting variety, those testing basic human competence in addition to monetary policy skills (such as “do you really not understand what the word transitory means?”).

There is on the chart above as well as everything in the last ten years a missing symmetry that is crucial to getting at what’s truly wrong. The economy falls down in recession, as it has countless times before, it gets right back up by an equal or greater amount in a reasonable space of time. There was no symmetry in 2009 when the Great “Recession” officially ended (at least in its immediate contraction), none in 2012 when the economy stalled again, and certainly it’s still missing now.

It’s this ratchet process instead where things only get worse, no acceleration or even the most basic cyclical impulse that “somehow” appear time and again stifled by “something more persistent.” The gap has only grown.

Evans introduced symmetry in his remarks, couching it in the context of monetary policy targets. It’s progress only in the sense that after ten years it shows the Fed, or at least certain officials within the institution, are capable of seeing reality (again, which shows just how contaminated the institution has become).

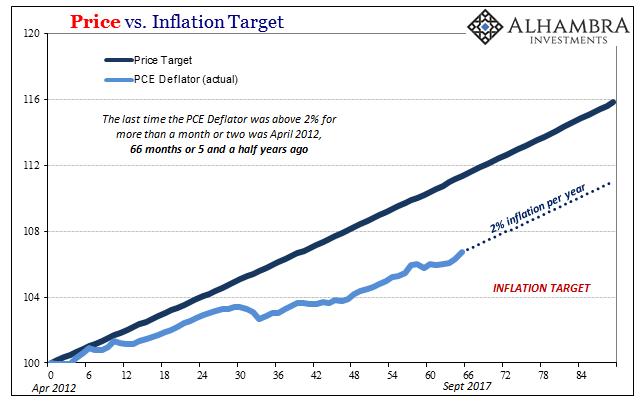

The Chicago Fed President apparently stressed that 2% “is a symmetric goal for inflation, not a ceiling.” That brings his thinking more in line with a price target, or at least a price level target. The difference from an inflation target is that symmetry, or in the context of underperforming for so long making an attempt to reconcile with that past underperformance (instead of running away from it). You can’t just ignore an economy that doesn’t get back up.

As you can see plainly above, if the US economy was to suddenly achieve sustained 2% inflation from this month forward, it would still leave consumer prices with a considerable gap from where they “should” have been had the economy been operating normally in recovery. Time is one factor on both sides; in that it has been more than long enough that if it was going to it would have by now; and on the other side the longer it has been left to decay like this the worse it gets for all involved (and the harder to get out).

We can’t get too hung up on the fact that the central bank wants to harm consumers at the worst possible time, that’s just their methodology of working through money to economy. In this case it’s actually progress because again they are being forced to recognize that inflation is behind, bringing them closer to the realization that it’s not just consumer prices that are desperately lagging (and then the big one, why that is).

Symmetry in the form of a price target would look far different. To close the price gap in two year would require 4.2% annual inflation in both years. The longer the Fed waits to try and force that, the greater the inflation required to bring prices up to where they “should” be. As inflation goes up to that level, so too, theoretically, would economic growth in at least nominal terms – the very thing that is missing. It’s a far different proposition than the current official consensus of “full employment” implying no output gap at all.

Again, it’s not that we want the empty suits in DC to undertake such a drastic measure especially via consumer prices, only that we want them to realize through this one window the desperate situation the economy is in, and has been in, that would require such drastic action to get out of it. It’s a measure of how far behind they have let things get wasting precious and costly time on QE’s that didn’t come close to accomplishing either of their primary tasks (both inflation as well as unemployment despite the official rate, as the two are linked).

And once they start thinking about the scale of the problem eventually, if we are lucky, they might finally and honestly begin to see the (obvious) source of it. They would almost have to because to shoot for 4.2% inflation they would be forced to reckon with why four massive QE’s couldn’t get close to 2% – the “something more persistent.” They might even start to question what exactly a bank reserve is and what its role in the effective financial plumbing really might be (not at all what the textbooks say).

Unfortunately, in the end, that’s a best case scenario that is probably unrealistic. Without a thorough housecleaning, there is simply no realistic way that the Fed can confess to the eurodollar, that there was an entire self-sustaining offshore currency ecosystem that it ignored and denied for more than four decades (running now on half a century). That kind of dereliction is not something any bureaucracy is really capable of, even in a state of self-reflection due to survival instincts, let alone inside one so recalcitrant that stating the obvious has become a distinct measure of progress.

Stay In Touch