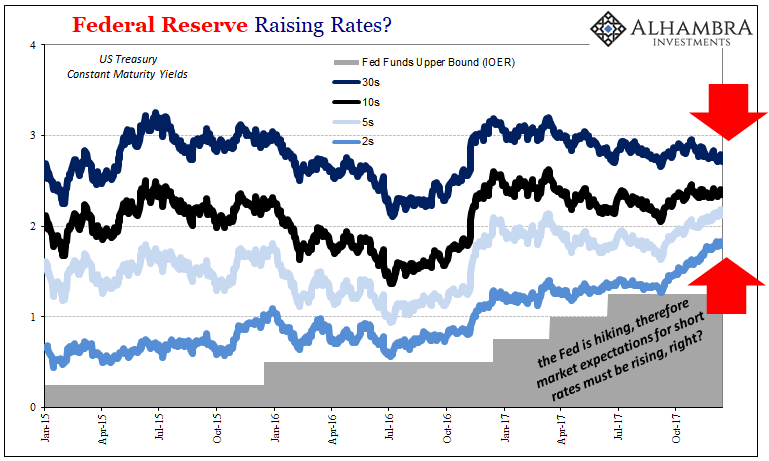

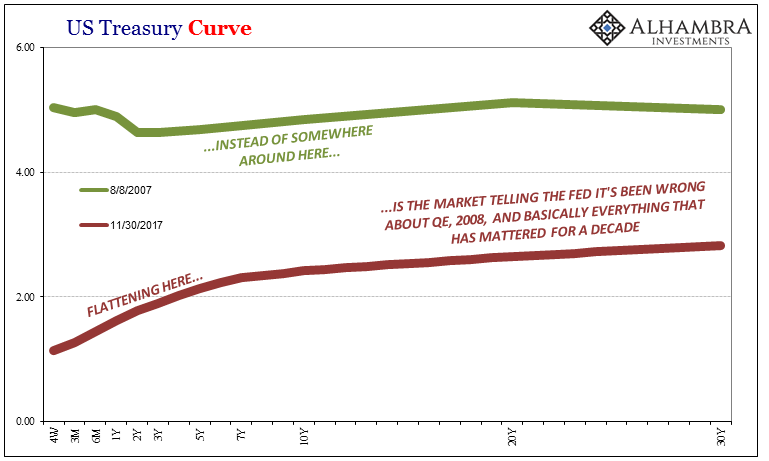

It was another pretty embarrassing day for the Federal Reserve and its policymaking body the FOMC. The latter voted, as expected, to raise the federal funds corridor (or double floor, if you can’t get over IOER fail) by another 25 bps. The long end of the Treasury bond market, however, was bid pushing yields down not up. There is a reason the 10-year UST is considered the main benchmark, meaning that these are not really “rate hikes” but RHINO’s (rate hikes in name only).

It was a perfect demonstration of curve dynamics, in this case meaning Fed officials really don’t know what they are doing. If it was otherwise, long bonds would be trading as the FOMC would like – rising nominal yields all along the curve short and long respecting monetary policy where curve flattening happens way higher than here.

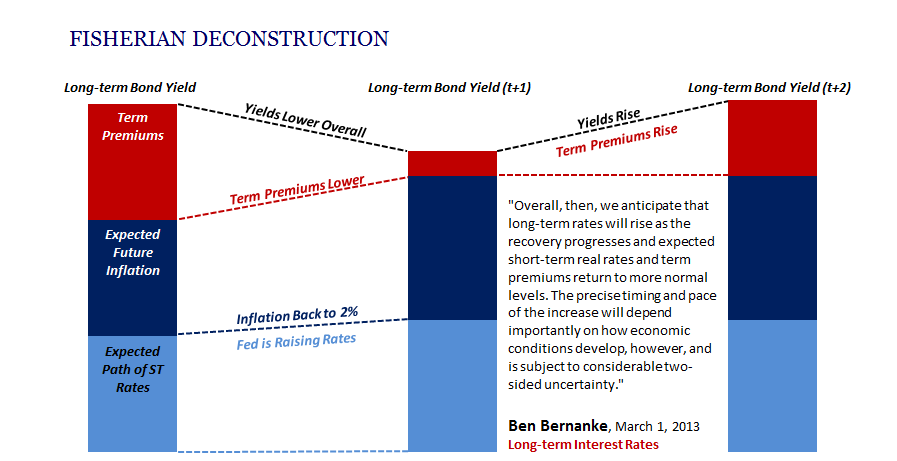

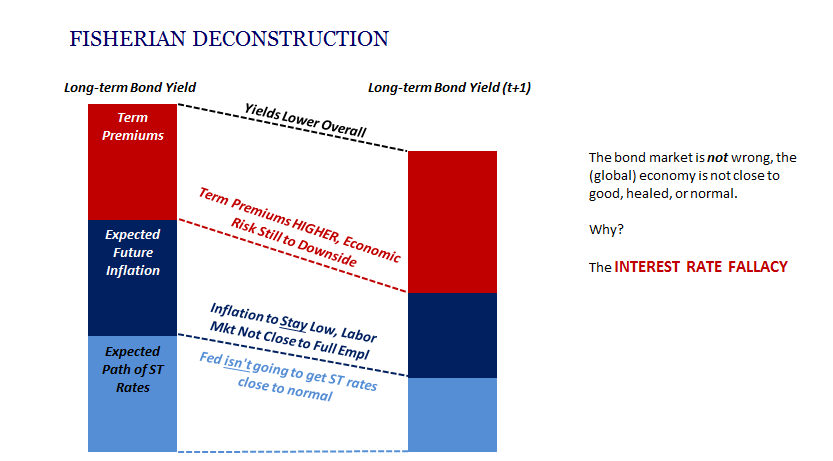

Instead, US central bankers have convinced themselves at least in the majority that the bond market is only temporarily resisting their outwardly more positive views until it gets its parts in order. And by parts I mean yield deconstruction and those stupid term premiums again.

The Fed is raising rates because it believes inflation is going to accelerate if more gently in its ascent. That for them takes care of the bottom two parts of the long end breakdown – the market has to be expecting higher short-term rates (because of the “hikes”) in addition to higher inflation expectations (the reason for the “hikes”). Once “term premiums” head back toward normal as Ben Bernanke, among others, has been expecting for years now, that’s when the official view will be proven correct.

It’s just a matter of time, right?

I suppose that makes term premiums transitory like everything else that doesn’t validate the inflexible official position. To start with, the mere fact that the Fed is raising the reference corridor for money alternatives (these RHINO’s) does not immediately propose the market is expecting higher short term interest rates (the bottom part of the yield curve decomposition).

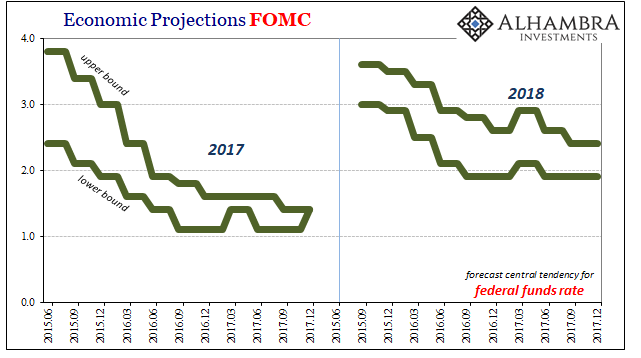

Long rates don’t really care as much about what’s happening in the short run, rather what matters are expectations about longer run conditions especially any anticipated changes to them. In that respect, not even the Fed believes short rate expectations are climbing higher; in fact, their own estimates of where the federal funds “hikes” end up, which is what really matters, keep getting lower and lower all the time.

In the middle of 2015 back when most economists were still delusional about the dollar and the unemployment rate, in total denial about what was then happening to the world economy, the FOMC models forecast between 2.50% and nearly 4% for the federal funds targets this year. The upper bound (IOER) has made it after this last policy vote only to 1.50%, meaning that the market like policymakers is reducing its expectations for where short-term interest rates will be when it matters.

Again, its not that the Fed is hiking but how many times the market thinks it will before they stop on their own or more likely are forced to by more “unexpected” and “transitory” financial deviations. In that respect because of the “rising dollar” the FOMC has actually moved much closer to that view rather than the other way.

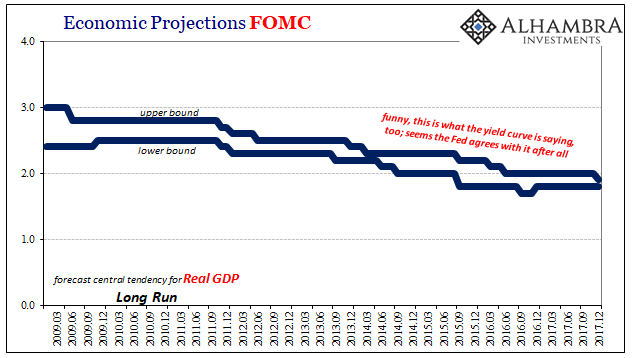

That leaves inflation expectations, which have collapsed since mid-2014. Part of the reason for that is what really drives long rates in the first place (relating also to what is keeping a lid on short term rates and expectations for where they end up) – perceptions about economic opportunity. On that score the FOMC’s models also are more in line with the current view of long rates than is otherwise described in the media.

The forecast central tendency for long run growth, meaning real GDP, has been cut over and over again going back to 2009. Back then, it was believed the US economy’s potential for growth was near 3%. As of this week and the latest update on the models, now even the upper bound expectation for long run GDP has sunk below 2%. That’s an enormous difference.

In other words, the Fed may let the media talk about a lot of this stuff in very favorable terms, but not even their math is buying it.

The Fed’s main tools don’t believe that anything has changed, either, which is exactly what the yield curve flattening at this nominal level is saying. Conventional interpretations of term premiums and the bond market being wrong is sorely misplaced. Even the FOMC’s math adds up to this “conundrum”, too.

It’s one last embarrassment for Janet Yellen, though quite appropriately so, her final performance review so to speak inside as well as outside.

Stay In Touch