December 2014 was something of a high-water mark. Early on in that month, the BLS had published payroll numbers (Establishment Survey) that to many confirmed the narrative. For the previous month, November, the US economy purportedly added a massive 321k new jobs.

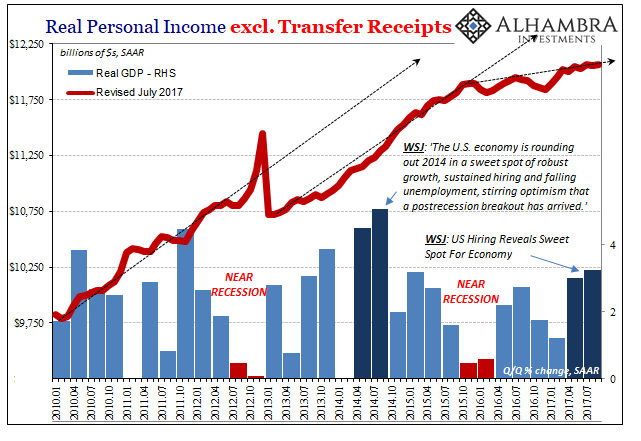

The media was predictably uncontrolled in its glee. Any survey of mainstream headlines for that particular report contains all the usual glowing buzzwords. “Strong”; “robust”; the “best in decades.” For the Wall Street Journal in particular, the US economy had, thanks in large part to Mr. Bernanke’s “courage” its writers and editors just knew would eventually work, at long last finally found the “sweet spot.”

It wasn’t just the labor numbers, either. A few weeks after the BLS publication, the BEA put out revised Q3 2014 GDP estimates. They had previously reported that growth in that prior quarter was more than 4%, but a few days before Christmas they figured instead that it was slightly better than 5%. Euphoria all around.

Like the payroll report, that was the best anyone had seen in this country in years. With the Fed more and more comfortable about removing its “accommodation”, it seemed time, appropriate even, to dare to dream.

The U.S. economy is rounding out 2014 in a sweet spot of robust growth, sustained hiring and falling unemployment, stirring optimism that a postrecession breakout has arrived.

We all know how it turned out; was at that moment already turning out. The problem then was the same as a lot of times, including now. “We” tend to take for granted what exactly it is these statistical snapshots provide. They are momentary numbers that don’t really tell us all that much by themselves. Any monthly figure, or quarterly figure for that matter, just isn’t that significant.

One quarter of 5% GDP is utterly meaningless. In fact, two straight quarters of 4.5% growth or better made no difference whatsoever. The Establishment Survey went off, averaging by late 2014 more than 250k a month. None of it meant what everyone said it did largely because they ignored all the gathering evidence these good numbers were a tiny holiday island in the ocean of malaise. Trends don’t break so quickly, at least without legitimate energy (and QE just was never going to be that).

Part of the problem is that before August 2007 there was nothing wrong with taking one quarter at face value. A good quarter like those presented in 2014 were the norm; finding another one would simply confirm the long-established baseline.

The issue in 2014, or any time since 2008, was assuming these good quarters signaled the start of something very different. But in doing so there had to be a legitimate reason for thinking everything had changed. There were a whole lot of dangerous assumptions embedded within that subjective analysis. It started with the premise that the post-Great “Recession” malaise has to end.

It may seem like a trivial distinction, but in truth it has meant everything. In terms of mainstream analysis, if you are looking for a “postrecession breakout” you will always have a tendency to see it in whatever, a predisposed yearning to jump all over the next “sweet spot” no matter how badly the previous one failed to register beyond the short run.

Where we are in 2017 is just in that same place. The Wall Street Journal again at the release of the November 2017 payroll report earlier last month was right back in the echo:

The U.S. economy is hitting milestones not seen in more than a decade, marked by robust hiring that has led to low unemployment and a sustained pickup in output.

The headline for that particular article? US Hiring Reveals Sweet Spot For Economy. When all you have is a hammer…

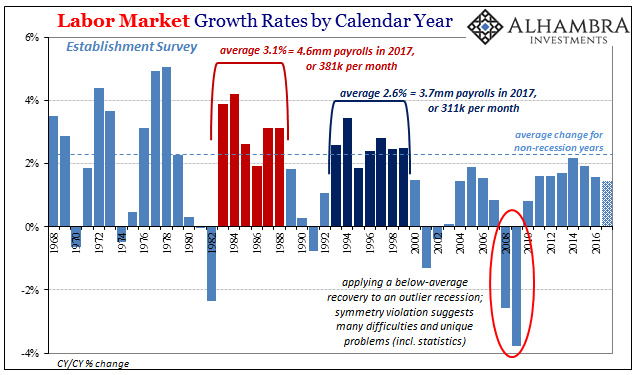

It doesn’t matter that hiring has slowed dramatically for those three years in between, the 6-month average for the Establishment Survey down from +260k in November 2014 to +170k November 2017. Apologies to the Wall Street Journal and all the rest, in truth neither of those are even close to a “sweet spot.” This is one particular statistic where bias is so completely naked. They keep talking about 2.2 to 2.4 mm payrolls gained as if that was some good result when it’s not.

You get the impression that for all of the past three years there was for the mainstream nothing but a “sweet spot” for the US economy; one so fervently hope for that nothing was going to be allowed to spoil it. It never really left the popular imagination even though reality took a far different turn. The worst of that downturn wasn’t nearly enough to force a reassessment, the media remained steadfast at characterizing everything as impressive and reassuring.

From the Journal on February 26, 2016, right in the midst of the “rising dollar’s” worst:

The U.S. economy started the year on a stronger footing than it ended 2015, suggesting American consumers are brushing off market jitters about plunging oil prices and slowing global growth.

Consumer spending grew in January at the fastest clip in eight months, new data showed Friday, as a strong job market and robust wage gains boosted Americans’ propensity to spend. Inflation also ticked higher, a positive sign for Federal Reserve.

Tomorrow’s payroll report is expected to be about +190k. In truth, the actual tally doesn’t matter one bit. No matter what the number comes in as, it will easily be right there in the sweet spot.

Tomorrow’s payroll report is expected to be about +190k. In truth, the actual tally doesn’t matter one bit. No matter what the number comes in as, it will easily be right there in the sweet spot.

The economy is instead a mosaic of snapshots, quite a lot more than just a few numbers detached and isolated from meaningful context. In other words, the difference between actual growth and mere positive numbers is huge. There is nothing in the rulebook that says the economy has to get better if for no other reason than there is no rulebook. Just ask the yield curve.

Stay In Touch