If it seems like we’ve been here before, it’s because we’ve never left. On January 30, 2015, the BEA reported a disappointing headline GDP for Q4 2014 following what was truly a blowout quarter the one before. It was that latter one which had many if not most people thinking the end of the malaise was at hand. The Fed had finally done it, QE3 (and 4) worked so at long last the effects of 2008 were expunged.

There was a lot, of course, that happened over the second half of 2014 to give one pause about all that hoopla. One of those things was the midterm elections held just a few months prior. Before them, Democrats were realistic about their chances, figuring to lose ground (as Presidential administrations always do in their 6th year) but openly optimistic that 2014’s economic surge would cushion the blow to a considerable extent.

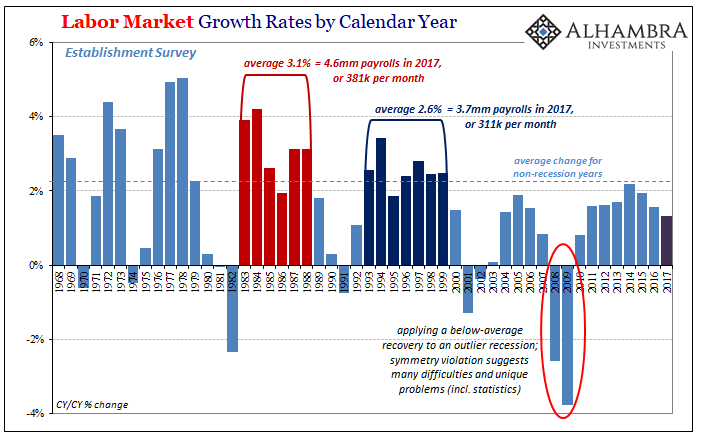

Forecasts for the second half of the year [2014] remain for growth of close to 3 percent or more, which should keep job creation at its current pace or above. Democrats can also celebrate that total employment in May rose above 138.5 million, the pre-recession peak of 2008. In addition, the U.S. economy has now created over 200,000 jobs a month for four straight months, the first time that’s happened in 14 years.

It didn’t help, nor did that blowout 5% in Q3 2014. These good quarters are always an aberration, the ones that prove transitory at the expense of good economics and the American people. They voted exactly that way in November 2014 despite the overwhelmingly positive headlines and analysis, all pointing to a robust economy that didn’t sit well with voters who were experiencing at best unevenness; at worst, the same no-growth world.

Republicans are now in danger of making the same mistakes. On the one hand, it’s a natural response once controlling all the branches to try and frame the country in the best possible light. But there is an art to it, and it can border on self-delusion if you go too far. Newt Gingrich yesterday sounded a little too familiar to 2014’s politically indulged self-assurance.

I think Trump will beat any of them. So it doesn’t concern me very much. I think the economic boom we are starting into is going to in fact, perform very well this fall for Republicans. And I think that it’s going to perform very well for Trump in 2020.

Gingrich may take issue that he qualified his statement thusly: “the economic boom we are starting into.” But, again, that’s the very mistake Democrats made time and again during Obama’s eight years. The economy can always better tomorrow because it stays plain awful year after year.

For Newt to be correct, and to be taken seriously, he has to spell out exactly what it is that has meaningfully changed. The answer he has in mind is surely the recent tax cuts, but we’ve seen tax cuts and “stimulus” as a regular feature of economic misconception since George W. Bush’s administration patted themselves on the back for handing out $300 to every breathing American in early 2008 (now that was a helicopter). The results have been uniformly negative regardless.

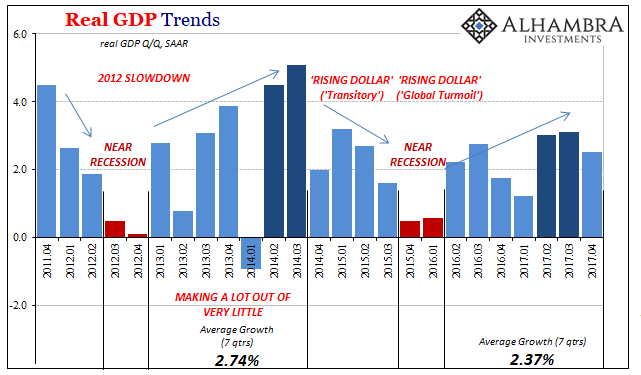

Coincidentally, the BEA reports today that Q4 2017 GDP disappointed at once again 2.6%. That’s down from a revised 3.2% in Q3. It’s considerably less growth than in 2014 that failed to capture the American electorate’s fancy.

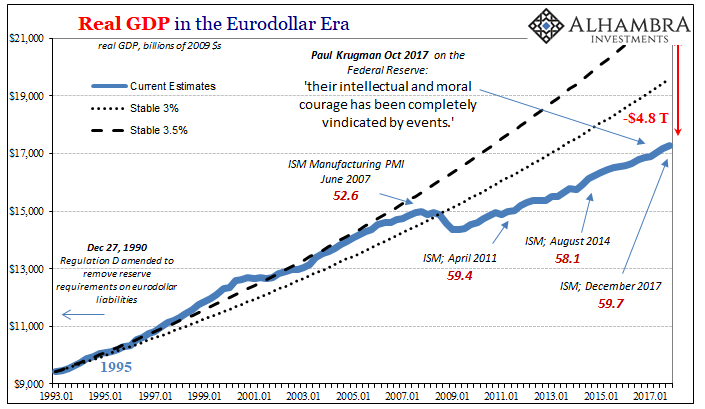

The reason for that is very, very simple. None of these numbers represent a significant and meaningful change in economic circumstances. That’s once again the message and interpretation this latest GDP report reinforces. Former Federal Reserve Vice Chairman early on in 2017 said it best, “We haven’t seen 3% growth for a long time.” Last year proved no exception.

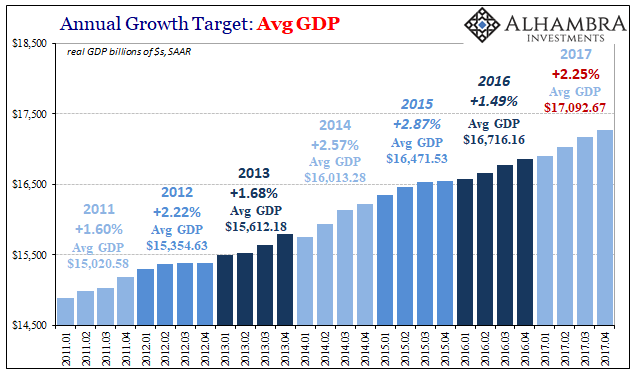

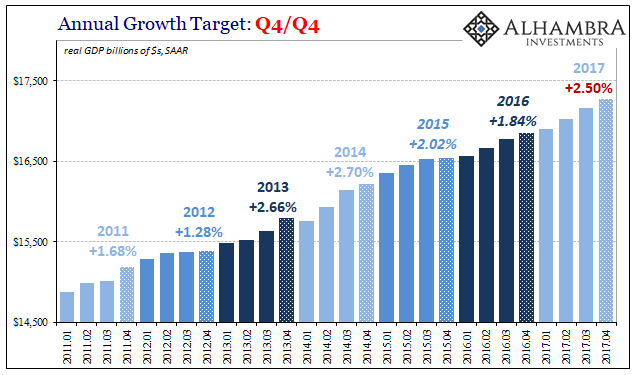

It really doesn’t matter which way you calculate annual GDP growth, either. They both show that nothing changed in 2017 – nothing. It was the same sort of lackluster malaise that persists no matter what politicians do, think they’ll do, and congratulate themselves for thinking about what all that will surely accomplish tomorrow. The boom, at some point, has to start actually booming.

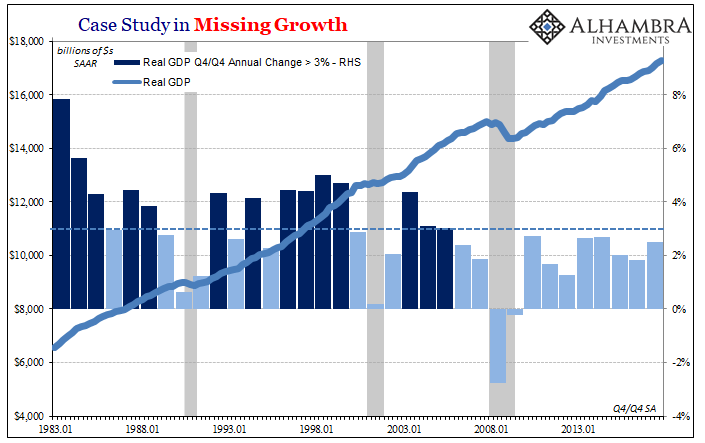

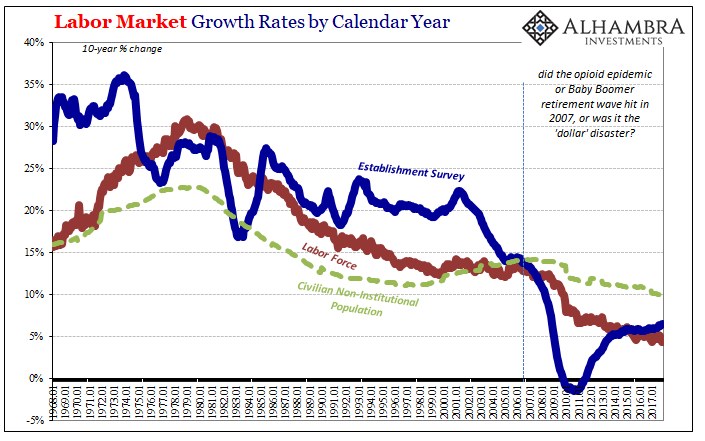

Checking Ms. Rivlin’s assumptions, she was absolutely correct. The American economy hasn’t seen 3% growth in any year since 2004 and 2005 (and in both of those years, barely). That gives us a very big clue about the big picture – without the housing bubble, and the massive monetary growth that created it, the 21st century has been a constant economic wasteland totally impervious to politicians’ constant big plans.

Sentiment has most definitely changed, but that doesn’t really count. What has been proven for now more than a decade is that “stimulus” doesn’t ever stimulate, but that it instead shows us that policymakers know that’s its necessary.

The economy used to grow, now it doesn’t. If you claim that it’s going to start growing, the burden of proof is on you to plausibly demonstrate what’s changed. Every statistic out there, including, ironically, the unemployment rate and its suspiciously low level all declare that nothing has. Q4’s GDP report is all-too-consistent in that way.

It’s a clear warning to Republicans, and it should still be taken that way for Democrats, too. I honestly don’t care which party takes this seriously, it’s so much bigger than partisanship. One of them at some point will have to. Republicans have the electoral momentum, or they did, and they are at risk of totally squandering it if they are in even the smallest way satisfied with the economy (constant use of the word “boom” at places like Breitbart and the Daily Caller are not encouraging). That’s self-delusion, and the marginal American voter knows it. He/she has to live with the pitiful results of always tomorrow:

What every politician should be thinking about right now is how the jobs market and labor utilization continue on at multi-decade lows every year there’s no 3% (really 6% or 7%). This is an emergency situation that should lead to complete and total reexamination of any government agency the slightest bit involved (starting, of course, with the Federal Reserve and its officials who still haven’t ever been made to answer for that clear break in economic conditions in 2008).

The real danger for thinking you’ve changed the economy when you haven’t, is that you stop looking for serious solutions; you lose interest in the very difficult and costly task of taking a deeper and more radical examination of the problem. Throwing the conventional at it, like tax cuts as if they’ve never been done the last decade, is a sign that’s actually the case.

What the Republicans are risking is a huge backlash given that their electoral position was given to them, Trump in particular, on the basis of addressing this very thing. We were told that 2017 was going to be the year. Not surprisingly, it wasn’t, so, again, what’s changed?

Stay In Touch