When Apple first came out with the iPhone in 2007, it was truly a revolutionary product. Even for those of us who hadn’t been impressed with Apple’s computers had to tip our caps to Steve Jobs (and team) for what they had pulled off. He knew it, of course, which is why earlier that year Apple Computer had dropped the latter word from its corporate name to become simply Apple Inc.

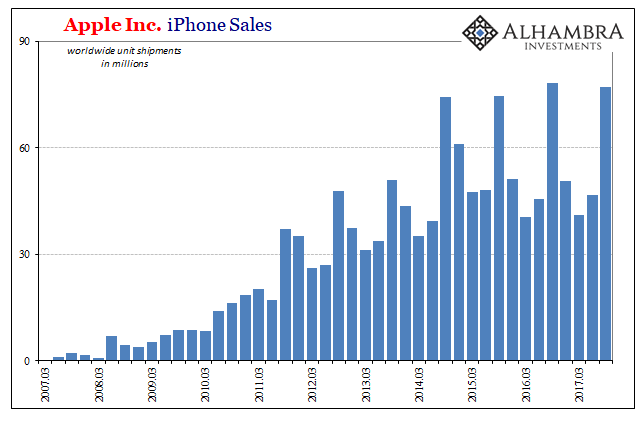

As with any new introduction, sales started minimally. In its first quarter on the market, Q3 2007, Apple sold all of 27 million units. The ramping up of adoption, however, took very little time and was all the more impressive given the economic backdrop of the process. In Q4 2008, during the worst global economic climate since the Great Depression, the company managed sales of 6.89 million. That was a 515% gain at a time when other major mainstream companies were begging the Fed for commercial paper funding as their baseline revenues plummeted.

Those massive growth rates didn’t last forever, nor was anyone expecting that they would. At some point a new and innovative product becomes a mature one. In Q1 2012, Apple shipped 37 million iPhones for a gain of “just” 128%. Late in 2014, the iPhone 6 was introduced, sprinkling a little more magic into shipments of 74 million by Q1 2015. That was a substantial increase befitting the long lines at Apple stores, growth of almost 46% from Q1 2014.

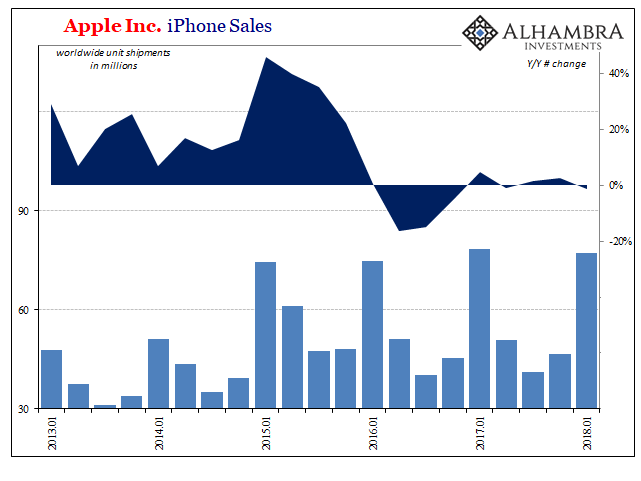

That was the last of it, however. Despite several new versions and models introduced over the intervening three years, Apple can find no more excitement. As of Q1 2018, the company reported just 77 million sold and shipped worldwide. That’s not even 4% more than the company managed three years prior. And it was down 1.2% from Q1 2017.

What happened?

Like anything else, there are a number of factors to consider, including tablets. Buyers are less impressed, and enthused, by new models which don’t offer as substantial improvements as earlier model switches had. Apple also has several key competitors who have caught up and in some ways surpassed the iPhone. Dominance is no longer a given.

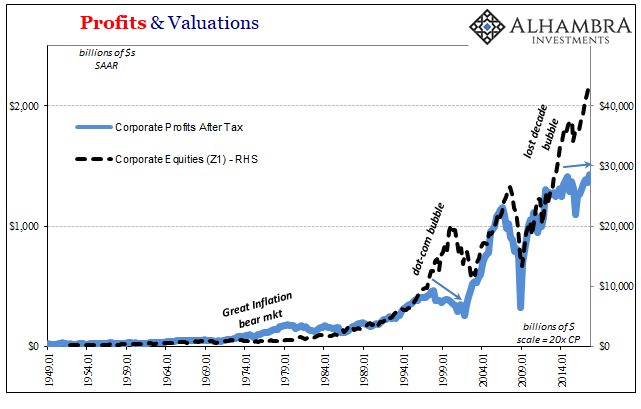

Still, Apple might be a proxy for macro factors. Consider that even in today’s world a smartphone is a big-ticket item. Economic weakness because of sluggish labor markets could be a major factor holding back customer excitement for the iPhone 7 and now an iPhone 8. The timing of this shift in Apple’s iPhone fortunes is one that we have seen time and again:

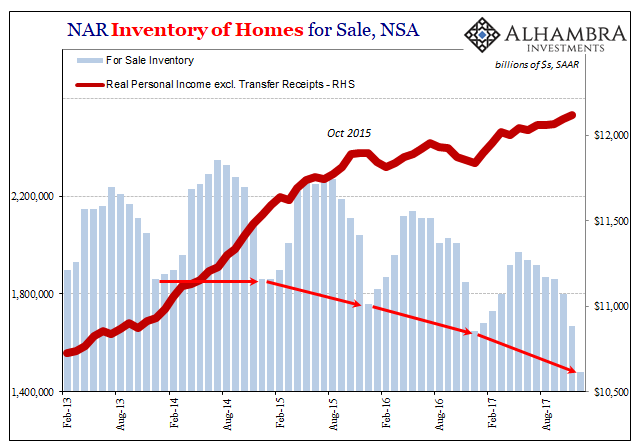

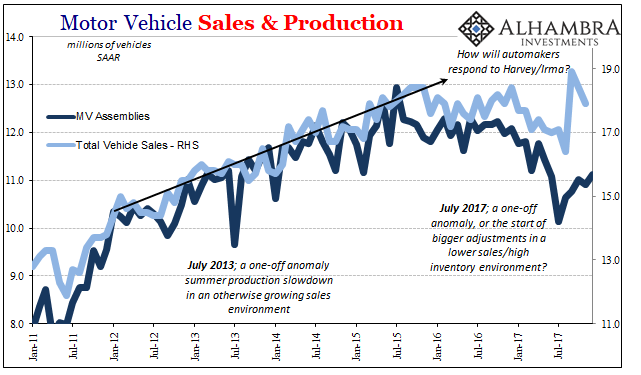

Since around the middle of 2015, the outbreak of “global turmoil” produced by the “rising dollar”, Americans have among other negative trends become noticeably more reluctant to sell their existing houses or buy new cars. It appears as if we can add iPhones to that catalog. It’s much too consistent to simply dismiss because of the Fed’s rhetoric or even their actions (given their track record) as to “rate hikes” and the inflation/growth expectations they supposedly represent.

It’s not just a US story, or an Apple one, either. Smartphone sales as a whole dropped by a record 9% globally in Q4 2017. The big reason? China.

Linda Sui, director at Strategy Analytics, said: “It was the biggest annual fall in smartphone history. The shrinkage in global smartphone shipments was caused by a collapse in the huge China market, where demand fell 16% annually due to longer replacement rates, fewer operator subsidies and a general lack of ‘wow models’.”

Or maybe China’s economy just isn’t all that robust. That’s not how it is described, of course, but then again when is it ever characterized as anything other than strong, robust, or booming?

Apple’s struggles, indeed those of the whole smartphone market overall, are not conclusive evidence one way or the other. There are plausible explanations on both sides. It is still a compelling possibility that maybe the globally synchronized boom just doesn’t have any boom in it.

Stay In Touch