Since LIBOR is a hot topic again, though no 2a7 in sight, I thought I’d add one additional perspective that isn’t found in any other analysis. LIBOR is, of course, a money rate applied not to domestic funding but eurodollars on offer in London. The current criticism of the rate stems from the fact that there isn’t volume in unsecured interbank lending these days, meaning that for a lot of LIBOR fixes they relate to what would be offered instead of what actually was.

There is quite a lot of volume, however, in other markets related to LIBOR and interbank rates. Other derivatives markets have developed over time to trade on monetary expectations for various reasons. To do so requires some degree of sophistication, knowledge of the inner workings of global eurodollar banking. You have to take into account more than just what the Federal Reserve might do, largely because it has the ability to change the reference of federal funds (in days past) and now its other corridor-type tools (RRP and IOER).

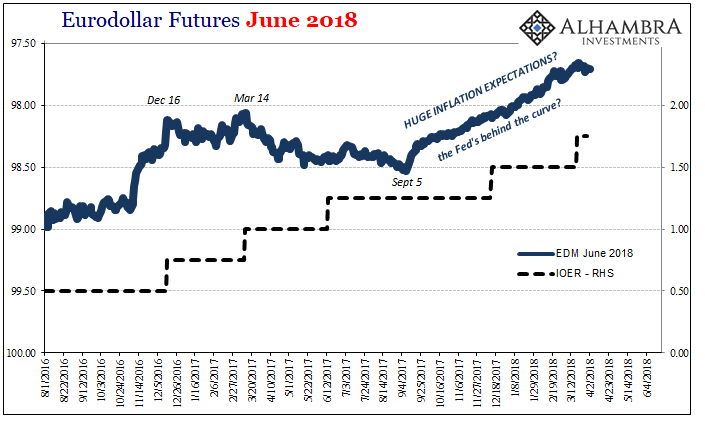

Going on that basis alone, we might observe other market indications of money expectations and conclude that since last year things like eurodollar futures are anticipating a more aggressive FOMC stance. Eurodollar futures, one of the deepest in the world, are settled in 3-month LIBOR and are therefore the best indication of what’s going on in terms of a probability spectrum.

The June 2018 contract will go off the board in a little over two months’ time. As it stands right now, the indicated price is substantially more than where IOER, the upper “floor” for FOMC policy, currently is or where it might be by the third Wednesday this June (assuming another “rate hike” occurs at either the May or June FOMC meetings).

That overly large spread might propose that the eurodollar futures market viewing an accelerating economy and expecting imminent inflation is instead pricing for two more rate hikes rather than one (one at each forthcoming meeting between now and expiration). It would seem to fit the narrative currently in place of a booming domestic economy tied into globally synchronized growth. But even then, that leaves a little too much spread.

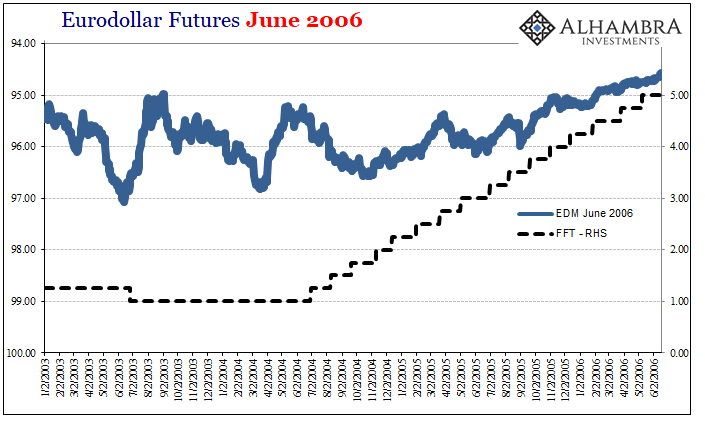

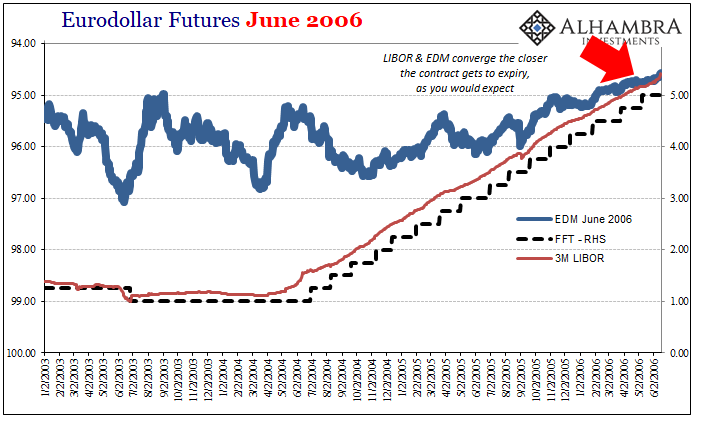

The question becomes more about interpreting that spread. If we go back in time to past “rate hike” regimes (and their concurrent bond market conundrums) the same general outline appears for eurodollar futures and FOMC policy (the federal funds target before December 2008). In the case of the EDM June 2006 contract, one that expired just weeks prior to the last of the 17 hikes 2004-06, the spread narrows toward the end.

It, in fact, converges with 3-month LIBOR right about where you would expect (factoring some time value). All three come together in a consistent fashion; a steady spread 3-month LIBOR to FFT (indicating smooth and seamless funding transition between domestic and London eurodollars), and then a small, diminishing to nothing spread EDM to LIBOR (indicating the expectation that seamless funding transition will continue through the contract expiration). We can take that as an expectation of how at least pre-crisis markets behaved not yet fragmented by the events of August 2007 and after.

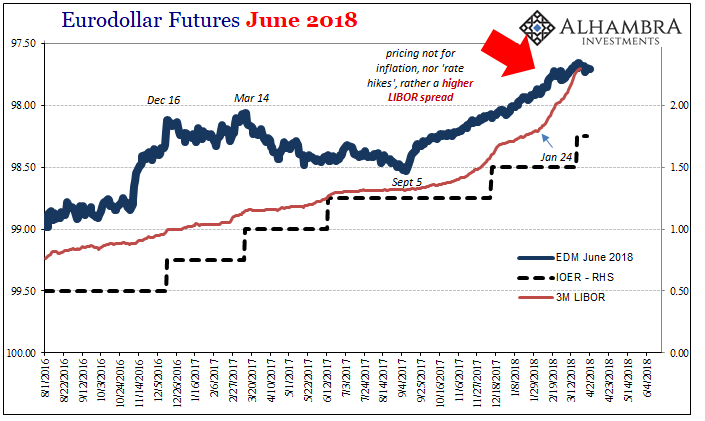

That’s not what we find for the last nine months or so, though. Again, going back to early September (and that one week which sticks out for all the wrong reasons) eurodollar futures prices began to fall and then continued to do so almost without interruption. If we plot 3-month LIBOR alongside we find that it was the latter converging with the former.

Even more interesting, that compression from LIBOR to EDM really gets going around January 24 – just days before the stock liquidations that rocked global markets and really disrupted this whole inflation hysteria. In truth, everything including stocks have remained upset by those disruptions.

We are left to consider the contrary possibility that eurodollar futures prices therefore indicated something quite different than a more aggressive FOMC tightening before imminent inflation acceleration. Rather the June 2018’s seemed to project, correctly as it is turning out, a much higher LIBOR spread!

In other words, the Fed is going to do what it’s going to do regardless, but at the same time market conditions at least so far as unsecured interbank eurodollar lending is concerned is tightening up on liquidity risk (which is exactly what LIBOR-OIS is about). This is a far different scenario, not just in how LIBOR has behaved but just as much as this all dates back to September 5. Because the June 2018’s will come off the board relatively soon, it’s about as pure an indication of short-term concerns as we might find.

They are weighted to illiquidity, not policy. And since the trend began before tax reform and all that fuss, there seems to be a whole lot of Asian flavor to the shift.

That view extends further into farther out futures contracts, too. The EDM June 2020’s, for example, because of those two additional years to maturity are to some degree anticipating not just where LIBOR might be (as a combination of FOMC policy and market conditions) but also what effects short-term LIBOR behavoir might eventually have on the markets and economy.

As a result, the 2020’s are starting to price a less aggressive future path for 3-month LIBOR, meaning some changing probability in favor of LIBOR rates that go up and then come down.

These are not risks weighted toward an inflationary scenario, but one instead of rising liquidity risk and the consequences of them (those that we have become quite familiar with over the last almost eleven years since August 9, 2007).

Something to think about the next time you inevitably hear how rising LIBOR is nothing significant, and there are nothing but good things forecast for Jerome Powell’s whole tenure.

Stay In Touch