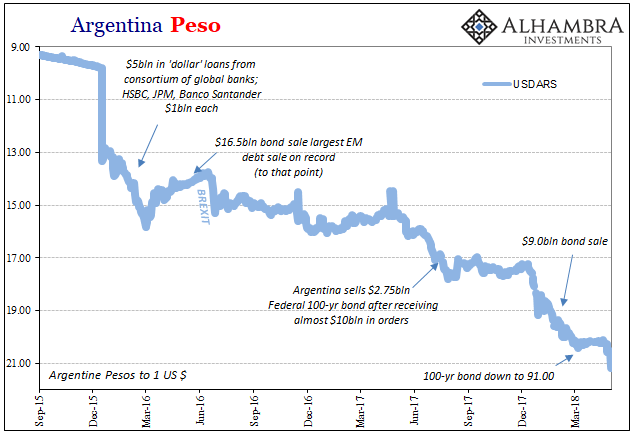

Argentina was perhaps the biggest success story of “reflation.” Left for dead in global markets as the hammer of the “rising dollar” pounded down on everyone, the country elected new leadership and began taking the right steps toward modern economic integration. That’s the story, anyway.

What really happened was a bit different. The country that had been funding itself at the mercy of global eurodollar banks switched to funding itself at the mercy of global eurobonds. Good choice in 2016. 2018? Bit of a different story.

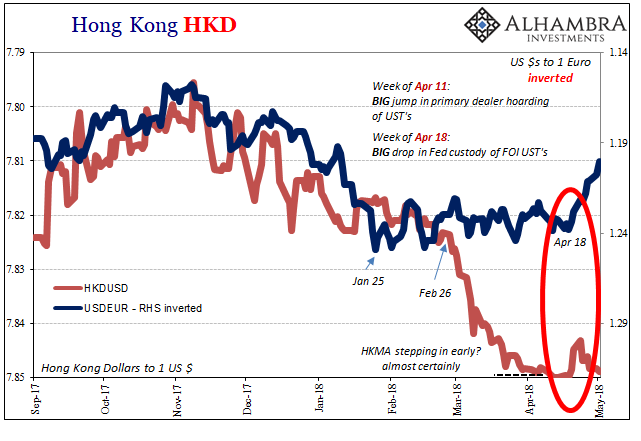

Argentina’s currency is now getting nearly as much attention as Hong Kong’s. Both are mystifying to conventional, mainstream expectations. Last November, Argentine President Mauricio Marci admitted what is obvious:

We are vulnerable, because we need financing; arguing against that is stupid. We have the best potential, compared with all the others. I am ready to continue if the citizens indicate that they want me to continue running the country.

Confounding conventional thinking even further, Argentina’s central bank began cutting rates in January. This didn’t jive with traditional understanding of currency pressures. The peso was falling, so Economists will tell you to raise benchmarks, not reduce them. Inflation, after all, is still a problem there.

The Argentine central bank’s second straight 75 basis-point interest rate cut on Tuesday has economists and strategists confused about what policy makers have planned for the rest of the year.

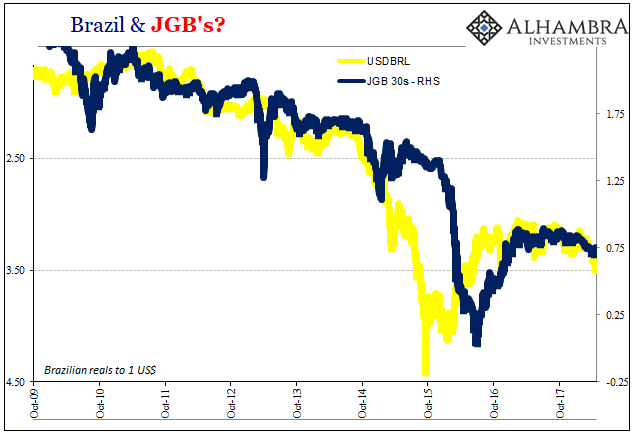

What Economists don’t say, because they haven’t learned much from the last few decades, is that Argentina’s economy is beginning to show like Brazil’s. Yes, the peso is dropping but to rescue it means economic growth not shallow “rate hikes.” It’s always risk/return, not interest rate differentials.

This obviously applies universally. The dollar shortage and the dollar short combine to some strange outcomes occasionally, but behind them are very simple perceptions about opportunity and the potential for mostly liquidity risk in trying to take advantage of them. Argentina looks pretty good in 2016 as the dollar shortage seems somewhat better (lower risk) especially via eurobonds, and with globally synchronized growth (opportunity) not just plausible but perhaps likely (I mean, everyone says it’s happening).

Fast forward to 2018, and the disappointment of 2017 starts to really set in. The global economy is growing even in synchronous fashion, but it didn’t really grow at least not in the way people were talking about it. Then, later in the year, liquidity didn’t look so good, either. Bond market bypass or not, that makes a big difference.

Thus, if perceptions are turning more against you on both counts, liquidity risk and dashed hopes for opportunity, it’s like you are right back at 2015 again despite all the great stories proclaiming so much difference. A seemingly stable peso turns unstable pretty quick.

Economic disappointment is a huge part of this evolving process. Last year was supposed to be the year, and it wasn’t even close. US growth disappointed, proving considerably less than even 2014, nothing like actual acceleration. Europe too, for the same reasons (everyone trying to claim slightly higher low positive numbers are not the same as the slightly less positive numbers before and therefore adds up to an actual boom). China even managed to slow later in the year, and then confirm it by more radical political maneuvers.

That doesn’t necessarily mean Argentina’s economy will fall off tomorrow, but the risks that it might go up in non-linear fashion the more markets begin to think this way. Eventually, it becomes self-reinforcing in the same way as any old bank run; people fear Argentina’s economy might be shaky as global growth doesn’t materialize, “dollar” markets tighten against it, therefore it becomes shaky. Result: “unexpected” benchmark rate cuts.

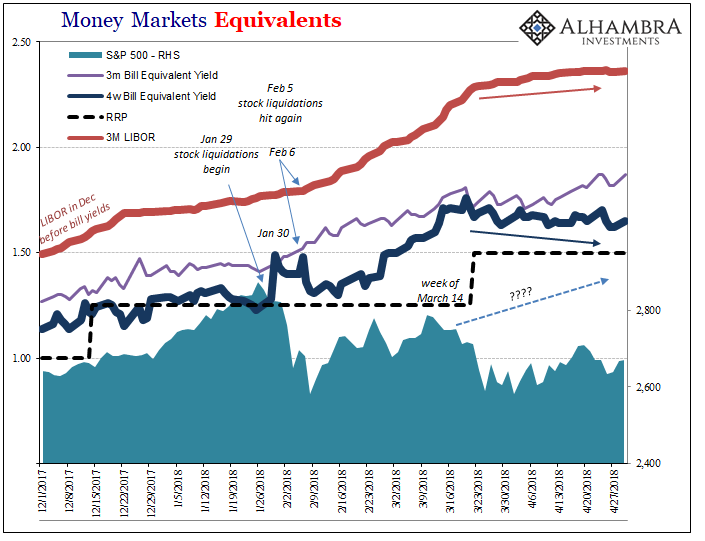

To that end, for Argentina and the rest of the world the Fed’s latest policy statement adds to the problem, just not in any way related to “rate hikes.” As noted earlier, these central bank communications were meant to clarify yet they have served in a vastly different role. With economic questions multiplying in 2018 after the letdown of 2017, the FOMC chooses now to remove the following sentence:

The economic outlook has strengthened in recent months.

Does that mean they believe the US forecast has weakened, merely stayed the same, or what? There’s no way to tell – not that it likely matters all that much. We don’t need the Fed to confirm what many are already beginning to suspect. But if the Fed, who is always optimistic about everything, is reconsidering that one little sentence, what does that say about intermediate economic prospects? Nothing good.

There is no globally synchronized growth, and funding markets appear well into a process for adjusting toward that very direction.

Taking that one sentence out of the statement can only feed that perception, whether that was the intent or not. As always, hawkish or dovish, neither words truly apply. It has nothing whatsoever to do with “rate hikes”, it’s about the nth demonstration that they really don’t know what they are doing. Inflation hysteria is starting to seem a distant memory already.

Stay In Touch