There’s one final step to our examination of QE and bank reserves (you’ll need to read through at least Part 1, though Part 2 is worth the time, too). It’s all well and good to try and map out complex subjects using very simple models. That can help illuminate concepts, but we should always strive for validation.

The heart of the world’s grave economic problem is, I believe, lack of monetary capacity. In the eurodollar system, however, it’s difficult to define what counts as money and therefore quantify what might be its supply (let alone figuring sufficient redistribution, another can of worms). In a vague sense it’s nothing more than balance sheet capacity, the offered ability for banks to use other banks to construct their portfolios as efficiently as possible.

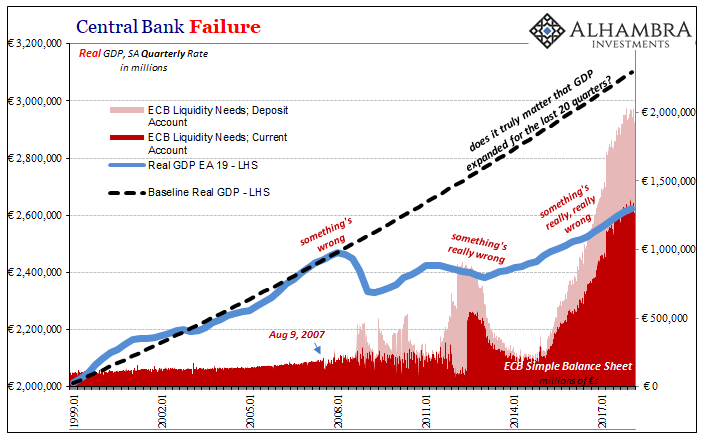

That’s not something QE could ever have solved both as a theoretical matter as well as in practice. The reason for this oversight is that it is given no oversight whatsoever. For central bankers, there isn’t the slightest consideration for these dynamic issues. And it shows.

Diagramming QE in practice as we did yesterday, we left off at that one crucial point.

I wrote:

Having substituted MBS securities for a reserve asset, policymakers expected that Bank A would then seek to further convert those reserve assets back into a working portfolio of non-toxic securities. The policy asset swap was meant as the first step to a second asset swap, the latter of which into risky securities.

That never happened, or at least not to any substantial degree that created legitimate economic success.

This is also what Ben Bernanke was talking about in 2009 when he denied the American banking system (let alone its other global participants) was about to turn zombie. It’s the one thing he got right, and yet in the end he did it so wrong despite recognizing the overview.

If there is one message that I’d like to leave you with, if we’re going to have a strong recovery, it has got to be on the back of a stabilization of the financial system.

QE, he believed, would fix the monetary end and that would then allow banks to get back to doing what banks do. Recovery, almost everyone thought, would soon follow.

I think zombie was not an appropriate description for any of the banks. [They have] substantial franchise value, they’re all lending, they’re all active, they have substantial international franchises.

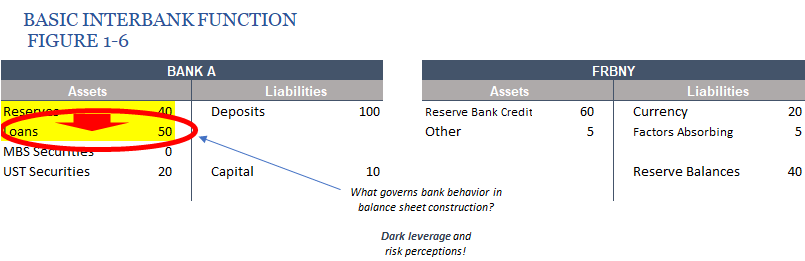

This is precisely the point I have sketched out in Figure 1-6. In my model, the franchise value is nothing, worthless. It may have meant something before August 2007, but a truly radical inflection had been reached; a true paradigm shift. QE created bank reserves which then sat there and did nothing of value for the banking system.

But is this a realistic assessment?

Yes, overwhelmingly so. I’ll provide you with only two from an overflowing catalog of concrete examples that show how though Figure 1-6 may have been stylized it still depicts just what has happened.

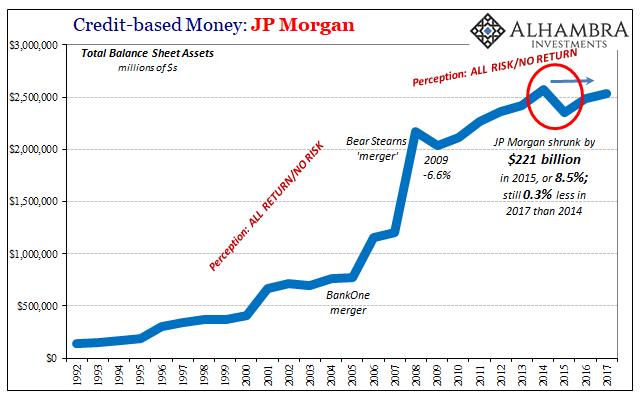

Starting with JP Morgan, I often use the bank in these situations because at one time it was the undisputed king of offered balance sheet capacity. Its derivative book in the middle of 2007 was unchallenged by anyone. No firm exemplifies what I’m talking about quite like JPM.

At least it did. The JPM of today isn’t nearly like its precrisis predecessor. For one, you can easily observe the buildup of inert bank reserves on its balance sheet:

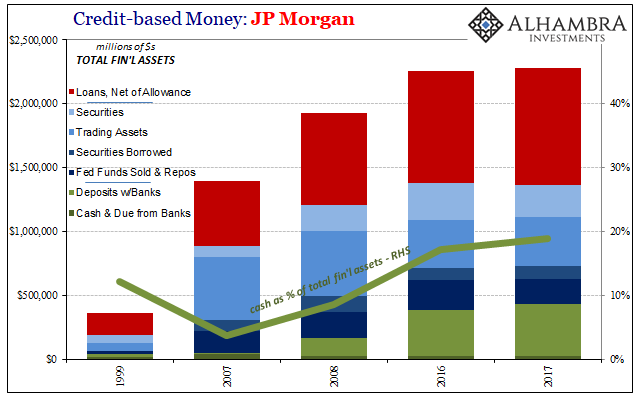

At the end of 2007, the bank reported $40.1 billion in cash and an additional $11.5 billion in “deposits with banks.” This latter category includes any balances on report with Federal Reserve branches. By the end of 2008, JPM’s balance sheet showed $26.9 billion in cash but $138.1 billion in “deposits with banks.”

With the first QE and the three that followed, by the end of last year these deposits would swell to a total of $404.3 billion (in addition to $25.8 billion in cash). Just as Figure 1-6 and those diagrams preceding it showed, reserve balances accumulated at JPM as a byproduct of monetary policy.

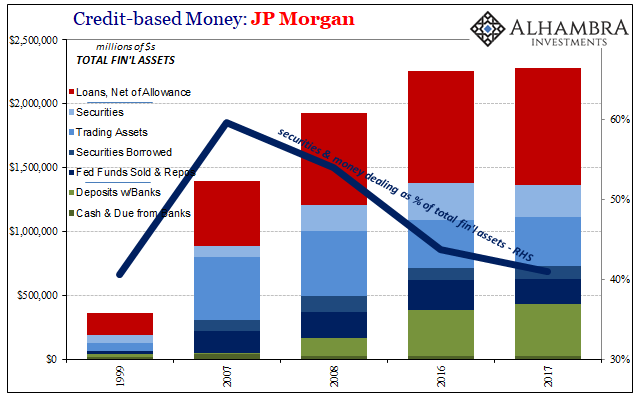

While the bank’s loan book remained a relatively constant proportion, JPM exited the securities and money lending business to a substantial degree. Many people still try to claim this as a result of regulations, but there was no Dodd-Frank nor Basel 3’s LCR in 2008. There was, however, a massive global interbank wholesale panic.

Even if you were otherwise disinclined to be careful before, that will get your attention – as would everything that followed up to and including repeated central bank missteps and overestimations of what they were doing. Thus, JPM was shrinking in two dimensions; the first in reduced money dealing (in favor of more cash) as a proportion and the second where the overall balance sheet declined (non-linear).

In other words, as Figure 1-6, cash balances went up as nothing more than an accounting result while this one bank then refused the second part of the asset swap because it was building instead a “fortress balance sheet.”

The term has proved successful, and you can’t deny that JPM’s balance sheet is anything other than a fortress – but that’s the point. In its quarterly earnings presentation released just this week, JPM still refers to its “fortress balance sheet” which is entirely at odds with the idea of recovery (why do they still need a fortress if things have been so good for years now?) as well as what Bernanke believed should drive that firm’s franchise value.

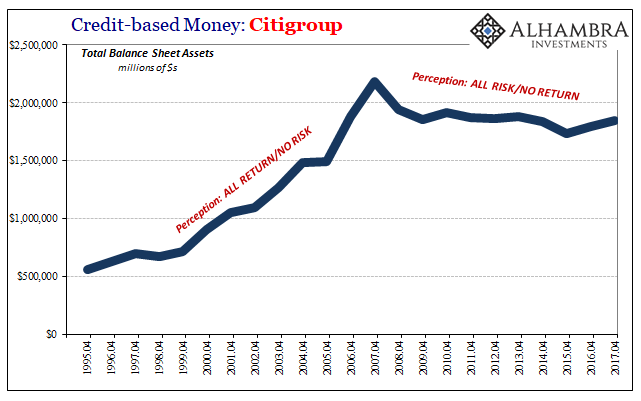

The other example I will present is even more representative of these issues. Citigroup was in fear of uncertainty long before regulators years later backtracked to ABS commercial paper. The bank was very nearly nationalized in what would have been the bigger Lehman.

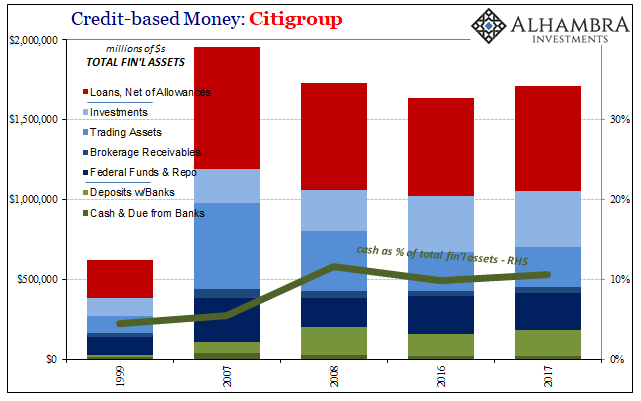

Like JPM, we find all the same accounting changes and behavioral shifts. The franchise value had become, in Citi’s estimation, worthless on this side of the eurodollar breach. By the end of 2007, the bank was already a substantial participant in the Federal Reserve’s bank reserve-making processes. It reported $38.2 billion in cash alongside $69.4 billion in “deposits with banks” (again including those balances with Federal Reserve branches).

One year later, well into full-blown panic and following the first bailout attempt, Citi showed $29.3 billion in cash but then $170.3 billion in those deposits. The nominal level of them has decreased since 2008, but so has Citi’s balance sheet overall.

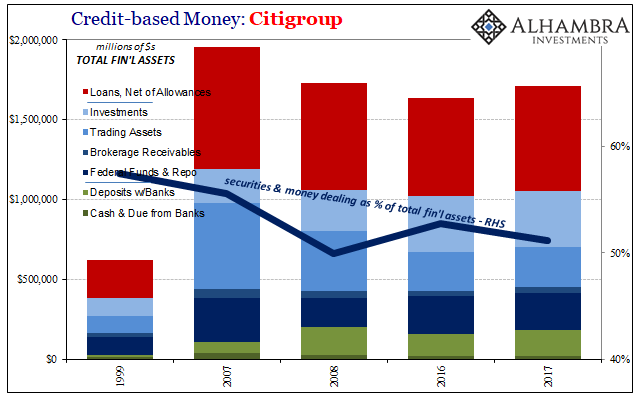

Which piece of it has been pared back for this altered behavior? FICC.

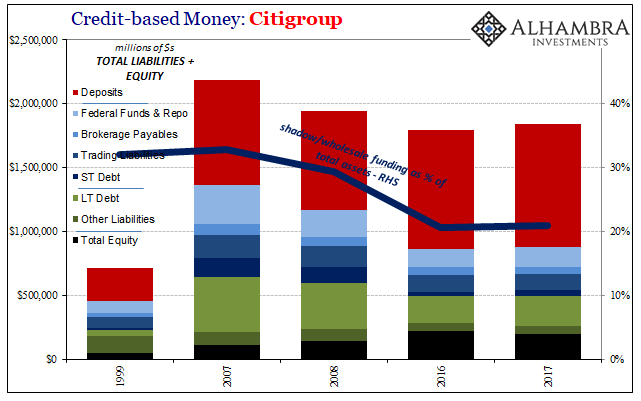

These massive alterations are not limited to the asset side, either. Over on the liability side, Citi as JPM has become more like a bank and less like an investment bank or hedge fund.

It now sports a much higher proportion of more stable deposit funding (52% of all assets in 2017 compared to just 38% at the end of 2007), and much less exposure to the kinds of shadow conduits that nearly destroyed the institution ten years ago. This seems like something we should celebrate.

Using economists’ idea of ceteris paribus, we might have. Banks are safer and more stable than they have been in a very long time, which regulations have helped to address and assure. A lot of the excesses of the last crisis have been expunged, primarily via writing an entirely new franchise direction at each one. So why aren’t there happy days all around the world?

If you don’t consider the crucial nature of balance sheet capacity within the global monetary system as it is, then eliminating a considerable portion of it thinking this was a good idea (on the individual bank level and then as a matter of policy) ends up with the contrary result. You are, like Bernanke, almost completely blind. It’s a hell of a destructive way to run a central bank, this policy of determined ignorance (often predicated on his arrogance; seriously, read the FOMC transcripts in 2007, 2008, and 2011).

The Fed, ECB, and all the rest got to Figure 1-6 and congratulated themselves, spending the balance of the last lost decade in bewilderment as to the results.

The banking system’s reaction was very different, of course, because a global credit-based currency regime is in no way bolstered by QE’s bank reserves. It required some major address to balance sheet capacity, which, as you can see above, has withered substantially no matter how much supposedly cash-like deposits appear on any balance sheet.

This exercise is also perfectly emblematic of the scale of our big problem. Figures 1-1 through 1-6 are all unimportant; a useless distraction from the real issue, which is what comes after 1-6. Yet, here we are ten years later and mainstream convention is still dazzled by those damn bank reserves.

We aren’t even on Step 1 to fixing the problem, we are still in the preamble.

Stay In Touch