Argentina has had a good month of July. When last we checked toward the end of June, the peso was still plummeting. It would nearly close below 29, an absolutely astounding drop that made plain this wasn’t devaluation as “stimulus.” That plus the whole record IMF bailout and the immediate dollar funding that came with it.

That was June 7, however, suggesting that maybe the market didn’t buy the news. Perhaps it took several weeks of digesting the scope and then the first tranches of the lending guarantees to dislodge stubborn eurodollar withdrawals?

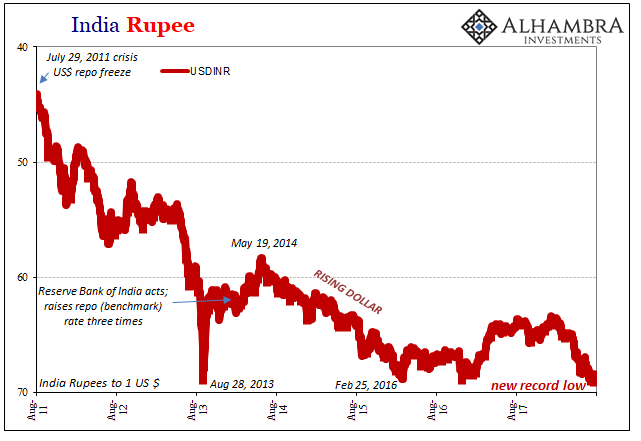

But then we look at something like India’s rupee, and again the end of June. INR has been something of a canary in eurodollar terms, and like its peers in the EM world the rupee had been collapsing. Even an interest rate hike by the Reserve Bank of India failed to register for more than a few days, interrupting this “devaluation” only temporarily.

Then on June 28, something changed. INR would fall a bit further to a new record low in early July, but like ARS this month has been if not a good one for India then at least it wasn’t so drastically bad. The trajectory was clearly altered at the end of last month.

Over in Brazil, we know their central bank has been, frankly, acting insane. Perhaps understandably so, given that the memory of 2013-16 is still fresh because the Brazilian economy hasn’t yet started to recover from it. That would put some urgency into the matter so as to avoid repetition if at all possible.

But it has repeated, at least again until late June/early July. Despite the announcement of interventions, and then stunningly tens of billions in swaps behind it, BRL was still falling after the knee-jerk immediately after.

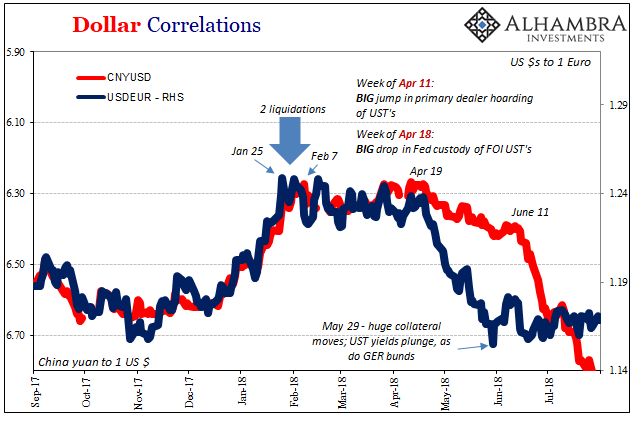

The thing is, these dates we keep seeing in these currencies means something elsewhere. April 18/19 (or April 11, for INR) matches up almost too perfectly with collateral problems (including gold) and the deflationary consequences of them. January 25 was the last before the breakout of global liquidations. Even September 8 last year is memorable largely for the same reasons, though repo fails then, if at the time the whole eurodollar system still firmly entrenched under Reflation #3.

What was it that might have registered so closely uniform across the eurodollar world in late June?

For one thing, we can eliminate Europe. The euro has been steady though only sideways rather than retracing since May 29’s global collateral run. That might suggest little or nothing as far as European banks and their apparently temperamental money dealer tendencies.

Even DXY shows up these particular dates. May 29, obviously, stands out prominently given this one dollar index’s heavy allocation in euros. But that date isn’t the recent high in the renewed “rising dollar.”

June 28 is:

Since June 28, DXY has been sideways to slightly lower, shifting from sideways to slightly higher after May 29. The world feels a little better for it, though caution and unease remain underneath. Not even 4.1% GDP and four straight months of 2% PCE Deflator inflation can shake the yield or eurodollar curves. Maybe that’s because we don’t really know what’s going on, and what’s going on isn’t renewed reflation so much as an absence of further negative pressure.

That’s a big difference.

The only factor or news that in my mind might just fit the bill is from June 27:

“The kind of dollar selling from that bank was so aggressive that we knew instantly that it must be from the Big Mama,” said a Shanghai-based senior currency trader at an Asian bank, referring to the Chinese central bank’s nickname among local traders.

If that is what is behind July’s shift from April – June, then it’s somewhat ironic given CNY is about the only currency still moving significantly lower. A testament to just how screwed the Chinese are?

The trajectory was altered starting June 28 even if the results aren’t as favorable as even Argentina’s currency. Before Big Mama, CNY was taking the elevator down rather than the escalator. Perhaps it was only the PBOC’s intention to slow the “devaluation” so as to limit the upset globally. Something like CNY less DOWN = less BAD?

July’s window of calm might just be the natural, organic order of things. Nothing ever goes in a straight line, even the screaming re-rise of the dollar. Perhaps the funding pressures themselves simply abated enough for more functional conditions to resume. Not good function, just less of open disorder.

Seeing the repetition, however, in so many places (especially something like DXY which doesn’t have any allocation to Asian currencies; I don’t include JPY in that category) makes me believe that something specific is behind it all. I’d like to know what it is because in all likelihood that would determine if, or when, things might change back; the window closes again.

For now, though, it’s undetermined with but circumstantial suspicions falling on the usual suspect.

Stay In Touch