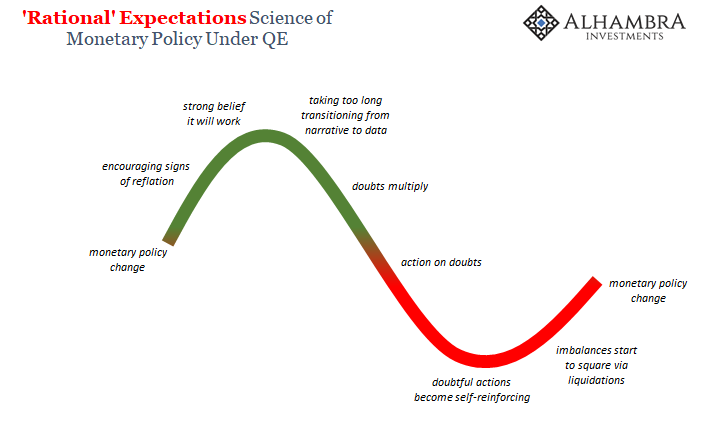

April was only a half a year ago, the optimism of 2017 at that time as yet untroubled by darkening skies. What had happened earlier in the year was nothing, they said, just a little nervousness about things becoming, don’t laugh, too good. Inflation was picking up because the global economy was roaring, which would require more aggressive action on the part of the Federal Reserve if not others.

These were, or would have been, very good problems to have after the last decade.

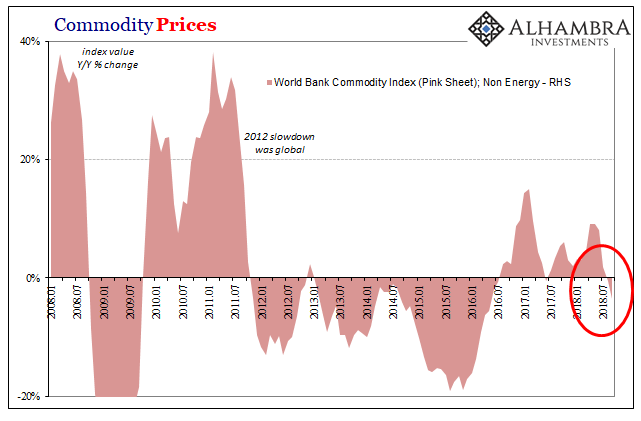

Importantly, commodity prices weren’t really buying it. They were up off the 2016 lows, but that was an incredibly low standard, a throwaway comparison. Far too many remained well below their 2011 post-crisis highs, which was a warning that investors were being as cautious as optimistic. There was a lot of initial enthusiasm at the start of Reflation #3 in the second half of 2016, but it didn’t follow through.

Commodities were signaling throughout last year that maybe everyone had gotten a little ahead of themselves on this globally synchronized growth business. Economists, however, were having none of that. They surmised that pessimism was, as always in their view, irrational. Over time commodity prices would have to reflect this looming economic boom.

Thus, when confronted by “unusual” activity at the start of 2018 it was dismissed. The World Bank in its April 2018 Commodity Markets Outlook predicted:

More than half of commodity prices (and all non-coal energy prices) are expected to increase in 2018 but four-fifths of them will remain below their 2011 peaks…Non-energy prices are projected to gain more than 4 percent in 2018 before they stabilize in 2019.

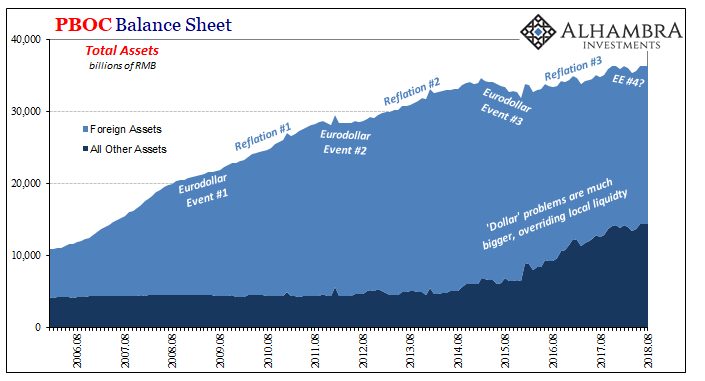

Between then and now emerging markets were massacred, a resurrected “rising dollar”. In eurodollar terms, meaning the world’s actual global reserve currency, deflation.

Assessing global economic opportunities in the face of tightening global money, commodity markets through September have reversed. Non-energy prices, according to the World Bank’s Commodity Index (Pink Sheet), fell slightly year-over-year in August and then accelerated to -3.7% in September. It was the steepest decline since, obviously, the last rising dollar period.

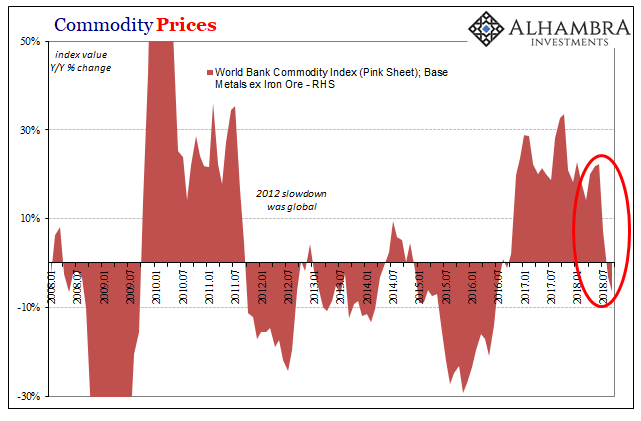

In terms of base metals (excluding iron ore), the dramatic shift is all the more alarming.

Between 2011 and 2017, there was that obvious deflationary wave that had developed in the wake of the eurodollar’s last stand. Outside of very minor reflation in 2014, it was a rough time for physical commodities as a reflection of economic conditions (in reality as opposed to mainstream commentary) especially in Asia and EM’s, China most of all.

Since commodities tend to be leading indicators, the major change in momentum indicated above, similar in intensity and suddenness to the latter part of 2011, wouldn’t appear to indicate anything good about the future direction of the global economy.

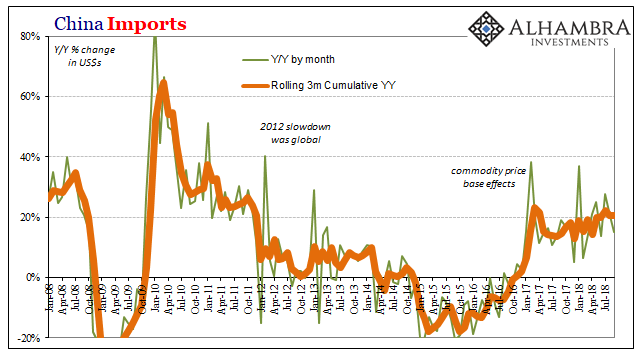

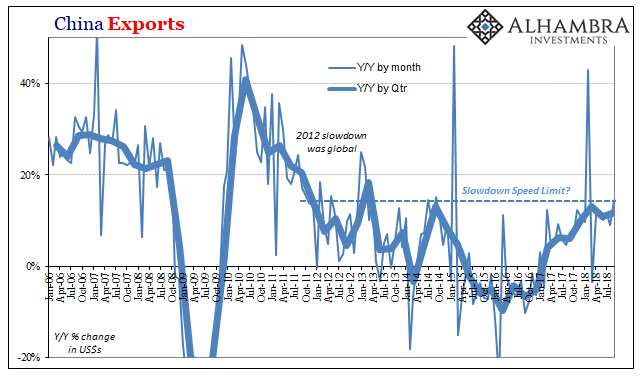

The Chinese reported today, relatedly, slowing import growth in the month of September 2018. While exports were slightly better than they had been the past six months, +14.5% year-over-year, imports were especially weaker. Rising just 14.3% year-over-year last month, that’s the second time in the last four months with less than 15% growth.

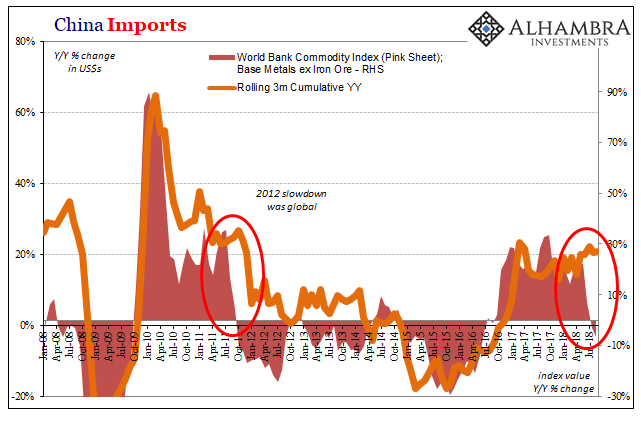

That’s not really the part to focus on, however. It’s the risks that are being priced right now in commodities for the near future. We’ve seen this deflationary stuff in the past, and commodity markets have been quite consistent in forecasting these inflection points both up and down.

In the middle of 2011, for example, commodity price growth (base metals ex iron) peaked right in July with the rest of the eurodollar recovery. By October 2011, metals were flat year-over-year and outright contracted starting the next month in November. Chinese imports had slowed only mildly from ~30% growth to ~25% all throughout the same year.

It wasn’t until January 2012 that import growth would sharply decelerate to below +20%, by May 2012 below +10%. The full nature of the slump in Chinese imports wouldn’t materialize until the last quarter of 2012.

If export growth for China was strong, meaning actually strong rather than the mainstream misuse of the term, then it might be left as a case of internal Chinese problems spilling out into commodity prices. But, again, exports haven’t been expanding at near enough of a pace to suggest any legitimate global growth.

That was, in all likelihood, the trigger for commodities; meaning, that seeing little actual economic expansion throughout 2017 especially relating to China inside and out commodity investors confronted with any monetary irregularities in 2018 were quick to the exits. The risks weren’t all that well balanced to begin with, and now if they are shifting negatively the skew is going to be heavy in that direction.

The IMF says there are mere clouds on the horizon. Commodity prices would seem to be saying those aren’t distant storm shadows, they are ominously already overhead. Not everyone is so quick to dismiss this dollar, nor what it actually means in terms of global monetary conditions unrelated to trade wars, Jay Powell, and whatever else might be carelessly offered to try to dismiss this significance.

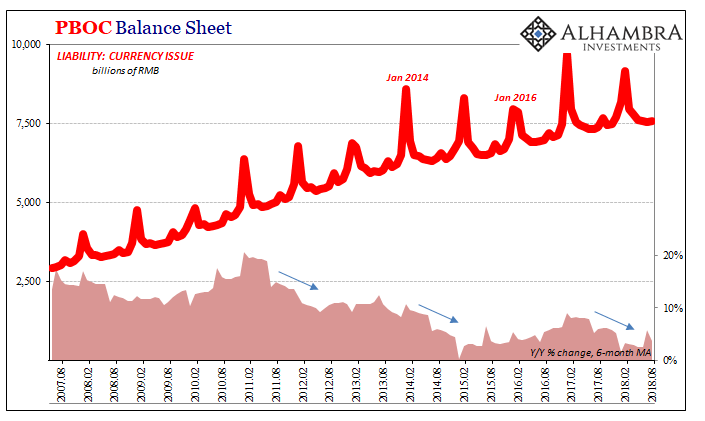

Ironically, for the mainstream assessment anyway, this is consistent with effective view from the PBOC itself. This latest 100 bps RRR cut in advance of more expected eurodollar-directed RMB tightening is pretty much the same thing from a different angle.

Stay In Touch