The Chinese economy had been sailing along fairly smoothly in the aftermath of the Great Somehow Global “Recession.” While the economies of Europe and the United States seemed suspiciously subdued especially given the scale of the contraction which registered in each, EM economies appeared unbothered. Then came 2011.

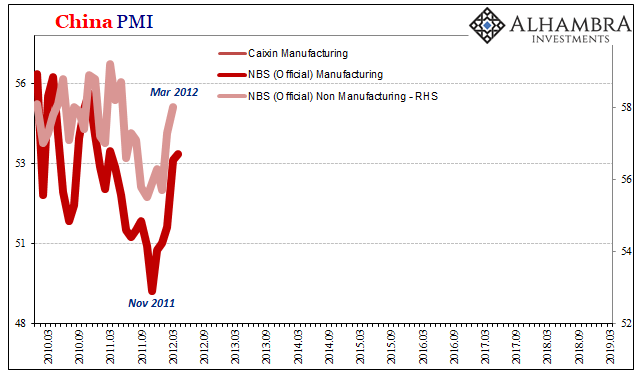

There were already escalating warnings coming out of 2010, but in the second half of 2011 the wheels came off everywhere. China’s official manufacturing PMI, one measure of business conditions in that vast and crucial sector of the Chinese economy, it had reached a high of 55 in November 2010 (the same month QE2 was started in the US). The index was still above 53 the following March (the same month QE2 was terminated).

The sudden eruption of renewed global monetary crisis, or what around here we call Euro$ #2, pulled China into the same ranks of the globally uncertain. The manufacturing PMI shockingly fell below 50, getting all the way down to 49 in November 2011.

The requisite denials were issued, the typical “nothing to see here” stories proliferating inside as well as outside of Asia.

Over the next several months, that did seem to be the case. Sticking with China’s PMI, the index rebounded quite sharply – as did its companion, the one for the non-manufacturing pieces of the Chinese system. By March 2012, the manufacturing version was back above 53 (the non-manufacturing 58) and the growth “scare” seemingly nothing more than that.

The improvement in new business “plus the modest improvement within the manufacturing sector confirms our view that the Chinese economy is likely to bottom out in 2Q [2012],” wrote HSCB’s China chief economist Hongbin Qu.

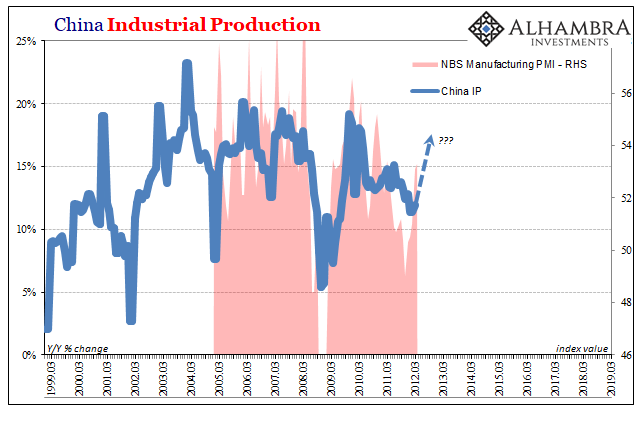

For as eye-opening as any similar plunge in any data can be, everyone loves it when the V-shape emerges especially when that upswing piece lasts several months of its own. Following along, Chinese Industrial Production, as estimated by the same statistical agency, China’s NBS, had weakened as the PMI fell. By March 2012, IP was growing by “just” 11.9% down from around 14% and occasionally 15% the years before.

It was widely believed and expected that IP would follow sentiment; the upswing for the PMI’s, especially manufacturing going from 49 to above 53, appeared to indicate a definitive end to the negative pattern.

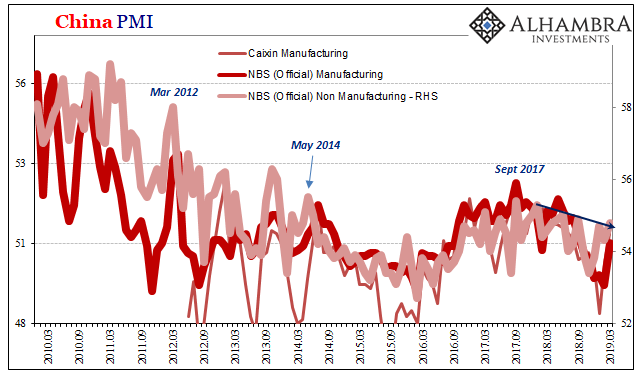

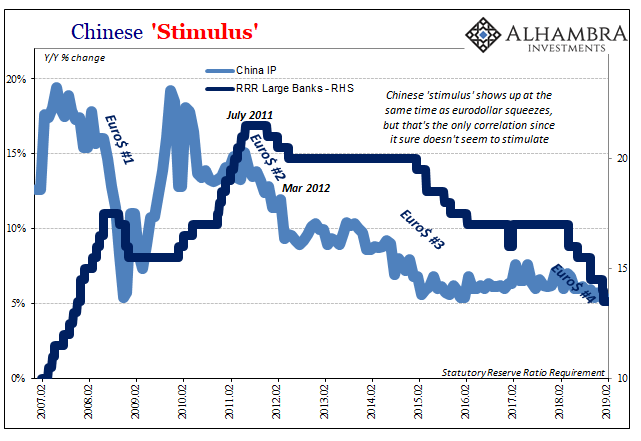

Obviously, that’s not what happened. Instead, March 2012 appears as an inflection point in economic data all throughout the world. It shows up in China, too, particularly in manufacturing. In many ways, every one that counts, the Chinese and global economy has never recovered dating back to that time; it’s been a series of “L”s ever since.

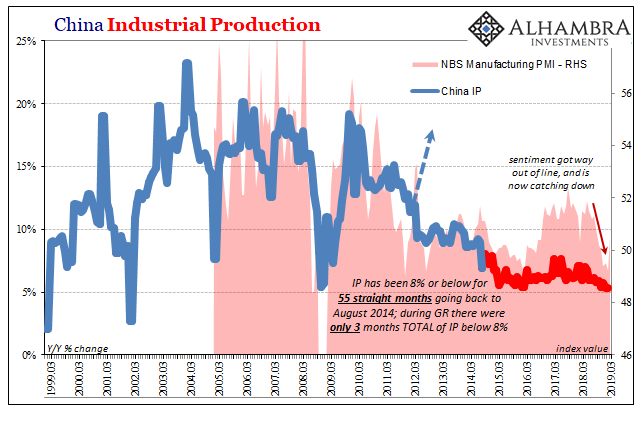

The latest one (Euro$ #4) finds China in a real bind. Industrial Production has reached new lows, consistent with the recent behavior of PMI’s particularly since last May. The manufacturing index had been trending lower, falling to 50 for November 2018 and getting down as low as 49.2 for the month of February 2019.

Today, the NBS reports that the manufacturing PMI rebounded to 50.5 last month from that recent low. Despite this being a single month, markets have exuberantly embraced and celebrated what some have called this “green shoot.”

“We believe policymakers will stick to their commitment on policy easing to stabilize growth,” the BofA Merrill Lynch analysts said in a note to clients.

Perhaps. It is more likely that people are in danger of making the same mistake(s) as early 2012. Thinking small and short run, it’s easy to dismiss the eruption of global market and money chaos as nothing other than those. They often seem that way – at first.

But we have to consider that China’s problems aren’t of its own making, and that the PBOC’s actions which have been called stimulus and easing ever since being unleashed just about a year ago have failed in every way to account. The first RRR cuts took place all the way back in April 2018, and they didn’t seem very (or at all) effective in keeping the Chinese economy from getting into this mess in the first place.

Sure enough, from November 2011 to June 2012, the PBOC cut the RRR three times. It didn’t work as stimulus then, either. It may seem impossible to many, but some things haven’t changed.

Stay In Touch