I wrote yesterday, twice, that it’s the eurodollar’s world, we are all just trying to live in it. This is not a uniformly recognized fact of life, though. People in the US are sheltered. We tend to overlook the dollar because for us it’s just the dollar. The very idea of a global reserve currency is truly foreign here.

Because of that, I tend to interact much more with people overseas. Any harmful effects of the eurodollar system’s decay strikes them first and often hardest. As Euro$ #3 began to really turn serious in June 2015, I wrote:

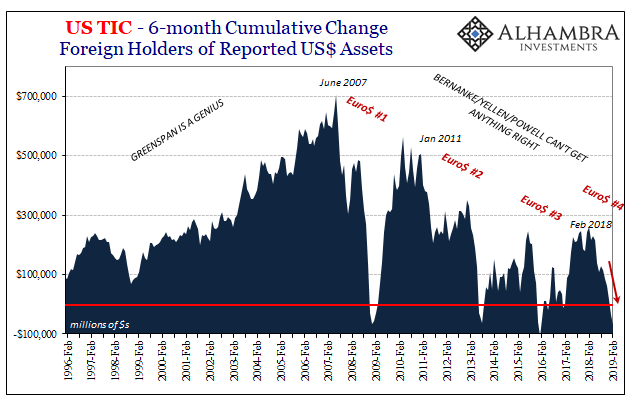

The latest TIC data through April 2015 confirms that central banks have not just mobilized massive reserves, they have done so at an unprecedented rate consistently for the past six months tracing back to the aftermath of October 15. Starting December, “official” sources have sold (mobilized) a net $77 billion in dollar-denominated assets; there is simply nothing on that scale in the historical accounts, even the worst parts of 2008.

The result was currency chaos from December 2014 forward. Since that tumult was measured against the dollar, Americans hardly noticed. The media dubbed it, with Janet Yellen’s approval, “overseas turmoil.” It was only in August 2015 that people here finally got the feeling something was up. And it wasn’t CNY’s plunge early in that month.

No, it was when Wall Street crashed two weeks thereafter doubts about the overheating, booming US economy were taken seriously. Those things were connected, though hardly anyone knew it.

Those outside the US could see it better because there was no getting around it. When your local central bank is forced to spring into action, chances are you’ve already noticed some bad stuff showing up in your own economy. Even if you don’t know that you central bankers are “selling UST’s” on your behalf, you can pretty easily connect the currency chaos to all that’s starting to go wrong in the real economy.

You don’t have know anything about the eurodollar to figure out there’s something not right about global money.

Currency problems, central bank mobilizations, these are all the things we never see simply because of the privilege of denomination.

The reason for that huge central bank presence is the retreat of bank balance sheets. The TIC series also calculates a measure of banks reporting their own “dollar” liabilities. In December [2014], bank liabilities in “dollars” dropped by the largest amount on record: -$241 billion…In short, as expected by the behavior of both the “dollar” and foreign central banks, bank balance sheets are contracting.

The idea of a dollar shortage just doesn’t come up in domestic life. In many ways, it doesn’t compute internally. Structurally, a global reserve currency doesn’t seem to be much of an issue for the issuer.

Even in the fifties and sixties that was true as the Bretton Woods standard was undermined by its inherent contradiction (Triffin’s Paradox). Americans might have heard Walter Cronkite talk about France and gold from time to time on the evening news, but hardly would anyone outside of international finance and small official circles had known the depth and degree of international dysfunction.

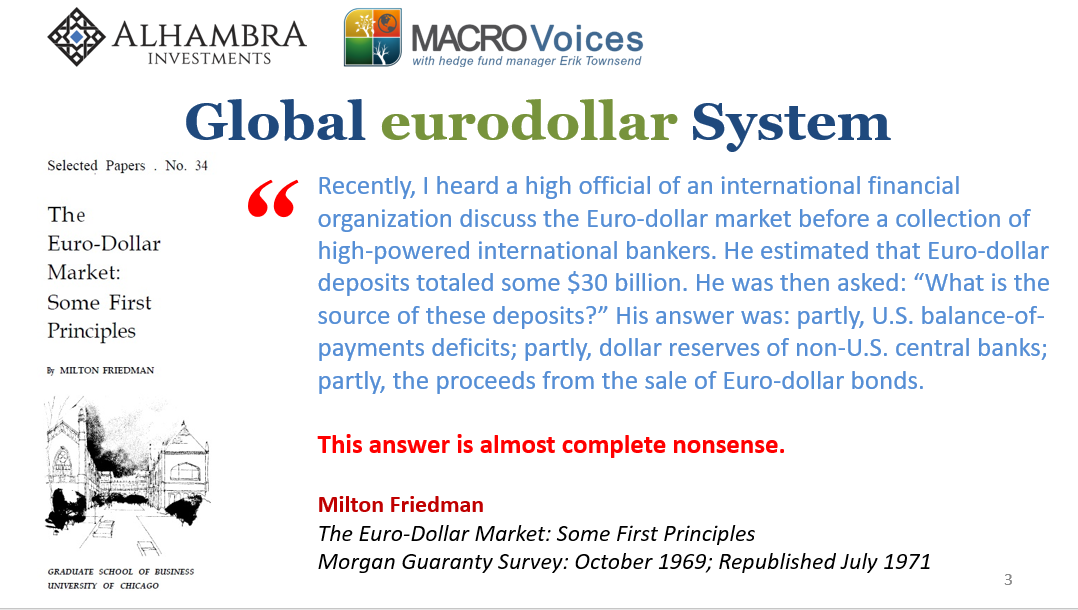

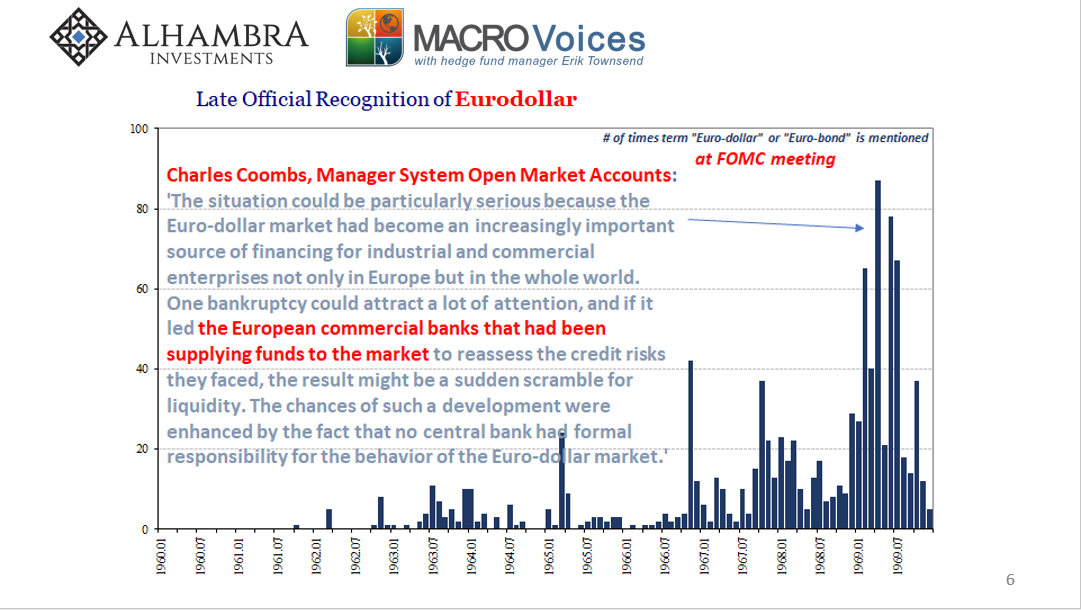

And even then, as Milton Friedman once lamented in 1969, none of them really knew why.

It was only in the seventies when the entire system was publicly reset that the people of the United States took notice. They never really knew the whole thing had already been reset during the entire decade before.

The whole world together sure perceived the results, though. The Great Inflation.

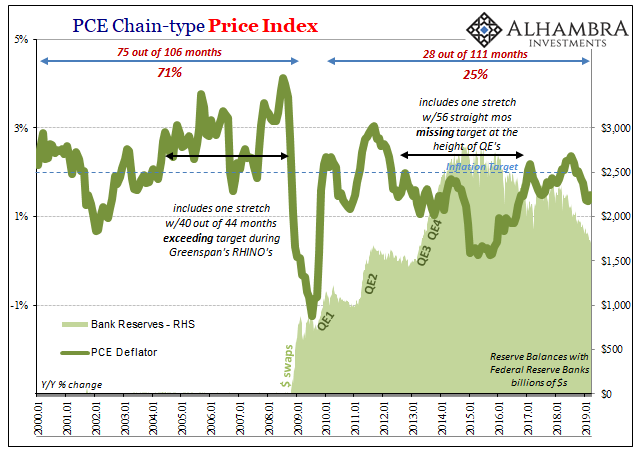

On this other side, almost a too-perfect bookend, it’s not inflation that’s the problem. In fact, every central banker around the world would give their reputation for some. They keep trying and trying to trigger an outbreak of it, idiotically by only forecasting more and more and hoping people just believe them (the puppet show), but fail each and every time.

Something seems wrong, but it’s harder to put your finger on it unless you witness the currency craziness firsthand and then make the connection(s).

Back to June 2015:

To a great extent, Americans are both sheltered and wholly unaware, but the rest of the world is very much alerted to the continued downside of the eurodollar standard. Stocks may be at or near record highs (though broader stock indices, such as the NYSE composite, have gone nowhere since the “dollar” started to rise), but Brazil is in a state of total economic and financial chaos while China flirts with what was never thought possible.

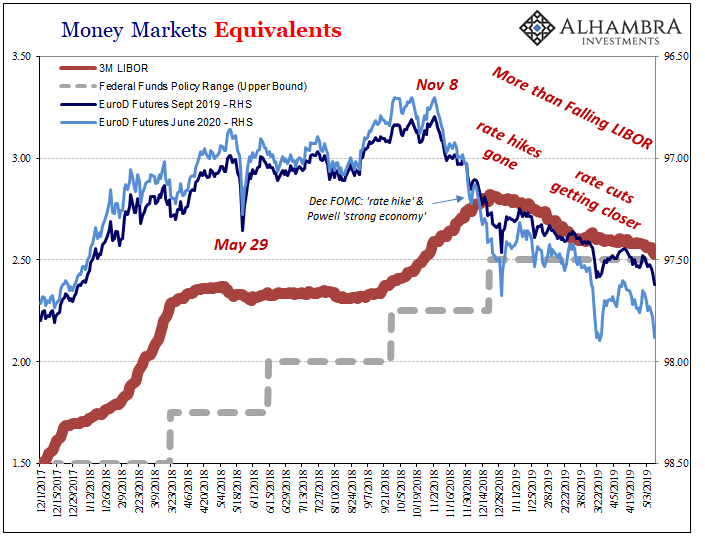

Even if you know nothing about the eurodollar system, there’s no getting around the obvious repetition. I wrote those sentences almost four years ago and somehow those words fit right in today. It’s always one step forward (reflation), two steps back (eurodollar squeeze). Rinse. Repeat.

Being sheltered is a double-edged sword. We don’t have to immediately face up to what’s wrong. But that also means we don’t notice what it is that’s wrong.

From my perspective, I can tell you right now there is far more interest in the dollar outside of the dollar’s presumed jurisdiction. That might change.

Stay In Touch