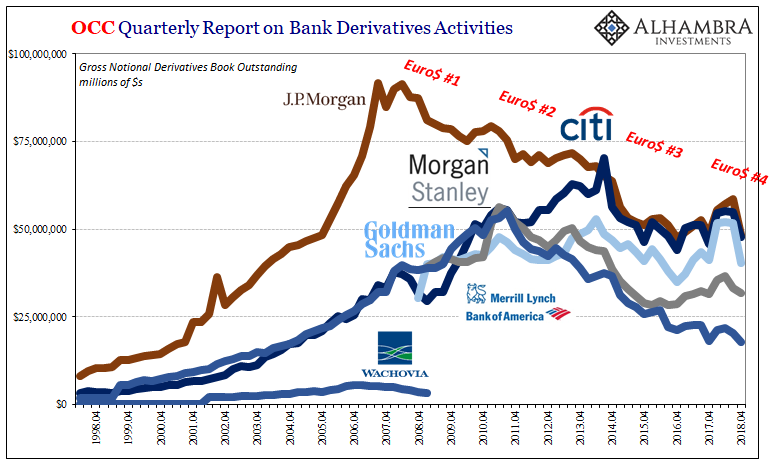

Perhaps it shouldn’t come as a surprise. After all, during the first quarter of this year several key banks announced they had had enough. Goldman Sachs, Nomura, Credit Suisse, as well as others, they all broadcast cuts to key operations. The FICC stuff, or bond trading to put it euphemistically. The very place the world actually gets dollars.

Only, they aren’t dollars so much as shadow dollars or eurodollars. A credit-based global currency therefore requires a credit base, meaning bank balance sheet capacity. If banks aren’t interested in bond trading or money dealing whatever you want to call it, if they become scared or get burnt (again) betting on whichever empty suit occupies the Fed Chair on any given day, quite naturally they get out. Prudence demands nothing less.

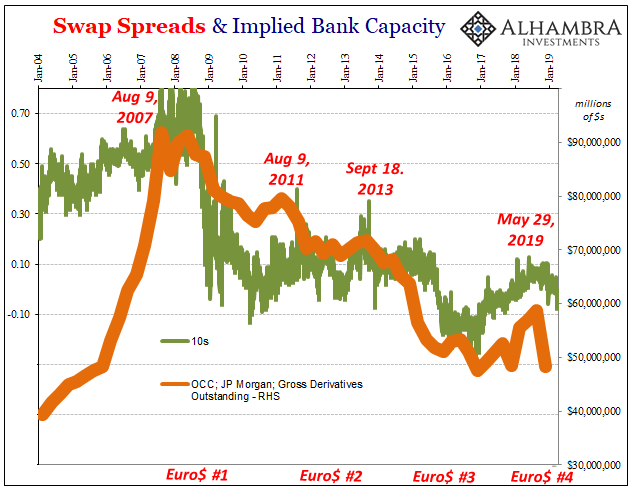

Others like JP Morgan never really got back in. Even as far back as early 2008, once the unrivaled ruler of the derivative business, the real bond trading, JPM has retreated back into its fortress balance sheet. It hardly sounds like anything consistent with a resurrection of global growth, which, if it was real, would surely raise global risk appetites.

Instead, as we know, while JPM’s management and suite of Economists might be all over Twitter expressing highly negative, massacre thoughts about the most liquid and safe assets JPM the bank has been backing the truck up for them. The more it buys in UST’s and the like for itself the less it is going to be doing shadow money.

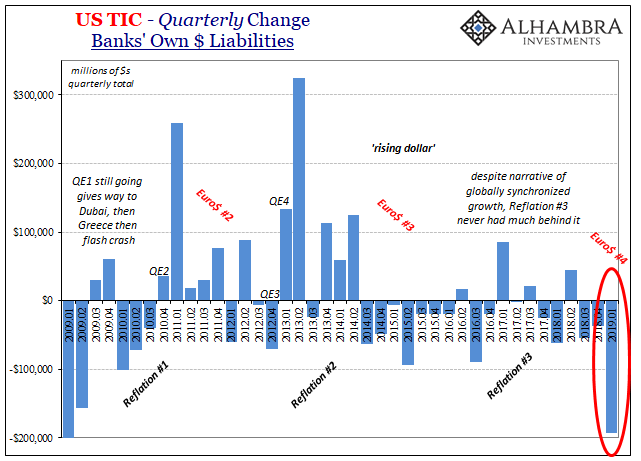

What the Treasury Department reported yesterday, however, was more than even I had been expecting. The trend was assured, banks would be retreating from the shadow spaces. In Treasury’s TIC data that meant reduced dollar balances maintained with overseas (read: offshore) counterparties. Banks’ Own Dollar Liabilities fall often sharply whenever a eurodollar squeeze erupts.

That is the squeeze.

Left without willing sources of ostensibly US$ funding, the world has to scramble for alternatives. There really aren’t many which is why whenever a squeeze does develop the global economy suffers for it.

Central banks in the Western world sit on their hands but those in the most heavily afflicted geographies are forced into some really bad choices. Hapless, incompetent, but most of the time well-meaning. I wrote about them, mainly China, last week:

To oversimplify again, let’s assume you need to borrow $100 every day in short-term eurodollar markets just to keep doing the vital economic and financial things you do. One day, the eurodollar market demands $110 for whatever reasons including problems on its own end. As the central bank, I promise to help you by giving you the extra $10 because you not having that $10 means you don’t get all of the $100 and therefore all sorts of bad things for you as well as the economy.

I can sell $10 in assets I already own, which, as noted above, means that’s $10 subtracted from the domestic monetary base. Or, the Brazil option, I can give you $10 today by promising to obtain $11 three months in the future. It sounds absurd, but that’s really what happens and it keeps the $10 in place for the domestic base while simultaneously giving you an acceptable liability covering your $10 shortfall.

Three months later, you are still borrowing the $100 on eurodollar markets as you always do, but now I have to borrow $11 on top of it, to close out that prior intervention. If the eurodollar market has gone back to normal, great. If the eurodollar market still demands $110 from you, then we have double the problem.

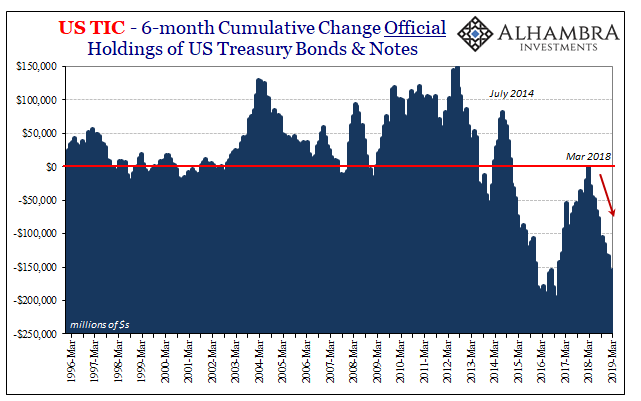

To put the squeeze in these terms, banks like Goldman and Nomura have just said that in order for them to fund your dollar short they’ll now need $110 to be compensated for the increased risk (as well as reduced resources they’re putting in their own operations). Your local central bank can subsidize that demand by selling $10 of its own “reserves”; this selling UST’s.

First, Q1’s massive squeeze:

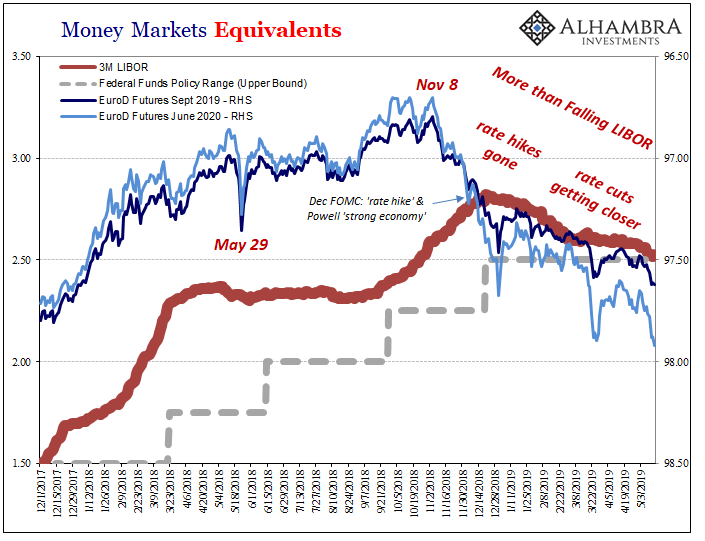

I think it’s fair to write that the global “dovish” turn by central banks including the Federal Reserve failed to convince global eurodollar banks everything was going to be alright. The economic data we reported yesterday in the US and China already showed the Fed pause had fizzled, putting it mildly. Here’s the figures showing why.

It was the second worst quarter in the series history dating back to 1978. The only single quarter greater, meaning illiquid, was Q1 2009.

As a consequence of banks demanding $110 maybe $115 or more in Q1, going back to the stylized example above, central banks had to step in which can only be a partial offset on the best of days (for reasons that I won’t get into here). Sure enough:

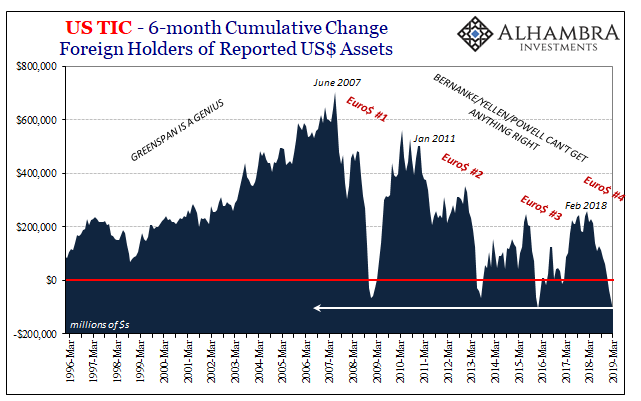

According to TIC, over the last six months including the latest data for March 2019, the official sector has disposed of about $121 billion in reported assets. As you can see above, that’s a monumental effort. And it’s still nowhere near enough, as the bank data indicates.

If the eurodollar market isn’t supplying eurodollars and central banks can’t meet all the dollar needs, then the only option left to an overseas bank synthetically short eurodollar funding is for them to sell their own US$ assets of whatever variety. Classic firesale stuff.

Normally, the foreign private sector on net is buying hundreds of billions in any 6-month period. In the 6 months up to and including January 2018, for example, private foreign parties had purchased, on net, $264 billion in reported US$ assets.

Over the last six months ending with March 2019, they’ve purchased, on net, just $11 billion. In just the past four, meaning going back into December 2018, private foreign parties have sold, on net, nearly $100 billion. It’s a quarter-trillion turnaround from last January.

The dollar short meets the dollar shortage. Global economy rushes toward global recession.

Combined private and official, over the last half year US$ assets have been sold at a record rate. A system going backward, illustrated above with lower highs (reflation) and lower lows (eurodollar squeezes) for each of these cycles.

Why are ST UST’s so attractive even at yields below T-bills or the Fed’s RRP? Straight liquidity risks. Banks are out and the rest of the world has to confusingly, chaotically deal in the aftermath as best as anyone can. The real economy places where it really matters are what are most deprived (the interest rate fallacy proved via TIC; low bond rates indicate tight money in the real global economy).

Though the data is two months in arrears, it pieces together nicely just what we thought has been really going on in the shadows. Escalating.

Stay In Touch