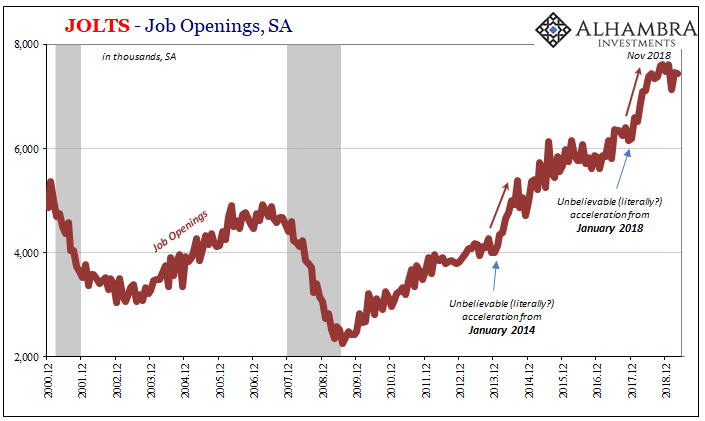

The unemployment rate has been maybe the loneliest of numbers. That didn’t quite mean it was entirely alone. Of the major economic accounts, only the JOLTS series and only one part of that series suggested the big mainstream employment indicator was anywhere close to accurate. Job Openings (JO) have been surging as if companies are in high demand for new labor. It has therefore been widely cited.

Or, more accurately, it had been surging. It is no longer as widely cited.

The level of JO has itself leveled off dating back to last November. It adds yet more evidence to the building case for an economic landmine in that October to December window. Even more robust than the unemployment rate itself, lost momentum perhaps an increasingly defined inflection in this one series would be a huge blow.

The case for optimism indeed the entire basis for expecting transitory weakness and a second half rebound rests entirely on one’s view of the labor market. Consumer spending is admittedly weak as is business investment. In this mainstream, FOMC version, these potentially concerning developments are less concerning when judged from the prospective jobs market which remains unusually strong.

If, however, one of the few measures consistent with that view has gone over to the other side, obviously that view takes a substantial hit.

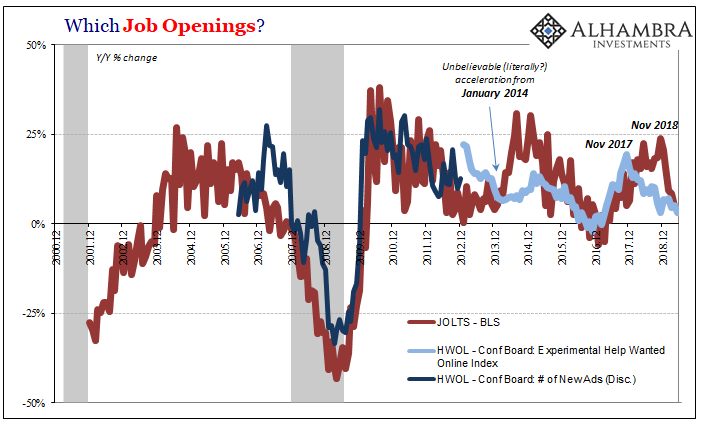

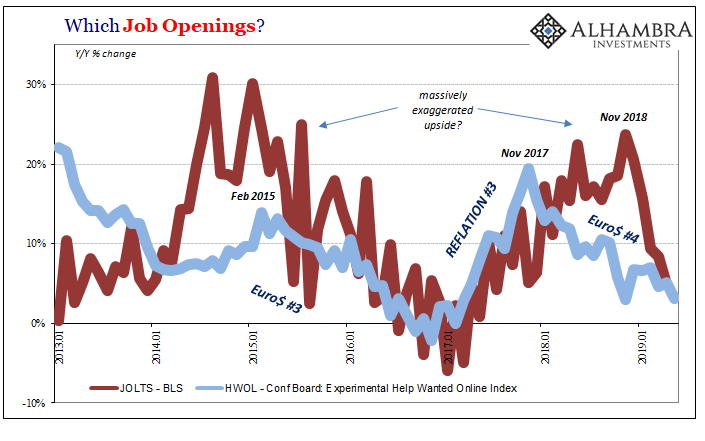

It’s even worse when you factor other indications of presumably the same thing. There are alternate calculations for labor demand – what JO is supposed to estimate in the elusive chase for Okun’s Law. The Conference Board, as we’ve noted for quite a long time, has produced an entirely separate figure for labor demand via online postings for job openings.

This alternate version has been far less roaringly optimistic at its peaks and actually turned toward inflection much earlier climaxing instead way back at the end of 2017. The current estimates for JOLTS JO therefore have merely converged into Euro$ #4, no longer disagreeing as to suggesting what might have happened only the timing as to when it began showing up in the US labor market.

In other words, a consistent picture emerges about the nature of Euro$ #4 – in the US economy, in the US labor market. There’s more evidence piling up for a profound change or inflection point rather than continued mild support for the mainstream, Jay Powell view. Given how the headline payroll reports have gone of late, the unemployment rate maybe now really is the loneliest of numbers.

Stay In Touch