The markets we use to monitor the economy (and those that influence it, which amounts to the same thing) have been tracking an economic slowdown since the 4th quarter of last year. That’s when interest rates, real and nominal, long term and short term, started to decline, credit spreads started to widen and the copper to gold ratio started to fall. Those are all classic market signals of an economic slowdown. Some of those have moderated since the beginning of the year though and today we seem to be standing at a crossroad. If the economy continues to slow, it won’t be long before recession becomes inevitable. As I said in the update earlier this week though, we aren’t quite there yet.

We first started to notice problems in markets over a year ago. Jeff Snider noticed disruptions in money markets (not money market funds but things like Eurodollars) early last summer. Still, it wasn’t until the late fall that these disruptions started to impact the economy and broader market psychology. Wall Street and its narrators offered a traditional explanation for the slowdown – it was the Fed going too far with rate hikes or the ongoing trade war with China (and other places) that slowed the global and then the US economy. Jeff’s explanation of distress in funding markets is at once more direct and more opaque. Direct because it offered an early warning but opaque because the causes are hard, maybe impossible, to discern. They call it the shadow market for a reason.

Jeff and I have discussed – debated – whether what he sees in money markets is cause or effect. He leans much more toward the former while I lean more toward the latter. The truth, as it so often is, likely lies in the middle. We have both wondered – because we can’t know for sure – if the troubles at Deutsche Bank are the source of the problems in global dollar markets. I think there is some truth to that but if anyone knows what is actually on DB’s balance sheet, they haven’t shared it with the rest of the world. Whatever the cause, there is no doubt that dollar funding outside the US is constrained and that is having an effect on the global economy. Whether a lack of dollar funding is the cause of distress or whether it is an effect of other problems is hard to say.

Of the traditional explanations, the Fed narrative is thin at best, at least from a physical standpoint. Unlike some I know, I won’t call the Fed irrelevant but their impact on money today is limited mainly to psychology. Which is important and powerful but ultimately limited by a reality central bankers can ignore for only so long. US GDP totals $20 trillion annually and I find it highly unlikely that the difference between growth and contraction is a 25 basis point change in the Fed Funds rate. If the US economy is contracting there is a lot more going on than a small change in interest rates. And the Fed isn’t going to reverse it with a similarly small change in the other direction. That is, frankly, absurd.

The trade wars, on the other hand, do seem more significant to the current slowdown. In fact, I’d drop the “wars” from that statement because global trade patterns were changing before Donald Trump came along to throw the tariff monkey wrench into the equation. (And as an aside, I am stunned at how swiftly the political establishment, left and right, has acquiesced to tariffs as a norm.) It seems likely to me that changing trade patterns and the shrinking of global trade more generally are both a cause and an effect of the diminished supply of dollar funding globally. Exports as a percentage of Global GDP have been generally declining since 2011 and whether cause or effect that means fewer dollars circulating globally.

From a more recent perspective, the uncertainty created by President Trump’s tariffs and threats of tariffs has definitely slowed economic activity. Companies are unsure how to respond. If they move their supply chain out of China they may just be moving from a country Trump has already targeted (China) to one he may target in the future (Vietnam). How does a company make long term plans in that environment? The answer of course is, they don’t. And companies sitting on their hands rather than investing isn’t positive for growth anywhere.

I have no idea whether this slowdown will turn into something worse but I do think we often underestimate the resilience of the US and global economy. Markets and companies find a way to get things done to deliver the goods to people who want them at a price they can afford. We’re seeing that now with Chinese companies shipping products to third countries for re-export to the US. We see it with US companies bringing back some production to the US or moving out of China (and taking the risk that Trump won’t impose tariffs on where they’re going). We see it with companies stockpiling inventory while they wait for a resolution to the trade issues. People find a way to get what they want.

Yes, the economy is slowing and these markets confirm that. But that’s all right now. No recession. Yet.

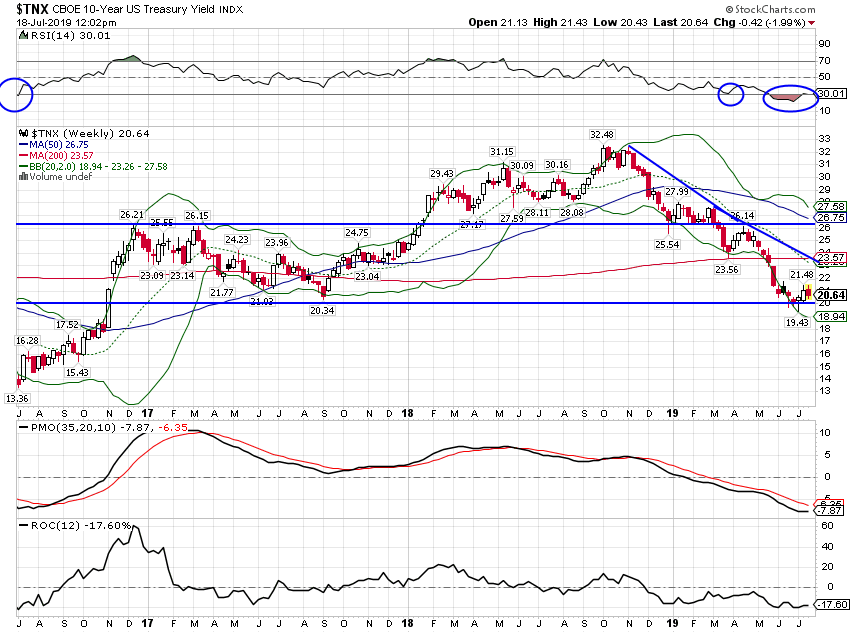

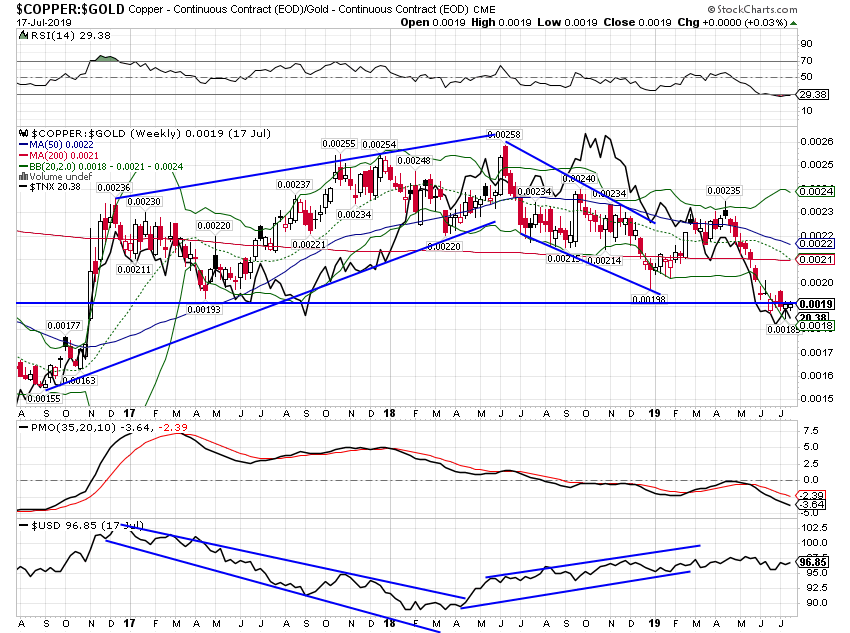

The 10 year yield has fallen to about where I expected around 2%. The sentiment on bonds is hard to determine right now. We still see large speculators short in the futures market but “long Treasuries” is also listed as the most crowded trade in the Merrill Lynch fund manager survey. I tend to think the latter is more accurate as there are lots of reasons specs might be short the 10 year futures. We need to watch the economic data closely and also monitor the copper/gold ratio closely. Short term I’m inclined to expect a rally in rates at least back up to the downtrend line around 2.35%.

Longer term I still think we may have seen the secular low in rates. There is a change in rhetoric around monetary policy that is quite disturbing. Combine MMT, Trump’s views on trade and the Democratic candidates’ belief in government intervention and you get a modern version of John Law. The scary thing is that I don’t think Trump would have a problem with MMT and the Democrats don’t have a problem with Trump’s tariffs. And both parties appear comfortable spending money we don’t have even if their priorities are different. I hope I’m wrong but politics seems to be trending in an inflationary direction.

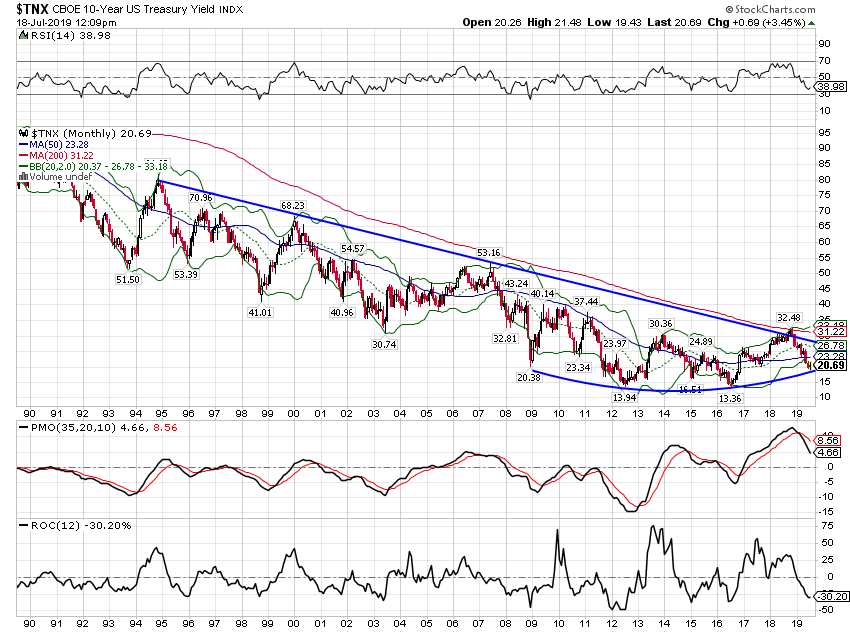

Real rates have fallen too but the 10 year TIPs yield is still above where it got to in the 2016 slowdown.

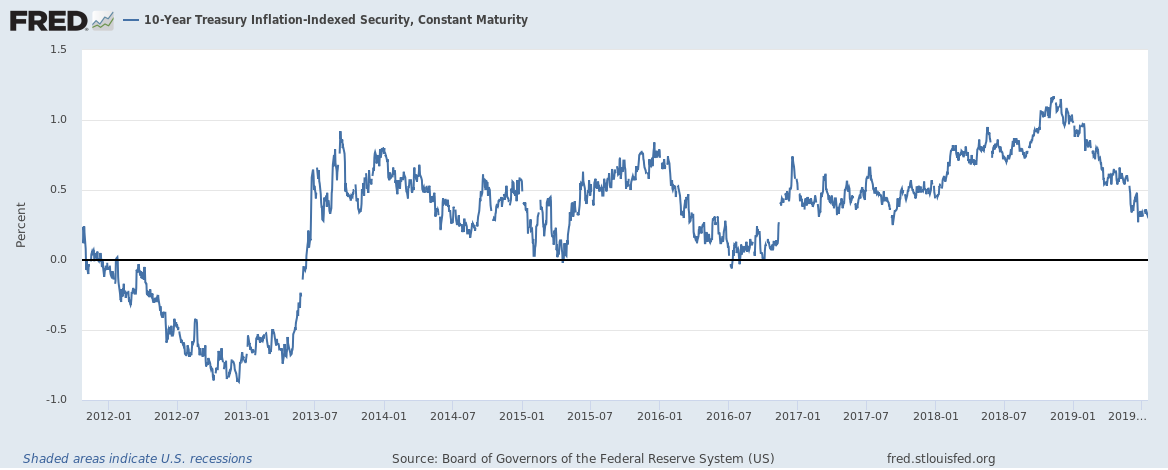

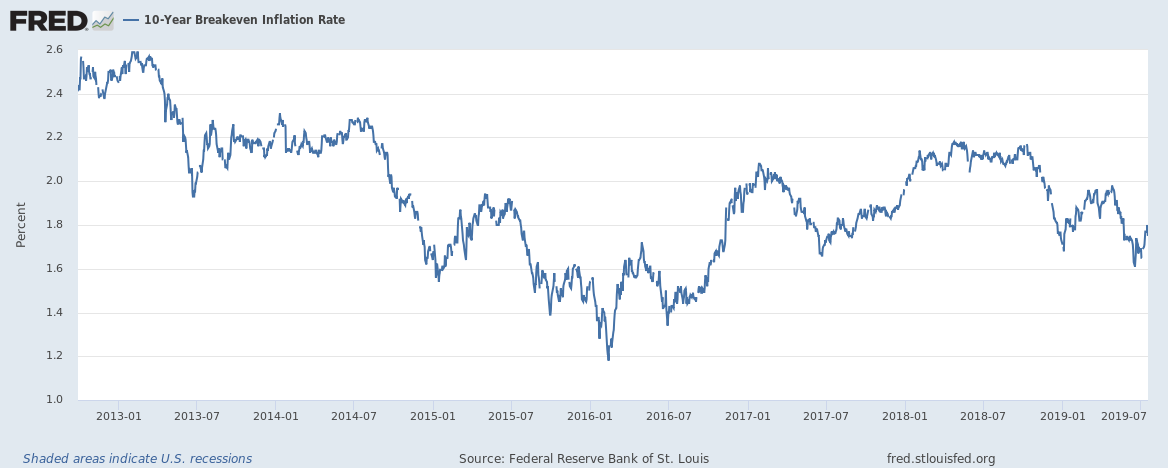

Inflation expectations have fallen although they’ve rebounded slightly recently. Again though, inflation expectations are still well above where they landed in 2016. Based on this TIPs still seem a slightly better buy than nominal bonds.

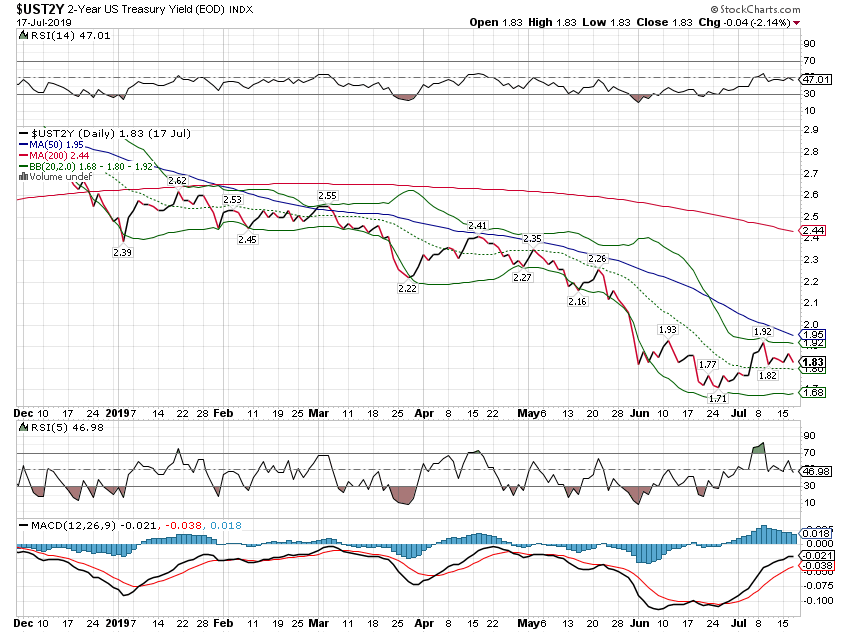

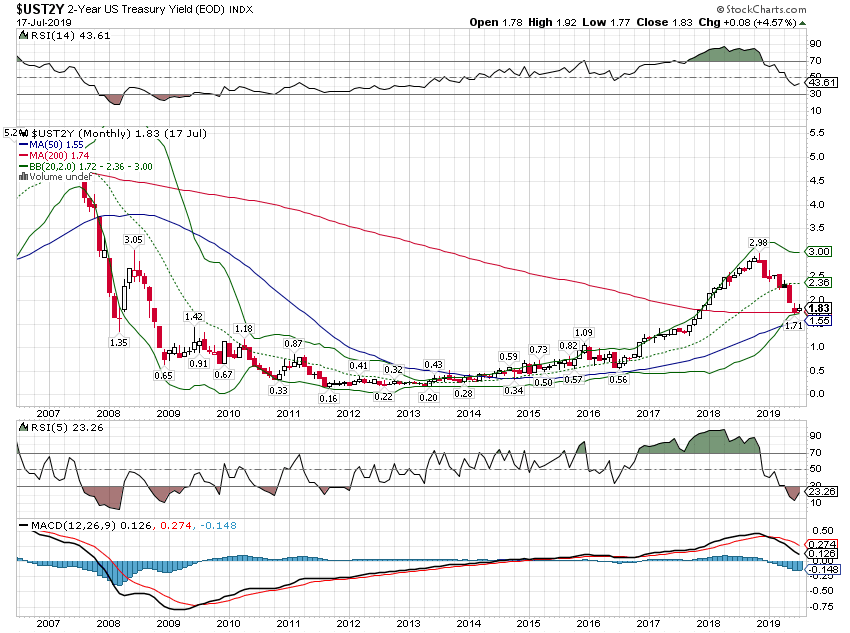

2 year rates have fallen too, somewhat faster than long rates which has steepened the yield curve slightly. Ask yourself this question though: Given that the 2 year yield was well less than 1% just a few years ago, if recession were imminent wouldn’t these rates be even lower? If we get a recession right now where do you think the 2 year note yield will land? A lot south of here is my guess.

Put in context the recent pullback in the 2 year yield looks more benign. When the 2 year was yielding nearly 3% at the end of the 3rd quarter last year, growth expectations were too high and they had to correct to reality. Are rates still too high?

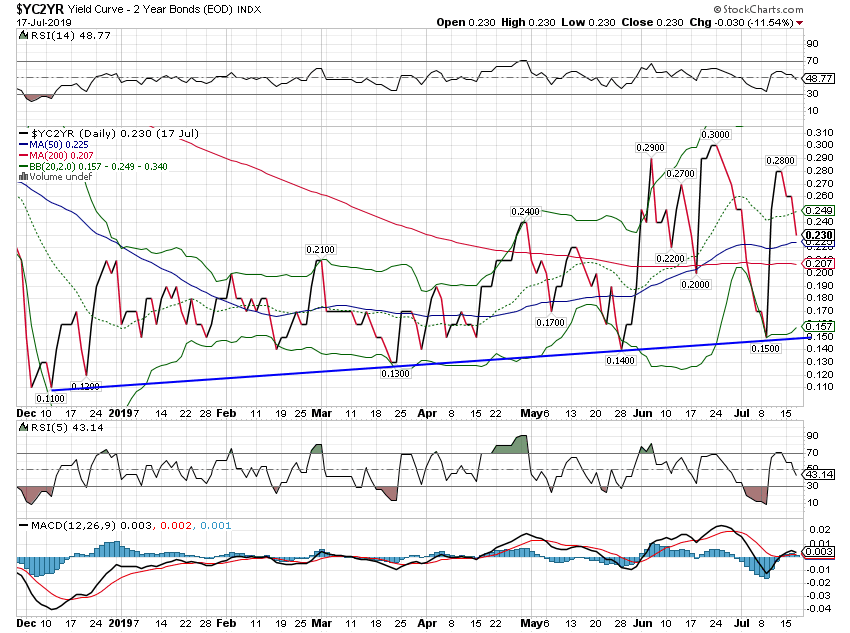

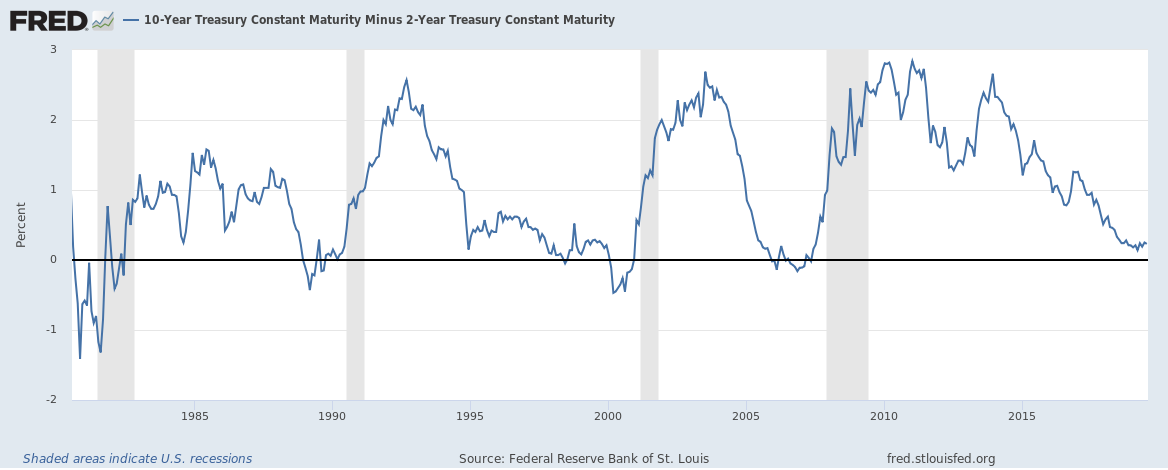

The yield curve has steepened slightly and not in a good way. Short rates have fallen slightly faster than long rates and the curve has steepened. But the total amounts to just 16 basis points. So far it’s just a blip.

And again, zoom out for some much needed perspective. The steepening so far is nothing when compared to what happened just prior to the last few recessions. Yes, that could change quickly and it may. But it hasn’t yet.

Same with credit spreads. Spreads have widened from their best levels. But this is nothing compared to what we’ll get if we are heading into recession.

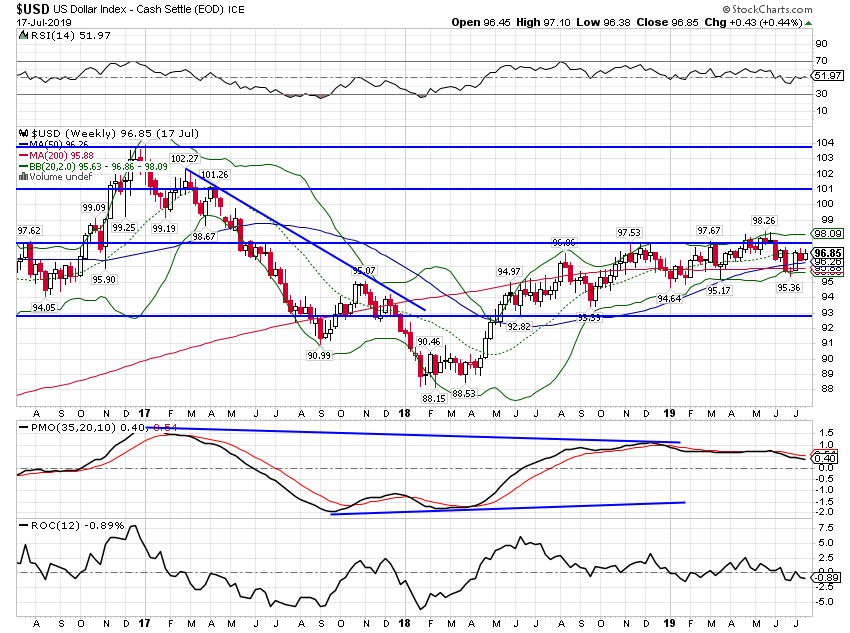

The dollar has just done nothing of late which is a good thing by the way. But momentum has turned lower and most everyone is already long so I would be more inclined to expect a fall rather than a further rally.

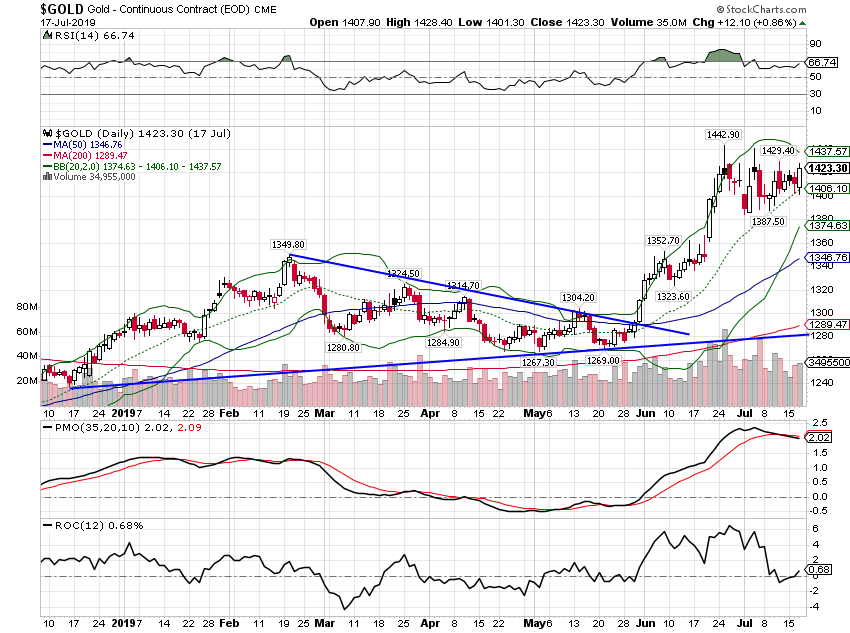

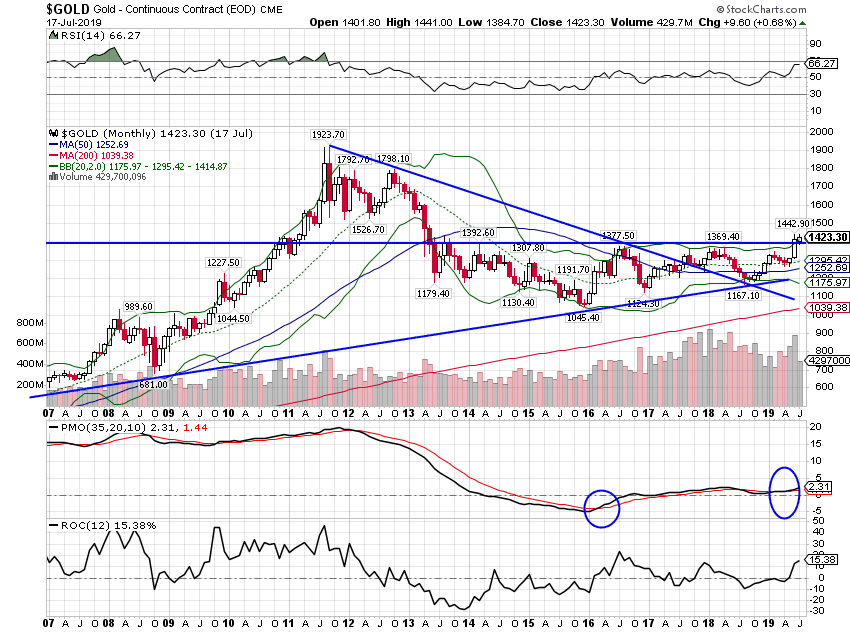

Gold has also rallied and broken above resistance that had held for years around 1350. Gold tends to rise when real interest rates are falling and especially when they are negative. It is an indication that investors don’t have much faith in future growth. After all, why park your money in gold if you have growth opportunities?

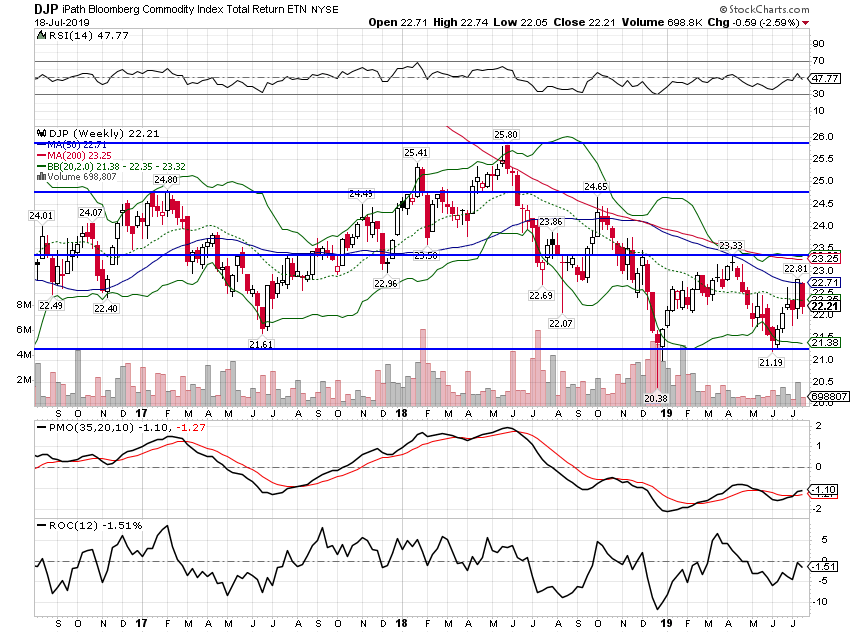

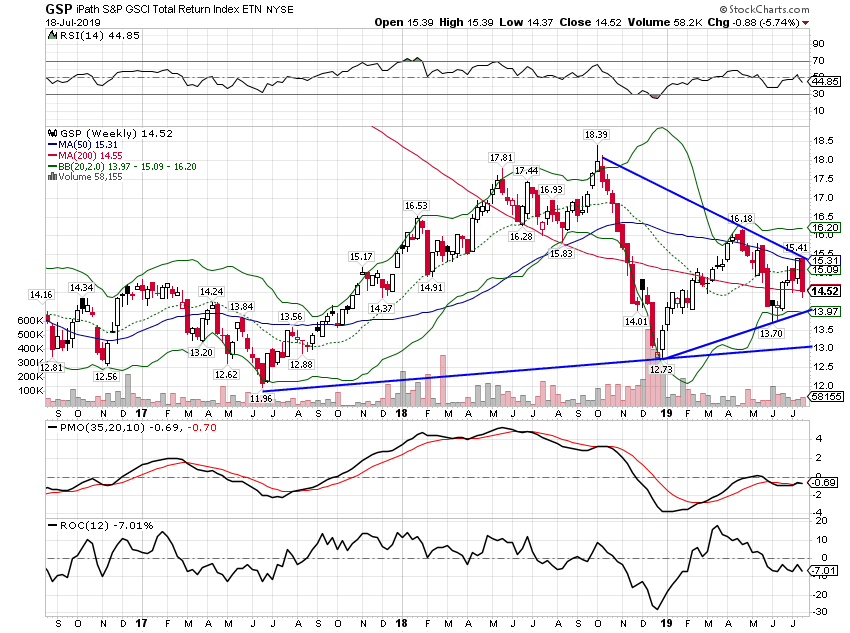

The general commodity indexes have been flat lining for over a year. That won’t change until we get a lower dollar and/or a better economic outlook.

The GSCI commodity index has pulled back recently with oil prices.

The copper to gold ration started to fall in the summer of last year right when we started seeing problems in the Eurodollar markets. This ratio is highly correlated with the 10 year treasury yield (the black line) and inversely correlated with the dollar. If growth expectations have hit bottom we would expect to see copper rise relative to gold, interest rates rise and the dollar fall.

Markets and the economy stand at a crossroad right now. Growth expectations have fallen dramatically since the end of the 3rd quarter last year. But the economic data seems to be trying to stabilize and markets are marking time waiting for further clues about future growth and Fed policy. I don’t know which way things will go from here but the trend is pretty obvious. It would be easy to just assume that the current trends continue until we’re in recession. Too easy maybe.

Stay In Touch