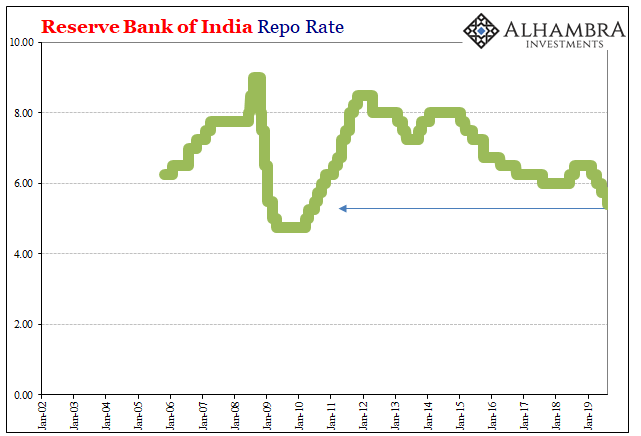

What got Urjit Patel fired (involuntary resignation) from his job atop the Reserve Bank of India was that he pulled a Trichet. Foolish enough to believe in the hype, Patel began a course of raising interest rates into the face of a gathering global dollar storm. The ECB’s Jean-Claude Trichet had done the same thing in the middle of 2011. But whereas Jean-Claude remained oblivious, Dr. Patel had actually spoken out about what he correctly identified as a global dollar problem.

They all believed too much in their forecasts. Economists worldwide had said globally synchronized growth in 2017. They kept with it in 2018 even as more and more things started to go wrong. As if some imbecilic, unaware grand marshal way too far out in front, Patel like Jay Powell and Mario Draghi hadn’t realized the parade behind them had stopped marching blocks ago.

With new leadership installed at India’s central bank, it’s been a steady reverse throughout 2019. Whatever might’ve been imagined about the prospects for a global liftoff last year, it isn’t even on the agenda anymore.

For the fourth policy meeting in a row, the Reserve Bank of India reduced its benchmark policy rate, the repo rate. In line with a deteriorating outlook, officials stepped it up a notch this time around. The prior three rate cuts had been 25 bps each. The one undertaken starting tomorrow will be 35 bps.

The benchmark is increasingly within sight of its record low reached in the awful aftermath of the 2008 Global Financial Crisis. India, like its peers, doesn’t seem able to escape and normalize which suggests that what accompanied the GFC in economic terms was not a Great “Recession” at all; it certainly wasn’t great and it couldn’t have been a recession.

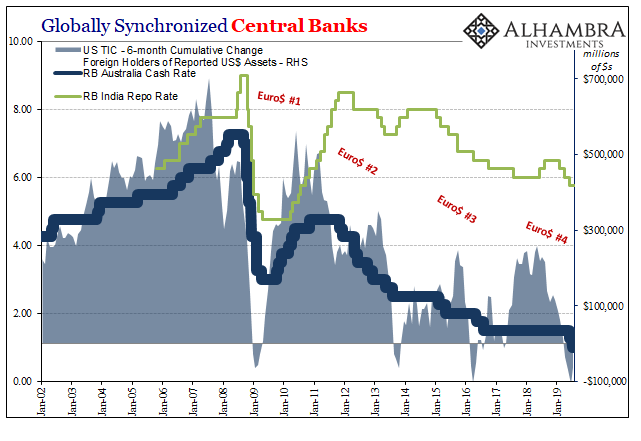

The RBI isn’t alone today. The central bank in New Zealand cut its rate for the second time while the Central Bank of Thailand acted upon its growing worries about serious trade problems.

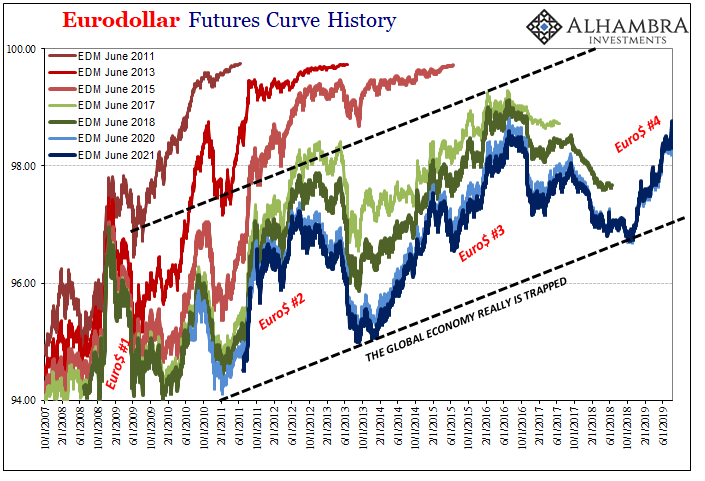

There is an unmistakable pattern in the behavior as well as the timing. Globally synchronized reflation, not growth, which teases a few rate hikes before the false dawn drops out of the sky. It then becomes a globally synchronized downturn which leads to the biggest conundrum of all, for the Trichet’s, Patel’s, and Powell’s of the world, globally synchronized attempts at stimulus.

All that is further synchronized with what foreigners tend to do with their dollar assets. Urjit Patel should have listened to what he was saying in the middle of last year – and then saw the market corroborate his story just a week later when the eurodollar futures curve inverted for the first time. Rates all over were going to head lower, not higher.

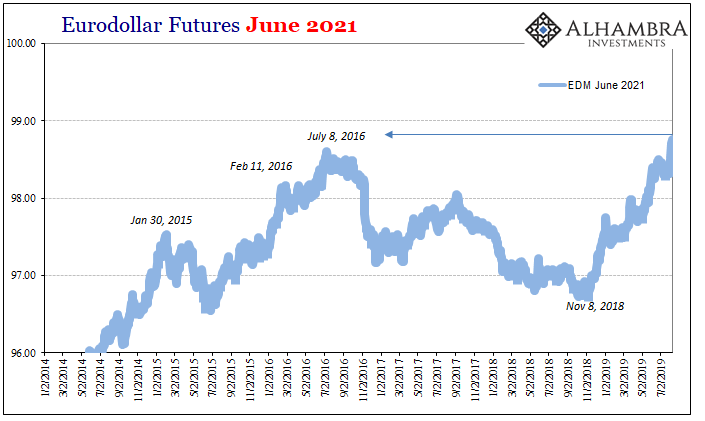

The June 2021 futures contract is out at the end of the inversion – the market saying that whatever is unfolding right now it is likely to linger for some time even out that far. This is no transitory blip. Reflation #3 has been completely, comprehensively unwound and we are staring at the prospects for new lows (meaning high prices).

Over the past few days, the contract price has spiked above its previous record set (July 8, 2016) just after the worst of Euro$ #3 (February 11, 2016). A higher contract price means the market expects a much lower LIBOR rate in the future. A falling and flattening curve indicates near-term risks becoming long-term issues.

In other words, the eurodollar futures market is saying the Fed is about to join India, Australia, Thailand, New Zealand, etc.

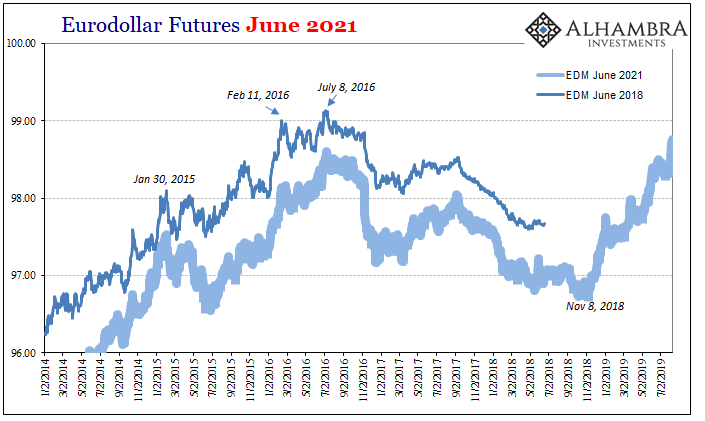

That’s not all; there’s more to the story. To be fair, more like apples to apples, we really should be comparing the June 2021 contract in August 2019 to the June 2018 contract in the spring and early summer of 2016 (to harmonize the time value).

The June 2021’s aren’t quite equal to the last bottom yet, but they are very close (just as the 10-year UST yield is back in sight of its record low). The eurodollar futures market in the middle of 2016 was saying at around these prices the Federal Reserve wasn’t going to do nearly as many rate hikes as had been forecast especially back during 2014’s “best jobs market in decades.”

There was a chance for some, but that the risks of renewed problems would continue to be high so that the more time went on the greater the likelihood of them popping up (like on May 29, 2018).

In more general terms, Euro$ #3 had shown the US and global economy really was stuck in a persisting malaise. It can never get going enough to take off, to pick up the momentum required to break free from what absolutely is a lost decade. Those easily fooled central bankers call it R*, but it doesn’t really matter what they call it.

When the curve inverted in 2018, that was the market calling the false dawn. The third one.

In other words, as the expected future path of US$ money rates is pulled back down again and starting from a much lower level it only further proves the global economy really is trapped by the same deficiency.

The whole world has an interest rate problem – starting with the fact everyone still calls lower rates stimulus. That can’t be American drug addicts and American Baby Boomer retirements. Neither of those are what forced Urjit Patel out of office, nor are they what has scared Thailand into an action very few thought would be undertaken (at least this soon).

Eurodollar futures aren’t suggesting a high probability of renewed ZIRP because of some convoluted R* theory (which conveniently would absolve monetary policymakers of twelve years of failure and incompetence). Investors are betting on constant liquidity risk, or the same thing which is driving European bond yields further and further underground.

Global interest rates, global money. Take it from here Milton Friedman:

After the U.S. experience during the Great Depression, and after inflation and rising interest rates in the 1970s and disinflation and falling interest rates in the 1980s, I thought the fallacy of identifying tight money with high interest rates and easy money with low interest rates was dead. Apparently, old fallacies never die.

By trading nearer and nearer those previous equivalent highs, eurodollar futures prices like UST’s or JGB’s are collectively signaling first such a high degree of short-term danger and once again the long-term economic damage which is quite likely to result from it. With no starring role for R* in Thailand or India, what’s left that explains all the facts?

Synchronized.

Stay In Touch