The investment industry is always focused on the short-term, an attempt I think to justify fees through activity. A recent example is the breathless reporting about a short term shift toward value stocks. Value has underperformed for so long that everyone is hyper-focused on finding the inflection point so every wiggle in that direction is hailed as the turning point.

The Last Time the Market Acted This Way, Value Stocks Gained 30 Percent

Institutional Investor, September 23, 2019

Value Stocks Had Been Left For Dead. Their Revival Could Be the Real Deal.

Barron’s, September 17, 2019

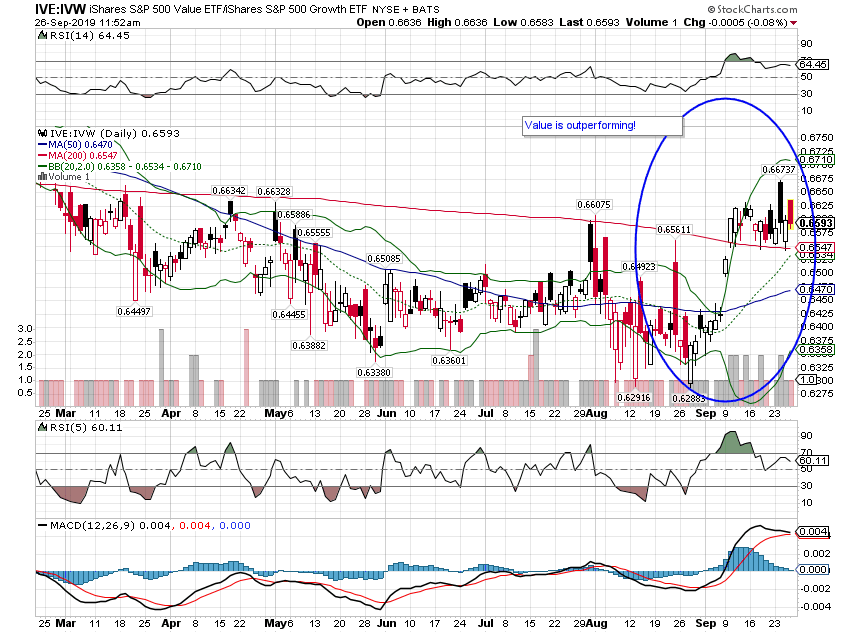

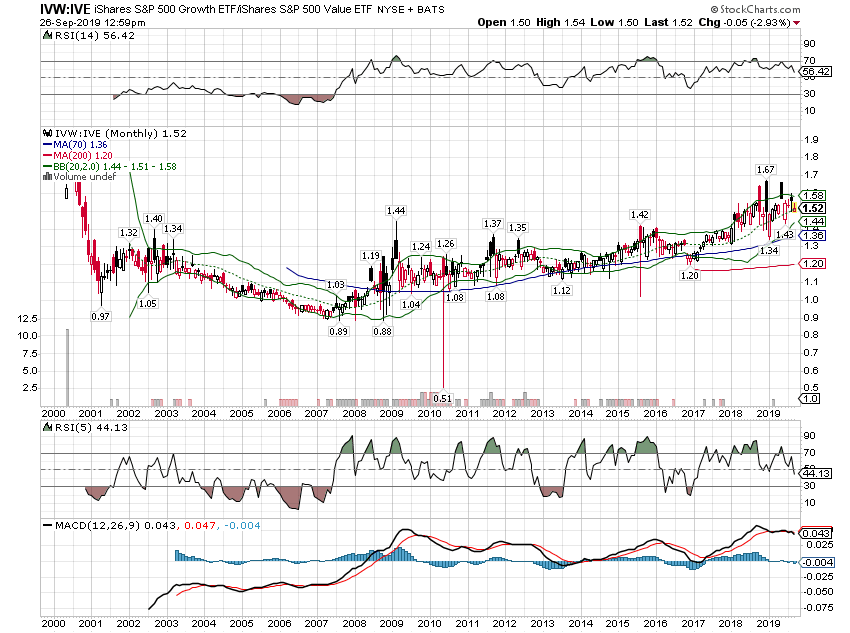

Here’s what they’re talking about. This is a chart showing the ratio of the S&P 500 Value ETF (IVE) to the S&P 500 Growth ETF (IVW). When the price is rising, value is outperforming:

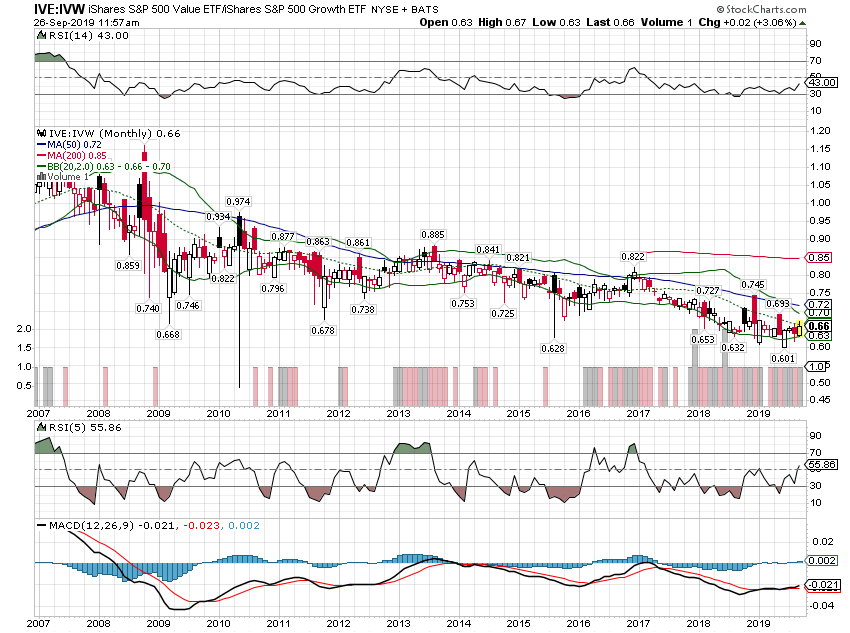

Time to shift your portfolio? Maybe not. Investors – rather than traders – need to focus on the long-term trends and not overreact to the shorter-term movements. Here’s the long-term trend:

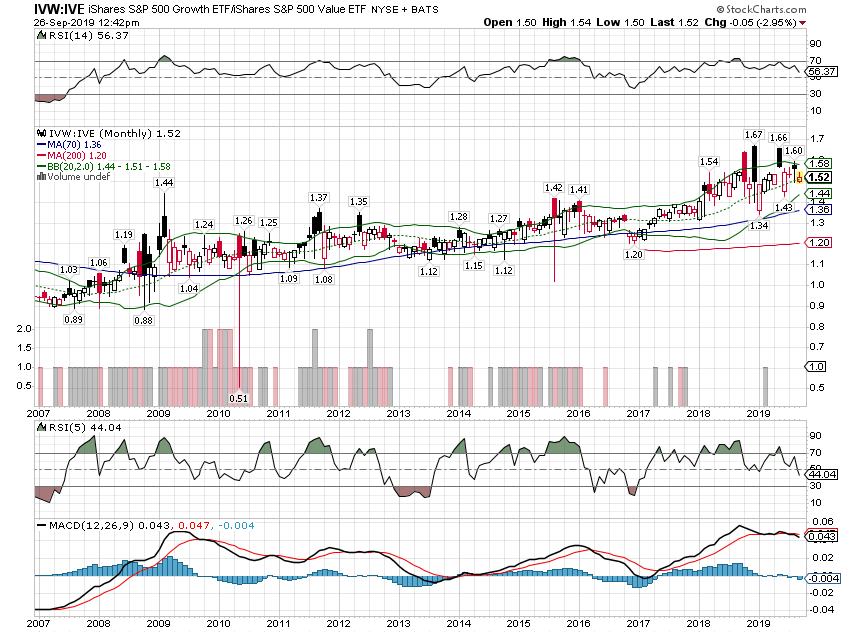

To make it clearer let’s flip the chart using Growth as the numerator:

Value has had short periods of outperformance in this cycle but the trend is obvious. Actually this trend started before this expansion cycle. Growth started outperforming value during the financial crisis with the inflection point in mid-2007. Prior to that, value had outperformed since the dot com crash in 2000:

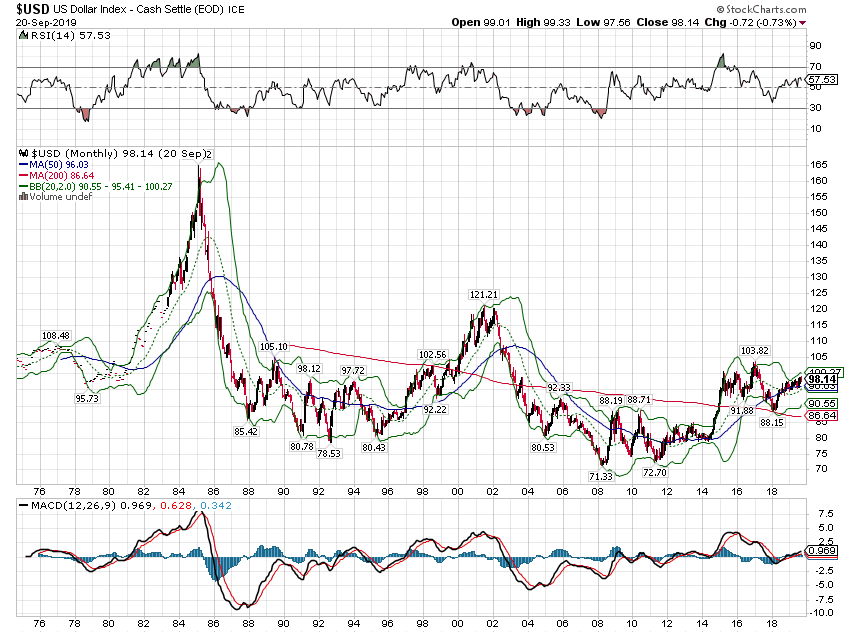

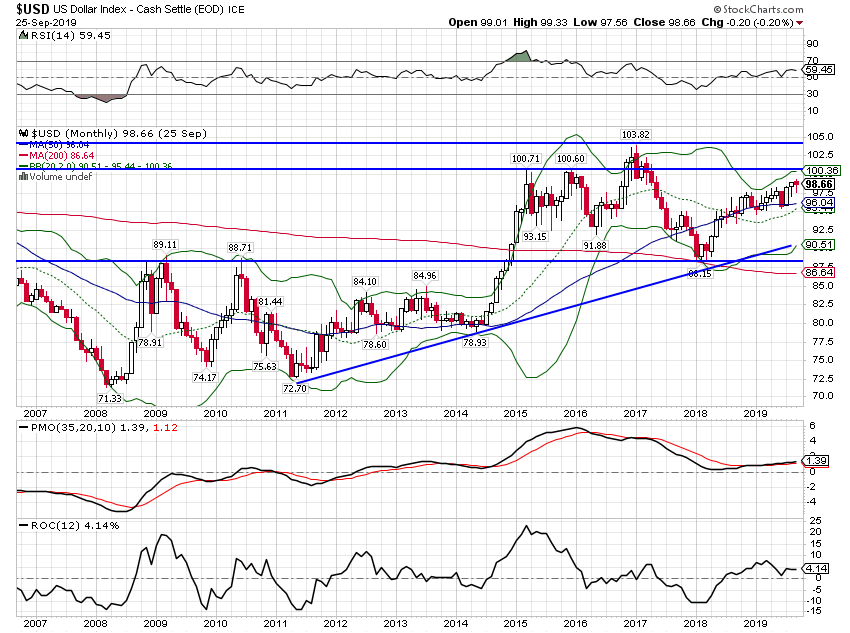

Value tends to outperform during weak dollar periods such as the 2000 to 2008 time frame. That is because the value index is dominated by energy and materials names that are positively affected by a falling dollar. And the inflection in 2007 reflects the other big allocation within the value side – financials. So, while we may see some short periods of outperformance by value, a long term shift will have to wait for those sectors to start outperforming. And that in turn likely won’t happen until the dollar gets in a sustained downtrend.

The multi-decade trend of the dollar is down but that is just the long term effect of inflationary monetary policy. That might be important for society but doesn’t help the investor all that much.

We focus on multi-year trends. Currency trends tend to persist, lasting years rather than months. And those multi-year trends have effects across multiple asset classes. The trend since the crisis, with some bumps along the way, is higher.

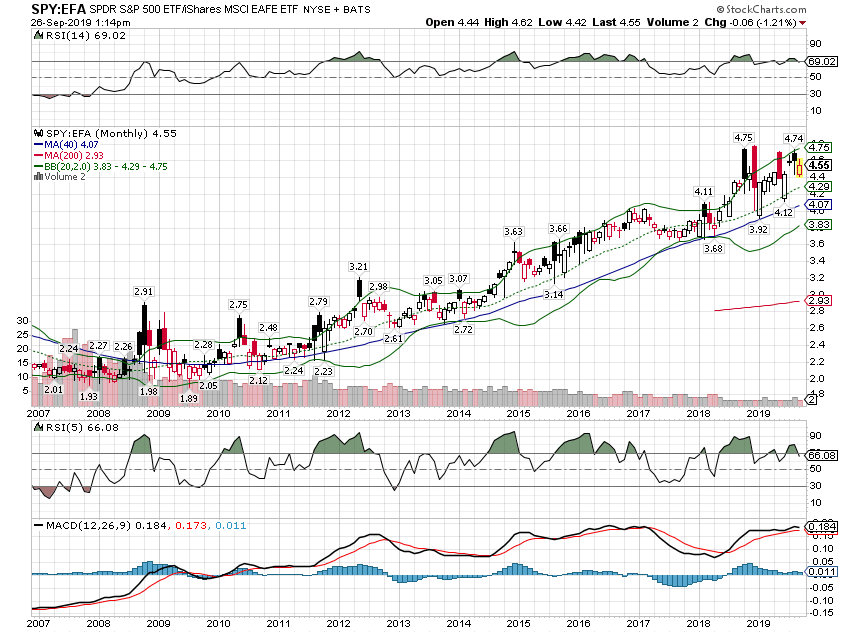

That rising dollar trend shows up in other ways too. When the dollar is rising, domestic US stocks tend to outperform their foreign counterparts. Here’s the S&P 500 vs the EAFE index:

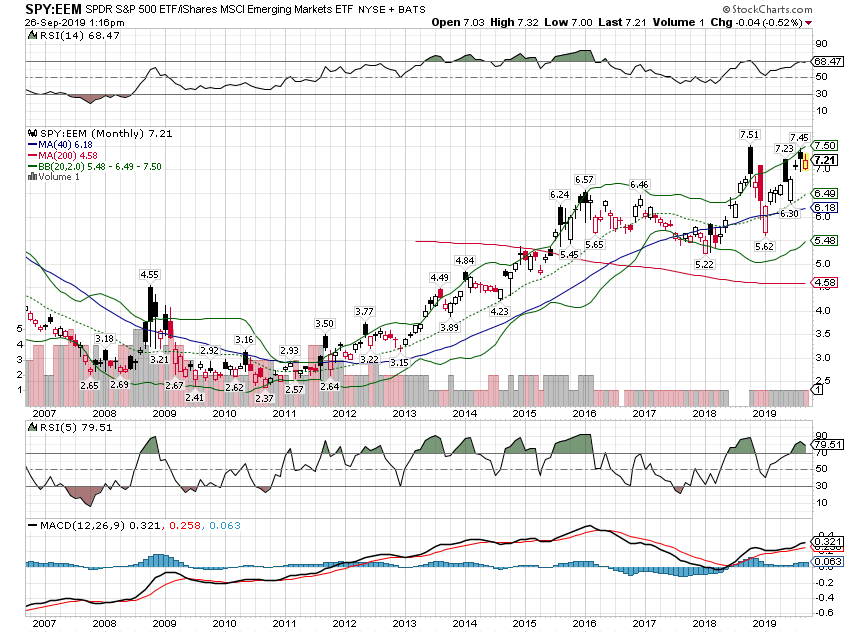

We see the same effect in Emerging Market stocks:

There are multiple reasons for this phenomenon but the easiest explanation is that foreign stocks are denominated in currencies that are losing value relative to the US dollar. Often you can find foreign markets that have outperformed the US in local currency terms, but once converted to dollars the outperformance disappears. If you own non-dollar denominated shares when the dollar is rising, you’re swimming upstream.

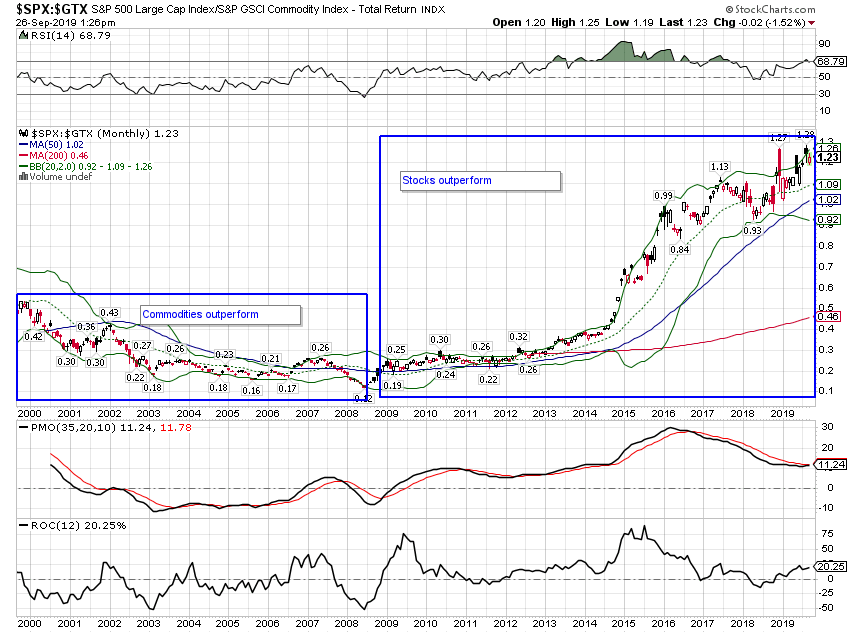

Commodities also perform poorly in rising dollar periods. This chart of the S&P 500 vs the GSCI shows both a weak dollar period when commodities outperformed (2000-2008) and a strong dollar period when stocks outperformed:

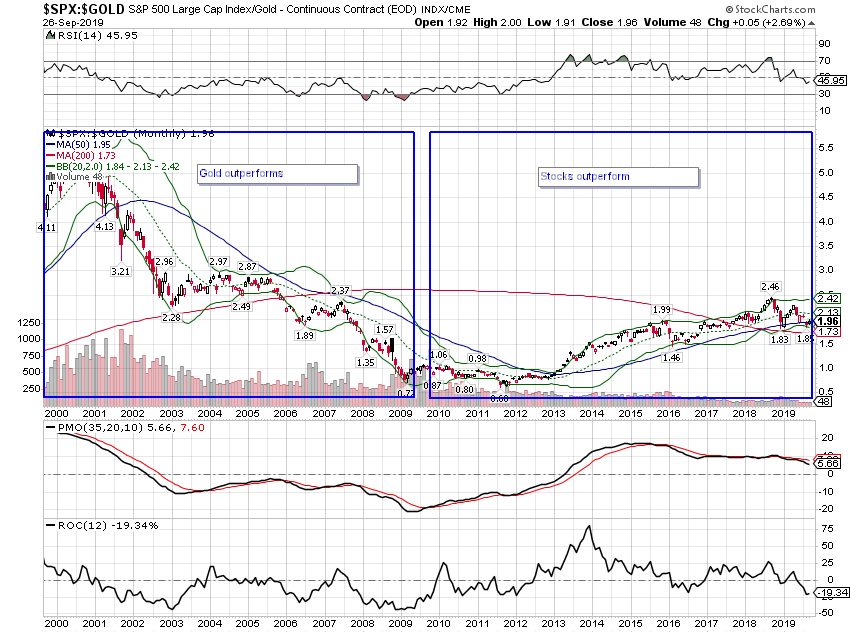

We see a similar effect with gold:

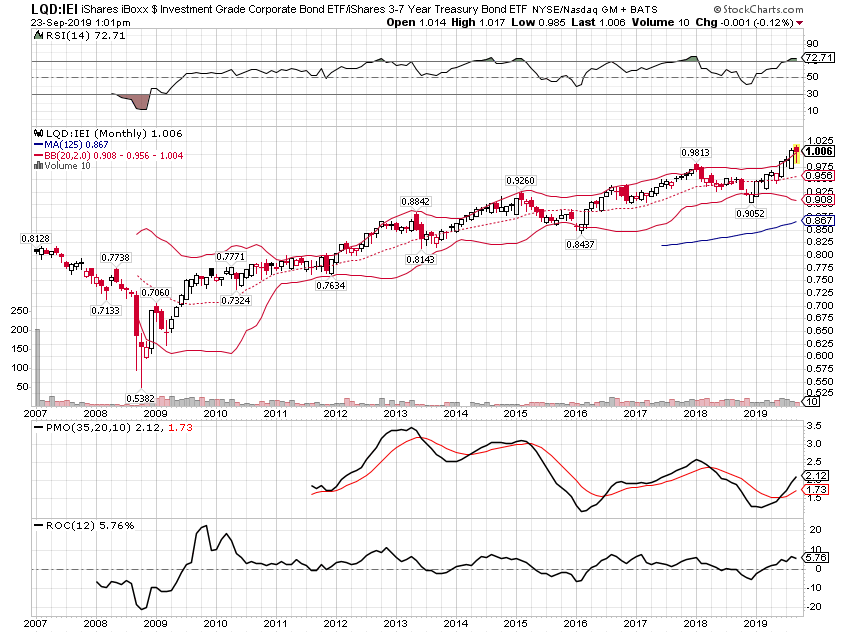

There are plenty of other long term trends that can be exploited through a business cycle. Corporate bonds will outperform Treasuries during an economic expansion and lag during a recession. This chart shows the ratio of the high-grade corporate bond ETF (LQD) to an intermediate-term Treasury ETF (IEI). LQD underperformed from 2007 to late 2008 and has outperformed since. The turning point came before the end of the recession and produced a large gain right at the beginning of the new trend.

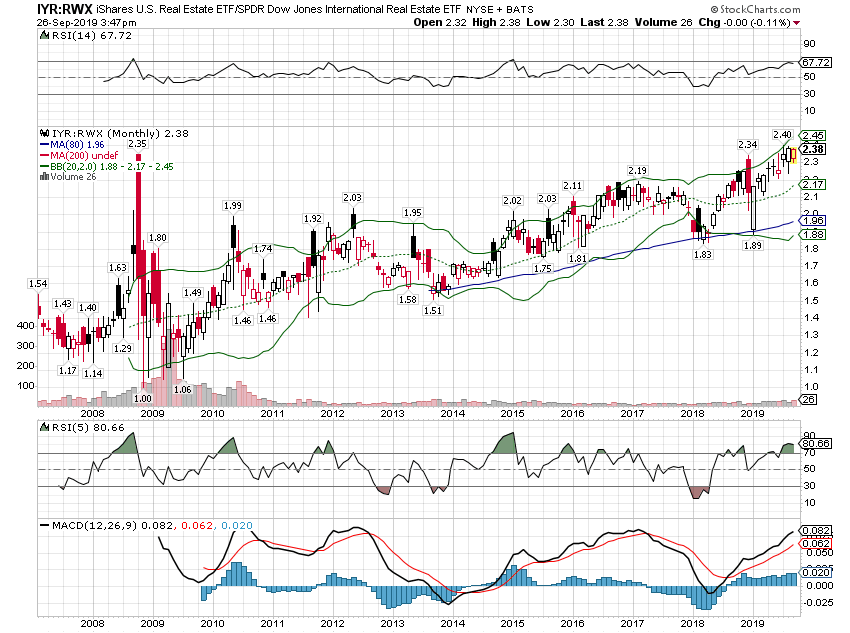

The dollar impact on real estate is the same as on stocks. This is US REITs vs Foreign real estate:

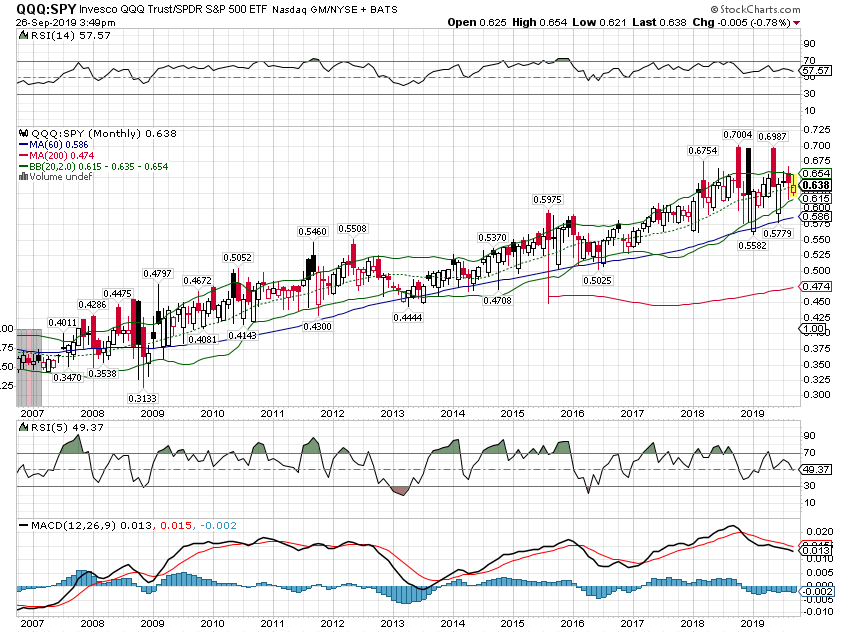

NASDAQ has outperformed the S&P 500 since before the last recession:

I don’t know how much longer these trends will persist – the inflection point could be tomorrow. Maybe it finally is time for value to outperform growth. But even if it is, an up week or two for value vs growth doesn’t change the long term trend and it isn’t sufficient to make changes to your portfolio. The transition to a new trend will take time. You can adjust your portfolio as it develops and you gain confidence that it will continue.

Fundamentals matter and we obviously want to be buying what’s cheap and selling what is dear. But trend matters too. Stop swimming upstream.

Stay In Touch