Despite the name, the Fed doesn’t actually intervene in the US$ repo market. I know they called them overnight repo operations, but that’s only because they mimic repo transactions not because the central bank is conducting them in that specific place. What really happened was FRBNY allotting bank reserves (in exchange for UST, MBS, and agency collateral) only to the 24 primary dealers.

These were repos only between those entities and the Federal Reserve. It had nothing directly to do with the repo market. If you thought they did, it would make Chairman Powell smile from ear to ear.

What monetary policymakers were hoping, as a technical matter, was that flush with a few tens of billions more of those bank reserves some or all of those dealer banks would then operate more freely and evenly in the repo market (spilling over into fed funds). The central bank repo operations were one step removed from it.

Therefore, if your big liquidity problem is that dealer banks don’t seem very willing to provide liquidity, then any plan which depends upon those same banks isn’t going to accomplish very much.

The real aim of these repo operations, in my view, was the label itself. At the worst possible time, the announcement of another rate cut, suddenly the Fed was being openly and publicly rebuked by obvious irregularities in its own (presumed) backyard. As I can attest, very (very) few people normally pay attention to repo and fed funds and then all of a sudden everyone is talking about them.

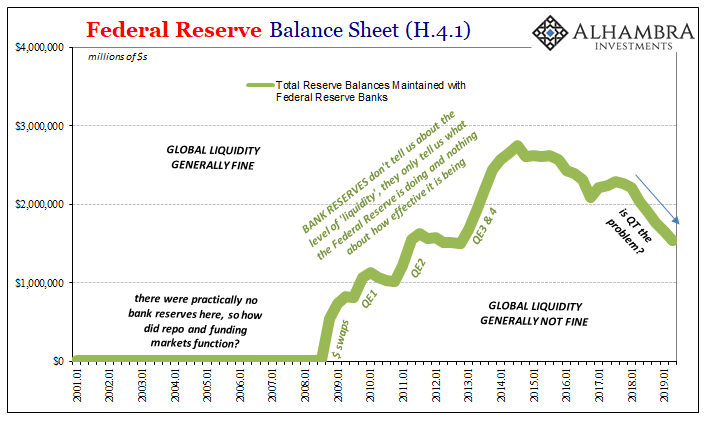

Not only didn’t it make much sense, the few who began offering explanations did so from the incorrect perspective of bank reserves. As I keep saying, bank reserves are largely immaterial and irrelevant to the situation.

Therefore, what the Fed had proposed was a set of operations that as a public relations matter included the term “repo” in the name for the public’s presumed benefit. Quiet the confused masses before any more real harm might come to economic and inflation expectations. Get people to believe the Fed was intervening in the repo market even when it was not.

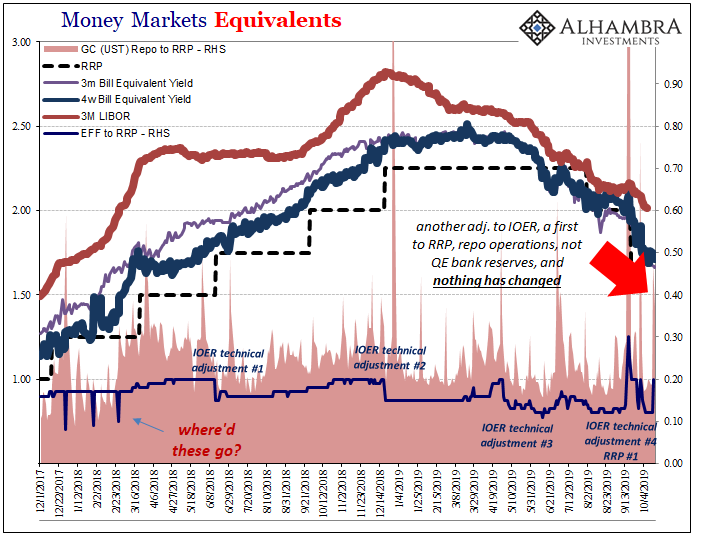

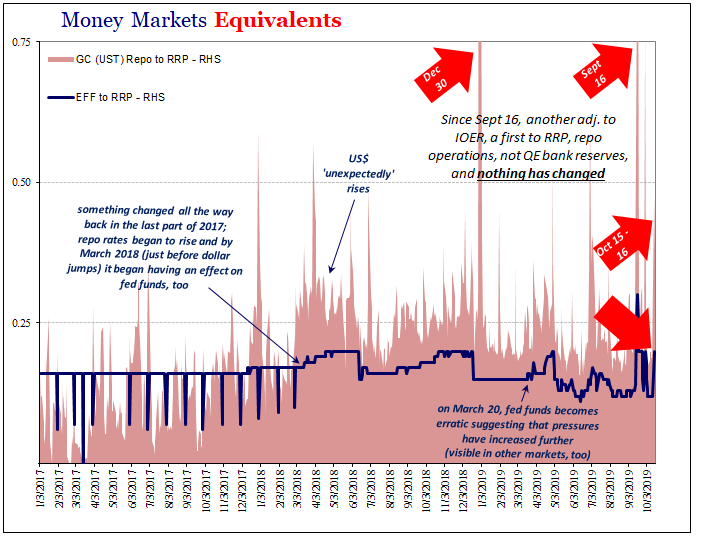

And it didn’t work. None of it. Nothing meaningful has changed since September 16. The extreme elevation of the repo rate has wound down but as a matter of the specific calendar liquidity characteristics rather than these “repo” (great, I have to use even more scare quotes for yet another central bank trick) operations.

In place of them, the FOMC has decided to first call them highly effective (which was the only thing guaranteed from the start) and then replace them with regular POMO’s – a not-QE SSAP. Again, bank reserves. When all you have is a hammer…

In exchange for these new bank reserves, again with only the primary dealers, FRBNY will be removing T-bill collateral from circulation. Repo market circulation. You have to hand it to these people, they find creative ways to possibly make things worse. As I wrote last week:

The whole bond market screams systemic collateral shortage and these guys think, well, let’s fix it by…removing the best collateral from circulation. Can anyone in such a position really be that obtuse? It has to be on purpose, right?

But they aren’t really evil masterminds greedily engineering the purposeful downfall of Western capitalism. Central bankers just don’t know their jobs, or even realize that their job is supposed to be money rather than expectations. Never ascribe to malice what is perfectly explained by often staggering levels of ignorance and incompetence.

Right on cue, the repo markets this week:

As of yesterday, the published GC rate for UST collateral (DTCC) was 2.17%, a stunning 47 bps above the RRP floor (which after September 17 is now less than the lower bound for the federal funds target range; a sub-floor?) Today wasn’t any better, the GC rate fixed at 2.069%.

According to FRBNY, the effective federal funds rate (EFF) was 1.90% yesterday and given what happened in repo today will likely be in a similar range when the calculation is made tomorrow. That compares to 1.82% Friday and the five trading sessions before.

In short: a fourth technical adjustment to IOER, a first to the RRP, overnight repo operations, term repo operations, and now non-QE POMO’s. And the net result is we are still asking that very same question. The only question that matters, the same one we’ve been asking since late 2017.

WHERE ARE THE DEALERS?

Constrained, obviously, but not by the level of bank reserves. This continued money market behavior is an ill-omen, a further warning that something continues to be a significant impediment. I continue to believe that it is the prospect for a big and unpredictable collateral bottleneck. I explained the main concepts behind it last week (typically at length, but I think worth your effort to begin understanding what I mean by collateral bottleneck):

If global money market participants had been expanding collateral perhaps imprudently when they thought things were going well, such as during 2017’s over-hyped globally synchronized growth, for example, what do you think they might have been doing once they realized their error? The more the global condition looks like it was an error, the greater the demand for…not bank reserves.

To put it very simply, dealers become (and then stay) unusually shy no matter what “repo” operations show up on Liberty Street. That’s where things stand right now.

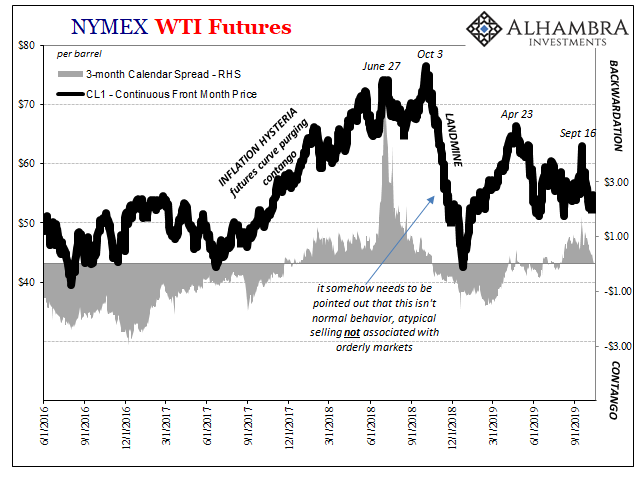

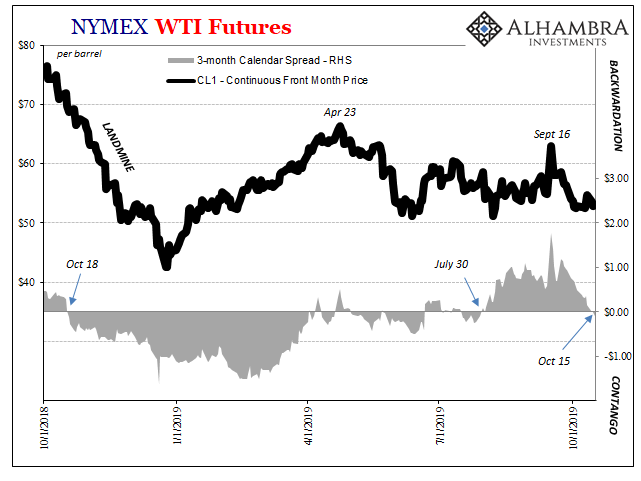

And just to emphasize that a little more, how about WTI’s change in behavior this month? I don’t mean necessarily the price of oil, rather more importantly the shape of the futures curve related to prices up and down it.

One big, bright flashing warning about last year’s Euro$ landmine which unfolded beginning last October (extending on into November and December) was how the WTI futures curve flipped from optimistic backwardation (a more balanced market, perceived rising demand for rising supply) into worrisome contango (not only worries about physical imbalances in oil markets, but also dollar liquidity risks becoming embedded within futures prices).

WTI as other global benchmarks this year spiked on September 16 in the wake of the attack on Saudi Arabia’s refineries. That pushed the curve into steeper backwardation. But ever since September 24, as the Fed bungles its way from one ineffective “repo” response to the next, the all-important front part of the WTI curve has been flattening until yesterday when once again, and once again in the middle of October, it flipped over into contango.

Rising liquidity and economic risks being set out in oil and money markets all the while the Fed tries to put the public (back) to sleep with bank reserves and “repo.”

Right now, tidbits of further warnings. And they are happening in what would be the more crucial second part of this current, ongoing, and escalating dollar shortage (eurodollar squeeze).

Stay In Touch