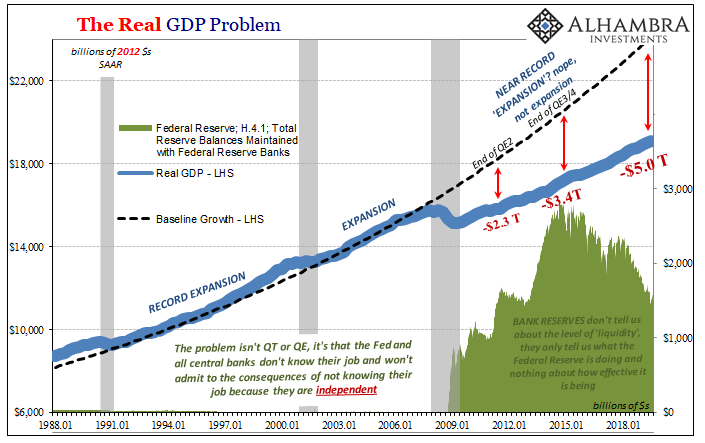

It’s not the level of bank reserves. It never was. QT was always a distraction. As I’ve said from the very beginning, the same thing the Fed’s researchers (rather than top policymakers) will say you if you ask them, the level of bank reserves only tells us what the Fed is doing. It does not, and will not, describe anything about their effectiveness.

Not for nothing, they haven’t been at all effective.

Reserves are nothing more than a byproduct of policy, whether QE or some other method of balance sheet expansion. That includes, as we’ve seen recently, overnight repo operations (which expand the balance sheet temporarily) and now this not-QE small-scale asset purchase (as a POMO, which aims to expand it more permanently). The more assets that go on the asset side of its balance sheet, the more the Fed has leftover, absent any intentional or unintentional sterilization, as bank reserves – the final remainder on the liability or money side.

Don’t just take my word for it; here’s still another one from 2009 back when the Fed was more eager to calm fears stoked by its critics who very wrongly asserted this “money printing” madness would lead to runaway if not hyper- inflation.

The central message of the article is that the data in Figure 1 [the level of bank reserves] only reflect the size of the Federal Reserve’s policy initiatives; they say almost nothing about the effects these initiatives have had on bank lending or on the level of economic activity. [emphasis in original]

Now after a decade searching for the little bit of “helpful” inflation QE was originally supposed to create, via influencing expectations rather than having been actual money printing leading to full and complete recovery, policymakers are less forthright about the way things actually work now that there hasn’t been one.

They won’t say it the way the financial media does, but if you still equate bank reserves with money printing and liquidity then Jay Powell is more than happy to let you keep on thinking that way. If the average worker and employer in the economy believes excess reserves are helpful, accommodating, and inflationary, that is their true purpose.

Every single problem lies elsewhere. In his last press conference, the Fed Chairman even after announcing a third rate cut (but don’t call it a series) and talking a little about the latest POMO’s (but don’t call it QE) finally admitted there’s been much more going on here. Liquidity-wise, that is.

Powell only hinted at “technical things” which he said the Fed is looking into, and I don’t doubt that they are because now almost seven weeks later they still have no idea what happened. The only thing they do know, which Powell confirmed at his last press conference, is that it isn’t really a problem of the level of bank reserves.

In addition to that, in addition to that, we’re looking at, there are, it’s a big, complicated marketplace, and there was the, one of the surprises, as I mentioned, was that banks that had told us that their lowest comfortable level of reserves was here. They were well above that, and yet they didn’t deploy that liquidity when there seemed to be great opportunities to do that. That didn’t happen. [emphasis added]

This was asked in response to a question about if regulations, liquidity and capital requirements, had been the reason why “that didn’t happen.” The Chairman said, “I don’t think so.”

As I’ve been asking forever, Jay Powell just told you that he has since asked his staff, WHERE WERE THE DEALERS? Only, they don’t seem to know, either, or they’d have given Powell a much better and more definitive answer to provide at his anodyne, never-confrontational press functions. Transparency!

He’s not the only one. Sheila Bair, who was in charge of the FDIC during the Global Financial Crisis, and thus had been on the ugly end of possibly having to be on the hook for these large complex dealers who once feasted on abundant wholesale funding, doesn’t believe it was regulations. She wrote quite recently:

It is true that banks’ own risk managers prefer reserve accounts to manage daily cash needs because those funds are easier to tap than Treasuries, which must be sold or posted as collateral to convert into cash. But that is the bank’s decision. It is not required by the rules. The idea that regulations have made big banks risk-averse scaredy-cats is also nonsense.

In other words, don’t look to the level of bank reserves or regulations. I kinda like the way Bair put it, a bunch of risk-averse scaredy-cats who sat there in the middle of September despite adequate levels of reserves (as Powell admitted) and let money rates skyrocket because they openly, publicly refused what would’ve been enormous profits.

Why? No one knows. Technical “things.”

Therefore, the whole issue, the entire thing in a nutshell, is why they became so risk averse in the first place! None of the rest of that stuff matters. And, unlike Powell and probably Bair, we know, because we’ve been chronicling it the whole time, they didn’t just suddenly break out in a desperate risk-off sweat completely out of the blue on September 16.

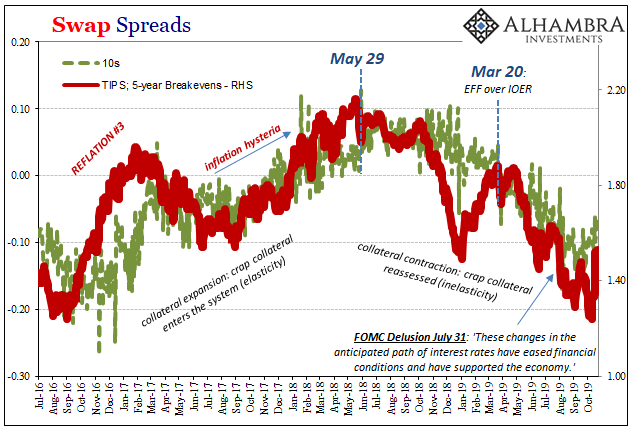

They’ve been moving in that direction for more than a year, especially after the dollar started to “rise” last April and then May 29 came calling. May 29, 2018. Collateral keeps looking like the likeliest suspect. I wrote several weeks ago:

What you take from Mr. Stein’s very vanilla example [of collateral transformation] is that both the hypothetical dealer as well as the hypothetical initiating insurance company are at risk from posting junk as the basis of the transformation. As a result, what becomes most “valuable” because it has the highest utility in all circumstances is that pristine form of collateral; and that is T-bills.

If global money market participants had been expanding collateral perhaps imprudently when they thought things were going well, such as during 2017’s over-hyped globally synchronized growth, for example, what do you think they might have been doing once they realized their error? The more the global condition looks like it was an error, the greater the demand for…not bank reserves.

The more collateral chains become questionable and maybe even break down, as it seemed on May 29, the more you’d expect to find scaredy-cats right in the middle of the liquidity system hoarding anything that even looks like liquidity.

The good news for Jay Powell if not the whole world was that mid-September had been nothing more than a dress rehearsal. It was not what central bankers would classify as a “market event.”

The bad news, potentially, is what happens if or when it is and no one has addressed the scaredy-cat issue.

They won’t do any good, but there will be more bank reserves if or when it does happen. While reserves won’t help those “technical things”, they’ve already achieved their primary goal and fulfilled their primary use. Though nothing has changed, hardly anyone is talking about repo any more despite the fact authorities everywhere continue to avoid answering the one question.

WHERE ARE THE DEALERS?!

Stay In Touch