Another dovish example to be put on the growing pile of good things? The People’s Bank of China (PBOC) earlier today trimmed one of its many policy rates. The 7-day reverse repo rate will be reduced from 2.55% to 2.50%, a 5 bps cut practically pointless in functional terms widely interpreted instead for its purported “meaning.” Like the Fed, the Chinese central bank, we are being told, is finally coming around to more and more “stimulus.”

Even if it is, is that really a good thing? In truth, the Communist central bankers have been executing all sorts of cuts and trims for just about a year and a half. Two weeks ago, PBOC officials reduced the rate they charge large financial institutions for borrowing RMB liquidity at their MLF window.

Curious developments for so much “stimulus”, especially so many prior RRR cuts which were supposed to have created a flood of bank-driven liquidity and turned the world around a long time ago. It’s the upside-down part of how convention views China and the global monetary system. We are told/taught to be enthusiastic the more central banks do, rather than wonder what’s really going wrong that central bankers feel they have to constantly do more.

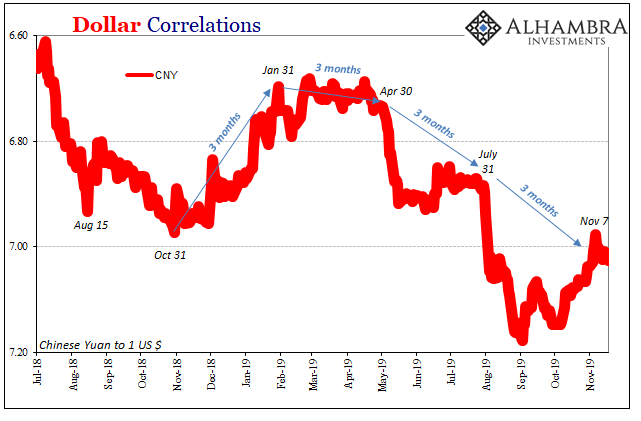

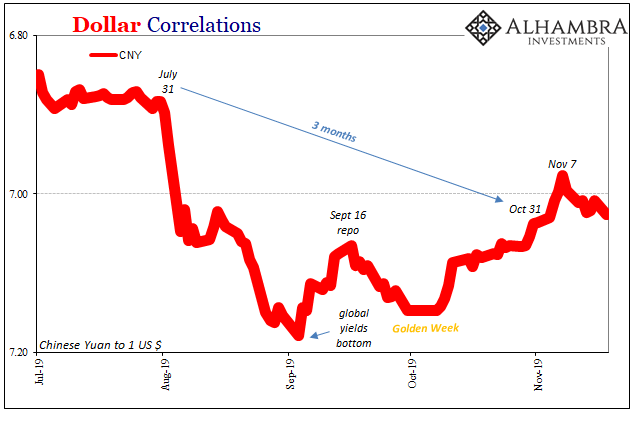

For one thing, there’s the missed clock. The last of the four “ticking clocks” wound down at the end of last month; on October 31. Yet, the Chinese currency rather than resuming its plunge continued to leg higher. It wasn’t until November 7 that CNY finally gave back and even then only a little.

While we can’t ever know for sure, the Communists sure aren’t going to tell us, the missed clock might’ve been due to the changed environment. For the first time since Autumn 2018, the global dollar condition was almost conducive; or, it wasn’t so obviously fading and atrocious.

From last October practically in a straight line to beginning of September 2019, the dollar system was a near steady retrenchment. The Chinese got away with the last few months of 2018 but then got caught up quickly during the latter end of that trend. The currency quite violently broke 7 to the dollar.

When the global bond market finally bottomed out around September 3 and 4, so, too, CNY. In fact, other than the hiccup surrounding the repo rumble (ASIDE: how unnerving is it that the repo disruption took place on an upswing across global dollar markets; imagine if that dress rehearsal had shown up, say, in early August?) the global funding environment has been almost benign.

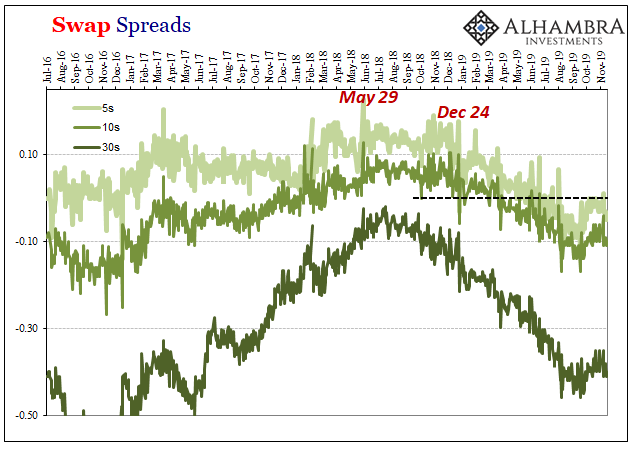

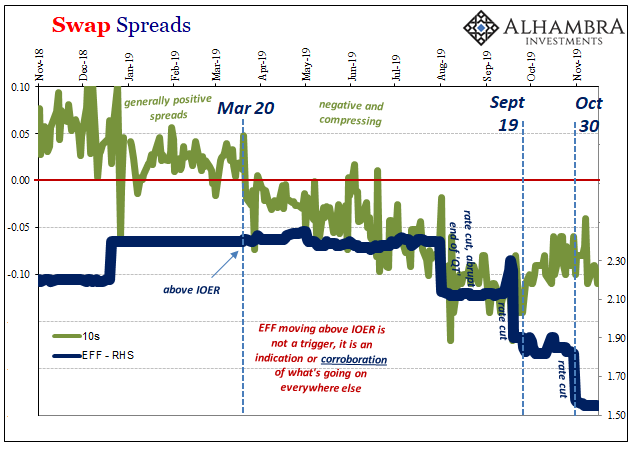

We see it in global yields backing up as well as other indications, curves stacking up a little bit along with interest rates. Swap spreads, too.

The central bankers have been fighting back. The ECB restarted QE, the Fed is now three cuts into a series, and the PBOC ever more purportedly dovish. There’s a lot for markets to digest (though those at the NYSE don’t feel it necessary to think much about what’s clearly so awesome).

And that may be the most striking part of all this – officials around the world are unusually busy and the (bond) market has given back only a very tiny part of its prior pessimism and tightness. More realistically, the most you can say about the swap market is that spreads stopped compressing the past few months. They haven’t exactly decompressed.

Is the market actually buying the dovishness? It truly doesn’t appear that way and now there are growing signs of it moving back toward the downline trend again. In swap spreads and curves, as more of November passes by the more familiar pessimism is creeping back. A lot of it, and not just the swap market, goes back to October 30 and 31 – the end of the last ticking clock.

In other words, it has every look and feel of the midpoint.

The world starts out warned by the bond market how something ain’t right, which central bankers and Economists all ignore before eventually being forced to begrudgingly give in to reality. They respond typically all over the place and the bond market cuts them a little slack to see if by nothing more than random good luck something goes right for once; the ECB’s QE maybe it hits the right magic number; the Fed’s rate cuts perhaps really do cheer increasingly dour manufacturers fussing about high inventory; any one of the PBOC’s confusing habits finds its mark.

The reason it’s never more than a midpoint is the same reason swap spreads and yield curves don’t really move that much to the good; the bond market knows by balance of every probability there’s nothing to the “stimulus.” A lot of sound, a little light, a ton of friendly press; all sizzle, no steak.

In much of the financial media, the recession has been called off and happy times are just around the corner again. The words “mid-cycle adjustment” means something if only here. Then again, this is the same financial media which sided with Jay Powell about 2019 being filled with inflationary labor shortages and more rate hikes than the bond market could ever realistically handle. Interest rates had nowhere to go but up – until they “unexpectedly” plummeted.

Now everyone’s talking about interest rates going up again when they are still closer to the lows than even midway through the last plunge. An awful lot of confidence over what remains – in the mainstream – completely unexplained. And the bond market is still moving on the same problems and same indications that showed up “unexpectedly” last year.

CNY, too, if maybe a little late.

Stay In Touch