It was a huge sigh of relief, seen as confirmation of the word “transitory.” Oil prices in late 2014 had crashed and while globally monetary officials tried to reassure everyone it was a good thing, a supply glut giving consumers something like a tax cut, the wipeout was still unnerving. And that uneasy feeling was reinforced by forward-looking economic data that ended 2014 on an increasingly sour note.

Early 2015, however, it began to look much better. Janet Yellen, in particular, had found her vernacular – or how to influence the financial media into saying these words on her behalf. Transitory. Overseas turmoil. Strong dollar. Nothing much for Americans to worry about, mere validation of US economy resilience facing nothing more than a soft patch.

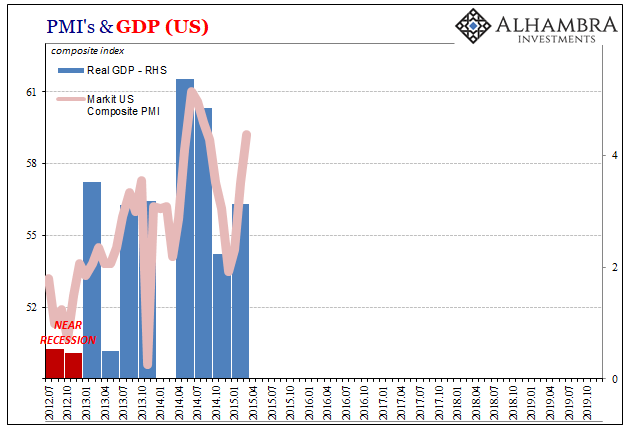

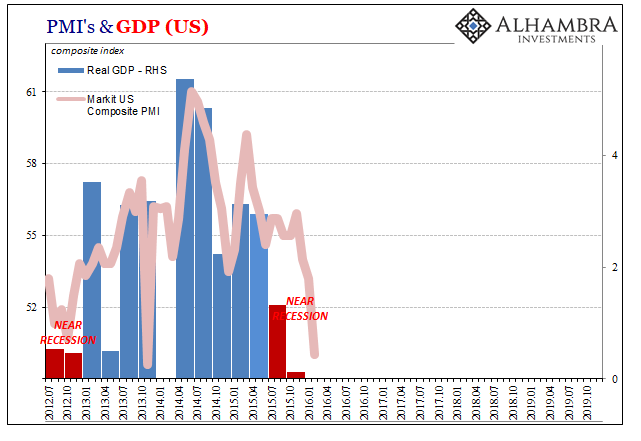

For the month of December 2014, IHS Markit (just Markit back then) had released some sobering PMI data. The firm’s composite indicator, the index which puts together services with manufacturing so as to gain a broader perspective, had fallen sharply. The index had been soaring up at 61.0 back in June 2014 as oil prices peaked, but then decelerated alarmingly once WTI/Brent plummeted for reasons no one could say.

By December 2015, the composite was down to 53.5.

Come winter, though, good news again. Over the next three months, January, February, and March 2015, the PMI soared once more. The flash number for that March was 58.5, a robust 5 point turnaround (later revised in current figures to more than 59.0).

As you can easily imagine, economic commentators were quite enthused, starting with Markit’s own chief Economist.

The US economy is showing signs of regaining momentum after the slowdown seen at the turn of the year, increasing the likelihood of interest rates starting to rise in September.

The flash PMI” surveys registered faster growth of both service sector activity and factory output at the end of the first quarter, as well as ongoing strong hiring. The data bode well for an acceleration of economic growth in the spring.

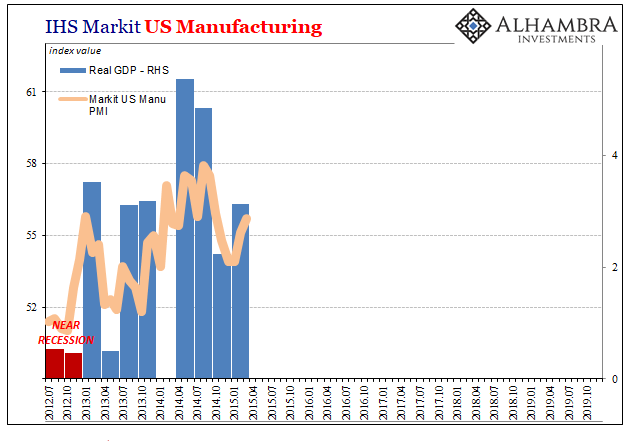

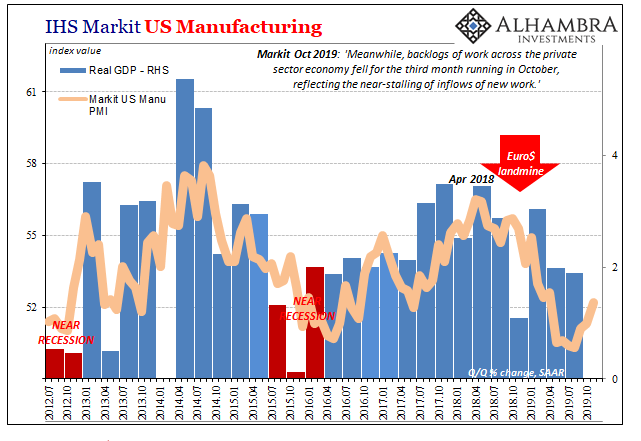

Markit’s manufacturing PMI had rebounded, too, though to a much lesser extent than services therefore the composite. Still, things seemed to be looking up even for the goods economy; particularly given the overall market context of those specific months.

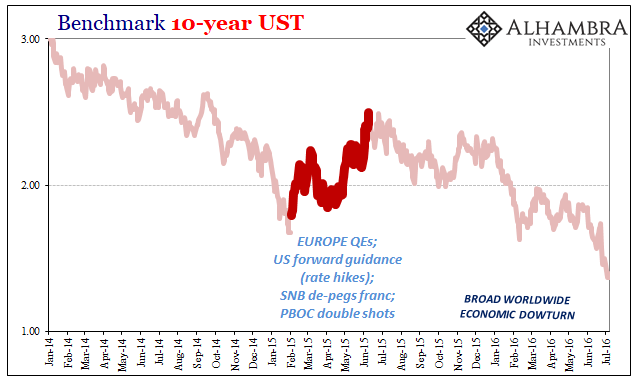

Early 2015 up through April and May: CNY suddenly stabilized; oil prices rebounded from lows; bond yields began backing up; rate hikes back on the table for the Fed.

In other words, Euro$ #3’s midpoint.

And that’s all it turned out to be, a cycle within a cycle; markets as well as economy. Nothing ever goes in a straight line, the temporary reprieve in between Phase 1 of the eurodollar’s squeeze and the much harsher Phase 2. It wouldn’t take Markit’s manufacturing PMI very long to figure that out, as the “manufacturing recession” really started to bite by late Spring 2015.

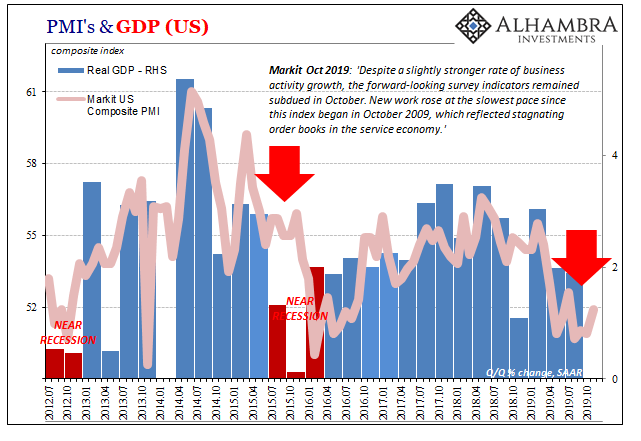

The composite version, because of purported strength in services, held up reasonably well until much later in Phase 2; making it pretty misleading for much of Autumn 2015. It would retrench almost immediately back down closer to December 2014’s low by June 2015 and would remain more or less stable while in reality the economy grew weaker and weaker.

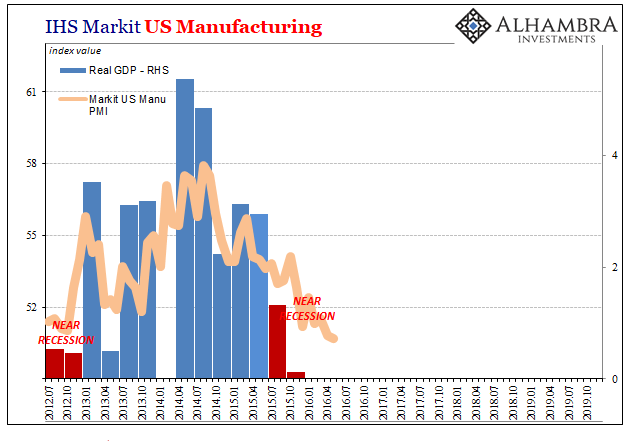

In terms of Markit’s composite PMI, the index wouldn’t actually pick up that near recession until it was nearly over with; finally falling to its lowest points in early 2016.

Why bring this up today? IHS Markit is once again reporting “rebounding” PMI’s and at a particularly familiar point in time. The current manufacturing index has been rising for each of the last three months, and is now up to 52.2 for November 2019. The composite is somewhat less bouncy, hitting 51.9 in this latest month but that’s up from a low of 50.7 back in August.

Markit’s chief Economist today and a touch of déjà vu:

A welcome upturn in the headline index from the flash PMI adds to evidence that the worst of the economy’s recent soft patch may be behind us. Output of the combined manufacturing and service sectors rose in November at the fastest rate since July, spurred by improved inflows of new business.

He didn’t specifically use the same words, “regaining momentum”, but said practically that very thing. The bottom is in.

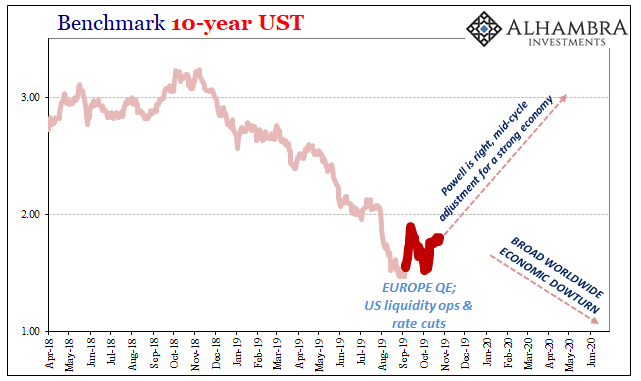

And it raises the familiar if unwanted quandary: is the bottom really in, which way are we really heading? Jay Powell today as Janet Yellen in 2015 says “transitory”, as in growth scare or soft patch whatever you want to call it that’s all behind us now. The end has been reached, it wasn’t all that much, now back to rate hikes (eventually) and growth acceleration.

The PMI data and certainly Markit’s Economist commentary come out cautiously on Powell’s side.

But like the circumstances, that’s the same, too. What it comes down to, what will ultimately determine the next step, is if there will be that Phase 2 of Euro$ #4 just as there were Phase 2’s for Euro$’s #1 through #3.

If this time is different than those, why is it different? Europe continues to be dragged downward, not even a midpoint, Japan looks increasingly negative, and then the Chinese who have for all intents and purposes told everyone around the world not to count on them for anything other than more economic and financial instability (if not worse). Don’t even look at global trade.

It is possible that Powell is right and the economy has seen its worst. It is also possible that this is just another midpoint. Conducting a broad survey of global market and economic indications, though, the data is more consistent with which option?

If it does turn out to be the latter, it would be one reason why I keep writing about how Euro$ #4 looks to be nastier than at least the previous two. If this is just the midpoint, #4’s midpoint across a lot of indications is already equal to the Phase 2 worst of #2 and #3. Most especially these PMI’s.

Stay In Touch