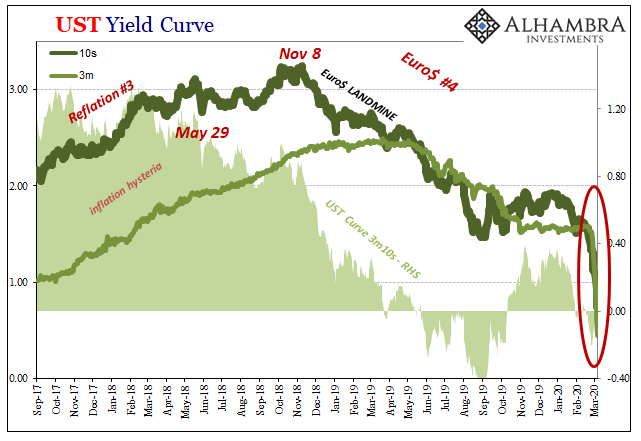

The 3-month Treasury bill’s equivalent yield has plunged, absolutely plunged. It was 1.45% last Thursday. Today? All of 45 bps. A one-hundred bp drop in six trading sessions. One hundred. Six days.

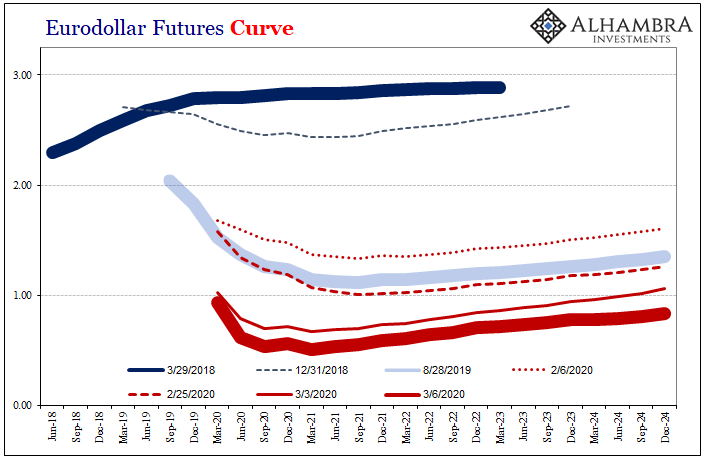

Rate cuts, right? Sure, that’s the premise. Like eurodollar futures, the front end of the yield curve is saying that there are more of them coming. The Fed’s unscheduled fifty will be augmented by another fifty at the next FOMC meeting in a few weeks. If not sooner.

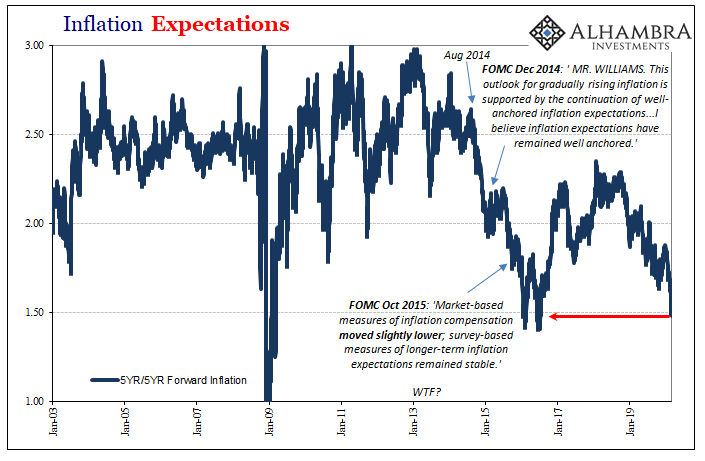

The rest of the yield curve, though, there’s a little more to it. For the first part, the long end is all about consequences. As in, if rate cuts were expected to be effective then, cue Janet Yellen in 2011, bond yields would be rising sharply. They are not, to put it mildly.

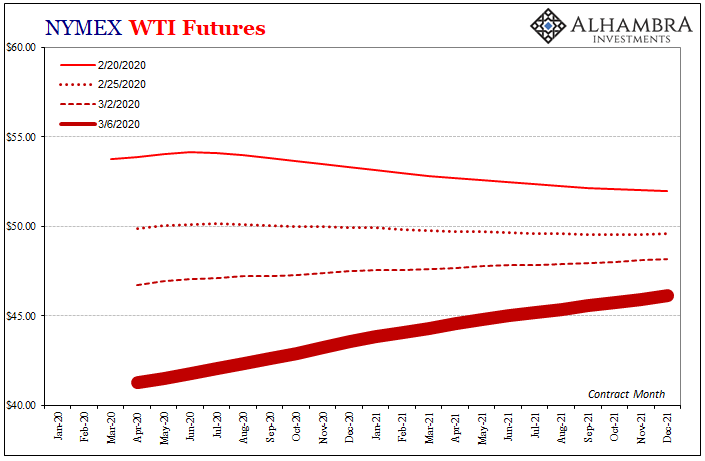

Long end rates have collapsed along with the short end. Therefore, the same thing that is driving the Fed to a rapid series of rate cuts the market is expecting this to be a long-lasting negative. It’s not just the prospect of looming recession, though that is more and more indicated by this “bad steepening” (where the short end of the curve falls faster than the long end), it’s the impotence of central bankers.

Why is that?

A major clue can be found in the behavior of these particular yields. On a day like today, the telltale, massive – and global – rush into all the major forms of pristine repo collateral. It’s what seemingly turbocharges the bond buying all over the place, turning a drop in rates into a full jump lower.

I’m talking about a collateral call. Another big one.

It was, after all, that which cemented the track the global economy has been on for nearing two years. The first stirrings of Euro$ #4 in early 2018 were significant, of course, but it was May 29 which, still to this day, shows up everywhere. An unmistakable rush into pristine collateral that only an Economist or central banker could mistake (even when referring specifically to the “strong worldwide demand for safe assets”).

While the mainstream media was going on about irregularities in the Italian government’s increasingly populist cabinet, and Jay Powell staring in the mirror of the Beige Book basking in the glow of his own hand-selected labor shortage anecdotes, I wrote on May 29, 2018, that:

It’s not quite yet on the level of October 15, 2014, but it’s not really that far off, either. What made the prior episode three and a half years ago unique was the condensed timeframe, as well as how far UST yields fell. Today has been a far steadier “flight to safety”, meaning the same thing just spread out over the entire session. Collateral.

Today’s trading, as well as much of the last week’s, brought everything closer to October 15, 2014, in terms of the proportion and, pardon the pun, collateral damage to other markets. Including, people are noticing, dollar funding elsewhere such as FRA-OIS.

Total risk aversion behavior in the key places where the world right now can ill-afford this viral breakout of funding strain. Collateral, which the Fed is powerless, and clueless, to do anything about. Even if they hadn’t completely missed May 29, the wouldn’t have been able to do much in its aftermath (the reverse repo has been, shall we say, an underwhelming fairy tale).

There was even a textbook gold slam today, one that was so on-the-nose I don’t think I’ve ever seen it quite so obvious before. An initial slam at 8:30am (which some may characterize as a reaction to the blowout payroll report, which is fine but I don’t agree) followed by the big one clustered in just before, and right up to, 10:30am.

What’s special about especially 10:30am? Closing the books on yesterday’s overnight repo.

I have to admit to being incredibly frustrated, often quite angered by what ended up being almost two years of all the so-called experts claiming there had been “too many” Treasuries. With yields taking the elevator downward, after pushing stock investors down the empty shaft first (liquidations), you don’t hear much about “too many” Treasuries these days.

While that’s a start, it is minimal and doesn’t do a damn thing to help us right now. Instead, there’ll be more rate cuts, more bond buying (QE or not), and more of the same stupid, ineffectual puppet show. Despite everything that is obvious about all of this stuff, there won’t be a single mention of collateral.

The next time the Fed Chairman says something substantial and meaningful about repo (and FX) collateral will be the first time.

Thus, as Euro$ #4 starts to get as nasty as we thought it could, I can’t help but think ahead to what inevitably will follow no matter how this all still turns out. Whatever waits us around the next corner, beyond it will be only Euro$ #5. Doesn’t that just explain the prospect of negative UST yields!

They really don’t know what they are doing. And that’s really sad because it wouldn’t take all that much to change it. Especially on a day like today. It’s all right here.

Stay In Touch