An honest-to-goodness oil crash. For a time this morning, the front month WTI futures contract had fallen into the $20s for the first time since Euro$ #3. Up to now, that prior outbreak had been the more (in)famous as far as crude prices have been concerned. Over the intervening years, it was thought that supply and demand had been made to be more balanced.

Though some will say it anyway, this time there won’t be nearly as many mentions of a “supply glut.” What makes oil especially violent is the combination of the two major factors other than supply. Yes, two more. There is, of course, demand, which, at the moment, the market seems to feel quite sick about.

What’s the third? Let’s go back to 2015-16, the last time there had been a curve shift and oil crash of this magnitude.

Instead, as oil piles up and liquidations roil the front end, those thinking Yellen correct at the back have thinned out with each weekly inventory build…In other words, “something” might actually be wrong with demand in a broad economic sense, thus pushing further and further into the future the plausibility of sustained higher prices.

Liquidations, funding, “dollars.” There are three major characteristics at work here: those who are supplying the crude, those who are buying it, and the funding providers who lend leverage to both. Black gold like gold gives us insight into a lot more than just what might be taking place in its own little corner of the marketplace.

What happened in February 2016, when I wrote the above and below, is taking place right now.

That means that those in the middle of 2015 looking for the “transitory” rebound are now faced with prospects of either cutting their losses and dumping out of their $60-$65 longer oil futures or re-hedging (and thus refinancing) their 2017 and 2018 positions for even farther out delivery. The whole curve collapses on the front end’s demand view – the “dollar” view.

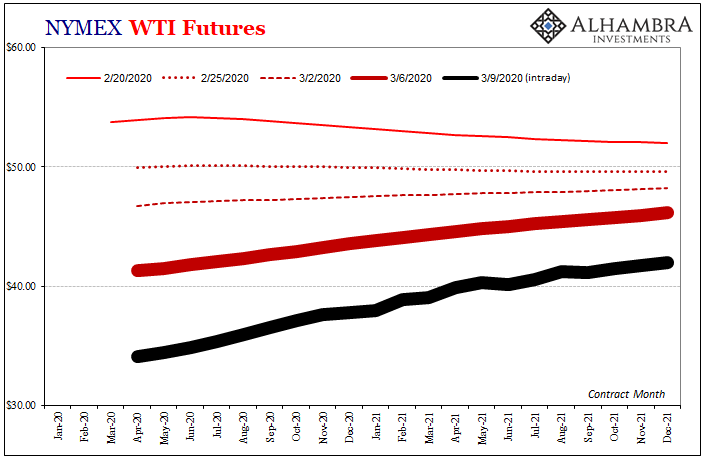

This, once again, is pure liquidation, a curve collapse mostly on dollars. From mildly contango meaning concerning late in February 2020 to HOLY SH%$ my money guy is on the phone demanding I pay up or he’s going to (financially) break my legs and punch my lights out. As I noted last Friday, collateral calls must be going out all over the world forcing everyone to sell what they can, and obtain as much pristine collateral at whatever price.

It’s what I called the Black Curve about a week and a half ago as the WTI futures fundamentally changed in this way. It was a pretty key warning about markets, not just oil markets, as they digest risks about the global economy, and, perhaps most of all, funding conditions.

Over the last week, something clearly snapped. More than the plunge in stock prices, the curve has morphed into the same kind of shape it did back in October/November 2018 – the first warnings of the impending landmine. Instead of backwardation past some minor initial contango, it’s now contango the whole way.

But, of course, Jay Powell’s got a lot more bank reserves. So there’s that…if you still think they matter. Or Jay Powell.

Stay In Touch