Jay Powell has a lot of catching up to do, and very little time to do it. He’s squandered so much already. First his emergency rate cut blew up in his face and now his dud of a bazooka. Before the market got going, officials had already added a 25-day allotment (of bank reserves, of course) on top of the usual overnight and 14-day terms.

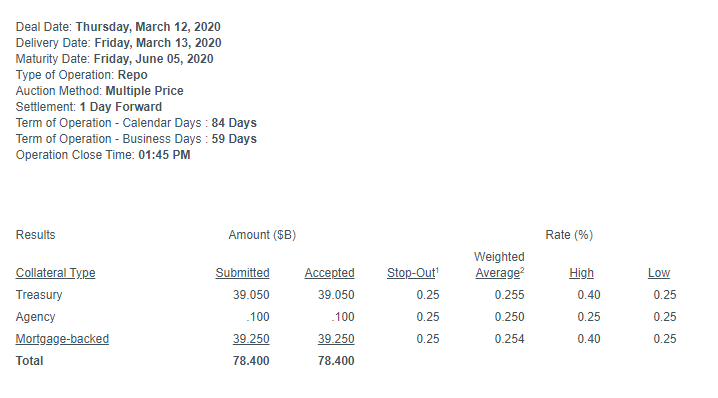

Obviously, it wasn’t enough; or, more accurately, it wasn’t the right thing. Undeterred, Powell’s Fed decided at some point during the disastrous morning to just say, screw it, and raise the roof. In a matter of hours, a 3-month (84-day) “repo” auction was announced, conducted, and closed.

The scale of the thing was supposed to wow you and all the suddenly impatient sellers on the NYSE (not intended as much for the repo market, as you’ll see). Half a trillion, baby! That’s the amount of “liquidity” authorities put up for bidding on this day of days.

Dealers ended up taking in all of $78.4 billion, or about 16% of what was possible. Either things aren’t nearly as bad as they seem (literally no one is buying that scenario), or something is wrong in bank reserve-land. Perhaps dealers just don’t want them, or maybe they don’t have the spare collateral to post for them.

We’ll know more tomorrow given that there will be another 84-day, $500 billion on offer.

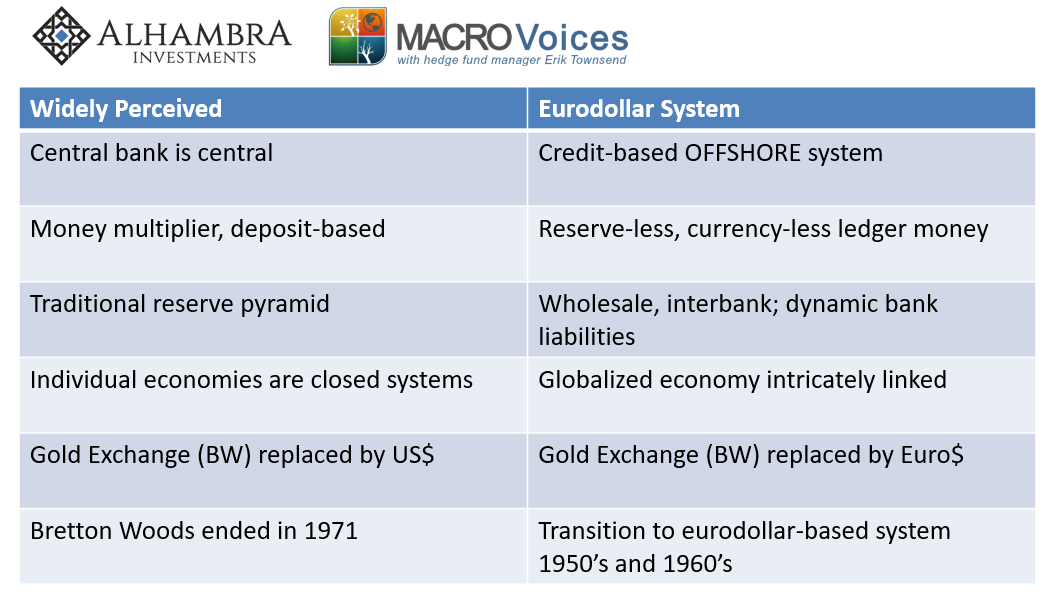

Even the stock market (THE STOCK MARKET!!!) wasn’t impressed. It is maybe starting to dawn on folks the central truth in all this – the central bank just isn’t central. The monetary world is so much more complicated than the simple model employed by both classroom Economics and the technically deficient policymakers these days struggling just to get by on a daily basis.

The theoretical issue, much of it, stems from a misreading of the Great “Moderation.” The pre-crisis era had been written down as the product of several factors, including Greenspan’s allegedly maestro-like performance.

The Economists who coined the term Great “Moderation” weren’t actually so sure. In their groundbreaking 2002 paper, James Stock and Mark Watson pointed to one unknown factor. Unable to determine what it was, they gave up trying and just declared it random good luck.

Seriously, that’s what they concluded. That, among other factors, had for several decades kept the US system (because that’s what they studied, not the global system) fortunate enough to have been spared the plague of financial crises that used to be regular features of the economic landscape.

What these two concluded should have made monetary officials’ blood run cold:

But because most of the reduction seems to be due to good luck in the form of smaller economic disturbances, we are left with the unsettling conclusion that the quiescence of the past fifteen years could well be a hiatus before a return to more turbulent economic times.

Ben Bernanke read the piece and immediately went on a determined road-show to hog all the credit. Nonsense, he declared, it was the brand-new (the eighties) monetary policy regime (interest rate targeting, meaning expectations) that was responsible. No good luck, just Economists. Geniuses, every one.

Looking back at it now, it is much easier to see for those who honestly seek some answers. Stepping outside the central bank cult, we find that Bernanke was right – it wasn’t good luck, after all – but desperately wrong in assigning the Fed its celebratory parade. A premature parade, obviously, as he would find out, but not figure out, just a few years later.

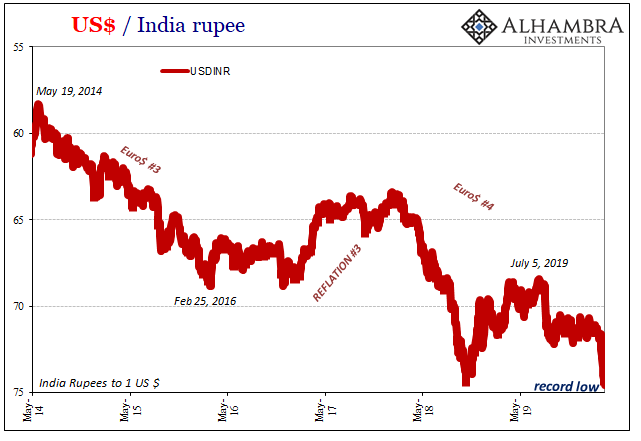

Even 2007 had been forewarned. Though the US had been steered clear of financial crisis, the world hadn’t during this period. Smaller crises were still relatively common, and then a much bigger one in 1998. The Asian financial crisis was a regional dollar shortage, and contained, largely, within a region that wasn’t so enormous and important at the time, a test of the system that had developed from the seventies forward.

It was this new global monetary arrangement that had kept the world within narrow tolerances, the US most of all. Not Greenspan and his ridiculous show of quarter-point fed funds adjustments, instead the supremacy of global eurodollar banks that had stapled LIBOR to fed funds and policed the entire hierarchy.

The banks did the heavy money lifting for which central bankers like Greenspan and Bernanke were only too happy to take credit – while they could. So long as that hidden shadow money system in the world’s vast offshore spaces kept expanding it kept the forces of domestic and global monetary crashes at bay; not good luck but blindness.

But the Asian flu had also been a key warning for what could happen. It showed the downside of a globalized economy dependent upon the quick and easy accessibility of (euro)dollars. So long as they are available, meaning banks not central banks, everything was hunky dory; Great Moderation and whatnot.

Once they started to disappear in sufficient numbers, look the hell out!

The warning, of course, went completely unheeded; Greenspan then Bernanke more interested in the vanity of interest rate targeting and all the media and academic adulation that came with it – one pattern, at least, unbroken all the way to Jay Powell, a curious trait of incuriosity about how nothing seems to work as planned ever since, oh, 2008 or so. No one bothered to check the assumptions, even after 1998 as well as Japan’s failures with QE in the early 2000’s.

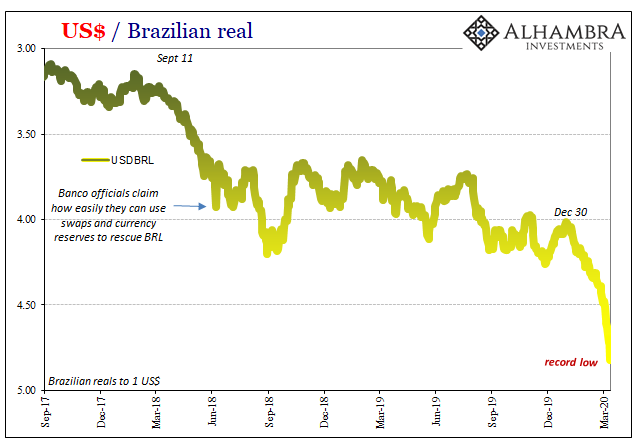

The world’s luck didn’t run out on August 9, 2007, the eurodollars did. Global dollar shortage. Ever since, it has been one global headache after another, some worse, some relatively mild. But scarcely a year has been put into the books without the words “global” “dollar” “shortage” and it hasn’t mattered one bit what the level of bank reserves were or had become during any of them.

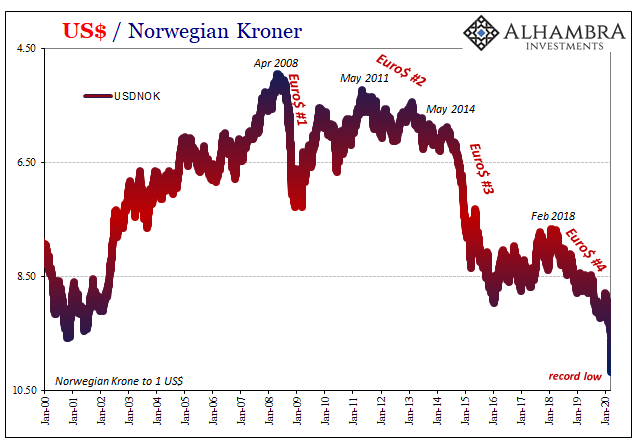

Rising dollar means dollar shortage (see below; particularly Norway’s currency). As Europe’s ill-fated LTRO’s (which were exactly alike these Fed “repo” operations), the Fed doesn’t plug in to this system. They don’t even speak the right language.

As I wrote back in 2017, amidst the hysteria and hype of the inflation globally synchronized growth was going to bring and the apparent return of good luck for that one year:

It was never monetary policy that created the Great “Moderation”, and outside of the narrow confines of orthodox definitions that period was never so moderate to begin with. As the eurodollar system built up, it only appeared that way because output was stable so long as what was hidden far out of view remained drastically immoderate. Now that is no longer the case, where the eurodollar system reverses, decays, and acts as an anchor upon global output, there is no stability anywhere. Suddenly exogenous shocks (like “global turmoil”) are the rule rather than the exception where even the US economy is concerned.

That about sums up 2020 so far, including the hapless Fed’s increasingly absurd flailing. Did the puppet show finally disappoint the last of its audience?

Stay In Touch