It barely rated notice, not even a mention. On Saturday, March 7, just before all Hell broke loose, Lebanon announced it wouldn’t be repaying a $1.2 billion Eurobond issue which was coming due right on March 9. Normally people only notice this tiny country for some terrorist action or recall much about it beyond the civil war which had devastated the once prospering nation.

Yet, even during the depths of its prolonged internal conflict, which lasted from 1975 to 1990, never once did the nation default, always repaying external obligations. That’s how bad it has gotten.

Like so many others in the same situation, Lebanon had gone all in on the debt bonanza, a Eurobond binge especially those two crucial years of pseudo-recovery. When all is said and done, all globally synchronized growth will turn out to have been is a gigantic cancer that had eaten away what little reserve foundation remained after 2008.

On the faulty basis of an official story of what really was a fake recovery, many officials around the world mortgaged their constituents’ futures. The growth wasn’t real but the response to the promises of it certainly were.

The primary owners of Lebanon’s Eurobond binge were, not surprisingly, Lebanese banks (at least a third, maybe as much as half). That’s why there have been bank runs and capital controls. Before the value of those bonds had plummeted, they had been such a tempting basis for local monetary expansion. In dollars.

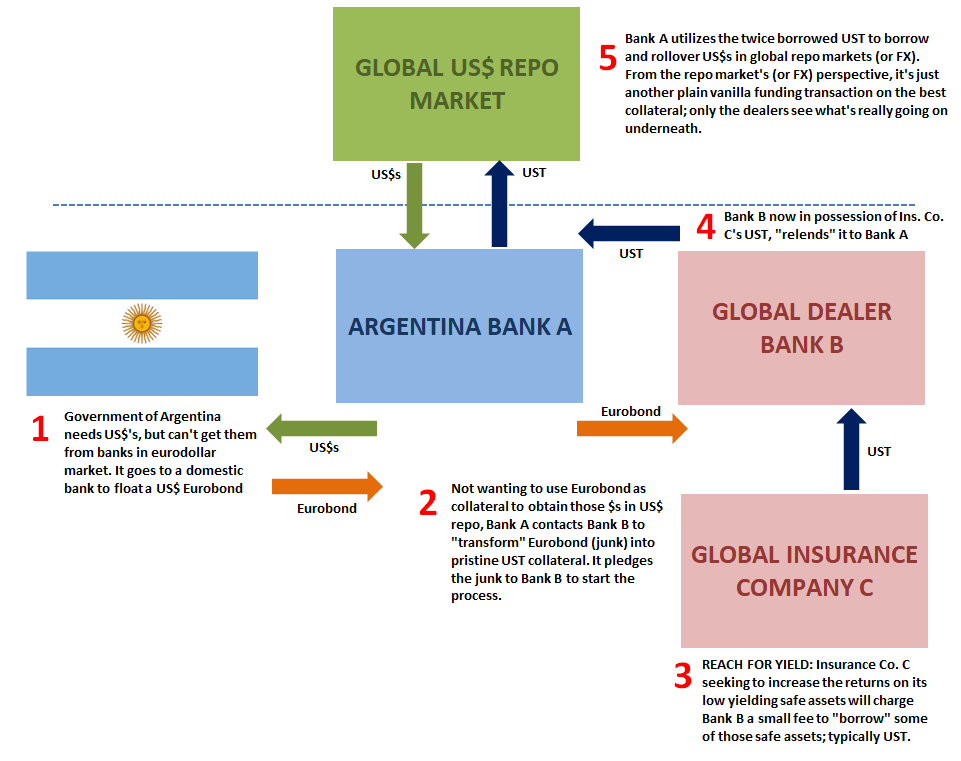

Just as I had diagrammed for Argentina, simply replace that country’s flag below for Lebanon’s recognizable green cedar and you’ve got a sense of what I’m talking about.

Why did the global situation spiral so out of control on March 9?

You could see it coming on March 6, a Friday. Gold slam right out of the gates; collateral. March 7, Lebanon’s announcement of what was already rumored, if not anticipated.

When Argentina got itself into trouble with its external obligations, there wasn’t so much of a violent reaction outside of anything in the immediate vicinity. This is what Argentina does, the market believed. It proved that there was some basis for the growing concern over the crap global collateral which had infected the global repo system over the intervening years, but it wasn’t the trigger for a more systemic re-evaluation.

Lebanon, though, a country which had always paid up, the default announcement was a serious jolt. And it was one the system had received at the worst possible time, already in a precarious state. Nothing to prove the crap in collateral quite like this one thing.

I’m not claiming this was the sole reason behind the world’s worst wave of liquidations since the Global Financial Crisis (or what might now be known as GFC1), it was at the very least some part responsible for turning last week (and this week’s Monday) into a dislocation rivaling those proportions.

Repo and collateral most of all.

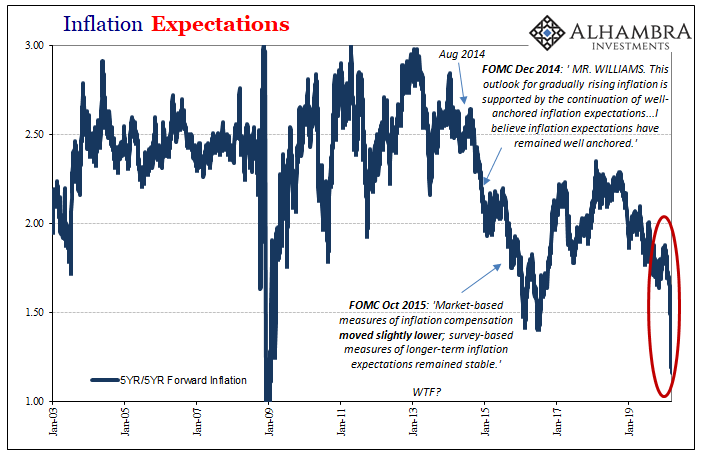

But all that’s in the past. What to do about today and tomorrow? Officials seem very intent on replaying the GFC playbook – because GFC1 turned out so well?

No, they simply don’t know what else to do; or, what’s worse, they actually have come to believe Bernanke’s fiction over how those policies kept the situation from becoming worse. Bernanke himself didn’t even think that way until December 2008, when it was all practically over; having failed to stem the crisis before it unleashed its massive damage, ZIRP and QE were really meant to just to cushion the blow (and even failed at that) before it took out what was left.

Starting with QE and ZIRP. Enough said on those, the markets spoke in response yesterday. For once, the Fed Chair couldn’t even enthrall the NYSE.

Now it will be helicopter money. You can make the argument that people are going to need a boost, and it’s a very valid one, but that’s not how it’s being sold. Giving American workers a cash infusion is one thing, just don’t call it “stimulus.”

As to the latter, we’ve seen it happen before and it isn’t. Often forgotten because it was overshadowed by much bigger official failures, the Bush “tax credits” were likewise hailed as an effective crisis countermeasure. For a time, it was even said that they had worked very well in that way (GDP in Q2 2008 was initially estimated to have been substantially positive, feeding optimism for a turnaround…until the bottom really fell out thereafter).

Everybody who lived through it remembers what happened in the Autumn of 2008, therefore very little of what came before.

Here, too, the effect of such “stimulus” has been to shorten memories. The ARRA received all the attention and scorn, but lest we forget it was not the first. The Bush Administration, supported enthusiastically by Congress, the Federal Reserve and orthodox economists engaged in a tax rebate scheme during the first half of 2008. The government essentially paid people for being people, only it was distributed through tax credits rather than physical cash. Economists, undoubtedly, will object to the format as not being a proper “helicopter” but common sense prevails.

It may not have lingered long in our collective consciousness because of its actual purpose – to make sure the US didn’t fall into recession in 2008. Thus, it has been collectively rendered a minor footnote to the bigger events of the day.

Believe it or not, I’m very much in favor of helping American workers and even doing so in this way; by all means, send out the $1,000 checks. What I’m very much against is the idea that it will do much systemic good.

We’ve already witnessed the erasure of other 2008 era policy prescriptions, including QE as well as those “repo” operations (which really aren’t anything more than reworked TAF). How about those dollar swap lines? Just as effective as they had been a dozen years ago. Resurrecting the commercial paper program? AYFKM!

There is a distinction between aid and stimulus. The former is purely about helping people who are down, or are about to be kicked downward. The latter is meant and expected to prevent or alleviate being down much or at all.

The lack of attention to collateral and offshore money dealing has meant there can only be aid and never stimulus. All that’s left is to call the aid “stimulus” and hope.

It didn’t work out so well in 2008. The official world had completely ignored collateral and offshore factors back then, too.

Stay In Touch