Faced with severe economic distress and a global market meltdown, they promised that it would be big. Massive fiscal “stimulus”, however, might come at a price. In the short run it was necessary, according to the orthodox view. When a crisis shows up you don’t worry about how to pay for things.

Once all is said and done, the current “stimulus” bill will probably dwarf the last one – not that size will make a lick of difference, mind you. There was a reason that prior effort ended up being ridiculed so much (its bullcrap was the only part of it which was shovel ready).

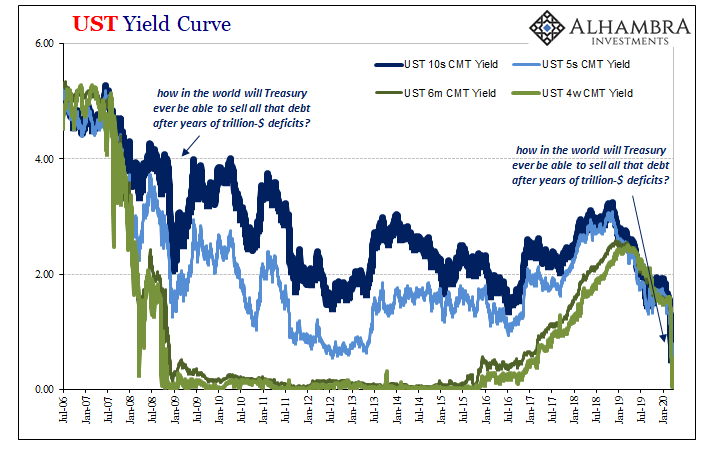

It seems quaint after a dozen years and no economic growth, but at the depths of the Great “Recession” critics of the American Reinvestment and Recovery Act warned that it would surely hasten the long-predicted return of the bond vigilantes.

Deficits can also affect the economy more suddenly. The prospect of large or out-of-control deficits can spark investors’ fears and cause a run on the dollar and a sharp rise in interest rates.

It’s amazing how these two things are always linked – in theory. The Treasury market would get blown apart causing the dollar to plummet. It’s not real analysis, more emotional pleading.

And, obviously, this argument hasn’t been limited to just crisis periods. Even when the economy seemed to be somewhat functional during Reflation #3 and globally synchronized growth’s inflation hysteria, the prospects for tax reform raising the fiscal deficit even more had the same people declaring sky high Treasury yields and a dollar plunging toward zero.

Here’s one from just last year:

But analysts warn that if the economy does go into a recession, the huge deficits projected now will expand significantly — possibly to a size that would send interest rates surging. Such a development, if it sparked worries about the stability of the U.S. financial system, might produce the type of deficit crisis they have been warning about for so long.

We are almost surely in recession right now, maybe even a truly bad one along the lines of 2008-09 or worse. In response to the possibility, when Congress does sort out its political differences in the coming days or weeks, the result will be an even bigger package than the ARRA. Two maybe three times the prior one which had so shocked and disgusted fiscal conservatives.

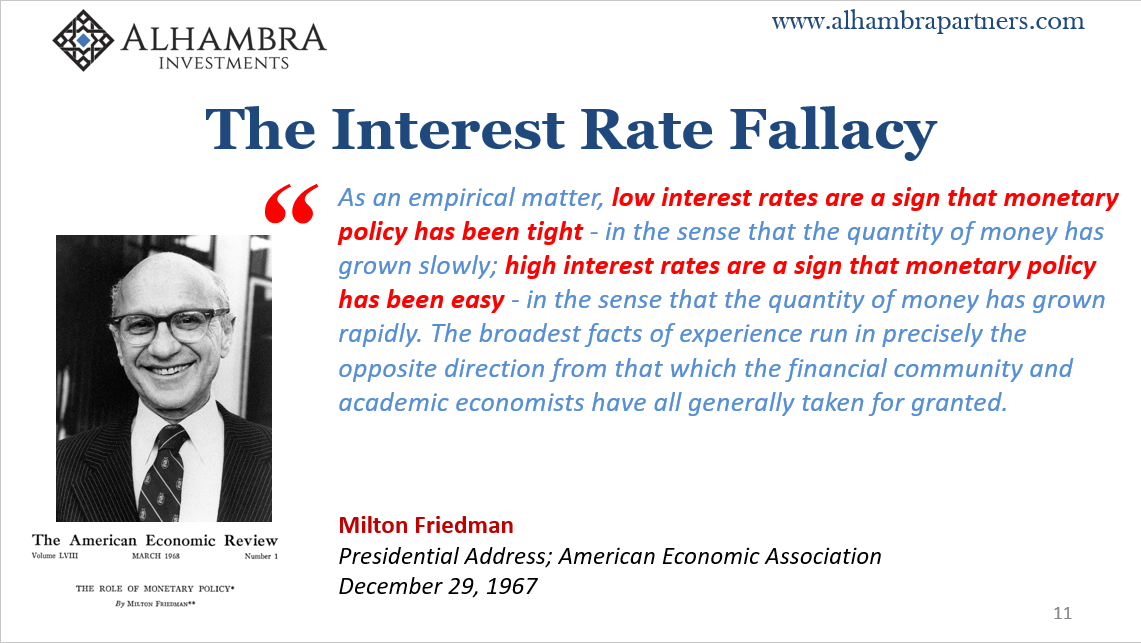

And yet, knowing full well what’s just ahead, interest rates aren’t surging. The bond vigilantes, all the Bond Kings, and even the “analysts who warn” can’t imagine how the Treasury Department would not run out of buyers even though it never does.

After all, it had been a major piece of the last few years; the “too many” Treasuries crowd going so far as to blame signs of illiquidity and systemic frailty on the bond market having trouble digesting issuance – even as the curves and all price action kept saying, unequivocally, demand was only rising.

The “strong worldwide demand for safe assets”, after all.

That’s how interest rates could once again be falling (and the dollar rising) like they were late in ’08 faced with the same unknowns, deficit and economy. On the list of priorities, fiscal frugality is way down toward the bottom.

The more you might sense that illiquid markets might become a problem (again), the more you are going to add to your stockpile – even if the US government is the brokest entity in human history (and it is). The illiquid market conditions matter tomorrow; the credit risks of UST’s, as the Japanese have shown, won’t matter until a long way down the road, if ever.

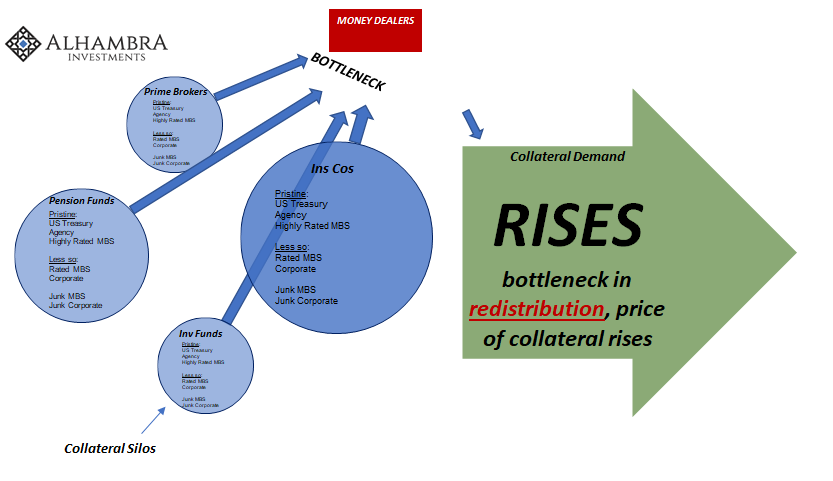

Since we are now arrived at tomorrow, surviving the collateral bottleneck unfolding before us is all that matters.

And what will matter in terms of interest rates in the aftermath isn’t the deficit, either. It’s whether or not things go right, for once, if we finally get a real recovery instead of the same fake one that’s been running on and off for more than a decade. That much Bill Gross got right during one of his (many) BOND ROUT!!! predictions over the years:

The manager of the world’s largest bond fund stressed that a bear market in bonds won’t start until economic growth and inflation pick up — an arrangement that he doesn’t expect to see immediately. [emphasis added]

That’s what the Bond King said on May 10, 2013 – and he was exactly right! The whole thing is wrapped up in economic growth and inflation; which is just what he got wrong, repeatedly. For a guy who lived atop the bond world for a very long time, you’d have thought he’d taken some time to figure out the Fed just doesn’t count toward the whole growth and inflation part.

Bond vigilantism and “too many” Treasuries are for a future that doesn’t yet have any chance to exist. Unless, really until, the monetary system gets fixed, truly fixed, the bond market isn’t going anywhere except into lower and lower rates. See: Japan.

There will always be a demand for these assets so long as policymakers do nothing about the collateral shortage; and that’s just the start of what needs fixing. Without a fluid functioning repo market, there’ll only be the global dollar shortage which remains the drag on economic growth and inflation.

And at times, much more than a drag. Systemic frailty is the whole thing, real fears about the bottleneck. I wrote in August 2018:

German bunds or UST’s, the message is the exact same. Flattening at low nominals means liquidity risk remains paramount. This overrides every other concern, including hostility to either government’s fiscal outlook. The US may be technically insolvent given its long-range liabilities, but UST’s are going to be bid so long as the real and effective global money system continues to be a malfunctioning mess.

The bigger the monetary mess, the more yields will decline.

A shortfall of a trillion dollars was downright insane, practically unthinkable eleven and twelve years ago. People once gasped at the massive deficits the government’s response to the GFC and Great “Recession” had caused, wondering how it would ever be possible to sell all that new paper.

In the end, though, it was easily absorbed, Treasury rates tumbling lower and lower and lower no matter how many zeroes got tacked onto the US total debt balance. Ironically, it wasn’t the Fed’s bond buying QE’s that caused this, rather it was the Fed being so bad at its monetary job (tightness) using QE’s instead of having learned something from Japan’s experience.

Nothing will change moving forward – except more zeroes. I’d absolutely love it if I could scream and criticize the ridiculously wasteful spendthrifts as a priority. Someday I will join the ranks of the vigilantes, and believe me I am very much looking forward to it, but that day doesn’t come until after Jay Powell, and the whole stinking rot, is aggressively removed first.

Stay In Touch