A Prognosis for U.S. Stocks

The future for U.S. stocks over the next decade appears ominous, regardless of the impact of the Coronavirus. Why? Because valuations matter. And stocks at the end of February were priced for perfection. Any significant negative development was poised to drive them lower. The COVID-19 Virus that shut down the U.S. economy has certainly qualified. From that February peak, the U.S. stock market as measured by the S&P 500 has already lost over 25 percent of its value. But even if stocks had continued to climb in the near-term, without the virus emerging, the decade-plus outlook was still poor.

There are several different ways to value stocks. Many of them are useless for deciphering a prognosis for the stock market. However, there are a few valuation methodologies that are positively correlated to future market returns. These are illuminating at extreme moments. Sometimes the stock market gets so cheap that an extremely positive outcome over the next decade is all but guaranteed, regardless of what happens. That was the case in 1982. Conversely, on very rare occasions the stock market gets so unhealthy with extremely expensive valuations that a negative outcome seems guaranteed. Unfortunately, the latter is the situation we now find ourselves.

Today’s Market in Bad Company

Of great concern to investors, is not that one or two indicators show today’s stock market to be dangerously expensive. It’s that every indicator, I can find with a strong correlation to subsequent returns, agrees this is one of the most expensive markets in history, sharing company with 1929 and 2000. It’s a rarity for stocks to deliver a negative return over more than a decade. In fact, it’s only happened twice. After 1929 and 2000.

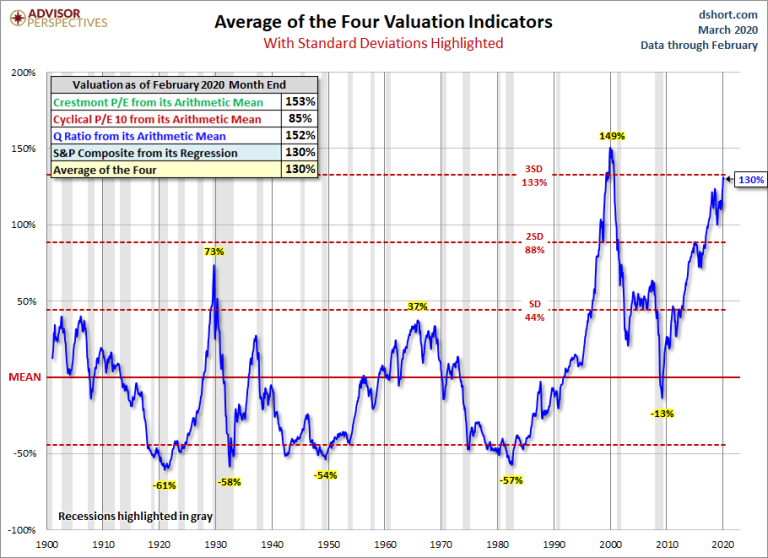

A wonderful reference for methods to value the stock market is Advisor Perspectives. Its website provides updates on multiple valuations methods with positive correlations to future market returns, including the P/E 10 or Shiller PE, Crestmont Research P/E, Q Ratio and S&P Composite price to a regression trendline. Conveniently, they also show an average blend of the four, which identifies this stock market as having become the second most expensive in history below 2000, but above 1929.

Professor Shiller and his P/E 10 or CAPE is probably best known on the topic of stock market valuation. However, a close second likely goes to legendary investor Warren Buffett, who has advocated using Market Cap to GDP. The so-called Buffet Indicator of Market Cap to GDP also shows stocks nearing the sky-high 2000 levels of just over 160 percent by eclipsing 140 percent earlier this year, meaning the stock market was valued at over 140 percent the entire gross domestic product of the United States.

But for my favorite indicator, I’m going to turn to the lesser-known work of John Hussman at Hussman Funds. His Margin-adjusted P/E (MAPE) shows a -0.89 correlation of log valuations to actual subsequent 12-year returns. And that really should be the qualifier of whether you pay attention to a valuation method—does it work by being correlated to future returns, where an inexpensive market accurately predicts higher returns and an expensive valuation, lower future stock returns.

The MAPE does so and it also shows this market peaking earlier in 2020 to be the most expensive ever—one of only three times in history with subsequent 10- and 12-year returns likely to be negative. Furthermore, Hussman’s ratio of nonfinancial market capitalization to corporate gross value-added also implies negative 10- and 12-year returns for the S&P 500. And that lines up with every worthwhile valuation methodology I can find in predicting a dismal decade-plus for U.S. stocks going forward.

Exercise Caution

Maybe if stocks had been cheap, the COVID-19 Virus would have created a compelling long-term buying opportunity in March by making them even cheaper. But U.S. stocks were not cheap and still are not inexpensive. They were priced for perfection, and a global recession is anything but a perfect environment for the stock market. Investors should be leery about rushing to buy stocks. They should also be concerned about advice they are getting to not panic, as they will be fine by simply buying and holding. Sure if you have twenty years, stocks should do well. But if you would like to make money over the next decade, be concerned.

In fact, you should have already been worried before the virus even emerged. Because when stocks are priced to perfection, like they were in 1929 and 2000 it’s a near certainty that perfection will not follow. Nor has it. Alhambra Investment Partners had no crystal ball about COVID-19. Our portfolios were underweight U.S. stocks largely because of valuations, before this stock selloff began. Other factors led us to further reduce stock exposure for clients.

Of course, looking solely at valuations, even those correlated to future market returns, doesn’t tell you what the market will do tomorrow, over the next month or even over the next few years. But it can tell you if you’ve entered one of those rare times in market history, where stocks are likely to deliver negative returns over as much as the next twelve years.

COVID-19 appears to be most dangerous to the weakest amongst us, particularly those of advanced age with preexisting health conditions. We may be about to find out that its financial risk is similar—this virus may be of most risk to an unhealthy stock market, suffering from extreme valuations.

If that is the case, then investors, particularly in U.S. stocks, should exercise caution. Along with posting negative returns over a decade-plus, the bear markets after the 1929 and 2000 peaks saw substantial losses. In 1929 it was over three quarters. After the 2000 peak, the stock market lost almost half its value, with the tech-heavy NASDAQ falling over three quarters in the ensuing bear market.

COVID-19 may be the pin that pricked the stock market bubble. Only the future will tell. But the past history of valuations tells us that the road ahead for U.S. stocks over the next decade-plus will be a difficult one. Furthermore, odds are good this will be an abysmal decade for passive buy-and-hold strategies around U.S. stocks. In our view, pursuing smart multi-asset investment strategies will be critical to success. Furthermore, making active tactical adjustments will be key to realizing success in U.S. stock investing. The next decade is going to look very different than the last.

Stay In Touch