With volatility in the stock market ebbing somewhat or at least going in a more comfortable direction – 1000 point up-days feel a lot better than 1000 point down-days – it seems a good time to start pondering the long-term implications of the virus and shutdown. All of us have been so focused on the short term – is this a bear market rally or the beginning of a new bull? – that the long term has gotten short shrift. That is understandable since you have to survive the short term with some capital to be in a position to ponder the long term.

I don’t know – no one really does – how the economy or more broadly, society, will change as a result of the virus. Generally, I’m more inclined to just wait for the future to unfold rather than try to guess what it might look like. As I’ve written before, I don’t think it is our job to predict the future. Our job is merely to interpret the present, a vital task that isn’t nearly as easy as it sounds.

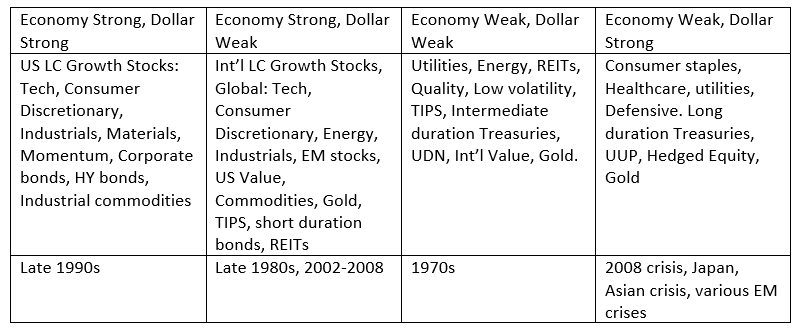

On the other hand, recessions and crises have, in the past, been turning points or regime shifts, as I’ve called them. I view these regime shifts through the prism of our four-box matrix:

Prior to the 2001 recession, we spent most of the late 90s in the “Economy Strong, Dollar Strong” box. Everyone wanted to own dollar-denominated investments and specifically growth (tech) stocks. Commodities were the forgotten asset class with crude oil falling to $11 and change in 1998 and still only $26 right before the onset of recession. Gold fell to almost $250 and copper fell to 60 cents a pound. The strong dollar played a role in two crisis situations (LTCM and the Asian crisis of 1998) but both were mitigated by Fed market interventions (not that that was necessarily a good thing).

During the recession, we were in the “Weak Economy, Strong Dollar” box but transitioned to the “Strong Economy, Weak Dollar” box as the recession ended. The dollar index peaked around 113 in February 2002 and fell all the way to 85 by March 2008. Commodities reversed, crude oil rising from $20 to $140, gold from $250 to $1800, copper from 60 cents to almost $4/pound. US value stocks outperformed growth stocks and international stocks outperformed both. The 10-year Treasury yield rose from 3% to over 5% and year-over-year CPI inflation rose from 1% to 5.5%. REITs strongly outperformed the S&P 500.

We stayed in that economic environment, except for short-term deviations, until the next recession. While the official recession started in late 2007, the dollar didn’t actually hit bottom until March of 2008. Crude oil peaked in July over $145, copper peaked in May over $4. The “Weak Growth, Strong Dollar” period was officially underway with all that implies (see matrix above). Copper fell to $1.25 and crude oil to $34 during the 2008 crisis.

The transition to a new environment was not smooth or quick. The dollar fell for most of 2009, rallied strongly the first few months of 2010, then fell again to make its final low in early 2011. Growth was recovering for most of that time though, so we generally moved between strong and weak dollar with strong (improving) growth. The dollar finally moved into an uptrend that peaked right after the election of President Trump. The dollar index has mostly traded sideways since then, although broader measures of dollar value have continued to rise.

So, we are presently in the worst of the four potential environments, “Weak Economy, Strong Dollar”. The only thing that works consistently in that box is defense. Treasuries, consumer staples, healthcare, utilities, and gold have all worked, to some degree, since the onset of the crisis in late February. There is also the outlier of technology, but I suspect the tale of this bear market has a bit more to run so maybe we should wait a bit before declaring tech a safe haven.

The question we can’t answer yet is what the world looks like on the other side of this recession. What box will we transition to next? I don’t know the answer to that and neither does anyone else. I do think a weak dollar consensus is developing with the only argument over the rate of – or existence of – economic growth. Weak dollar seems to be a given which is surely interesting to one with a contrarian streak.

But we don’t have to predict the next transition; we just have to observe it. We don’t have to guess if the dollar will rise or fall, merely observe and acknowledge the trend. If the dollar does reverse and start to fall that will dictate certain tactical changes to our portfolios. If it doesn’t and growth revives, then we’ll be making different tactical changes. Currency trends tend to persist so you probably don’t have to worry much about missing the exact turning point – if there is one.

So, we’ll just wait for the environment to change and when it does, we know in advance – generally – what tactical changes will be required. But there can be multiple options within the general category of, say, LC stocks, so it can be useful to think through how things might change and how that might affect our tactical approach. What will the economy look like when this ends? How will our behavior change? How will politics shape the economy in the post virus era? We may not know the answers yet – even if we have some pretty good guesses – but hopefully we can know the right questions. The market will reveal the answers in due time. All I want to do is identify new trends early, as they develop.

We don’t know yet how long we’ll be dealing with this virus, but absent a quick vaccine – which is certainly possible – or herd immunity or some other magic bullet, our economy, our society, is going to change. Whether the changes are large or small, temporary or permanent is hard to say, but I don’t see how anyone could possibly expect a return to the status quo ante.

One term keeps popping in my head as I think about how things will change over the next year or more – acceleration. Many of the things that come immediately to mind are existing trends the virus will accelerate. Online shopping, meal delivery, grocery delivery, telemedicine, homeschooling, working from home, and moving away from large, dense cities were all gaining velocity prior to the virus. Some of these trends, maybe most of them, will maintain the momentum they’ve gained during the virus shutdown. All of them have implications for the economy beyond their narrow industry.

How these and other industries and trends change in the post virus world will have an impact across the economy. Here are some of the questions I’ve been pondering:

How will offices adapt to continued distancing measures after the lockdown ends? Will they use their existing space and alternate workers in the office either via shift or days of the week? Or will they take a larger space to try and give everyone the necessary spacing? Will they use less space and keep a larger portion of their workforce working from home?

A migration from large to small and mid-sized cities was underway prior to the virus, something Joel Kotkin has documented extensively. Will that trend now accelerate? In the pandemic age, it certainly makes sense for individuals to want to move to less densely populated areas. Will companies follow their lead? Will Greenville, SC gain as NYC loses? Will Amazon continue to expand in the northeast or shift more to Nashville? How do we invest in this migration?

How badly will retail real estate be hurt? Will small retailers come back? How long before people feel comfortable eating in a crowded restaurant? Which large retailers will fail? Macy’s? JC Penney?

Will the increased use of telemedicine continue after the virus? Can widespread adoption of telemedicine have an impact on healthcare outcomes and costs?

Will pharmaceutical manufacturing be considered a national security issue? Will drug companies be forced, by government diktat or public outcry, to move manufacturing back to the US? What about the associated chemicals and other raw materials? What about healthcare equipment such as ventilators?

Will states or the federal government be responsible for stockpiling goods for the next pandemic? Who will manage these stockpiles to ensure their future usefulness?

What about other industries? Will there be a concerted effort to bring manufacturing back to the US? Will companies seek more redundancy in their supply chains? How would a mass repatriation of manufacturing affect employment and wages? Will the Trump (or Biden) administration expand the use of tariffs to force that repatriation? Will companies that don’t bring manufacturing back to the US be vilified as unpatriotic?

Will trade continue to contract? How will reduced trade affect the status of the US dollar? How will foreign companies and countries with US dollar debt obtain the dollars they need to service those debts? Will they refinance into another currency? Which one?

Will there be a political backlash against China? How will that impact the recently signed trade deal?

Will companies carry larger inventories to mitigate against future shutdowns?

Will remote education/homeschooling continue after the shutdown? What is the impact on public and private colleges? Primary and secondary schools? Teachers? Dormitory operators? Apartment operators in college towns?

How will our consumption patterns change? Will we see more precautionary savings? Can we with high unemployment? How long before people feel comfortable sitting in a crowded arena to watch a sporting event? Can pro sports leagues adapt to smaller live audiences? Will the expanded use of grocery delivery services continue after the virus passes? Will bricks and mortar retailers be forced to contract and sell more online?

Will the debt added to the national tab for the virus mitigation affect future growth? Trend growth prior to the virus was 2%. Will the additional several trillion in new national debt reduce that to 1%? With little room for error will that mean more frequent recessions? Does greater debt today imply higher taxes tomorrow? Will more debt be inflationary? Deflationary? How will bigger deficits impact Fed policy? The dollar?

Will investors be more conservative in their asset allocation? Will investors continue to favor index funds if returns are low for an extended period? Will bonds continue to play a large role in most portfolios even with interest rates near zero?

We are currently in the worst type of investing environment and it doesn’t seem likely to change in the short term. The economy is certainly in a recession already, the depth and length of which we cannot know. Our investments reflect this, concentrating on defense. At some point though, growth will accelerate or the dollar will fall and a new trend will start. That will allow us to make tactical changes that make sense for the new environment, whatever it might be.

In the meantime, it’s a good time to think and watch. What else are you going to do during the great virus shutdown? TV is almost always a waste of time (Killing Eve a brilliant exception). Sports is shut down and I’m curiously not missing it much. So, I’m spending my time reading and thinking about our post virus world. It’s going to be different for sure. Different better? Or different worse? The answer to that question has not been written yet.

Stay In Touch