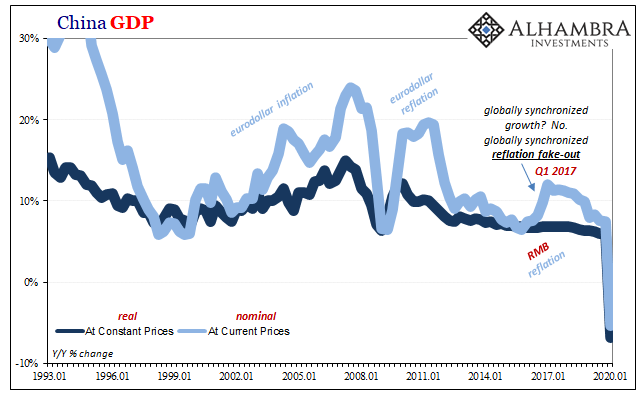

Questioning the veracity of Chinese estimates (for anything) has always been something of an amateur sport. For a stat like real GDP, everyone “knows” that it is managed. In a complex world where an economic system for a billion and a half is incomprehensibly unpredictable, there’s really no other way to always hit your government’s mark (unless the Chinese are using the same accountants and corporate managers who likewise manage to “beat” their quarterly EPS by $0.01 every time).

The world wants to know what the other side of this dislocation will look like. What better place to start looking than in China where everything began.

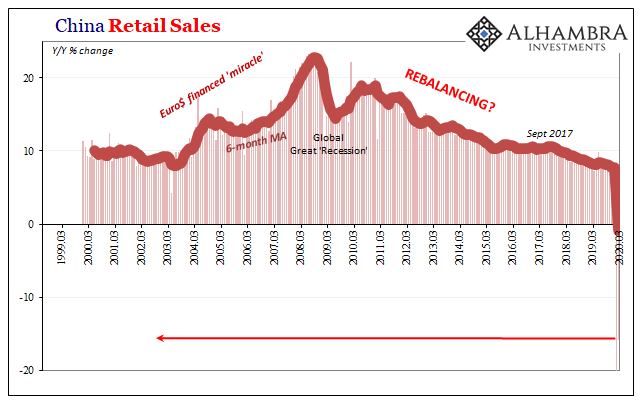

For many people, there’s the hope (it’s really not much more) that with this severe contraction being driven by a non-economic factor once the situation becomes settled everything will just go right back to normal. The quicker the better. We all know the disaster the short run will turn out to be.

But if that short run chaos lingers a little too long, then even this most optimistic scenario goes out the window. And it was a long shot anyway.

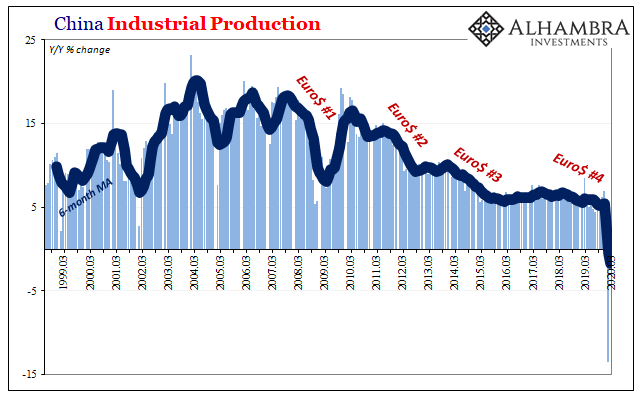

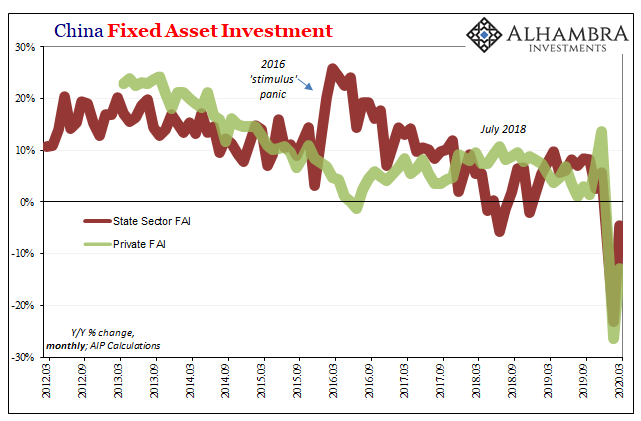

Here’s what China just reported: real GDP in Q1 2020 declining by 6.8% year-over-year, a little worse than expectations (but not that far from them; see what I mean). Within GDP, for the entire quarter industry shrank by 8.4%, fixed investment by 16.1%, and consumer spending (retail sales) down 19.0%. At the same time net exports (exports minus imports) collapsed 80% and the “rebalancing” service sector dropped about 7%.

How does that all add up to -6.8% in real terms?

Wink. Wink.

True to form, China’s NBS is serving a purpose. No doubt the Communists would conclude it is a higher one, such as:

The resumption of work and production accelerated, with fundamental industries and major products vital to national economy and people’s livelihood growing steadily. People’s basic livelihood was well guaranteed and the national economic and social development witnessed overall stability.

Unless it really didn’t. And if it didn’t in China in March when the shutdown was being lifted, then all bets are off for the best case globally.

It doesn’t necessarily mean the worst case, but the likelihood of everything progressing flawlessly diminishes greatly. If China has to fake GDP to that extent…

It was, again, always a long shot because the pandemic shutdown isn’t the only factor here – as if we hadn’t already noticed with other data from around the rest of the world, especially here in the US where more than 1.6 million workers just gave up last month.

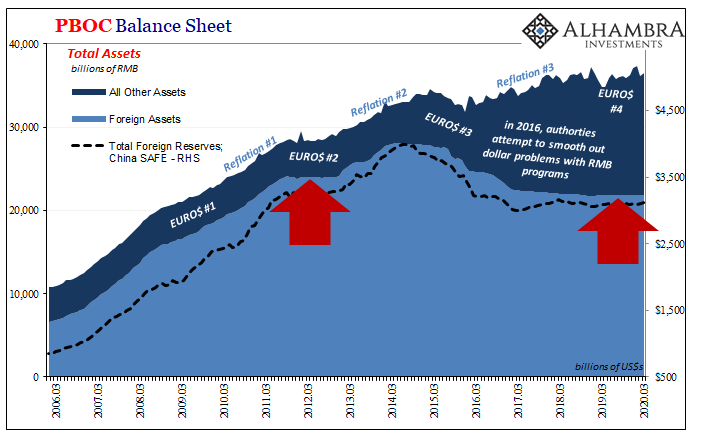

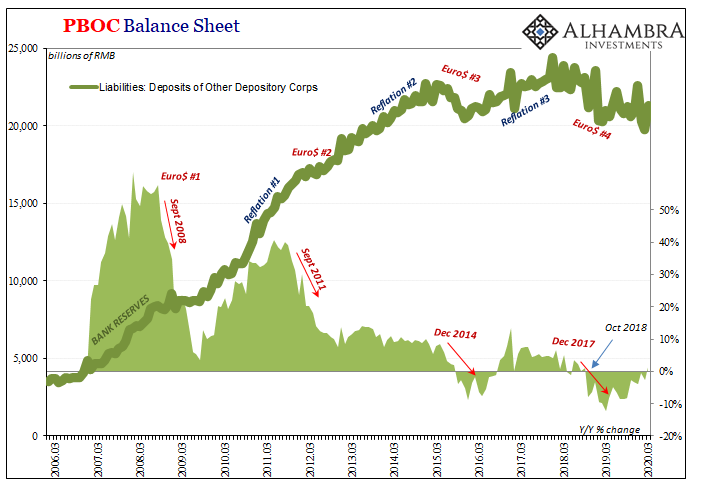

More important than GDP, in my view, is the PBOC’s balance sheet. There’s something even more unnatural going on right at the top where the central bank reports “foreign assets.” These are the backbone of China’s highly (euro)dollar-ized monetary system. As I’ve been documenting for so many years, it’s the domestic reason why CNY DOWN = BAD (tighter internal RMB restriction).

Not only is CNY not down much the past half year or so the balance being reported for foreign assets has barely budged. Miniscule changes. It’s down ever so slightly, but really it’s just a straight line.

Going back to early 2019, back when China’s CNY clocks still ticked, the number reported hasn’t varied by more than RMB 20 billion in any month (which is a tiny amount given the RMB 21.8 trillion reported). Most months, less than RMB 10 billion. How is that possible? How is that possible with everything going on?

Especially when considering other balances being reported, such as Foreign Direct Investment in China. According to the country’s Ministry of Commerce, total investment (largely in dollars, but foreign money regardless) fell by 11% in Q1 (-14% in March alone).

The process by which foreign currency makes its way onto the PBOC’s balance sheet is convoluted, to be sure, but the point is especially in an environment where the yuan’s exchange value isn’t moving all, and neither FDI nor financial eurodollars were available anywhere in the world last month, something should be happening to the central bank’s bookings somewhere. A straight line is the last thing you’d expect to find unless…

Wink. Wink.

I try hard to stay away from conspiracies, but this isn’t all that conspiratorial.

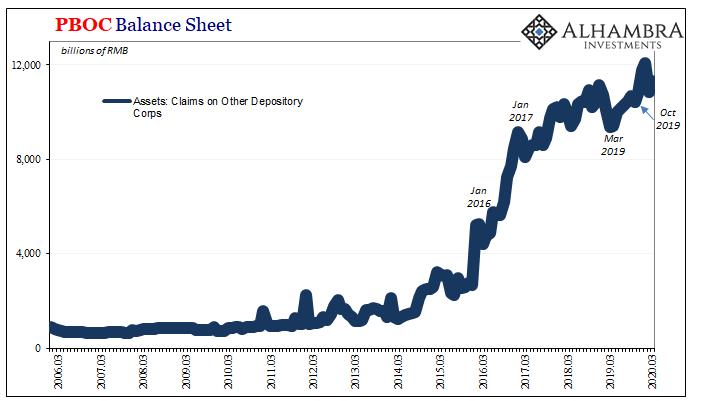

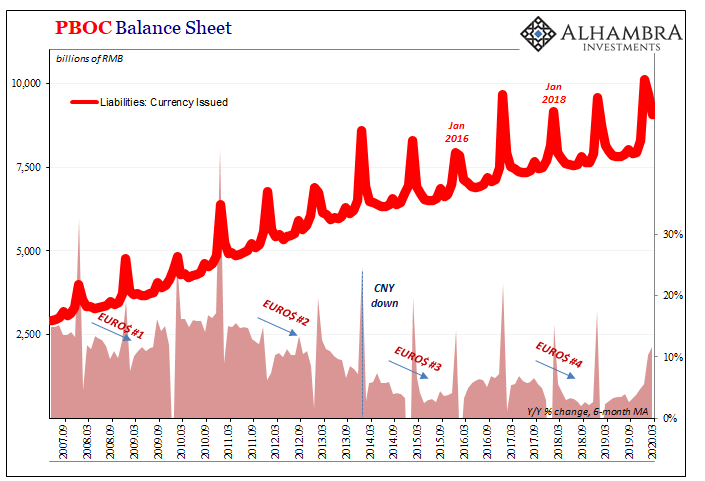

Wherever the dollars are coming from, likely, in my view, China’s banks sourcing them in other more creative ways, with a stable topline the PBOC has been able to take advantage by letting the monetary (RMB) buildup from 2020’s Golden Week stick around into March.

Every year, the central bank increases liquidity because of a weeklong shutdown for China’s banks during the holiday, when the Chinese people and businesses (and banks) end up holding more currency (and reserves).

Typically, all that cash is brought back in during March and April, managed reversion to whatever policy established baseline. This year a noticeably slower return, meaning year-over-year currency issued was nearly 12% more in March 2020 than March 2019.

Even the level of bank reserves managed to be modestly higher, though that’s not a “real” number, either, though, in this case, that just means calendar factors rather than more winking.

Everyone wants badly to know what’s going on in China, and what we see is that it is going badly. But as to what is really going on? We know, or think we know, even less.

Which might be an important indication in itself.

Stay In Touch