The debate over the shape of the recovery, “V” or “L”, which might emerge following the dislocation and global contraction. What clues can we find?

1. Domestic Data clues

“Deprive any animal of oxygen and watch how it doesn’t move very fast.”

- How the labor force changed right @ hardest part of GFC1, why it matters, what it means (workers just plain giving up)

- Up to then LF in recession was constant – big change

- Bernanke in 2013 – maybe denominator in UE rate does indicate something bad

- GFC2 right out of the gate huge decline in LF (IOW, we’ve seen this before and it doesn’t end well for the long run)

2. Global Data clues

“If all goes right, worldwide policy response perfect, global trade ends up just slightly behind its prior 2011-18 baseline. Should policy interventions (including fiscal) perform flawlessly. Yeah, OH SH%$ is right.”

- WTO green line if everything is flawless; red closer to the baseline

- We’ve already been thru one L – also associated with GFC – so history as well as common sense is stacked against us

- L predictions from 2016, incl LF

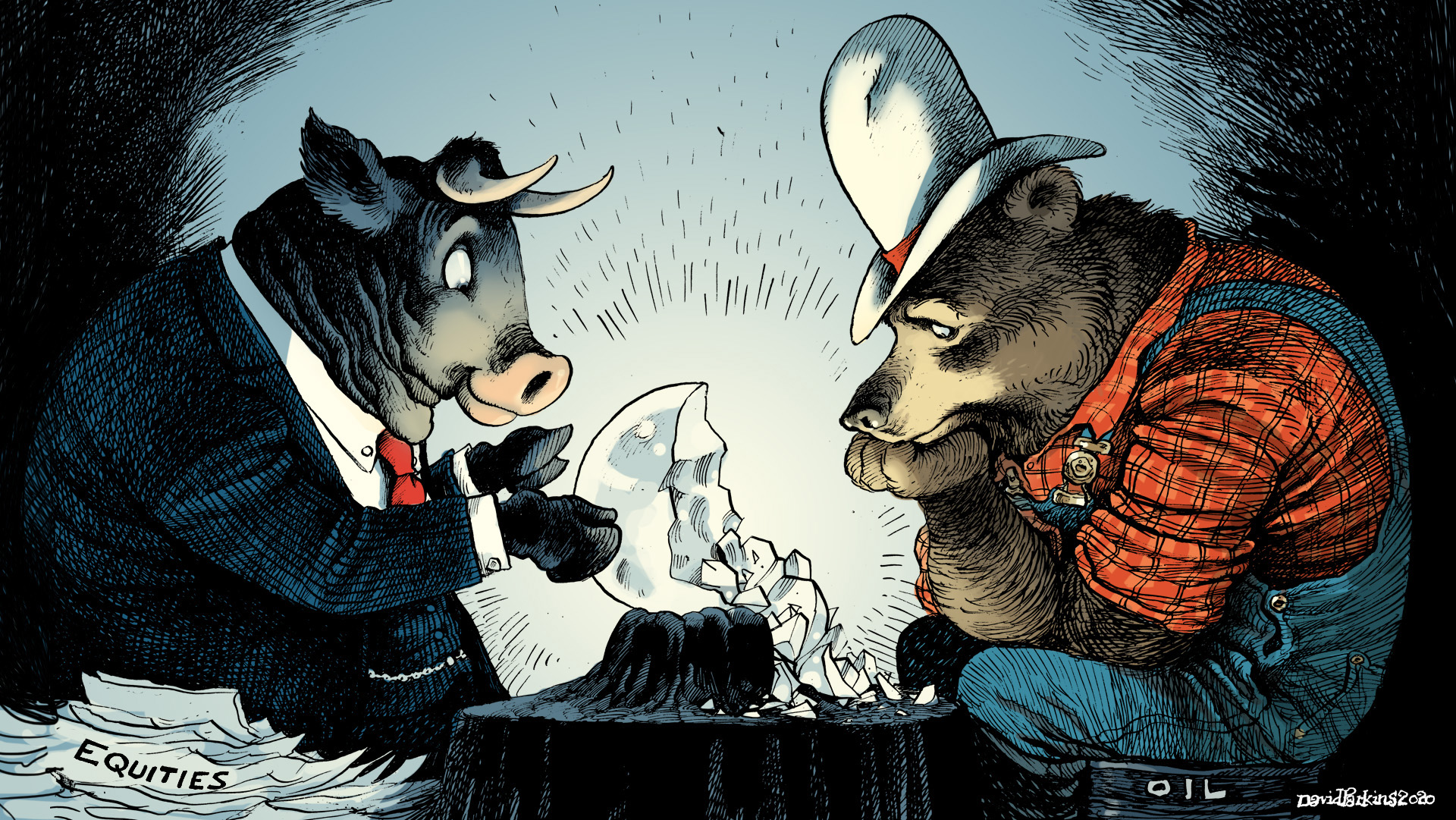

3. WTI Curve

“What would anyone have thought last year about the global situation if they were told oil would be in the $30s throughout 2021 and right on into 2022? Nothing good.”

- Contango at the front is about the shutdown (short run need to push supply into storage)

- Back end is more important – LR where demand and supply will be (and dollars)

4. Bonus

- Economists always apologize for being overoptimistic.

- Repo & repo collateral in T-bills despite $1 trillion being auctioned off lately.

Also available:

Stay In Touch