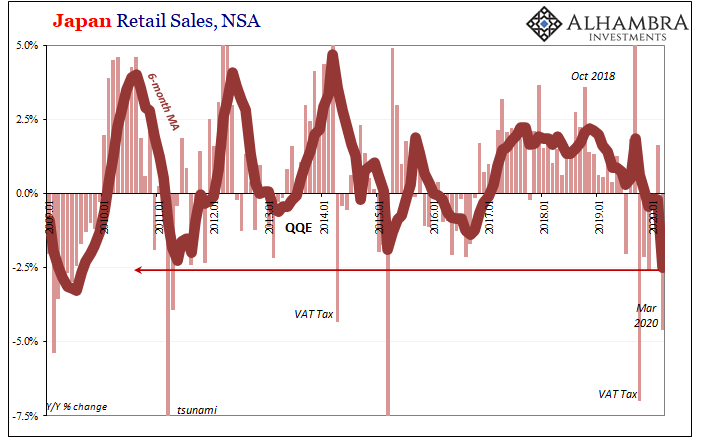

The Japanese went ahead with it anyway. Real GDP had bounced back, sort of, from a near recession in 2018. Central bankers at the Bank of Japan had reassured Shinzo Abe that the economy was on the mend. Therefore, the second round of the VAT tax hike, an imposition which had been postponed since 2015, could go ahead in 2019. The government had put it off long enough.

In this way, Japan made the same mistake late last year about the tax everyone made this year about the pandemic response. Thinking their economy was sufficiently robust to overcome a non-economic factor, the tax hike, they instead were forced into making excuses throughout Q4 2019 as to why it instead seemed to collapse so easily.

Consumer spending figures, like retail sales, you could at least understand. But why business investment?

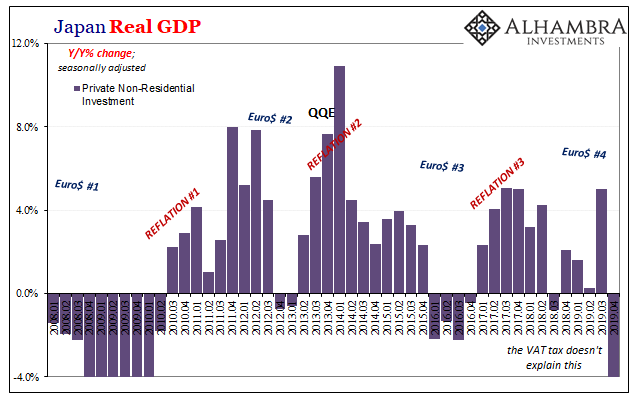

Real GDP in Q4 turned out to be much worse than anticipated, -1.8% (like Europe, that’s a quarterly rate). While final sales did decline substantially, it was really Private Non-residential Investment that had been responsible for the big headline miss.

There was no tax reason for Japan Inc. to cutback so much on capex. After all, if the VAT drama really was nothing more than a short run interference, the economy otherwise accelerating, Japanese businesses would be investing by looking ahead into that much sunnier outcome.

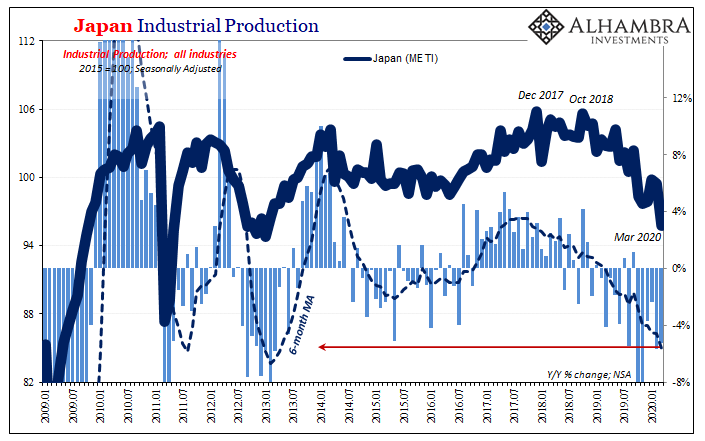

They didn’t because they hadn’t been. Euro$ #4 was in charge the whole time, as we can easily observe throughout Japanese industry and its output (IP).

Folding like a cheap suit isn’t just an American proposition at the start of what is for the entire world going to be the worst quarter since the 1930’s. Nor is it left to just the Europeans to shock anyone at just how bad it was entering this crucial period.

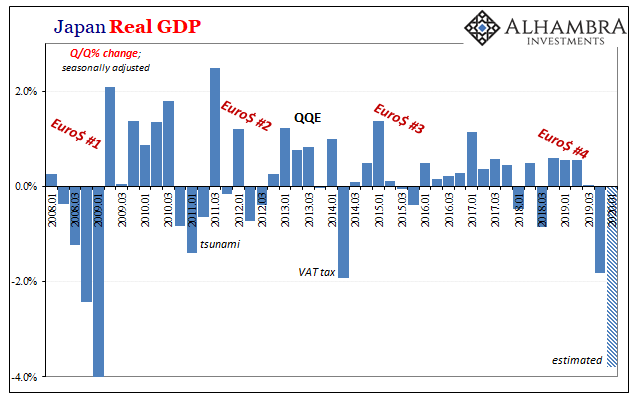

Japan is expected to follow up Q4’s awfulness with an even greater negative sign in Q1. The current consensus (FWIW) is pointing toward -4% quarter-over-quarter, in about the same range as Europe as a whole.

The Japanese are the last to release GDP figures for Q1, the preliminary estimates aren’t scheduled to be published until May 17, but once they do it will have been a clean sweep. China, the US, Europe, and finally Japan.

We all knew that Q2 would be a total disaster. The second quarter of 2020. The fact that Q1 is already rivaling what’s happening now is a very bad sign. One more time:

No one is downplaying the severity of the situation, even the worst offenders deserve some limited credit here. Where they’ve offended is in overplaying both the starting position and then their ability to limit the downside and pick everything back up on the other side. In between is not really the issue.

We’re only getting data on the first part of it, and already it’s enough to make you sick. They bungled 2008, badly. They botched everything about the last two years. And now the first steps into the current crisis couldn’t have gone worse.

Such a fragile global situation right from the start just doesn’t bode well for that “V” everyone is shooting for, and so many seem to be just expecting for…reasons.

Stay In Touch