It was an absolutely mad scramble. Banking difficulties in the Fed’s sixth district, the Atlanta branch, had sparked an irresistible wave of panic which spread throughout the Eastern seaboard. By December 1930, it had reached the streets of New York City – the world’s monetary capital.

On December 11, customer withdrawals had left the Bank of the United States with no other option but to close its doors and seek refuge from bank authorities. Given the institution’s unfortunate name, one shared by the first two central banks in the country, this closure was big news and spelled big trouble.

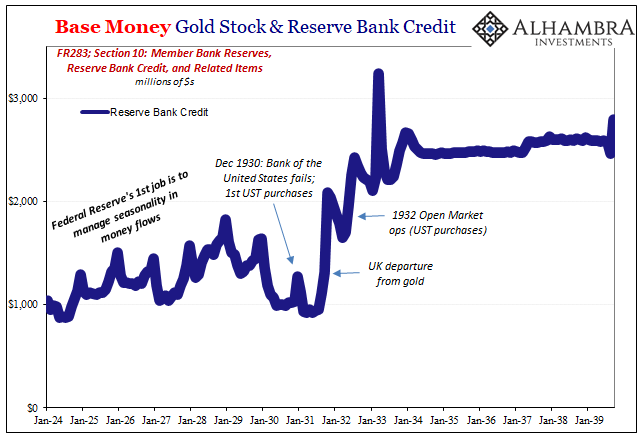

The Federal Reserve’s New York branch would end up purchasing $45 million in government bonds that month, almost entirely from two New York banks being stripped clean by customer withdrawals. It wasn’t quite quantitative easing, but it was a nascent beginning down that very road.

Up to that point, the Federal Reserve had mostly jiggered its interest rate mechanisms, primarily lowering the Discount rate (from 6.0% in October 1929 down to 2.5% by July 1930; eerily similar to the first half of GFC1). But demand for funds in December 1930 coming out from NYC meant FRBNY, at least, would have to open up its Open Market accounts.

Bank reserve credit, what we call just bank reserves today, the systemic balance had fallen substantially from the prior peak. A high of $1.8 billion reached in December 1928, by the time the US central bank bureaucracy had authorized substantial Open Market purchases in September 1930 Federal Reserve bank credit had declined to just $1.0 billion.

Officials had reasoned that the banking system didn’t need any extra; the amount of credit, like the condition of the overall economy, was contracting and so depositories across the nation had little use, they thought, of Fed discounting and whatnot.

All that would change in 1931 and thereafter. Suddenly alarmed by the first massive wave of panic, monetary authorities began encouraging usage of all its plans. A modest bond purchase program was initiated, and then more determined rediscounting particularly given what happened to the US gold stock following Britain’s abandonment of gold in September that year.

These UST purchases were greatly expanded so that in April 1932 the Federal Reserve System as a whole, not just the New York branch, but mostly FRBNY, would go on to purchase $100 million a week for five weeks in a row. On May 17, another $500 million was authorized.

These were thought to be astronomical sums.

By the time it was all over, the Great Contraction, the Great Depression had already been brutal. After the waves of bank panics subsided in 1933, the Fed was left with about double the amount of reserve bank credit that it had created before the events of 1929; two and a half times more than at the bottom in 1931.

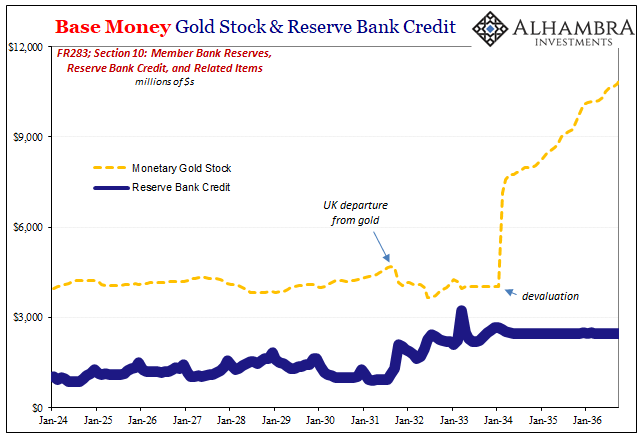

The far bigger problem, as far as officials were becoming concerned, was gold. Monetary gold had flowed out of the US in the wake of the UK’s crisis measure, necessitating that rapid expansion in bank credit to try and offset the contraction, but then it flowed back – in the extreme – once the dollar was devalued in 1934.

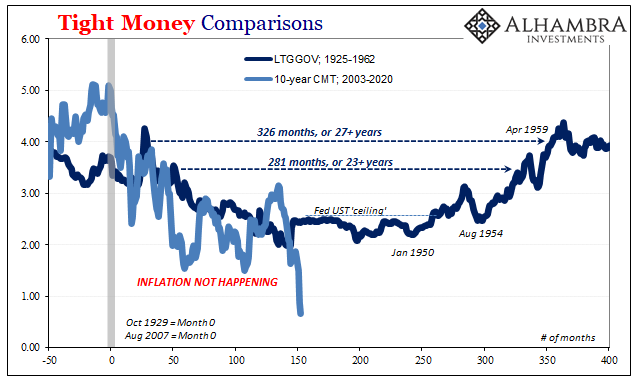

As recovery from the depression seemed to be taking hold, the central bank’s attention turned increasingly away from deflation fears and toward its opposite. So much “money printing” would surely lead to a second disaster; a depression followed by something that might be too much like Weimar Germany (which climaxed only a decade before then).

But what to do?

Officials began making plans as early as 1934. The contraction and depression increasingly behind them, but not far enough, they were somewhat paralyzed by indecision. The easy answer would have been to sell bonds; to reverse the purchases conducted under emergency conditions, therefore draining the system of so much monetary “excess.”

QT, in other words.

In addition, the Fed could partner with the US Treasury to effectively sterilize incoming gold.

They didn’t immediately turn to either option because, again, the contraction was just too recent and had been too traumatizing. In terms of Open Market Operations, no one at the Fed was willing to send the wrong signal too soon; that the central bank not long after the end of the nation’s worst economic disaster was “tightening” monetary policy which might risk setting off another wave of systemic illiquidity.

The situation, they thought, was just too fragile.

Those fears eventually subsided so that in 1935 and 1936 the bureaucracy was solidly in the inflation camp. It was coming, everyone thought, therefore the Fed had to act before inflation got out of control. What policymakers couldn’t agree on, at least not at that point, was how to act.

In December 1935, the FOMC noted:

It is the view of the Committee, however, that the amount of excess reserves of member banks constitutes a source of danger…The Committee believes, therefore, that action should be taken as soon as possible without undue risk to absorb a part of these excess reserves as a safeguard against possible dangers…

The following month, January 1936, the FOMC displayed added urgency. In addition to all that “money printing” in high reserve balances along with gold inflows, the federal government was spending like a drunken sailor; fiscal profligacy of the kind never before witnessed in American history.

Combined, how could it not add up to a huge inflationary problem?

The Committee recognizes that the risks of action are somewhat increased by the present budgetary situation, but it recognizes also that the longer action is delayed, the greater are the dangers resulting from the combination of inordinately large excess reserves and an unbalanced budgetary situation, and the greater will be the difficulty of taking remedial action.

Not wanting to drain reserves because that might appear like monetary contraction, these geniuses hit upon the idea of instead locking up what reserves they had created to (ineffectively) fight the depression in the first place.

At that December 1935 meeting, the FOMC had voted 7 to 5 against an increase in banks’ reserve requirements. As noted in the quote above, the argument wasn’t against inflation, even the “no” votes were worried about it, rather it was about what they thought might be the best way to deal with the monetary situation; how best to address those “excess” reserves.

To that end, the Board passed (8 to 4) a resolution stating that monetary inflation was in need of attention at that time, only that some members preferred the simpler, cleaner bond sales.

By July 1936, however, central bankers felt they could no longer wait. Opposition to using the reserve requirement instead of the Open Market Desk melted away and the new mandate was scheduled for a phased-in approach beginning later that year. In its August 1936 Annual Report, the Fed declared:

The Board’s action was in the nature of a precautionary measure to prevent an uncontrollable expansion of credit in the future.

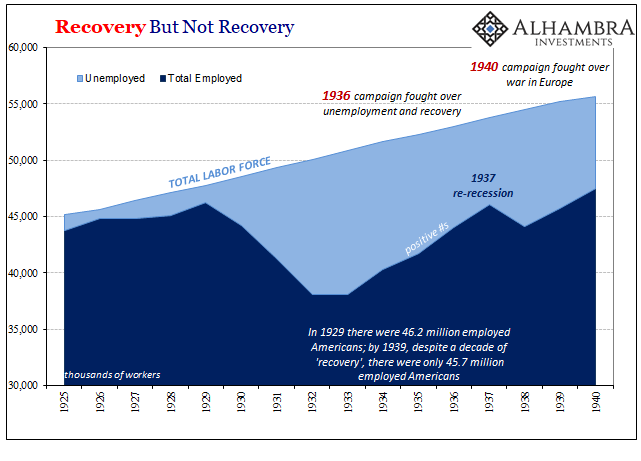

And almost as soon as the reserve requirement was raised the banking system bled liquidity, the economy fell into a second severe contraction, one which would’ve rivaled the country’s worst had it occurred on its own, and the Great Depression once more proved its absolute deflationary hold. The 1937-38 depression-within-a-depression.

There was no inflation, let alone any real risk of a runaway situation.

Going back to those early Open Market Operations during the Great Contraction, only Roy Young, Governor of the Boston branch (they were called governors back then rather than presidents) seemed to have appreciated the singular value of a reserve bank credit – which wasn’t much.

As Milton Friedman and Anna Schwartz noted in their 1963 book A Monetary History, while glossing over his statement, Young had been the lone dissenter (10 to 1) among the Committee Members voting for the 1932 authorizations for those big Open Market Operations.

…[Young] questioned whether purchases of governments which piled up reserves in the centers would result in the distribution of these funds to other parts of the country. He was skeptical of getting cooperation of the banks without which success appeared difficult…He cited the experience of 1931 as an indication of the futility of government purchases.

While that was true during the deflationary collapse, it also proved to be true during the recovery. As much as the level of bank reserves had been raised in between, without the cooperation of the banking system itself there was no chance of those “excess” reserves being used for anything other than self-written liquidity insurance.

They are otherwise inert.

It had been a paradigm shift, and a big one. As Friedman and Schwartz later note on the folly of raising the reserve requirement, banks weren’t going to just go back and act like it was 1925 again. They’d learned a valuable lesson, those who survived, as the system had itself destroyed so much credit and monetary capacity unrelated to the Fed. In the thirties, what was destroyed had been depository (the multiplier); in the 2010’s, it was wholesale (balance sheet capacity).

And a big part of that was understanding on a visceral level how you couldn’t count on the central bank. Better to build up a huge liquidity cushion on your own and hunker down.

An inflationary scenario was, therefore, impossible at any level of official “money printing” and gold flows. Authorities had feared what couldn’t happen because, seeing an inflationary ghost due, unsurprisingly, to the fact they didn’t really understand the system they were “governing.” They sure didn’t on the way down, and they proved it all over again during what had been only a partial and uninspiring recovery from the bottom.

Ignoring persistently low bond rates, especially UST yields, there really was no excuse for this second bout of extreme incompetence. Low yields = tight money. Inflation was a non-starter.

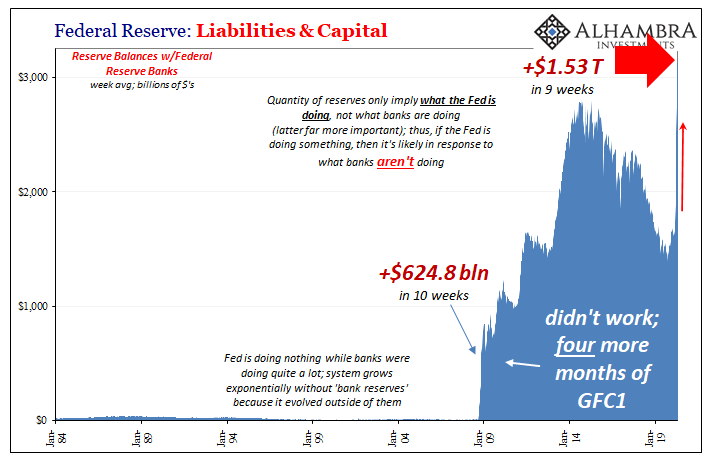

Yet, here we are all over again. The inflation monster is being resurrected from its sleep of irrelevance where it belongs because “money printing.” Reserve bank credit, bank reserves, whatever you want to call them, they’re only a part of the picture. At times like these, a very small part.

I get it; you can see the big jump on the Fed’s balance sheet since March 2020 staring you right in the face. So what? It’s not what you can see that matters, it’s what you can’t. Like I wrote yesterday, “Japan 2001. America 2008. Japan 2013. Europe 2015.” Those merely added to a list that starts with 1933-38.

Stay In Touch