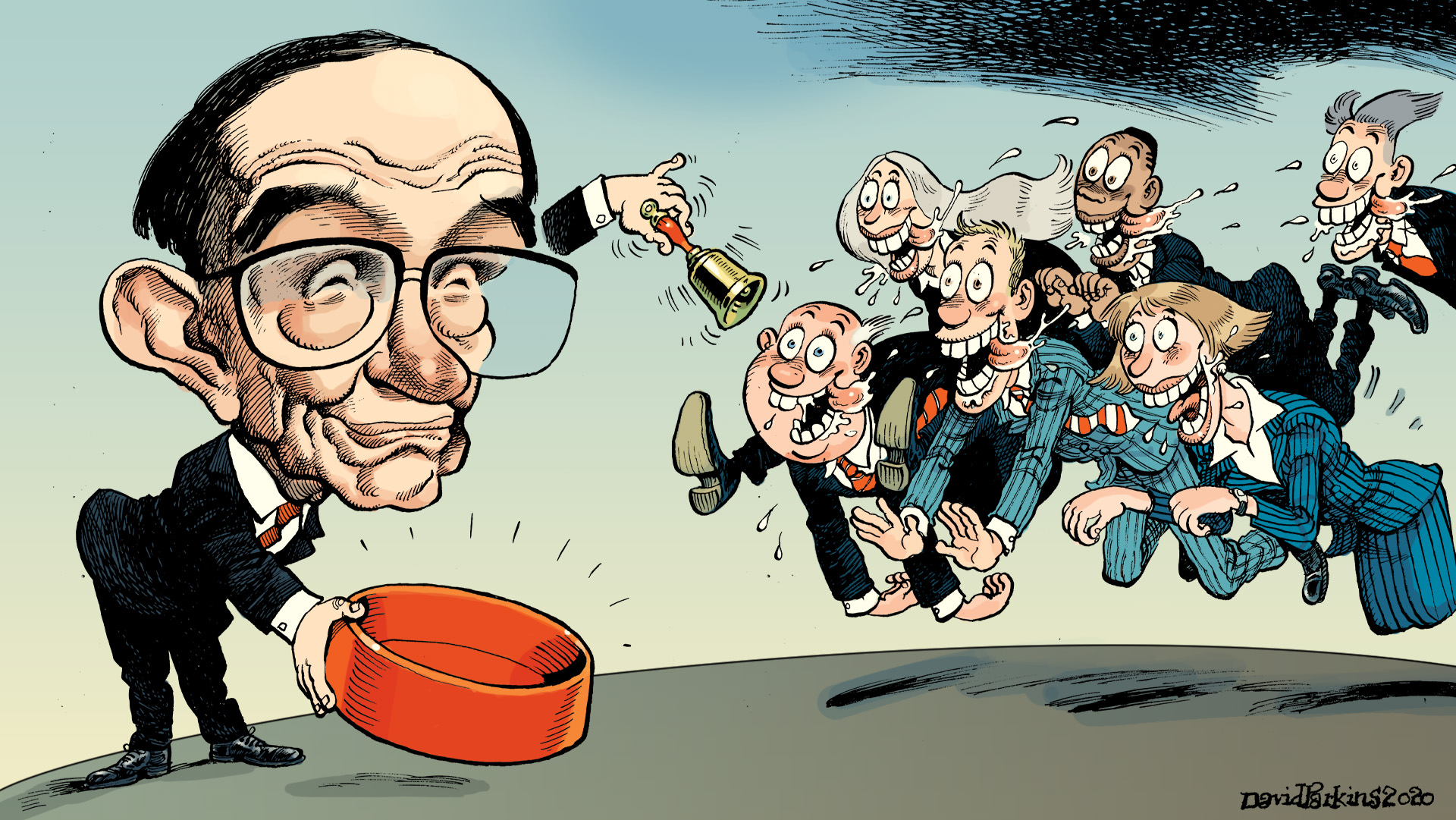

Is it really that simple? The central bank hands out “free” money or “supports” markets with purchases, so that’s all there is to it. Once Jay Powell or Christine Lagarde moves in with the big bazookas, who’s not going to climb on board the money train as it rockets out of the inflation station?

If only Weimar was that easy. Easy money, as it turns out throughout history, is extremely hard. It’s no different today than it’s ever been (thanks T. Tatteo):

The European Central Bank has offered to pay eurozone banks if they keep loans flowing to eurozone businesses.

But many banks—still struggling with bad loans left over from the last crisis—have turned the central bank down.

Everyone sees what the ECB offers, and often does with those offers (bank reserves), and they are taught to believe that’s all there is to it. Inflationary money printing!

What you never, or rarely, see is the shadow constraints from the shadow money system predicated instead on the banking system; limitations independent of whatever policy and intervention Lagarde and Powell make every effort to publicize.

What matters is what banks, not central banks, actually do, especially if what banks don’t do never sees the light of day (double negative intended). The banking system makes, and destroys, effective money resources. Central banks make for sometimes compelling made-for-TV drama intended for a specific audience (NYSE).

With the above European flavor in mind, we turn to consumer credit in the US. The issue is whether or not second and third order effects begin showing up. If they do, that’s a pretty clear indication against the short run “V” scenario and much more in favor of a longer, drawn-out episode.

Searching for these just a few days ago, I wrote:

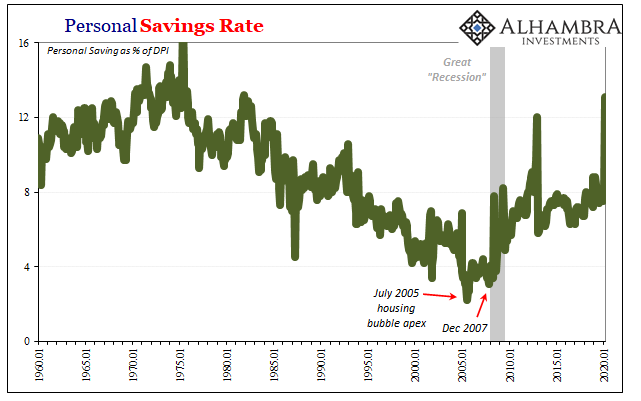

It represented only the start of a paradigm shift in behavior, one that wasn’t unfamiliar, either. How many stories from our parents and grandparents (or maybe great grandparents, for those of you possibly much younger) who had splurged during the Roaring Twenties only to regret it in the early thirties while being transformed into the most frugal of spenders for the rest of their lives?

Something Economists call a second order effect (or third order, depending on in which order you place these factors). The first order effect was the shock of the Great “Recession”, really the first eurodollar shortage (GFC1). Millions lost their jobs and their access to credit at the same time.

This then caused a behavioral change that, as you can see above, was no one-off, temporary rebuke.

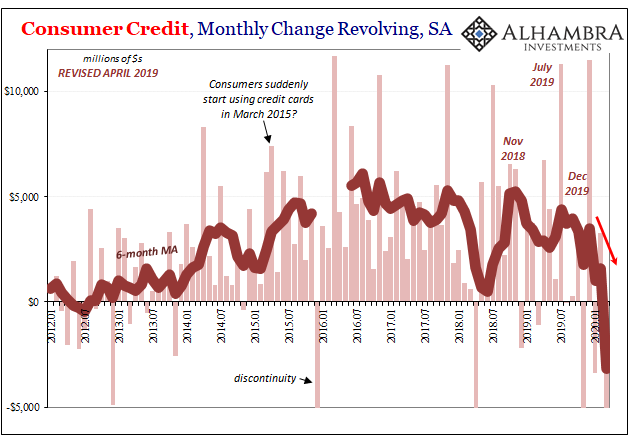

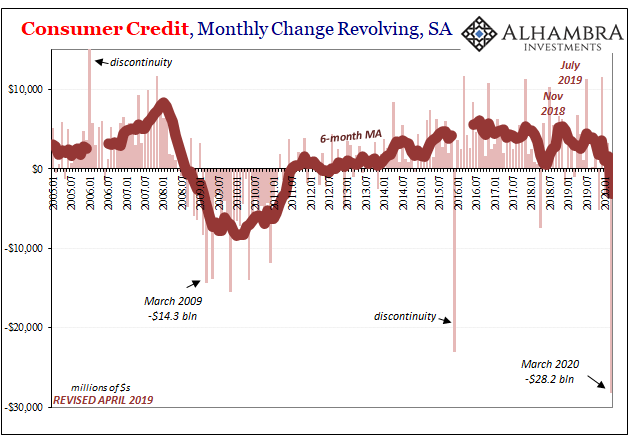

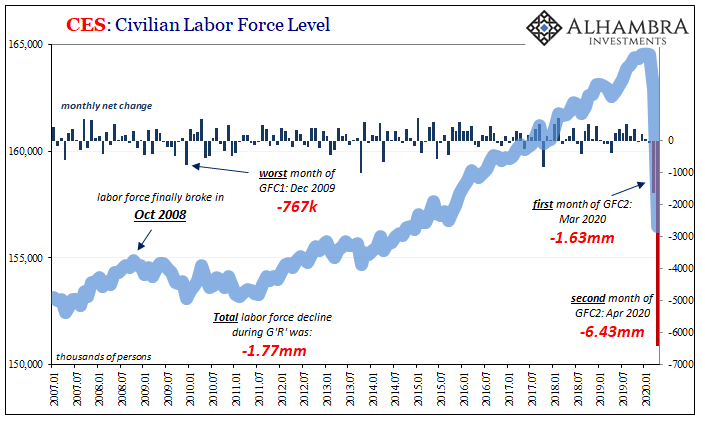

The Federal Reserve, of all entities, reported yesterday one of the largest drops in revolving consumer credit in the entire data series. The month-over-month change (which we have to view with some caution, not only are these figures prone to big revisions the monthly changes may not always be what they initially seem) in March 2020 was an enormous -$28.2 billion.

How does that compare? During March 2009, for example, revolving consumer credit fell by just half that amount even as millions of American workers were being laid off and the banking system had largely abandoned many of its marginal credit functions.

Again, these latest estimates are for the month of March 2020 – the first month of GFC2 and only partly affected by the COVID-19 shutdowns. In other words, this isn’t even to April yet.

How do we interpret the data?

To start with, you’d think it would have been the other way around if this dislocation was being viewed as nothing more than a short-lived non-economic dislocation. In other words, why didn’t consumer credit skyrocket as Americans used their credit cards to fill in the income gap created by the disruption? With the Fed on full blast and “everyone” claiming massive stimulus will see us through, online shopping heaven at least.

There were, as always, warning signs preceding March. Growth in revolving credit was already waning from back to last summer (that whole recession “scare” that was more than just a scare). This suggested a serious level of caution and uncertainty to begin with (consistent with Euro$ #4’s globally synchronized downturn showing up everywhere outside the US unemployment rate).

When GFC2 struck early on in March I have to imagine both consumers and banks hunkered down for the long haul. The prudent response for each would have been to reduce exposure and leverage; individuals paying down existing balances while banks beginning to shift toward extending less credit.

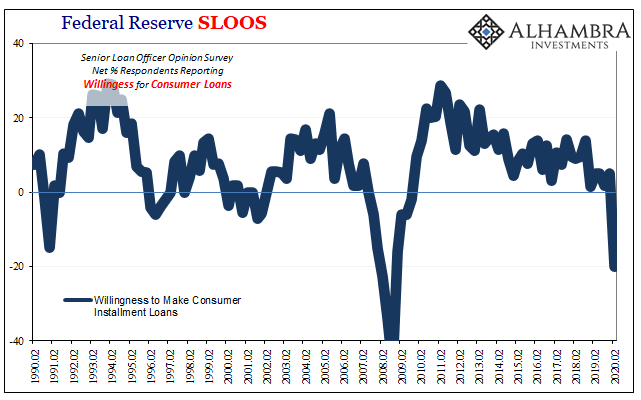

We already know the latter is true…because the banks have already declared it:

The SLOOS data, also from the Federal Reserve, is derived from a survey conducted in early April and therefore pretty much in the same range as the consumer credit balances compiled from March.

There is also the (small) possibility that early payments from the Treasury began showing up and these were used not as “stimulus” but as the very means to deleverage; exactly like they had been in 2008.

GFC2 (first order shock) > consumers alter their behavior paying down credit cards, lower marginal propensity to freely spend compared to pre-shock (second order) > banks pull back credit available, reducing the inclination even further (third order) > no “V.”

And that’s before we even get to the labor force, the layoffs, and what terrible damage must be going on with businesses.

The Fed and ECB talk a great game, but their bowl is empty. Always has been. Banks, not central banks.

Stay In Touch