They merely repeat the words, as it is intended. With major fanfare and widespread praise, the Federal Reserve weeks ago had announced it was going to buy corporate bonds. Well, not actual bonds but ETFs. It hasn’t bought a single one of those, either, at least not until today and yet the program is being assigned the usual magical properties.

U.S. corporate bond exchange-traded funds rose Tuesday after the Federal Reserve said it would begin purchases of the securities as part of its package of measures to support functioning of credit markets through the coronavirus pandemic. [emphasis added]

How does the Fed actually support this crucial segment of the bond market? Not with its purchases, obviously, rather Jay Powell is counting on the word “support” being paired with “market” printed over and over and over and over again in every single news article written on the subject.

And since this is a historic first, you better believe there’s been widespread coverage. It reinforces the perceived notion that the central bank must be “taking over” the bond market. No more risk to anyone.

Bullsh##.

Think about what’s actually going to happen from this point forward. Like the Bank of Japan (there’s your first clue), the Fed is buying ETF’s – not individual corporate credits. And it does this by handing a list over to its traders, one containing specific, round number allotments of ETF’s predetermined by consultations with BlackRock.

The FOMC is just making noise hoping that you don’t think too deeply about the actual details. Such as:

A central bank is not a market, but it often pretends it can be. So long as you believe in the fairy tale, you might take a little risk yourself – which is the whole damn point. Expectations rule here, not actual money even when there are actual bids and buys.

It really doesn’t matter if any central bank steps in, as the Bank of Japan’s ineptitude ably demonstrated (again). The official trading desk isn’t fielding every call from panicky bank clients desperately ditching to sell anything not nailed down; that’s just the perception they try to produce so that you will calm down and not join the cascade.

When the avalanche of selling shows up, the central bank desk continues to operate according to its rigid bureaucratic rules. And often well behind the curve, unable to keep up with events and developments. It was and never will be possible for Kuroda to buy up every offer. He just wants to fool you into thinking he can so that you don’t push the panic button yourself.

It wasn’t US$ ETF’s that went fire-sale levels of bid-less during GFC2 back in March. How is the Open Market Desk buying up exchange funds going to put a floor under individual securities if that piece of the market goes dark again? It won’t even shore up the price of the ETF’s let alone the credits they hold. And if this happens again, what good is the Desk’s static, predetermined buy list?

But, again, you’re not supposed to think this deeply on the matter. All you’re meant to do is to see the word “support” plastered all over the entire financial media. If everyone says it, who’s to question the convention?

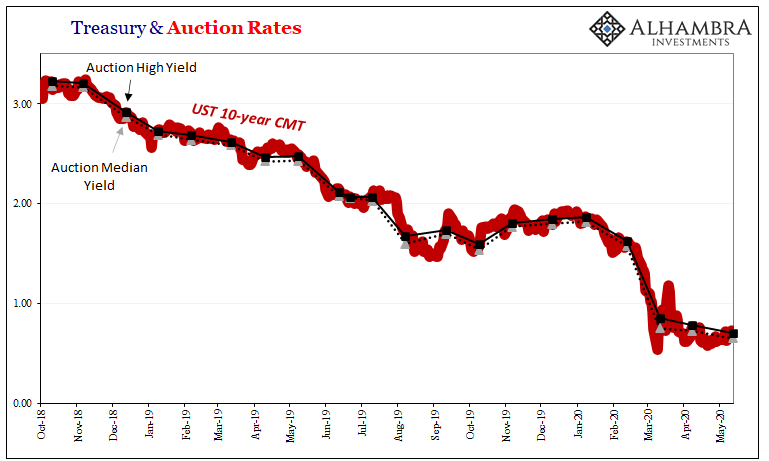

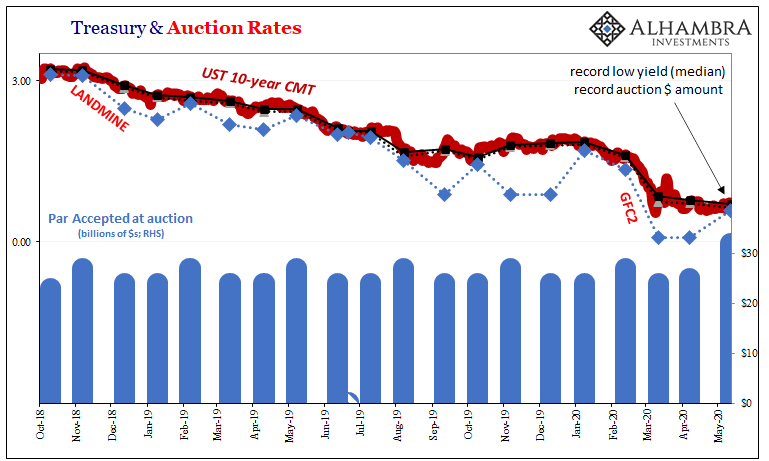

If instead you want to observe real support, market support, look no further than the Treasury market. Today, the federal government auctioned off a record number of 10-year notes at a record low yield. The “too many Treasuries” folks can’t seem to catch a break.

Wait, they’ll claim, it’s the Fed’s QE which is responsible; as if that’s not a pretty childish misdirection given the last two years.

What the auction data proves, unequivocally, is that the market was never in over its head with regard to supply (and the 10-year I’m showing here is just one example; the results aren’t any different at other maturities). No disconnect whatsoever throughout what has been one of, if not the, largest rallies in the market’s very long history.

Instead, when you look at the full auction internals you actually find curious bends in the pricing regime – in the other direction. In other words, if there had been “too many” of these things then we’d expect to find the high yield starting to inch up and above the market.

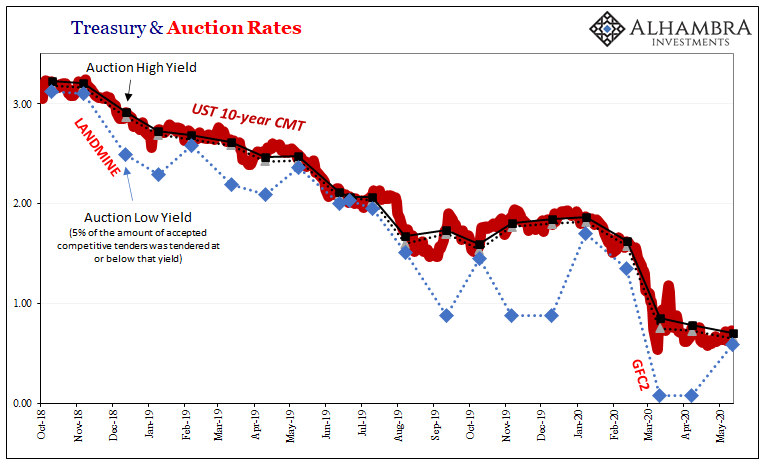

That didn’t happen because the demand was, at very conspicuous times, amplified. You can see what I mean when I plot each auction’s low accepted yield on the same chart:

In the middle of March, for example, while GFC2 was raging all around, the collateral bottleneck obvious to everyone except central bankers and members of the mainstream media, Treasury conducted a 10-year auction in which 5% of all bids were accepted at or below 8 bps, competing with T-bills; a feat, by the way, that was repeated in April.

Again, if there were “too many” of these bonds then we’d see the high yield rather than the low moving out and away from the range. At times – such as late last year or during 2018’s landmine – there’s an even larger bid, an obviously one, where buyers are lining up to pay extraordinary premiums in order to get their hands on the most liquid, on-the-run issues.

Why might that be, I wonder?

This ties directly into the puppet show surrounding the Fed’s highly publicized “support” of the corporate bond market. Retail investors might be buying it, but deep inside the actual system substantial doubts remain (about the collateral bottleneck as well as wider economic and other forms of liquidity concerns), thus the yield curve where it is.

Take it away Dick Fisher:

MR. FISHER. In summary, I want to mention that, as I said earlier, most of these variations that have been suggested are very un-Bagehot-like. And what I mean by that is, twisting [or QE] entails purchasing assets that investors are fleeing toward, not assets that they are fleeing from.

That’s how screwed up everything really is; current convention (not wisdom) says the Fed is supporting both the Treasury market as well as corporate bonds with its predetermined lists, meanwhile the Treasury doesn’t need the Fed (as Fisher admitted along, with the continued heightened market demand) because it doesn’t believe there’s much central bank support for corporates (the bottleneck) whether it buys ETF’s or not. Or anything else.

In short – the whole reason for this epic Treasury rally in the first place, the same monster rally all these media types falling all over themselves to play up Powell’s latest scheme missed entirely.

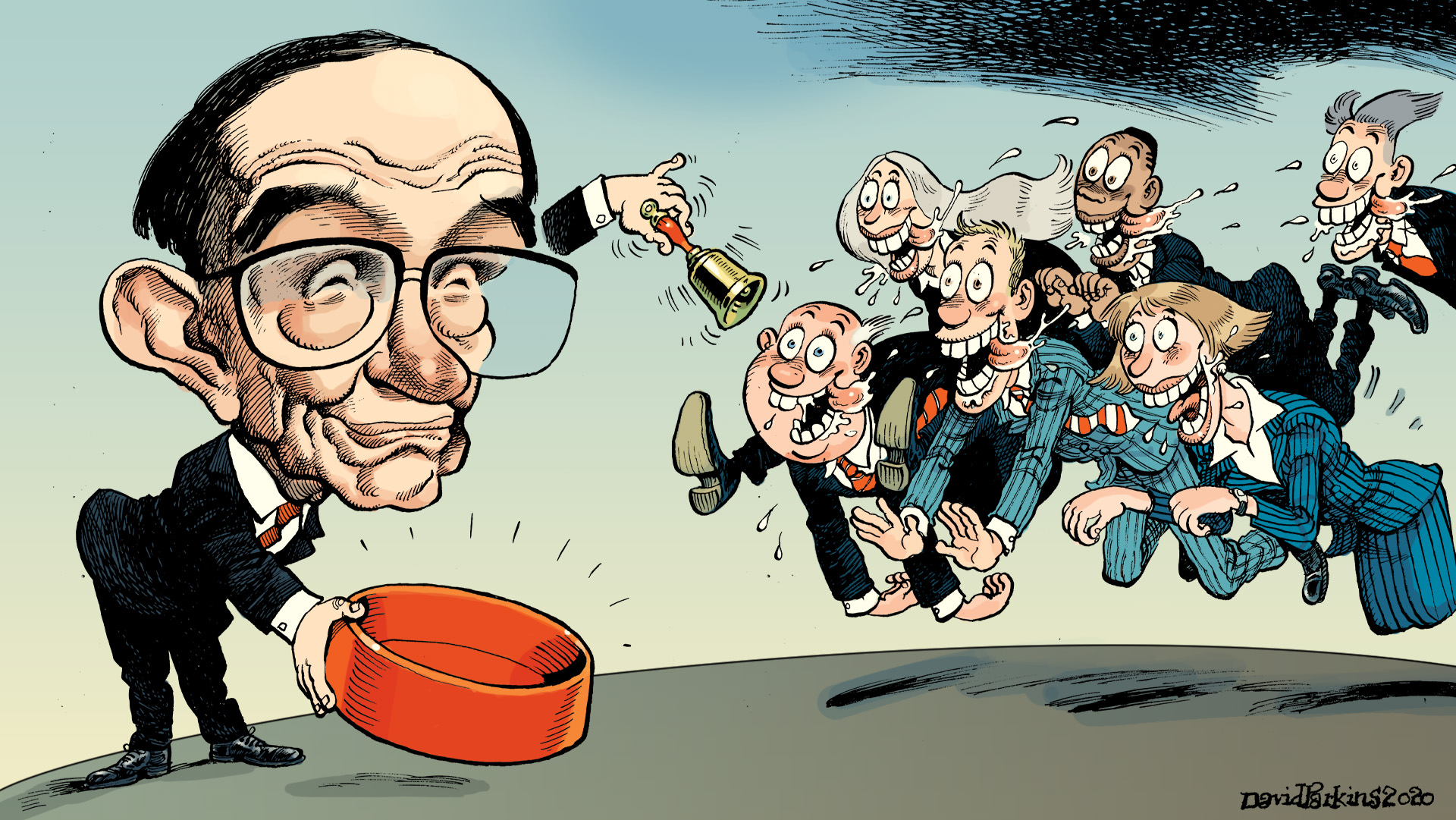

The Fed’s not supporting the market, any market. That’s the whole point, the whole reason there was a GFC2 just like there had been a GFC1. The Greenspan put is still an empty bowl no matter what his successors might pretend to put in it.

Stay In Touch