Why didn’t 1987 turn out to be 1929 redux? Alan Greenspan was deathly afraid this would be the case, and in turn he made everyone else unnecessarily upset along the same lines. Especially Congress. The fact that both stock market crashes occurred during the month of October, though, actually ends the similarities. That plus clueless Federal Reserve officials.

Why the one was and the other wasn’t is a matter of money; thus, the confused personnel of the central bank. If there’s one thing history has shown conclusively, it’s that the Fed has no idea what’s going on when it comes to money.

The difference is simply a matter of category. When the stock market crashed back in ’87 it caused several years of portfolio pain for investors, but nothing more. Back in ’29, the stock market was intricately linked to the monetary system via what were called Street Loans.

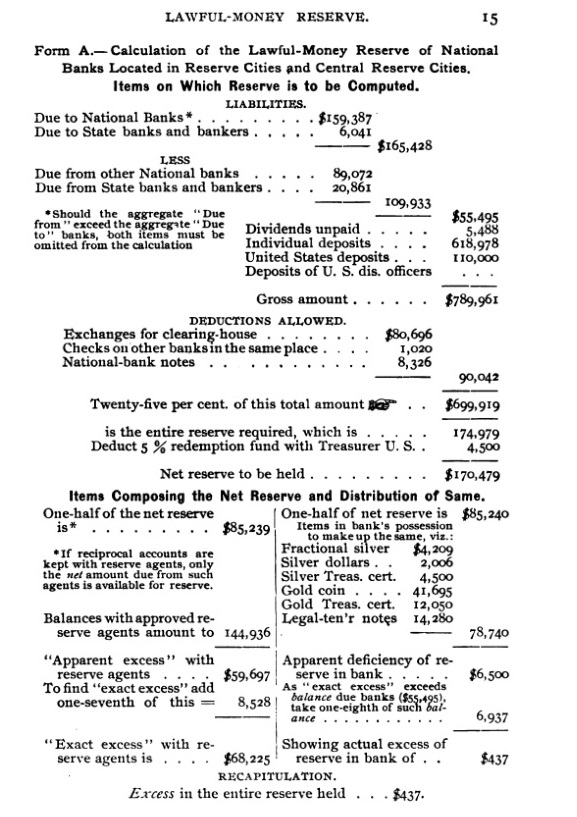

Because New York had been the epicenter of many of the nation’s bank panics, the national banking regime (under the 1863 act) required the city’s central reserve banks to maintain a 25% reserve of “lawful money” in its vaults against deposits. This was an expensive proposition, pushing these key nodes in the monetary network into risky behavior.

In reserve cities outside New York, other systemically important financial institutions were also made to hold 25% in reserve, but they could count deposits placed at one of these NYC depositories for one-half of that requirement. Smaller country banks spread throughout the interior American hinterland needed only a 15% lawful money reserve, but of which they could count on three-fifths being correspondent balances at reserve city banks.

Thus was the private correspondent system, the earliest form of national payment system whereby the nation’s banks hung in a hierarchy, waterfall, or pyramid. Country banks placed money at city banks who placed money at reserve city banks, not just counting up for reserve requirements but also an effective float as payment requests were increasingly sent all over the national landscape.

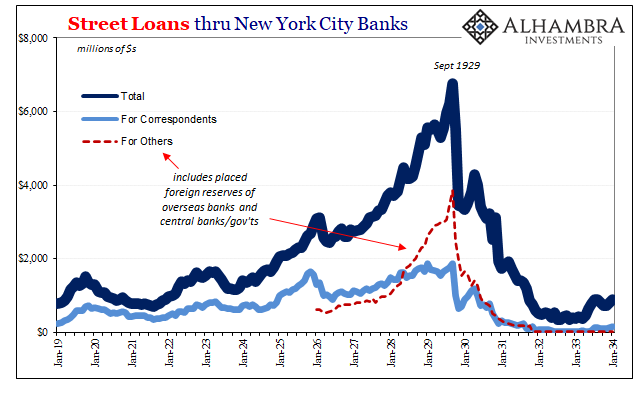

Explosive credit and banking growth throughout the 1920’s had meant more money ending up in reserves flowing up the chain to New York (as well as foreign reserves). The city’s stock market offered a highly liquid and alluring alternative to idle vault cash and illiquid lending for these reserve balances; something known as call money or street loans.

In that important sense, the entire national payment structure rested upon a foundation intricately linked to the fortunes of share prices.

If (rather when) equities crashed in October 1929, the resulting losses were not just booked by private speculators limited to their portfolio holdings. It began a monetary cascade whereby the banking system’s entire correspondent reserves were at risk. As the NYC banks lost money on street loans gone awry, that meant it lost some of each of its reserve city correpondents’ money which those originated, in part, on behalf of reserves placed with them by country banks.

Imagine writing a check (if you’re younger than 40) to an out-of-town payee and then the bank telling you it can’t be honored since there’s no money for it on the other end because the stock market tanked. That’s the difference!

Not only does that interrupt vital payments flow, also imagine what that does inside the banking system itself – triggering an avalanche of re-evaluation about where and how banks want to hold or place their reserves. The more they rethink and then act on the impulse, the more money is deprived from NYC street loans and therefore the stock market itself.

Which makes it decline still more, destroying more of the nation’s payments and reserves, and round and round it went.

The Federal Reserve’s job at the time was unclear where only some parts of the System, like the Atlanta branch in the sixth district, sprang into action on the requirements for interbank liquidity (reserves). Otherwise, the cluelessness on the part of central bankers in 1929-30 was watching the system fall apart and thinking it was natural, totally unaware of the devastating consequences of a fragile system once thought strong and made redundant by these very overlapping reserve tiers!

The Great Contraction obliterated the call money market and street loans ceased to be anything other than a minor lingering headache which was cleared up by Glass-Steagall. No more would banks tie up lawful money reserves in what amounted to securities speculation.

You’d think, then, that by 1987 Fed officials would’ve been somewhat more aware of this fact. Monetary scholarship of the sixties, seventies, and eighties, however, was muddled, to say the least. Though banks were prevented from acting in the way they had during the twenties, Greenspan couldn’t be sure there wasn’t some other way of linking stocks and money (point: he should’ve been rather than abandoning monetary competency entirely in favor of the pop psychology behind expectations-based policy).

To put it bluntly: stocks since 1931 are not a monetary issue. They’re only made to be by popular legend, including a really bad interpretation of what really happened in 1987. Portfolios, not money.

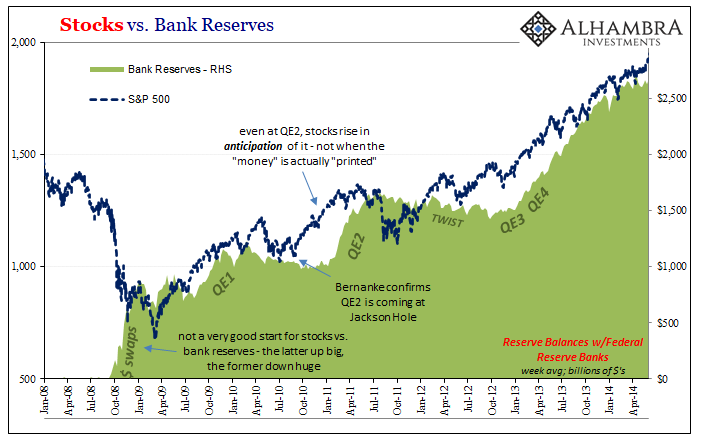

But, everyone today says, there’s a clear correlation between the Fed’s balance sheet and the S&P 500! To which I always reply, is there? Where?

To begin with, the Fed’s balance sheet expanded by leaps and bounds – in late September 2008 just as share prices globally headed directly for the crapper. If stocks = money printing in clear correlations they shouldn’t be so fickle.

In the 2008 case, too, it wasn’t the stock crash which destroyed so much banking and economic growth, rather it was repo which did and then got linked back to stocks through forced liquidations and fire-sales. Equities were a symptom not a cause, just like the Fed a sort of interested party bystander caught up in the maelstrom.

And the market rout wasn’t ended by balance sheet expansion suddenly appearing in early March 2009 – the whole monetary episode was finally turned around when the FASB rewrote FAS 157 (mark-to-market) in…early March 2009 (you’ll have to slog through all of Eurodollar University Part 2 to get the full sense of what I mean, but when you do it’ll be clear enough).

There are time periods when stocks and the Fed’s balance sheet do sync up somewhat well – which are the specific instances where this broader stock/bank reserves idea for a connection comes from. But it’s not real money which explains them.

Instead, it is psychology alone – not necessarily to/from the man on the street but more so aimed squarely at fund and portfolio managers of the professional variety. Those in the financial services industry who have been most thoroughly steeped in the legend of the “maestro” and his Greenspan put from their very first Econ 101 class; those who manage money for a fee on behalf of others who control at their fingertips not one portfolio of potential stock buying but many.

Those who also would rather not know how it all this stuff works, comforted instead by their ingrained idea of this wise technocrat who must understand what needs to be done even if everything gets done behind the shabby curtain and out of their view.

I say this with deep and very long personal experience. After all, the entire reason I went looking into shadow money in the nineties was because no one else wanted to. And I mean not one other person. I’d ask questions and the answer was some form of either, “Greenspan’s got it covered” or “why do you care, have you seen Qualcomm’s stock today?”

The Fed knows that it can depend upon this professional class to act in the manner it deems appropriate. If central bankers can send their signal by raising the level of bank reserves so as to get the financial services industry in near unison to hit the BUY button across-the-board.

Risky portfolio allocations, in other words. Not money. Not reserves.

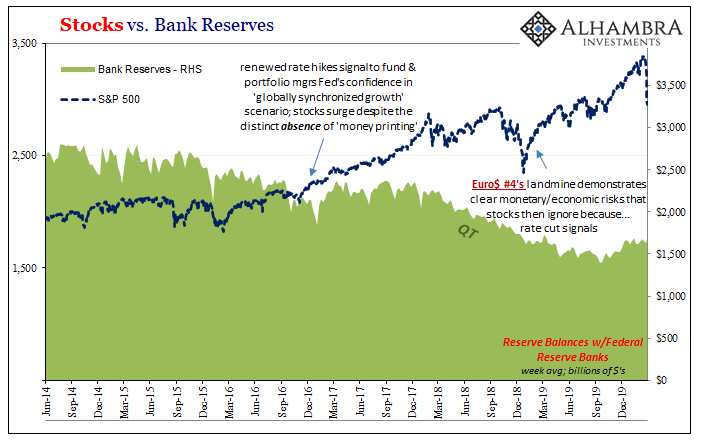

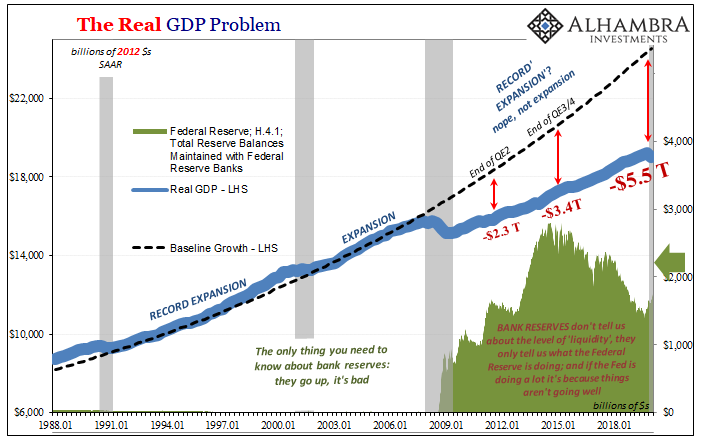

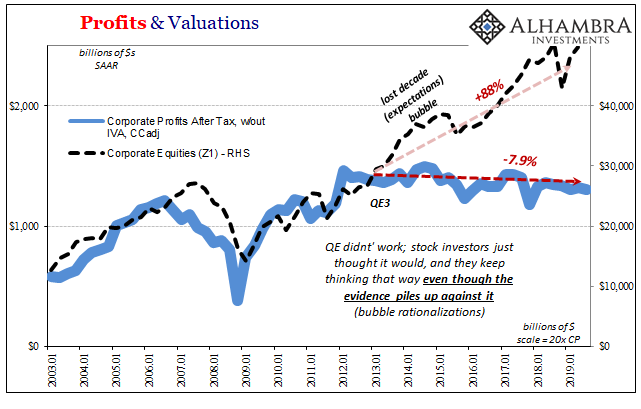

This is how, the only way, you can explain the last half decade in stocks when “money printing” has almost entirely been absent. By the bank reserve theory, if the correlation was real then why did equities surge during globally synchronized growth when the level of reserves was at best steady and at worst falling?

The answer: psychology. Ironically, the Fed was signaling to portfolio and fund managers this time through rate hikes as well as eventually quantitative tightening. In the immediate aftermath of the crash, QE and bank reserves were meant to convey conditions supposedly consistent with a low risk environment (conducive to broad share buying) because of all the “money printing.” By 2017, rate hikes and QT were meant to convey the same thing this time due to economic growth and recovery in reinforcing the message that QE and bank reserves had worked!

Thus, low risk environment as rate hikes plus QT gesture to the financial services industry of the Fed’s confidence in that interpretation; one which was widely shared across some markets but, importantly, not inside the monetary system itself.

What are Bond Kings if not the most prominent example of the typical financial services professional? Here were the archetypal Wall Street persons doing what? They were parroting the Fed’s interpretations of QE and then rate hikes/QT at every possible turn, both of those supposedly tied to low risks, and doing so in the realm of the bond market. United in every way to the vast majority of financial services on the equity side.

It was Bill Gross and Jeffrey Gundlach yelling about how interest rates had nowhere to go but up, but it was Janet Yellen’s and then Jay Powell’s words.

They stuck out in bonds because the bond market, the monetary system, didn’t actually agree with them. Stocks could rise on portfolio psychology detached from economic reality (sky high valuations) because shares were long ago removed from money – while it required a whole lot more than magic words and wishful thinking to achieve anything like that in money and bonds.

The interest rate fallacy and the empty bowl in one swoop.

There’s no money in monetary policy, just a bunch of technical puppetry designed to make an altogether uncurious financial services industry lap it all up. Like the Bond Kings did. You don’t think the stock side hung on every word from Bill Gross as if it was somehow illuminated, authoritative confirmation of what they was already conventional thinking?

But the Bond Kings had it all wrong – as the bond market kept pointing out and then with vigor and enthusiasm by late 2018. If there was no money in money, how could it be in stocks? Instead, what was being priced in equities was this low risk idea sprung from all the myths and smoky, mirrored signals planted by a compliant industry further emphasized by the uncritical media.

Share prices, more than anything, correlate to signals not bank reserves. And in the respect they correlate to bank reserves at some times, those, too, were purposefully-designed signals. Ever notice how all of them always end up suggesting low risk at a time when the economy kept on falling behind to now more than a $5 trillion gap beneath its prior baseline? Just in the US.

That’s because these disguised by monetary policy were actually noise where policymakers had long ago – in the absence of monetary competence – put the cart before the horse. Expectations policy really says that you can create money out of psychology; get stocks up and consumers will spend, businesses will invest (economic demand and therefore demand for money) that then creates the low risk environment which convinces banks to put up the real printed cash (bank balance sheet capacity) for it.

The world outside the NYSE just doesn’t run on fairy tales. It’s more than fly in the ointment, a flaw in the plan. Since the early thirties, it’s just nuts.

Stay In Touch