iTunes: https://apple.co/3czMcWN

Spotify: https://spoti.fi/3arP8mY

Google: https://shorturl.at/fpsEJ

Alhambra-tube: https://youtu.be/P7Wx7AYFDsQ

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Art: https://davidparkins.com/

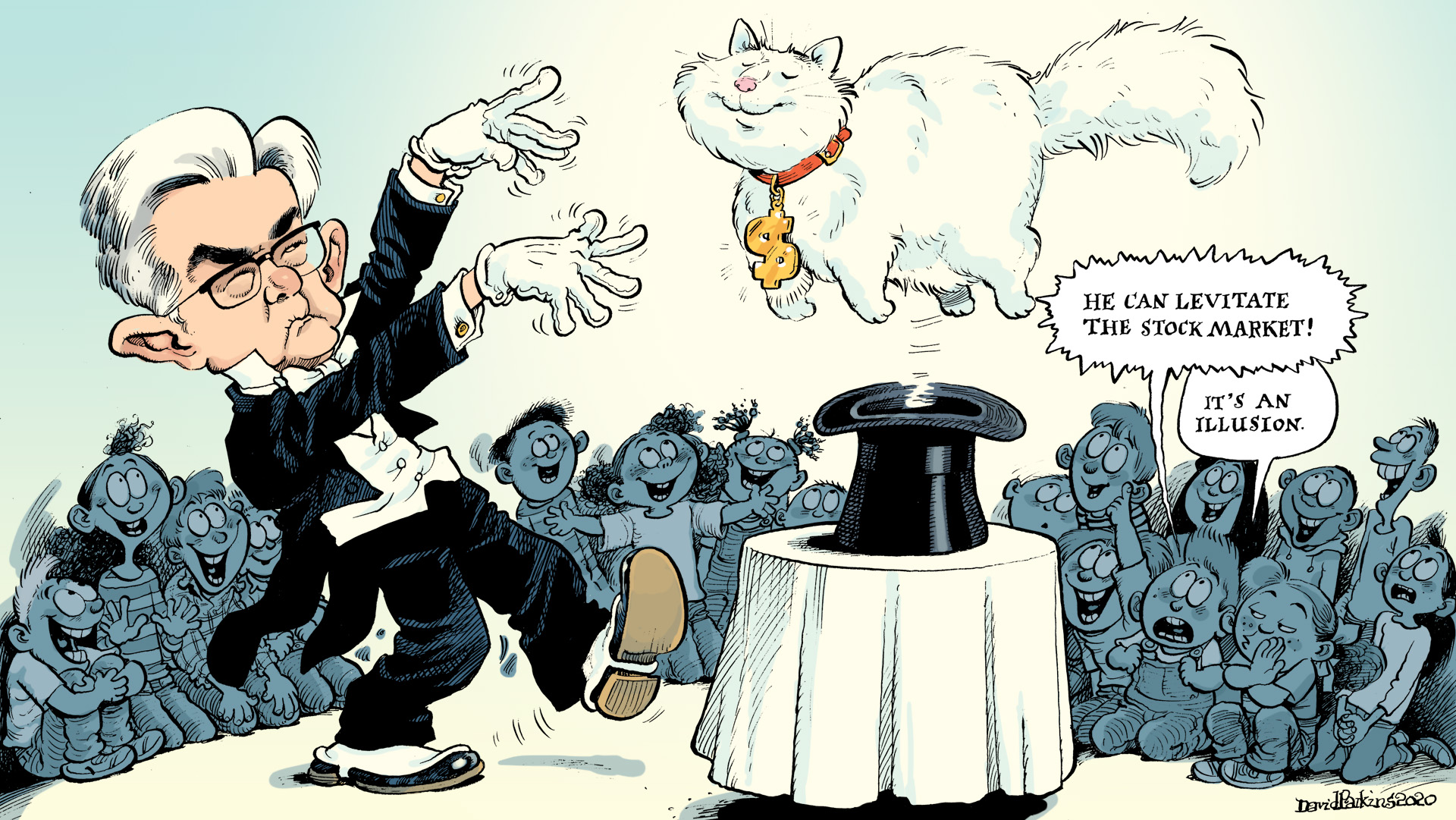

[Emil’s Summary] Then: a man or a woman who is a medium or a wizard was ascribed powers of enchantment and the supernatural. Now: a monetary technocrat is imbued with necromancy, conjuring money out of thin air and levitating stock markets.

About: We are informed by the financial press the agitated creation of reserves are, to capital market participants, a mix of whiskey and Felix Felicis; liquid courage and luck. The first manifestation of the wealth effect, which will encourage households to consume and corporations to invest. The financial market animal spirit. The economist’s Patronus Charm.

But what did the Federal Reserve do – and more importantly not do – in 1929, 1987 and throughout 2008-20 to support US stock markets? When was there a direct link between bank-created money and the stock market? And when was there nothing more tangible than “expectations policy” – the modern equivalent of the warlock’s frantic charms, hexes, jinxing and spell-casting?

Also, Federal Reserve Chairman Jerome Powell was interviewed on the American news program 60 Minutes this week. He said, the Fed saw the market meltdown coming, that the central bank increased money supply – he says they can print ‘real’ money too, you know – that there’s no limit to what they can do to support the economy (and also that the said economy may not ‘get back to zero’ until the end of 2021). We review the interview by pointing out what the smoke is obscuring, where the mirrors have been placed, and discuss how “theatricality and deception are powerful agents to the uninitiated.”

Articles Discussed:

Stocks Haven’t Been Moneyed by Jeff Snider

The Reason For So Many Lies: He Finally Realizes He’s In Way Over His Head by Jeff Snider

Bonus Video (also discussed):

Stay In Touch