It’s now more than two months out from GFC2 and more importantly the Fed’s response to it. Why is Jay Powell’s reaction more important? Simple. Because it outlines what happens next. Had the FOMC been anywhere close to successful in anything other than convincing the media, GFC2 might’ve been a singular instance of disruption related to the non-economic shock of COVID-19.

Instead, yet again, the central bank clearly demonstrated it isn’t central to the monetary system and therefore has very little to offer except well wishes.

In the mainstream media, Jay Powell has been said to have flooded the world with useful money. So much so that people are actually worried about inflation. You believe that? With everything that has happened over the last twelve years, including how we’ve gone through this very same exercise already once, the Fed’s powerful PR machine continues to crank out its hollow puppet show to an eager audience.

That’s really all Powell has at his disposal; there is no printing press, not one that’s been used, anyway.

After all his trillions in bank reserves and the federal government pitching in with its herculean efforts, inflation is being forecast left and right. That’s what “they” keep telling us, especially those in the financial services industry who make up the main demographic for Jay’s puppet show.

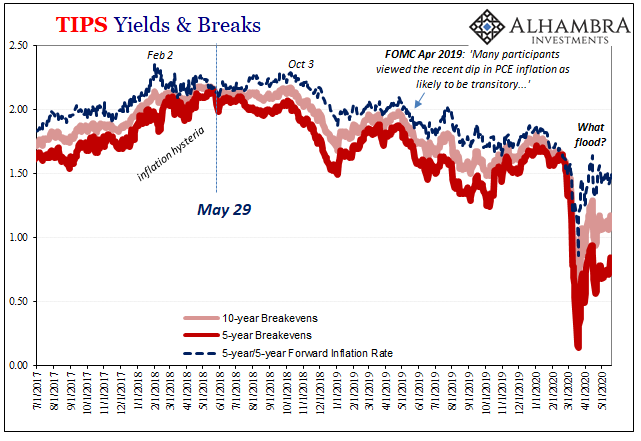

Nope. Not even the slightest hint after two months of bank reserves and the constant media stories extolling their awesome inflationary power. The bond market, as I wrote, has seen this all before and it’s not falling for these empty policies.

What flood?

Perhaps the more important of the three prices shown above is the blue one, the 5-year/5-year forward inflation rate. This is derived from the difference between the other two, the 5-year TIPS breakeven and the 10-year. It tells us about longer run inflation expectations that are especially relevant and revealing, as I wrote three years ago:

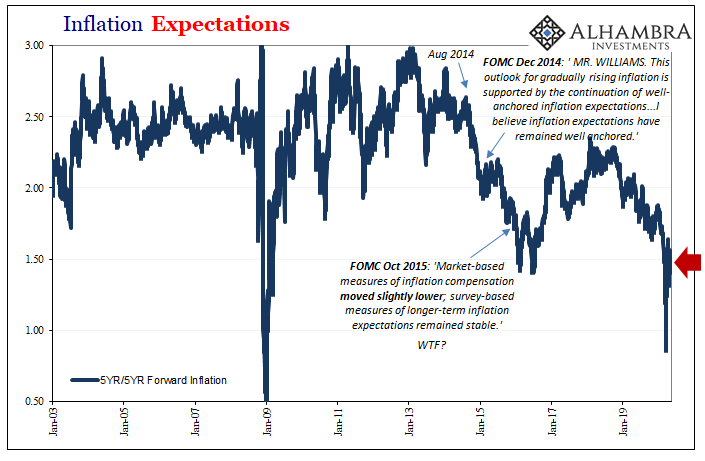

The 5-year/5-year forward inflation rate, a calculation derived from the inflation breakevens of TIPS securities, is one prominent means for demonstrating this monetary stability. By measuring the differences of inflation expectations in a second five-year period above the first, it essentially captures market expectations for whether short- and intermediate-term concerns or trends embedded in breakevens are believed to have an effect on the long run. Prior to late 2008, no matter which direction the PCE Deflator went, the 5-year/5-year forward rate was remarkably stable, indicating that no matter what bond market investors largely believed the Fed had it covered in the short run so as to maintain the same stable long-term economic prospects.

Just as the TIPS market told you all the way back in 2017 there was no inflationary breakout looming, that globally synchronized growth was nothing more than a bumper sticker slogan, the same market tells you right now not to believe there’s been a “flood.” The only flood has been the number of media stories reporting on what doesn’t meaningfully exist.

Bank reserves are not useful money, and the bond market (made of banks which do do money) knows the difference. As do, importantly, companies in the real economy, too.

The 5-year/5-year forward rate indicates that no matter what happens in the short run, deflation, there’s only going to be the same thing over the longer run, too. Inflation expectations are further anchoring, as they have since 2014, at historically low levels.

Uh oh. Big swing and a miss, Mr. Powell. This will have not just long run implications, but almost certainly create problems over the months ahead. Expectations have stuck around these depths knowing how the first part will lead to even more from the puppet theater. That’s the long run implications being priced in this second set of expectations.

What I mean is, the first 5-year segment shows continued deflationary pressures which will undoubtedly cause a significant and lingering menace that certainly will bring out even more from Jay Powell. And, as history has conclusively established, the more you see any Fed Chairman doing the worse, not better, it is likely to become.

Unsolved short-term monetary shortage which creates a long-term “L”; no “V” and certainly not an inflationary one.

No amount of bank reserves is going to change this; a fact, yes fact, that most people have a very hard time accepting.

Even though, as I wrote, we’ve seen this all before! Almost exact replica.

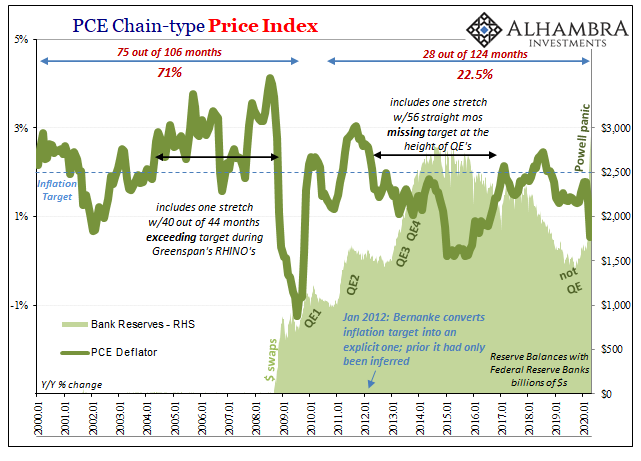

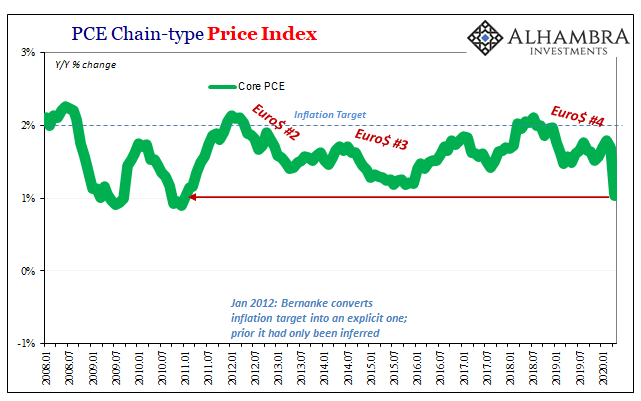

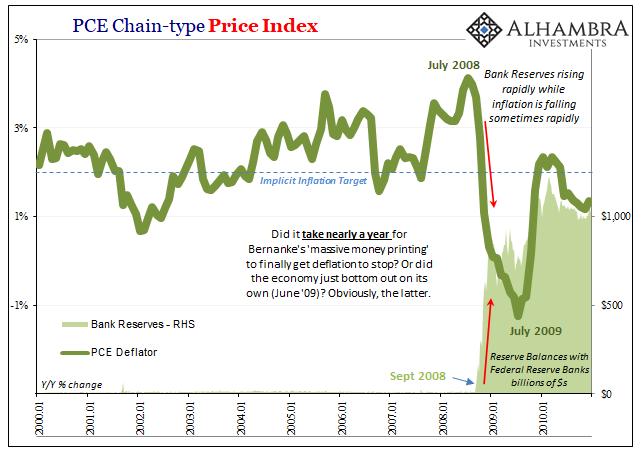

The BEA today released its inflation calculations for the PCE Deflator, the very measure the Fed is supposed to measure its monetary policies against. The core deflator has tanked in April 2020 as expected to nearly match the GFC1 lows while the headline will arrive in that same situation with next month’s figures – even as the level of bank reserves, what’s wrongly called “money printing”, continues its precipitous rise (though at a decelerated rate).

Back in January 2012, then-Chairman Ben Bernanke made this 2% target for the deflator an explicit one which means the central bank overtly promises to do whatever it has to in order to meet it. And then promptly the US economy undershot the target for just short of five years; all the while Bernanke and then Yellen kept trying to claim “transitory” factors were responsible.

Unlike the gullible financial media, bond investors in TIPS actually get paid for the CPI (which is related to the deflator, if not exactly). Therefore, unlike reporters and Economists, there are consequences for being wrong. Such as believing there’s been a flood of money via bank reserves built up through QE’s or other kinds of puppet show programs.

Back in 2008, in September as Lehman and AIG “unexpectedly” became headline news the Fed responded by ending its reserve sterilizations and letting the aggregate level rise swiftly. Money printing they called it.

And yet, during that time there was nothing other than continued deflation (see above) as well as financial crisis (globally, because the problem that bank reserves never solve is this global dollar shortage). In terms of the PCE Deflator, it wouldn’t bottom out until July 2009!

Almost an entire year after the start of the original so-called flood of money which impressed most people in the Autumn of 2008. Did it take that long for all those “dollars” to circulate and finally end the deflationary carnage? Of course not. GFC1 ended in March 2009 (mark-to-market) which then allowed the Great “Recession” to bottom out by June. Prices began to rebound two months later unrelated to Ben Bernanke’s “heroic” act of puppetry.

But, some will say, that was then, this is now and Jay Powell has exceeded every limit and made things so much bigger! And while that’s true, the market, as you see throughout bonds, doesn’t care. For one thing, the economic hole we’re all staring into is as well.

Bank reserves don’t solve anything; indeed they don’t actually do anything except create a buzz in the media and among fund managers looking to justify their itch to buy stocks at any price and in any macro situation. And that’s actually their true purpose – expectations policy, not money.

This is not conjecture, it has been empirically established once a dozen years ago and already this latest unfortunate experiment has led to the same exact results right in front of our very eyes.

What flood?

What the mainstream pictures of Jay Powell:

What Jay Powell really is (as real economy participants like banks in the bond market realize):

Stay In Touch