iHeart: https://ihr.fm/31jq7cI

Castro: https://bit.ly/30DMYza

TuneIn: http://tun.in/pjT2Z

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Castbox: https://bit.ly/3fJR5xQ

Stitcher: https://bit.ly/2C1M1GB

Overcast: https://bit.ly/2YyDsLa

PocketCast: https://pca.st/encarkdt

PodcastAddict: https://bit.ly/2V39Xjr

Twitter: https://twitter.com/

Twitter: https://twitter.com/

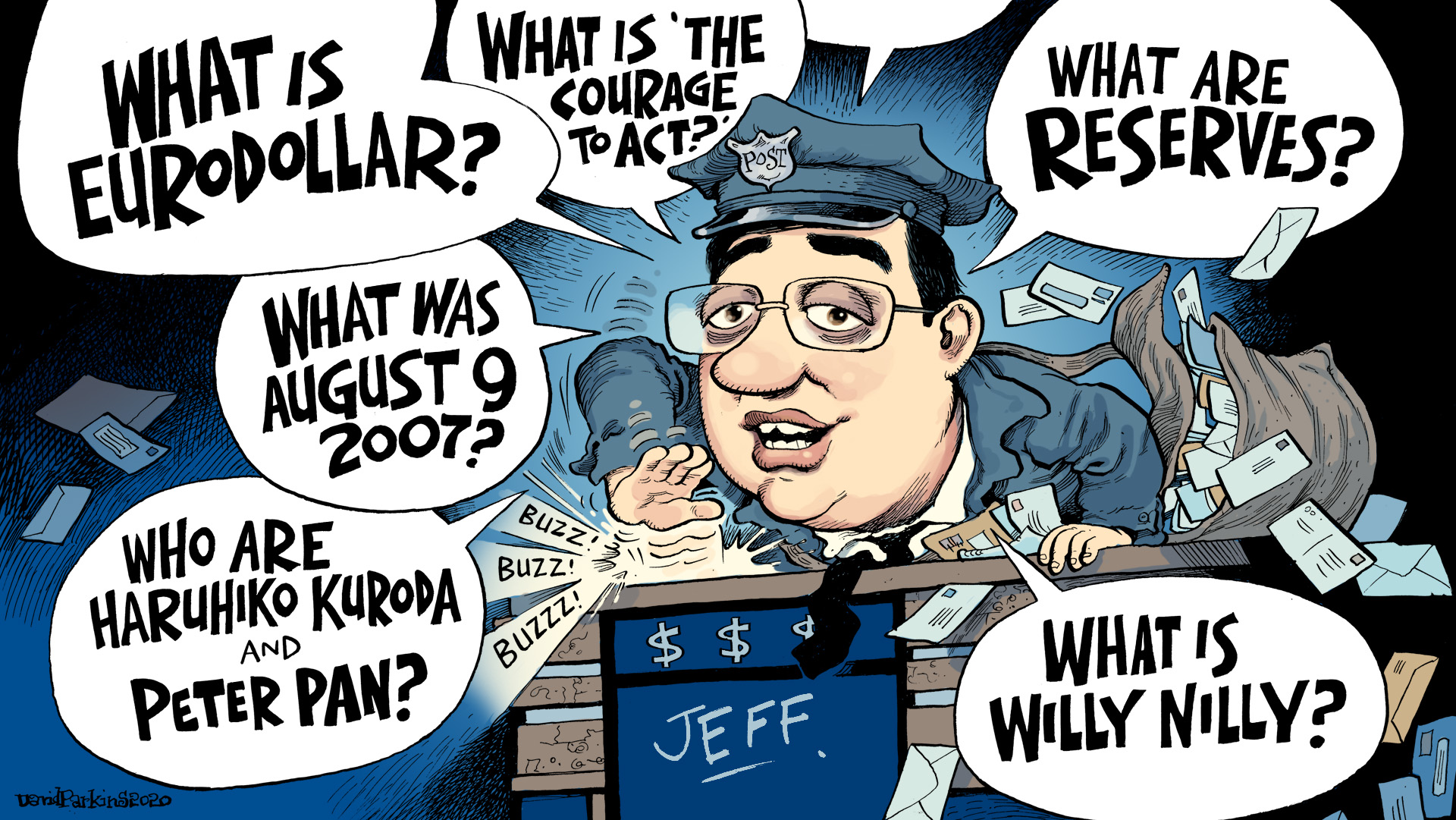

[Emil’s Summary] Jeff Snider answers your questions about central banks, inflation, measuring money, private banks… and potpourri? A Jeopardy!-style mailbag show with the ‘Cliff Clavin of the Eurodollar’.

After half-a-century, some 8,000 episodes and numerous tournament of champions the American television game show Jeopardy! decided to hold its definitive contest to determine its ultimate victor. The trial featured three accomplished champions: Ken Jennings, Brad Rutter and James Holzhauer. The selection of these three remains one of sports’ great scandals — right up there with the Czechoslovakian judge in Lillehammer. The three contenders were fine, having won more than a 100 contests and $10.7 million dollars between them. That’s not bad… as far as humans go. Who should have been in the tournament?

The first contestant most clearly deserved to be Phil Connors. Connors, initially a Pittsburgh weatherman stuck in a time loop, eventually attained the status of god. Not the God – at least he didn’t think so – but a god. And as a deity not only did Connors know every answer in “Lakes & Rivers” – What is Mexico? What are the Finger Lakes? What is Titicaca? – he knew the question before the answer was even given: What is the Rhône?

The second contestant was god-like in its knowledge: Watson. The likely forerunner of HAL-9000, this question-answering computer system already beat both Jennings and Rutter in an exhibition match for a million dollars. A eurodollar realist and having no use for a pyramid of physical bills, Watson promptly set the money alight and was heard walking off stage saying, “It’s not about the money – it’s about sending a message.”

The third contestant inhabits that shimmering space between reality and myth called “legend”: Clifford C. Clavin, Jr. The part-time Boston-area mailman and full-time bar patron appeared on Jeopardy! in 1990, where he feasted on the categories like a walrus in a bed of bivalve mollusks, which is the mammal’s preferred food you know. “Civil Servants”, “Stamps from Around The World”, “Mothers and Sons”, “Beer”, “Bar Trivia”, “Celibacy”.

It is in the spirit of these latter three – as legend, as eurodollar realist, as living through a monetary time-loop – that Jeff Snider confronts listener questions in a Jeopardy!-style show in this, the 16th episode of Making Sense.

01:42 Central Banks | Do bond markets tell us anything if banks buy almost all the bonds?

03:35 Central Banks | Are new Fed policies paid for with reserves or ‘money printing’?

05:11 Potpourri | Richard Koo’s balance sheet recession – holy grail or partial explanation?

09:41 Inflation | Transitory supply shocks inflation versus pervasive monetary phenomenon

12:40 Inflation | How to encourage banks to create money and credit?

16:04 Eurodollar U | An introduction to teaching the monetary order

17:59 Measuring $$$ | Divisia monetary aggregates and broad money measurements

22:31 Private Banks | What can you do with bank reserves? Anything. What is done? Nothing.

25:19 Private Banks | Eurodollars satisfy just two of the three classic functions of money, so what?

28:31 Central Banks | What is the proper, disinterested role of a central bank?

31:31 Final Jeopardy| Infinity is not the limit but the way station to greater infinities

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

Yield Cap History Is Rock Solid, Just Not At All In The Way They Are Telling You: https://bit.ly/38x4aZe

Stay In Touch