It’s another one of those crisis-era programs, GFC1, the Fed probably hopes you never think too much about. Almost nobody noticed while the thing was operational. It was called the Supplementary Financing Program (SFP) which was thought up and initiated during the middle of September 2008 just two days after Lehman Brothers and AIG. Its purpose was, unbelievably, to drain reserves from the banking system.

Drain, as in remove.

At the time, the Federal Reserve actually believed it had created, and was about to create, too much money. Too much. During the worst banking panic and global liquidations since the Great Depression.

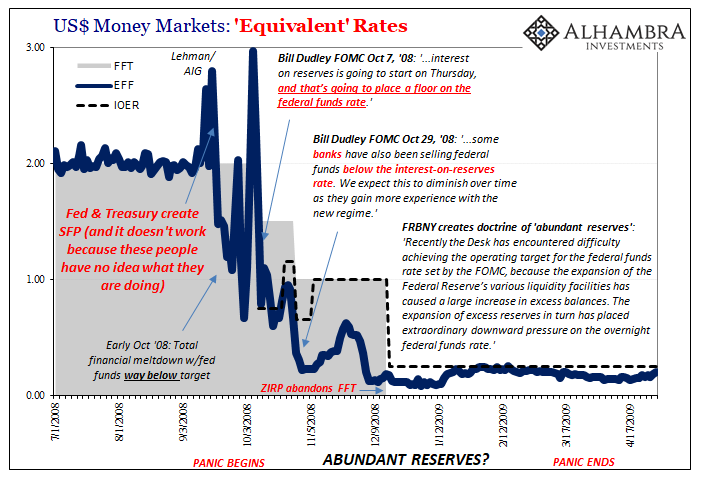

The specific issue was the federal funds effective rate (EFF). Long story short, EFF indicated to these idiots that an excess of reserves must have accumulated in this market. In reality, an exceedingly low EFF rate in defiance of a much higher monetary policy target rate meant quite the opposite – that banks were panicking and parking every bit of spare liquidity in this one place just as they were depriving liquidity from every other place.

And the low rate within fed funds itself suggested nothing short of this sort of chaos (as explained in detail here).

So, in addition to not understanding much about bonds and curves central bankers also know just as little about how the monetary system truly functions.

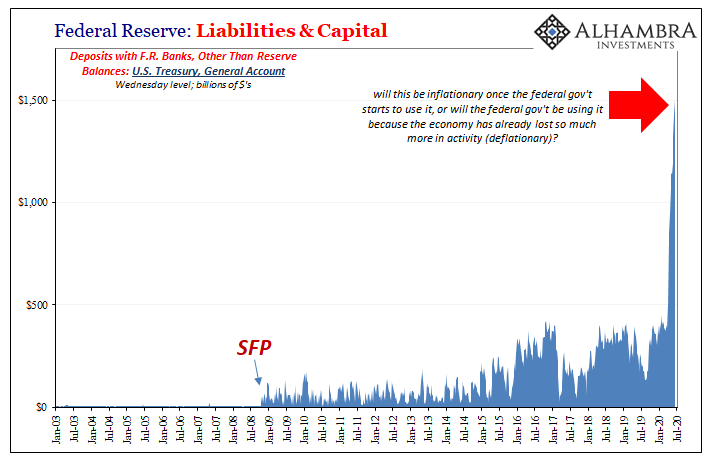

What they do know is purely accounting. Under the SFP, the Treasury Department sold short-term debt securities to the banking system with the proceeds from the sales being held in Treasury’s General Account at the Fed.

In a monetary system absolutely starved for good collateral, even these off-market securities were met with frenzied demand. Ben Bernanke and his clueless morons thought that this was confirmation of their “too many” reserves theory when in fact it showed they had no idea what had really become the centerpiece of disaster (repo and repo collateral).

Accounting-wise, every dollar that ended up in the General Account was a dollar that had been taken from some bank. Therefore, draining reserves.

Had it been effective, EFF would’ve moved back up. Instead, the effective federal funds rate continued to sink lower and lower despite this absurd madness; because it was absurd madness offered by incompetent officials who didn’t know their jobs, and therefore what these market signals were really telling them. Bernanke accidentally added a little bit of collateral while thinking at the same time he needed to drain reserves with Treasury’s assistance.

GFC1 really does make a ton of sense once you realize it had almost nothing to do with subprime mortgages.

The balance sheet results are the same for any government expenditure or receipt, not just SFP transactions. Whatever dollars are added or subtracted from the General Account this changes the level of bank reserves for the banking system (it all takes place as a remainder on the Fed’s liability side of its balance sheet). For each dollar in a tax receipt that comes in, for instance, like the SFP that’s a dollar that gets locked up under the government’s discretion the banking system can no longer access.

Going in the other direction, for each dollar Treasury uses from its General Account to pay for some expenditure, that’s a dollar reserve which gets added to a depository institution’s balance.

When the General Account balance goes up, all else equal, fewer reserves are available to the banking system (draining). And when it goes down, more are freed up for non-government use.

With that in mind, over the last several months the federal government has been building a monumental cushion in this part of the Fed’s balance sheet. At last count, for last week, the balance was $1.624 trillion. Truly breathtaking.

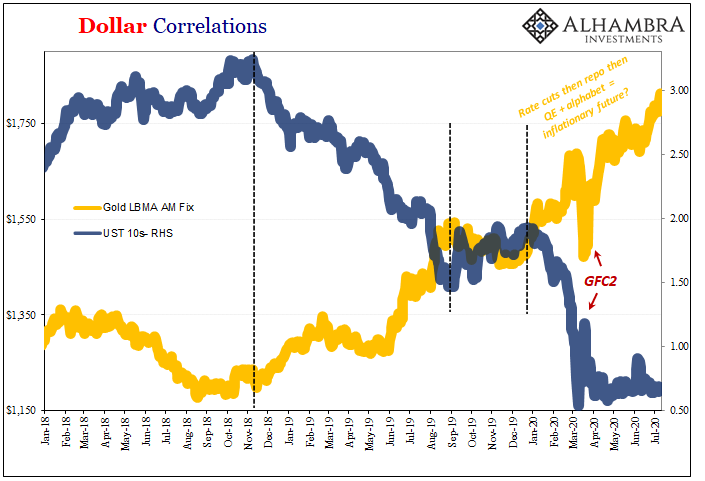

Now remember our accounting; as the level was going up, that meant fewer bank reserves were left available for bank use. With so many, more than a trillion and a half added, to a lot of people this represents potentially an inflationary mess once they are released into the economy (banks first); that will be when the full measure of the Fed’s recent balance sheet expansion (“money printing”) finally is unleashed.

One reason why is because as that cash gets used over the coming months these reserves will be added to the other trillion and a half the Fed created and left on account with the banks already; separate from the General Account. So, if that first trillion and a half wasn’t inflationary already, then the second trillion and a half sitting in the government’s hands today surely will be when it all gets mobilized!

Yeah, no.

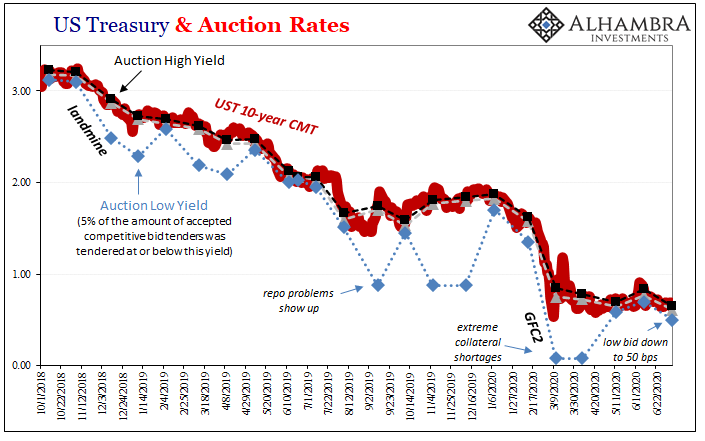

Two reasons. First, bond yields and the leaky bucket. As I wrote yesterday with regard to that first pile of bank reserves which had already been made available to banks from the get-go:

The Fed doesn’t (it just doesn’t!) print money nor add liquidity; monetary policy is merely a reflexive response to what’s otherwise happening in this shadow system. Thus, as dollar-denominated bank liabilities are destroyed (dollar shortage) the Fed (belatedly) reacts to the awful and disruptive symptoms of that hidden destruction you don’t directly see by creating bank reserves which you do.

Hand pouring water in a leaking bucket

In other words, whether reserves are made for banks or stored temporarily with the federal government, both sets are in response to monetary destruction you hadn’t seen. That’s the leaky bucket, a bucket which has already lost a tremendous amount of water (effective money) before any of this reactive response.

Releasing a second set of reserves accomplishes only the same thing as the first. At best, hopefully (but not really; see: above, EFF in later 2008) partially filling the bucket back up.

There’s also a second leaky bucket to consider, too. And it’s the second reason why the General Account won’t be inflationary. Ask yourself, why is the government sitting right now on $1.6 trillion in cash? It’s never, ever done anything like this before. What’s really going on here?

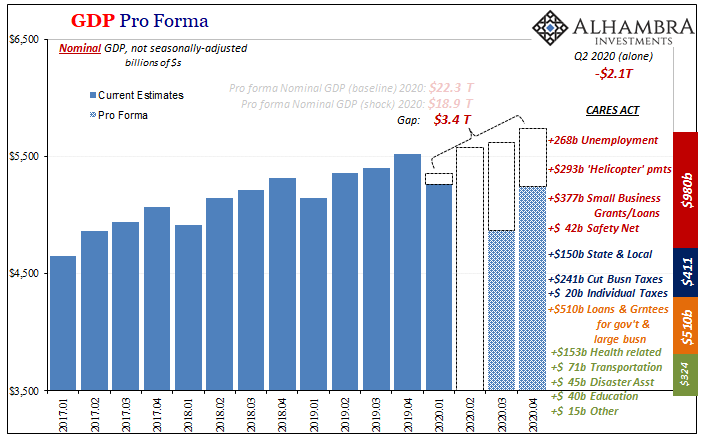

Like all the mainstream econometric models, because of all the mainstream econometric models which are being used to set this agenda, the feds know that the economy is going to fall way, way short of even for probably several years (2022 at the earliest, and that’s if everything goes perfectly). Economic activity will be at a lower level for a prolonged period.

That means so much less money flowing through the private economy in the form of wealth-creating activity; less profits, less earned income, less investment. How much less? We’ll find out about how bad the opening round shortfall had been when the BEA publishes its first Q2 2020 GDP estimate in fifteen days.

That $1.6 trillion sitting in Treasury’s account at the Fed is intended to further offset this economic shortfall – the economic bucket which has already leaked out a massive amount of activity we’ll never get back.

So, like the Fed on the monetary side, the federal government is trying to use these reserves to add back some water that’s already flooded out and in all likelihood to a much greater amount.

Not inflationary because neither set of bank reserves are being added to a system starting from zero, or at baseline. Nothing is being added. These are being used to hopefully offset a system plunged already into a huge deficit. And a hole that will only get bigger the longer it takes to rebound.

Economic destruction is just as deflationary, if not more so (when it really gets going).

As I’ve said about the bank reserves the Fed’s created for the banks, the higher that balance goes the worse you know it must be. Same here. The higher the balance in the General Account, it’s only because the government knows that’s just how huge the problem has grown.

When it finally gets around to releasing these funds, how big’s the hole going to be by then? The very fact the General Account is up to $1.6 trillion gives you a relatively good sense of at least what the federal government is preparing for.

It ain’t weak dollar/inflation.

Stay In Touch