Sporting goods and hobby stores, easily understandable. That category includes all kinds of leisure activities. In addition to basketballs and crafts, there’s musical instruments and books. Not long ago, the bookstore was practically extinct yet here it is making book on this trend.

According to the Census Bureau, retail sales recorded at all the various types of retail outlets included in this group absolutely exploded upward in June. On a monthly, seasonally-adjusted basis, it was +27%. Reopening, sure. On a yearly basis, sticking with seasonally-adjusted figures, an eye-opening +24%. A whole lot more than reopened outlets.

In other words, this wasn’t a gigantic positive when compared to the bottom, it was a gigantic positive when compared to last year when everything was supposedly normal.

This isn’t difficult to figure out. Americans are clearly preparing for a more durable alteration to their previous baseline habits. Leisure is where it makes the most sense to begin the adjustment; instead of going to a movie theater, pick up a baseball bat and glove. Rather than a trip to the mall casually perusing several different shops around its entire expansive property, read a book.

But why groceries?

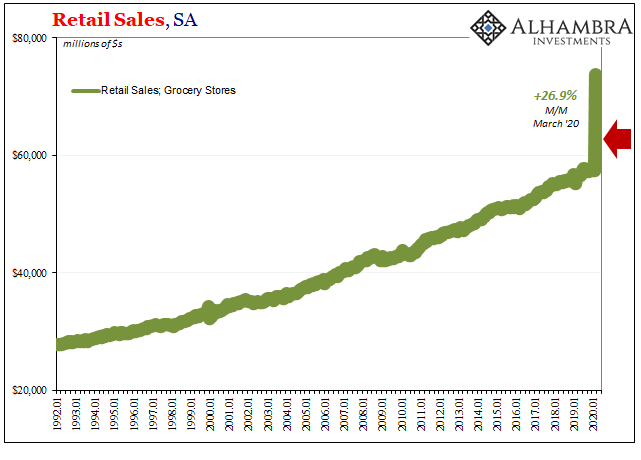

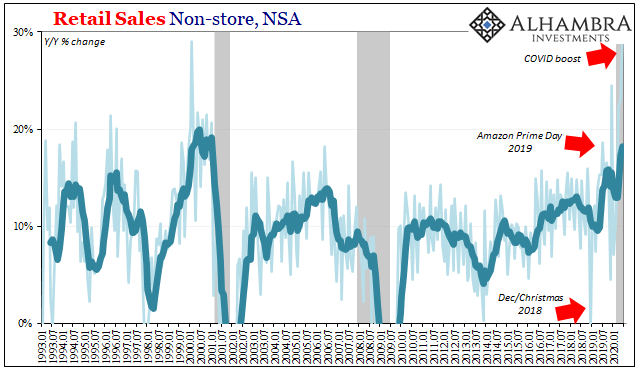

Other than non-store retailers such as Amazon, who are cleaning up for obvious reasons, the same reasons, Americans have apparently fallen in love with grocery stores. When sales skyrocketed in this category in March, that made sense given the Great TP Panic of 2020. Stocking up ahead of what was going to be a relatively prolonged inconvenience.

According to the Census Bureau figures for last month, though, grocery store retail sales continued to be enormous for the fourth month in a row. While down just a touch sequentially (seasonally-adjusted) in June, a little over 1% compared to May, when compared to June 2019 grocery stores did an enormous 11.7% better.

That’s not toilet paper anymore.

It seems instead to be determined preparation. Part of it definitely due to grocery stores being deemed essential and therefore open where and when other kinds of retailers weren’t, but in May and especially June with more things open (see: hobbies, books, etc.) we’re looking at American workers stocking up on essentials in widespread fashion. Food being the most basic of all.

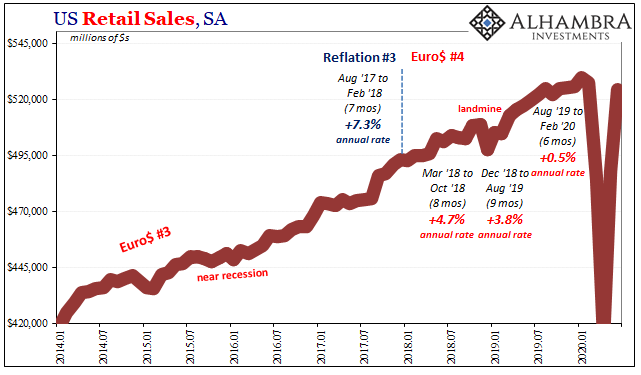

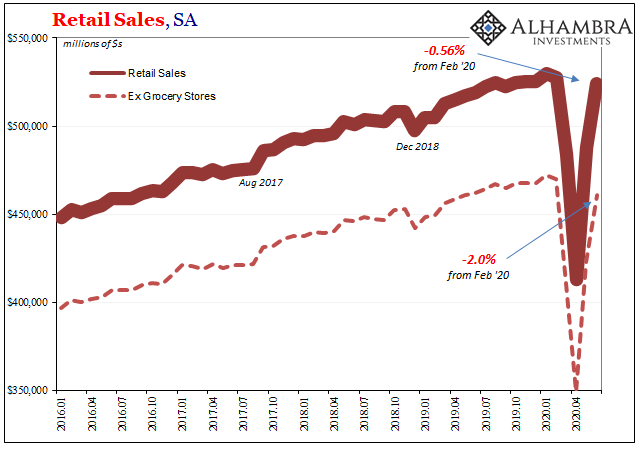

In total, retail sales during June for all categories came in just slightly below where they had been in February before all this began. From August last year until February, consumer spending had already been in a determined slump. What that suggests is consumers taking an opportunity to do some catching up at least in these categories.

This is why there’s been very little excitement about what looks like a full “V” at least in the key consumer/retail component of the economy. Behavioral changes abound in the figures, as does the obvious reason for these distortions.

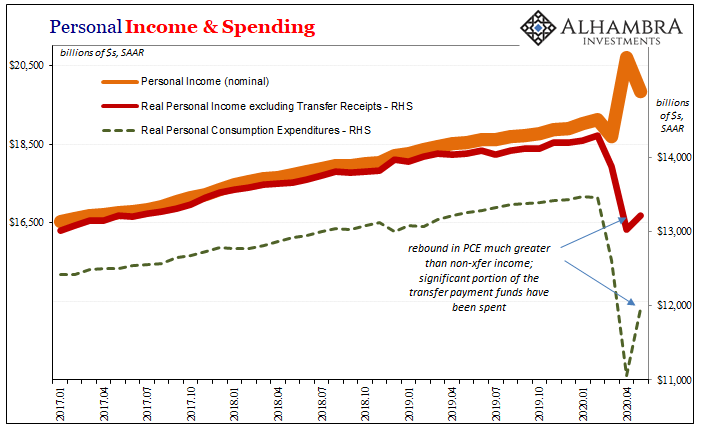

The government handed out cash by the hundreds of billions, and many of those hundreds have wound up at the grocery store and in the pockets of book and hobby sellers.

Inside this window of gigantic positives, June may be, probably will be, its apex. It is very likely that things probably will not look any better moving forward than they do now. The private economy erodes underneath, fears of further shutdowns drive new if temporary consumer habits, and stocking up in advance of the all-important what-comes-next after the initial reopening.

This is why there’s been such a big difference between retail sales and, say, industrial production. Producers aren’t getting themselves back up to speed with anywhere near the same speed as consumers putting to work the non-work cash placed in their hands. A temporary burst of downright prudent action, but then what?

The production side of the economy is hunkered down, too, in its own way (the way that leaves unemployment historically high, and actually helps explain much of this prudence).

Where the data, at least, gets dicey is in the auto sector. Something’s not right between what the Census Bureau reports for retail auto sales and what the BEA says in terms of light vehicle units sold. According to the latter, the pace in June was a mere 13.04 million (SAAR). While definitely an improvement from April’s 8.7 million low, it was still 23% less than February and -24% year-over-year.

Retail auto sales, by contrast, were supposedly up 9% year-over-year. While these Census Bureau numbers include price increases within them, tabulated by the dollar value of all sales, there isn’t 33% inflation which could explain this growing discrepancy. And it’s the second month in a row where the two series seriously diverge (in May, Census had retail autos at just -3% year-over-year when the BEA had units -27% year-over-year).

Thus, you have to wonder about the integrity of the data being collected in one, the other, possibly both. And this isn’t some conspiracy to juice them or to make them look awful; with the situation being what it is, the regular format of survey and responses is almost certainly being interrupted, too, along with practically everything else. Understandably chaotic. There’s already been self-reported quality issues raised by the BLS, for example.

What we see here in autos is two very, very different views presumably measuring the same thing. They are not the same thing.

As if we need to factor another factor, caution, already the standard for evaluation, is further warranted. Not just in one direction or the other; unstated here is the very large revisions that keep showing up month after month in retail sales as well as other data series. Estimates for last month retails sales, for example, were revised substantially upward even as they were already the biggest on record.

At a time when we want data quality to be even better, that’s probably not a realistic desire.

Either way, Americans splurged last month which wasn’t surprising. By how much, and why on what they did, those are the real and unanswered questions. With the window of gigantic positives closing, and underlying economic reality perhaps beckoning, the answers may just be close at hand (which is why the 4-week T-bill down to 10 bps of equivalent yield speaks so loudly, at least to me).

Stay In Touch