There is a tremendous difference between the world de-dollarizing and those living in it being de-dollared. The former is a choice, the latter a fact of existence since August of 2007 (to varying degrees). Yet, most people, especially the “experts”, talk of only the first one as if that was all there is to it.

Especially when it comes to China.

We are told, repeatedly, that the Chinese are gunning for the dollar. And while that’s absolutely true, it doesn’t mean nearly as much as we are led to believe. There are certainly geopolitical factors to consider, particularly with tensions heating up way beyond that whole “trade war” nonsense.

But there’s so much more to it than that where a reserve currency is concerned. If it all it takes is some willingness then history would have been very different. That’s the thing when you hear all these “experts” talking about the numbered days of the US$ as one. They don’t sound as if they know what a reserve currency actually is, what it means, and most importantly what it really takes.

One who actually may have some idea is the current Governor of the People’s Bank of China (PBOC), Yi Gang. His predecessor Zhou Xiaochuan had started this argument off way back, appropriately enough, in March 2009. Zhou didn’t attack the dollar so much as the absolutely astounding global economic and financial destruction a malfunctioning global (euro)dollar system had brought.

Already by early 2009, while the Western media consented to be fooled by Bernanke’s “heroism” and the conventional fixation on subprime mortgages, at least one person at a central bank saw the crisis for what it had been. Dollar shortage; the world suddenly, shockingly, and involuntarily de-dollared.

But was it a one-time thing?

The Chinese Communists know more about the dollar than all the American central bankers and Treasury officials combined. And the Chinese don’t know near enough.

Before succeeding Zhou in 2019, Yi had years before been talking up the IMF’s paper gold scheme. Called Special Drawing Rights, or SDR’s, these are nothing more than a reserve currency in name only. They are given that title by political decree but in no way serve that purpose. At times, they can act with some monetary purpose somewhat in substitution for eurodollars, but only under the most special circumstances and in very short run periods with limited use.

That’s not a reserve currency.

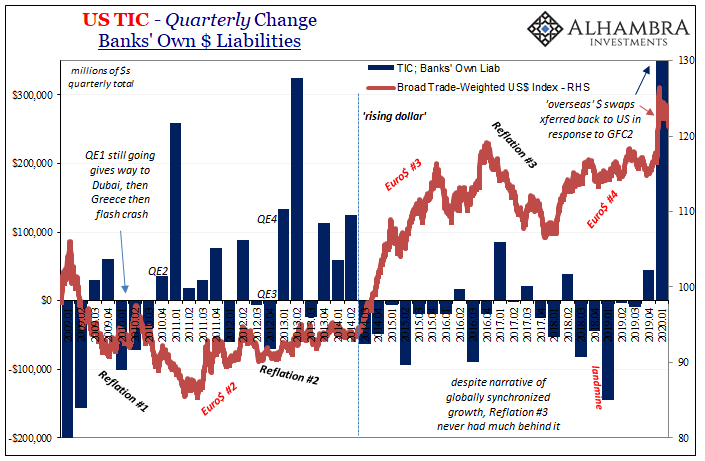

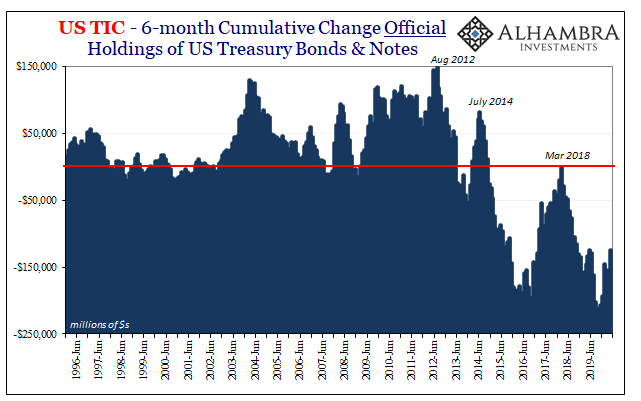

And it’s why when foreigners – particularly foreign central banks – are selling their UST’s that’s a really bad sign; not for the dollar, mind you, rather this is a signal that the dollar is about to blast higher in exchange value if it already hasn’t. As we’ve seen, in data best seen via TIC, as banks withdraw these dollars creating the shortage all the overseas central bankers can do is to “sell” their UST’s in the hopes of offsetting the shortage, providing some dollars the (euro)dollar system no longer does.

What you see below isn’t by accident nor mere coincidence; and it’s described almost completely backward in all the mainstream commentary. Banks withdraw dollars, the dollar shoots up to signal that shortage, and then the selling.

Before joining the PBOC, Yi had been head of China’s SAFE; the government agency tasked with managing that nation’s massive foreign reserve “stockpile.” While there’s no evidence he had become aware of what I call the nightmare scenario (briefly: the more “dollars” that flow in to your country, and the more your official sector scarfs them up, those that then become reserves aren’t insurance so much as a target; the worse, potentially, it is for you when the eurodollar system goes awry because the more reserves you’ve taken in it’s only because yours is a big dollar short leaving you the most susceptible to the dollar shortage as history since 2007 has shown), Yi like Zhou at least understood the downside of being unwillingly de-dollared.

While initially post-crisis that criticism was aimed at “money printing” and QE (see what I mean about not figuring out the how’s and why’s?), Chinese dissatisfaction increasingly swung in the right direction over the years since. Maybe that was by necessity, especially in and after 2014’s Euro$ #3, but for whatever reasons the official China stance on dollar issues in the last half decade or so sounds more correctly like complaining about the chronic global shortage (the opposite of what QE was supposed to have achieved).

At the IMF/World Bank spring meetings held in April 2017, Yi spent a lot of time talking about SDR’s. Not merely a polite nod to the setting and the setting’s sponsor, you could tell China’s future top central banker was serious. SDR’s were a potentially useful monetary tool in the global reserve framework; what was lacking was the very thing that made the dollar, to that point, and still to this point, irreplaceable.

If more and more people, companies and markets are using SDR as a unit of accounts, that would give it more advantages in the market.

Yi Gang on the role of the SDR in the international monetary system. Watch the video: https://t.co/Umf0eJq4Of #IMFSDR pic.twitter.com/kqZyYLDAXk

— IMF (@IMFNews) April 24, 2017

In order for that to happen, however, there needs to be a true market behind the SDR. A currency no matter how much officially supported needs to be more than a unit of account. Unless it can become an efficient and dependable medium of exchange, there’s no point in further discussion. This is the whole ballgame.

And that was Yi’s main point; to encourage developing the necessary infrastructure and depth behind the SDR. Why?

Three years later, with no progress to report, in the aftermath of GFC2 (most serious dollar shortage), the head of the People’s Bank of China was once again touting SDR’s. Just hours ago, he said:

Under the immense shock of the Novel Coronavirus pandemic, emerging markets and developing countries are especially weak, and the general allocation of SDR is especially important for them.

The majority of emerging markets and developing countries are not just facing a public health crisis, they also facing many economic and financial challenges.

The value of SDR’s is determined on the basis of a basket of key currencies. The general allocation of SDR’s can supplement the foreign exchange reserves of IMF’s member states and raise their purchasing capability.

The IMF has been in discussions about undertaking another quota allocation, increasing the number of SDR’s available to member countries to use. To use for what? In place of the dollars they can’t get, and moreover aren’t going to be able to get, from a still hostile, abnormal eurodollar marketplace.

So much for Jay Powell’s “flood” of liquidity.

There is simply no alternative to the eurodollar system. There just isn’t. If there was any kind of realistic substitute, we wouldn’t still be talking about just now hopefully, maybe, possibly getting one started after so many years of hearing about intentional de-dollarizing in the media – talk which, by virtue of all this time going by, has always gone nowhere.

Even Yi Gang knows CNY will never, ever be able to come close to replicating and substituting the necessary functions of a global reserve currency when compared to a dysfunctional eurodollar. That’s why they’ve only been talking and pleading for more than a decade, to no avail.

Chinese officials know yuan can’t even match this current arrangement which doesn’t work and hasn’t for more than a decade! That’s how tall a task this thing really is.

We’re stuck in a system which de-dollarizes the world by default, not by choice. If it was by choice, with a substitute ready to go, then there’d have been this other currency rising in availability and depth as the eurodollars slowly drain from the globe and fade away into historical trivia.

But because the world is involuntarily de-dollared instead, the dollars disappear first (or, the other definition of monetary tightness, grow too slowly) with nothing to offset that disappearance. This leaves the whole global economy with tightness, too little money.

The leaky bucket.

The Fed can’t fill the bucket back up nor can any other central bank. So, Yi Gang is once more attempting to shove the IMF’s SDR’s at least into the conversation. If the dollars are disappearing, and they are, then fill up the bucket with some SDR’s in the global reserve space to hopefully, like the Fed’s bank reserves, temporarily tide eurodollar’s victims over until…

Yi Gang also knows, however, that an allocation won’t be nearly enough; you can’t just try to refill the water level, the bucket itself needs to be repaired in order to plug all the leaks. Maybe additional quotas would help get the EM’s and China through the current crisis (doubtful), but that would still leave the system woefully inadequate to the challenges and necessities of a true reserve currency.

Why try to fill a bucket you can’t possibly stop from leaking? And if you can’t stop it from leaking, often in torrents, what’s the point?

If you’re Jay Powell, Christine Lagarde, or Haruhiko Kuroda, you know you can’t plug the leaks so you try to get the bucket to heal itself (expectations policy) by continuously pumping something that looks watery into it and hoping it fools enough of the bucket to fix the problem for you (BUCKET, HEAL THYSELF!) Not surprisingly, it hasn’t worked yet, though the initial cracks formed on the exterior of the bucket just about thirteen years ago.

One or the other must change if this is ever going to get truly fixed; either the leaks are plugged, meaning the entire system is changed, or this is just going to keep repeating until it can’t go on any longer. GFC2 and the current crisis have seriously raised the threat level for the latter (as if you hadn’t noticed just looking at your window lately).

The dollar isn’t going to be dethroned because there’s nothing to dethrone it.

It tells you how a great deal about how difficult and how substantial it must really be to create and maintain this reserve system; that despite a decade’s worth of noise, fury, and quite often heartache, there is simply no realistic alternative.

At the very least, it keeps the lights on. Barely, at times.

We are stuck with this arrangement largely because the media, politicians, central bankers, etc., don’t know a thing about it.

Of the few who might know a thing or two, like Yi Gang, they’re still way behind and aren’t in much position to do more than try to fill the bucket with yet another liquid-looking substance.

For a real global reserve currency, the issue isn’t the liquid that goes into the bucket. It’s the bucket itself. The world system isn’t moving toward de-dollarizing at all, it’s still being de-dollared by default.

Stay In Touch